Not really understanding the questions at the bottom, please show work if there is any!

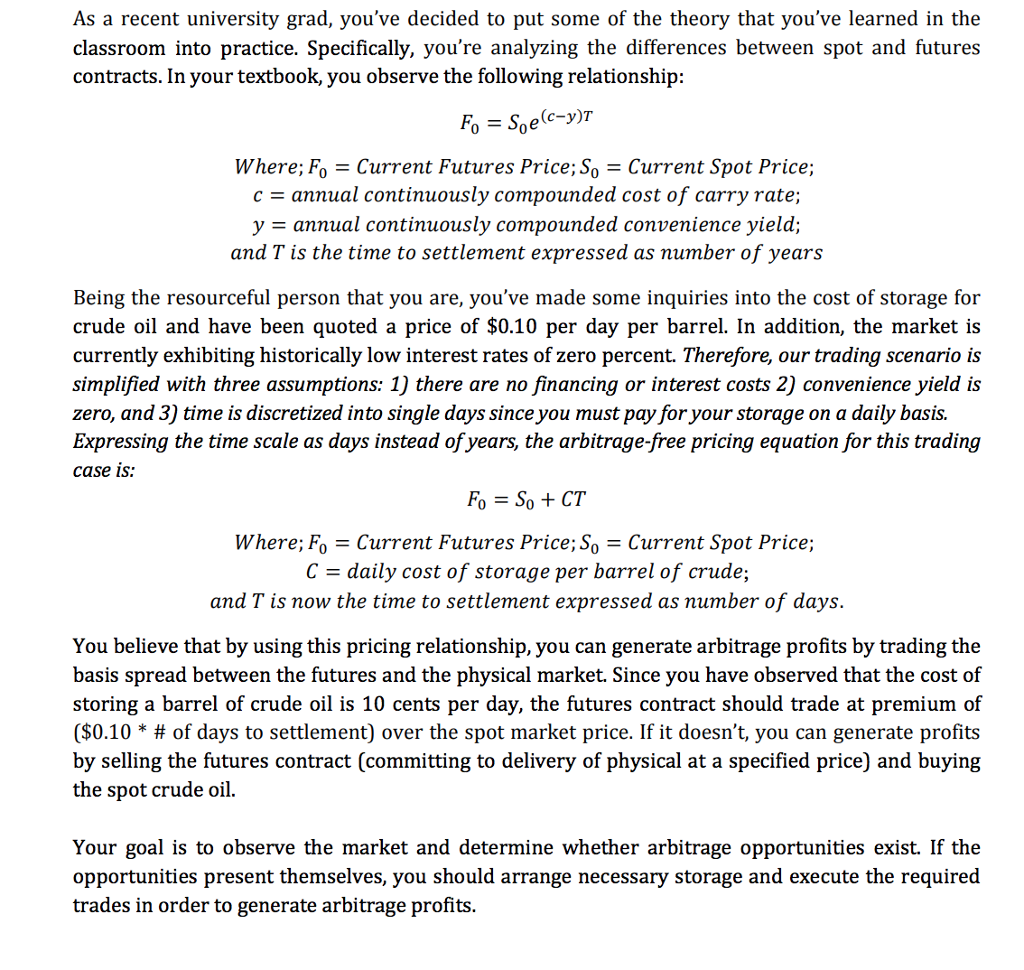

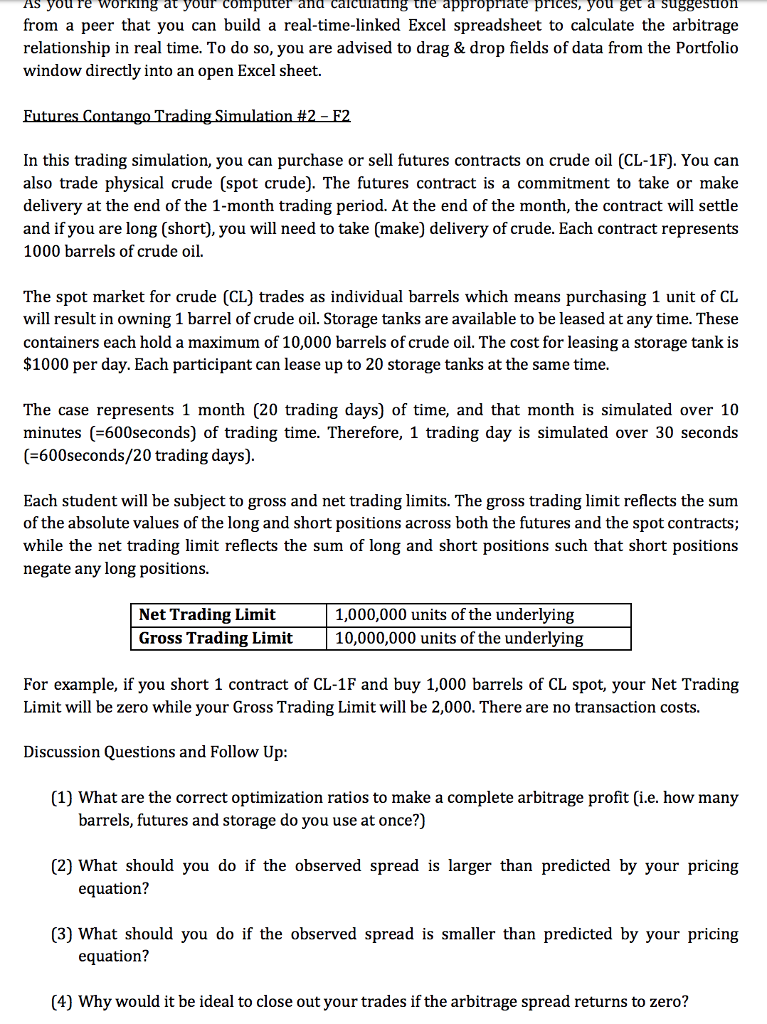

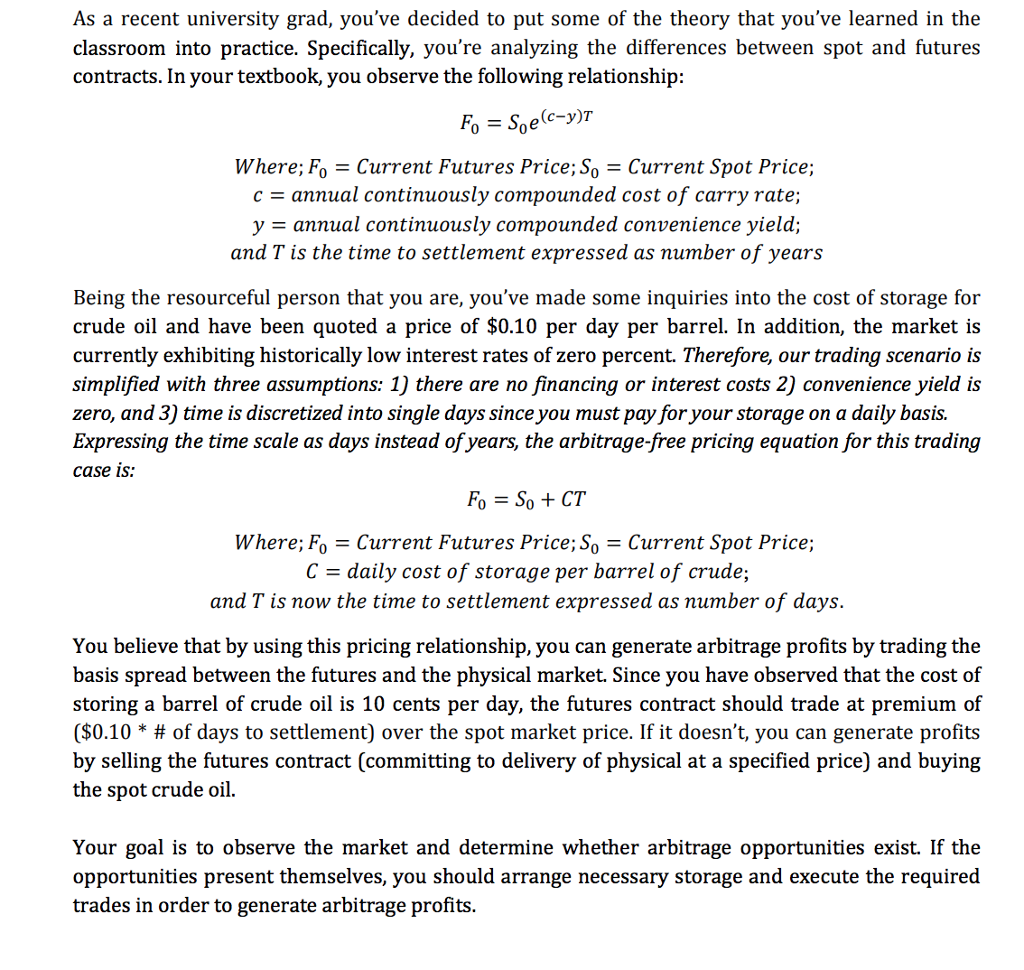

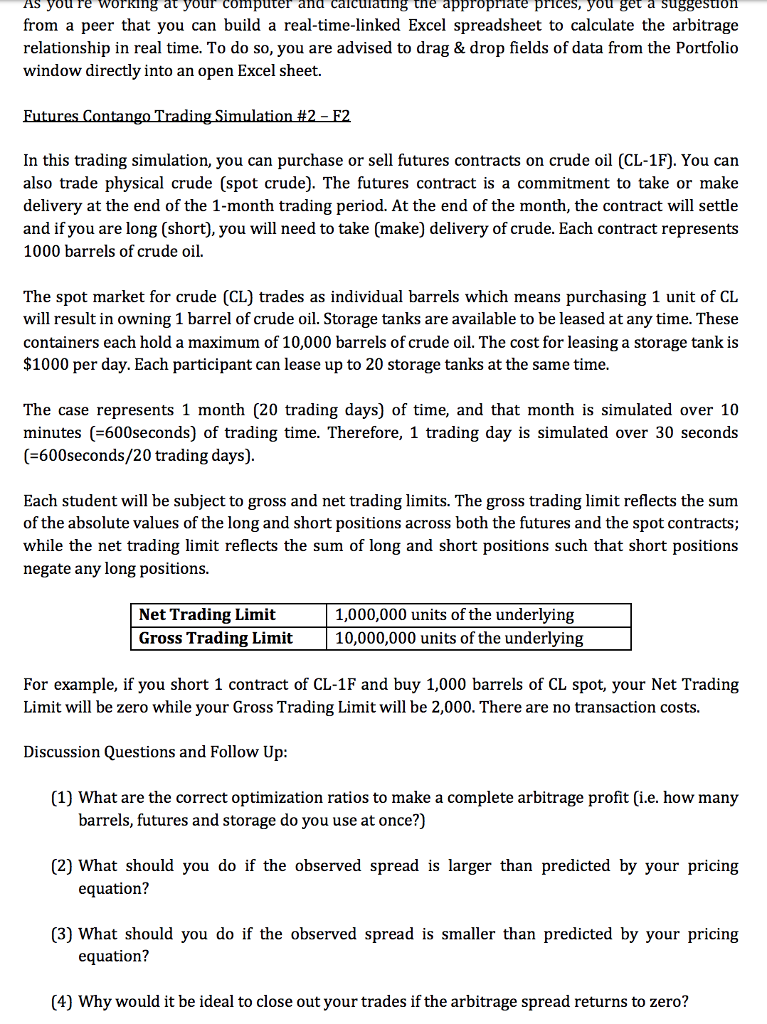

As a recent university grad, you've decided to put some of the theory that you've learned in the classroom into practice. Specifically, you're analyzing the differences between spot and futures contracts. In your textbook, you observe the following relationship 0 0 Where; Fo -Current Futures Price; So - Current Spot Price; c -annual continuously compounded cost of carry rate; y = annual continuously compounded convenience yield; and T is the time to settlement expressed as number of years Being the resourceful person that you are, you've made some inquiries into the cost of storage for crude oil and have been quoted a price of $0.10 per day per barrel. In addition, the market is currently exhibiting historically low interest rates of zero percent. Therefore, our trading scenario is simplified with three assumptions: 1) there are no financing or interest costs 2) convenience yield is zero, and 3) time is discretized into single days since you must pay for your storage on a daily basis. Expressing the time scale as days instead of years, the arbitrage-free pricing equation for this trading case is: Fo=So+CT Where; Fo-Current Futures Price; So-Current Spot Price; C = daily cost of storage per barrel of crude; and T is now the time to settlement expressed as number of days. You believe that by using this pricing relationship, you can generate arbitrage profits by trading the basis spread between the futures and the physical market. Since you have observed that the cost of storing a barrel of crude oil is 10 cents per day, the futures contract should trade at premium of ($0.10 * # of days to settlement) over the spot market price. If it doesn't, you can generate profits by selling the futures contract (committing to delivery of physical at a specified price) and buying the spot crude oil Your goal is to observe the market and determine whether arbitrage opportunities exist. If the opportunities present themselves, you should arrange necessary storage and execute the required trades in order to generate arbitrage profits. As a recent university grad, you've decided to put some of the theory that you've learned in the classroom into practice. Specifically, you're analyzing the differences between spot and futures contracts. In your textbook, you observe the following relationship 0 0 Where; Fo -Current Futures Price; So - Current Spot Price; c -annual continuously compounded cost of carry rate; y = annual continuously compounded convenience yield; and T is the time to settlement expressed as number of years Being the resourceful person that you are, you've made some inquiries into the cost of storage for crude oil and have been quoted a price of $0.10 per day per barrel. In addition, the market is currently exhibiting historically low interest rates of zero percent. Therefore, our trading scenario is simplified with three assumptions: 1) there are no financing or interest costs 2) convenience yield is zero, and 3) time is discretized into single days since you must pay for your storage on a daily basis. Expressing the time scale as days instead of years, the arbitrage-free pricing equation for this trading case is: Fo=So+CT Where; Fo-Current Futures Price; So-Current Spot Price; C = daily cost of storage per barrel of crude; and T is now the time to settlement expressed as number of days. You believe that by using this pricing relationship, you can generate arbitrage profits by trading the basis spread between the futures and the physical market. Since you have observed that the cost of storing a barrel of crude oil is 10 cents per day, the futures contract should trade at premium of ($0.10 * # of days to settlement) over the spot market price. If it doesn't, you can generate profits by selling the futures contract (committing to delivery of physical at a specified price) and buying the spot crude oil Your goal is to observe the market and determine whether arbitrage opportunities exist. If the opportunities present themselves, you should arrange necessary storage and execute the required trades in order to generate arbitrage profits