Question

Not for nothing was Sophie Brazier, an acclaimed Michelin star chef. Coming from a family of culinary experts dating back three generations, it was Sophies

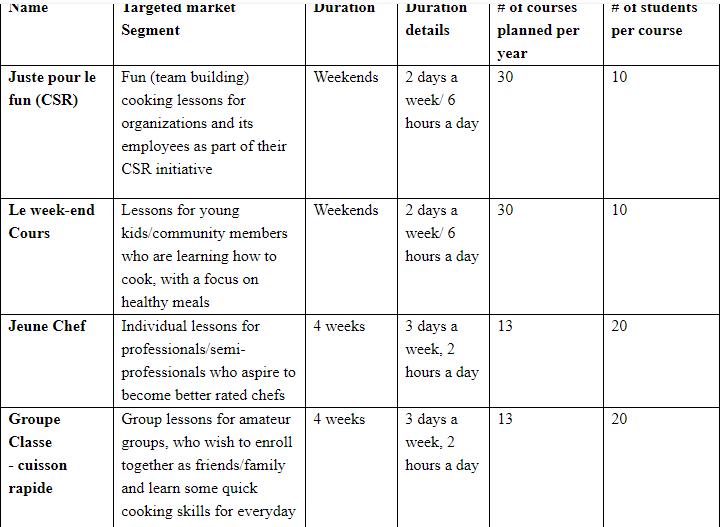

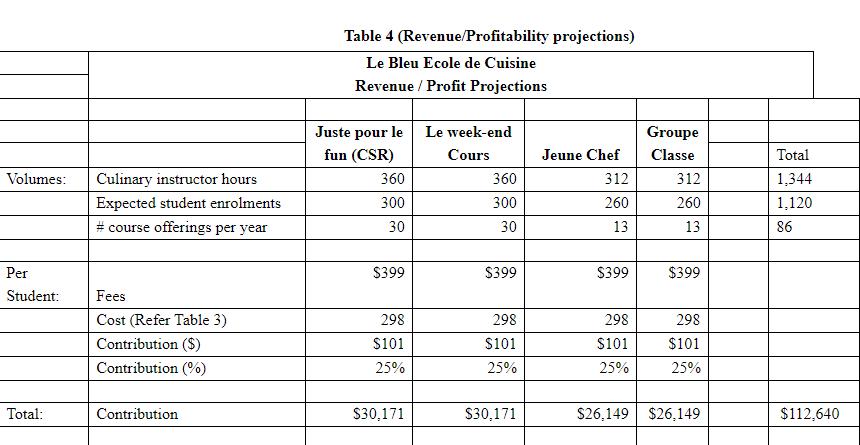

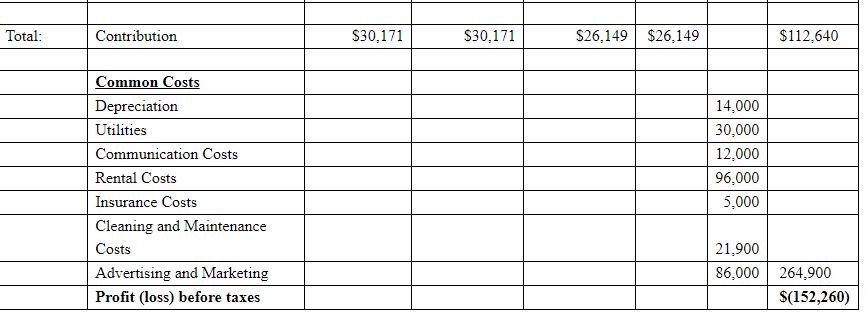

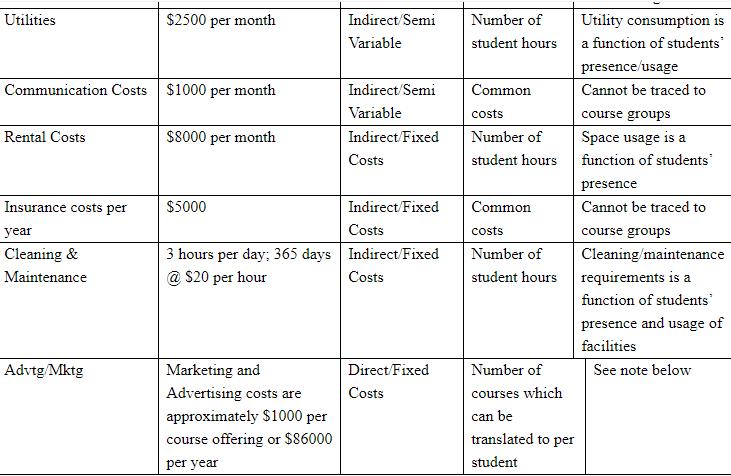

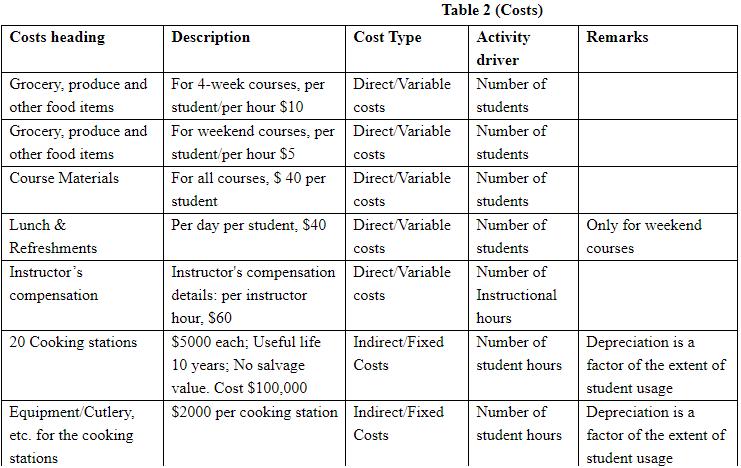

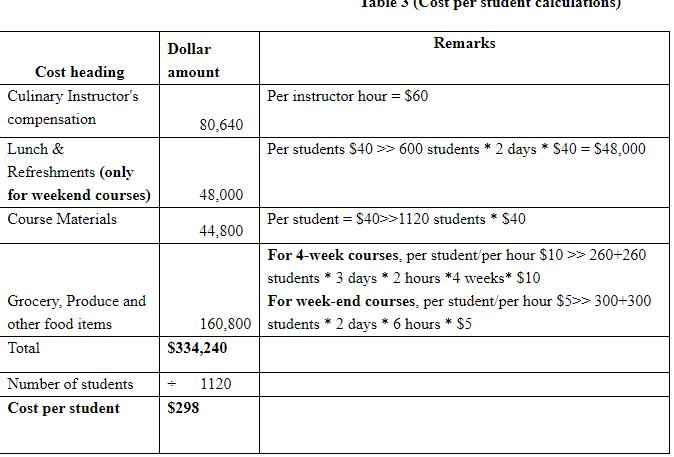

Not for nothing was Sophie Brazier, an acclaimed Michelin star chef. Coming from a family of culinary experts dating back three generations, it was Sophie’s great grandmother who was an inspiration behind her great grandfather becoming a famous chef during a time when women were hardly recognized in this profession. Sophie was not only a great chef but also had the rare ability to share her knowledge and skills by training young budding cooks. One fine spring morning, in April 2020, from her beautiful waterfront home in Montreal, when the world was crippled due to the COVID-19 pandemic, Sophie started to formalize her longtime dream of setting up a culinary institute to offer various courses to train and improve participants’ culinary skills. She took some notes on the type of courses that she might be passionate about and in a moment of creative flourish, coined a name for the institute (Le Bleu Ecole de Cuisine) and also some names and descriptions for the cooking courses she wished to offer (Table 1). One of her broad strategic goals is to bring cooking to the corporate world and to the community. She wished to offer week-end courses to employees to learn healthy cooking, while also having fun. She also wished to offer a similar program for the young kids and community at large, which potentially could bring back the health and fun element to cooking. She deeply detested the fast food culture and held the view that it was singularly responsible for many modern-day malaises. Her mission was to bring the joy of delightful cooking and mindful eating back into everyone’s lives. Over the next couple of weeks, she held web-conferences with her tax accountant and shared broad details about the type of courses on offer, in terms of its duration, scheduling, and so on (Table 1). She also carried out extensive research to come up with an estimate of costs with the help of her tax accountant (Table 2). She realized that not all of these costs may be applicable for all courses that she intended to offer, however being unsure how to organize those costs and revenues to calculate profitability, she relied on her tax accountant. She did place a higher emphasis on Advertising/Marketing costs with a greater focus on Corporate clients and Community/Young weekend participants. She was also particular that cleaning and maintenance be carried out throughout the year to maintain good hygienic discipline. Since she wanted to make this affordable to most participants, she was keen to peg the fees at $399 per participant, as course fees. Thereon she commissioned her tax-accountant to estimate the profitability of the institute and if possible, individual courses. Sophie’s tax-accountant reverted in a week’s time and reported a broad summary of operations and profitability (Table 4) and a cost per student (Table 3). In his calculations, although the individual courses looked profitable with a positive contribution margin, overall LBEC was projected to make a loss of C$ 152,260.00 in the first year of operations.

Not for nothing was Sophie Brazier, an acclaimed Michelin star chef. Coming from a family of culinary experts dating back three generations, it was Sophie’s great grandmother who was an inspiration behind her great grandfather becoming a famous chef during a time when women were hardly recognized in this profession. Sophie was not only a great chef but also had the rare ability to share her knowledge and skills by training young budding cooks. One fine spring morning, in April 2020, from her beautiful waterfront home in Montreal, when the world was crippled due to the COVID-19 pandemic, Sophie started to formalize her longtime dream of setting up a culinary institute to offer various courses to train and improve participants’ culinary skills. She took some notes on the type of courses that she might be passionate about and in a moment of creative flourish, coined a name for the institute (Le Bleu Ecole de Cuisine) and also some names and descriptions for the cooking courses she wished to offer (Table 1). One of her broad strategic goals is to bring cooking to the corporate world and to the community. She wished to offer week-end courses to employees to learn healthy cooking, while also having fun. She also wished to offer a similar program for the young kids and community at large, which potentially could bring back the health and fun element to cooking. She deeply detested the fast food culture and held the view that it was singularly responsible for many modern-day malaises. Her mission was to bring the joy of delightful cooking and mindful eating back into everyone’s lives. Over the next couple of weeks, she held web-conferences with her tax accountant and shared broad details about the type of courses on offer, in terms of its duration, scheduling, and so on (Table 1). She also carried out extensive research to come up with an estimate of costs with the help of her tax accountant (Table 2). She realized that not all of these costs may be applicable for all courses that she intended to offer, however being unsure how to organize those costs and revenues to calculate profitability, she relied on her tax accountant. She did place a higher emphasis on Advertising/Marketing costs with a greater focus on Corporate clients and Community/Young weekend participants. She was also particular that cleaning and maintenance be carried out throughout the year to maintain good hygienic discipline. Since she wanted to make this affordable to most participants, she was keen to peg the fees at $399 per participant, as course fees. Thereon she commissioned her tax-accountant to estimate the profitability of the institute and if possible, individual courses. Sophie’s tax-accountant reverted in a week’s time and reported a broad summary of operations and profitability (Table 4) and a cost per student (Table 3). In his calculations, although the individual courses looked profitable with a positive contribution margin, overall LBEC was projected to make a loss of C$ 152,260.00 in the first year of operations.

This unnerved her no end. Despite the fact that Sophie was passionate about cooking and sharing her skills, she was not yet ready to make such a significant investment of her personal time and resources for a loss-making operation. Her conversations with the tax accountant was not enlightening or encouraging either. For example, she was not sure why the accountant combined many of the costs as common costs ($264,900) and not related it to the individual course groups. She also felt that the cost per student ($298) across all the courses, did not appear right. That is when she remembered her dearest high school friend, Sonu Mani, who herself went on to become a meritorious CPA graduate and now a senior partner with one of the Big 4 firms. She immediately got on phone with Sonu, who was enjoying a bit of respite amidst her radically changed schedule due to the COVID-19 pandemic. It was now left in Sonu’s safe hands to save Sophie’s worthy culinary institute!

Purpose of Case

LBEC is a culinary institute proposed by Sophie Brazier, a famed Michelin star chef. Based on her vision and research, which she shared with her tax accountant, a revenue and profitability projection was prepared by the latter for the first year of operations. It appears that the business would suffer a loss of $152,260 and Sophie has requested a review the financial information.

Requirements

You are expected to review the financial information and prepare a report for Sophie Brazier with recommendations.

1. Critically examine the calculations and projections made by tax accountant. The tables are all provided in an Excel worksheet on Brightspace.

2. Provide an alternate set of calculations (in contribution format by course) to provide further insight to Sophie on the profitability of each of the proposed culinary courses.

a. The per student cost calculation of $298 for all courses is a gross average based on a number of assumptions and grouping of all costs.

b. Advertising and Marketing costs are treated as common costs and shared equally.

c. Use the concept of traceable costs and cost drivers to directly assign or allocate the applicable Fixed and Indirect costs to the courses.

d. Identify what costs are truly common or shared and should not be assigned to the courses.

e. Without changing the number of courses or students or pricing what is a more accurate profitability of each of the courses?

3. What price per student per course is necessary for Sophie to at least break even?

4. Suggest some strategic and operational factors that Sophie should consider to improve the profitability of LBEC before going ahead with the project. For example:

a. Pricing strategy of the different courses - target markets, competition, etc. Should it be the same for all courses?

b. What is Sophie’s target profitability or expected return?

c. Competitive analysis of the Montreal culinary training market. What are cross marketing possibilities? Are there government grants or training funding available?

d. What are some potential financial and non-financial KPIs and measures that could be used to evaluate performance and success?

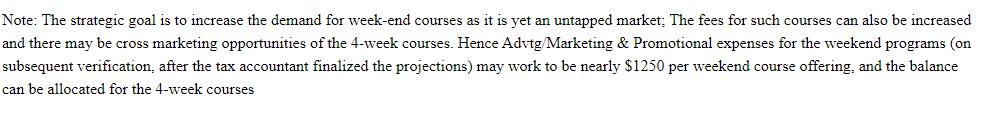

Note: The strategic goal is to increase the demand for week-end courses as it is yet an untapped market; The fees for such courses can also be increased and there may be cross marketing opportunities of the 4-week courses. Hence Advtg Marketing & Promotional expenses for the weekend programs (on subsequent verification, after the tax accountant finalized the projections) may work to be nearly $1250 per weekend course offering, and the balance can be allocated for the 4-week courses

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Analysis of Le Bleu Ecole de Cuisines Financial Information Review of Tax Accountants Calculations The tax accountants calculations have limitations Averaged Costs The 298 cost per student doesnt refl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started