Answered step by step

Verified Expert Solution

Question

1 Approved Answer

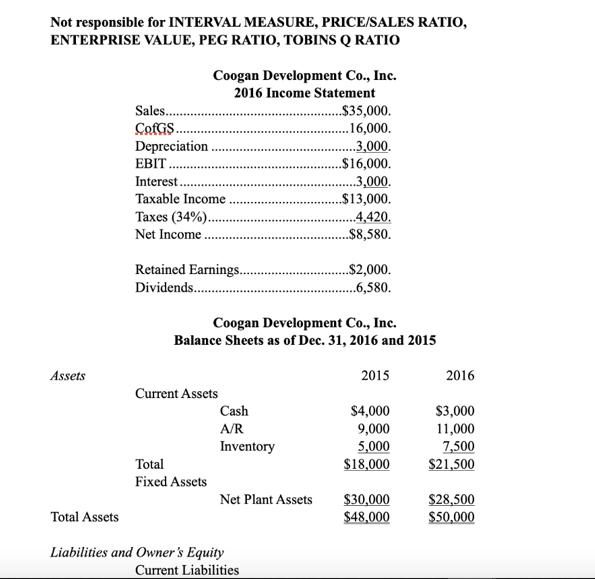

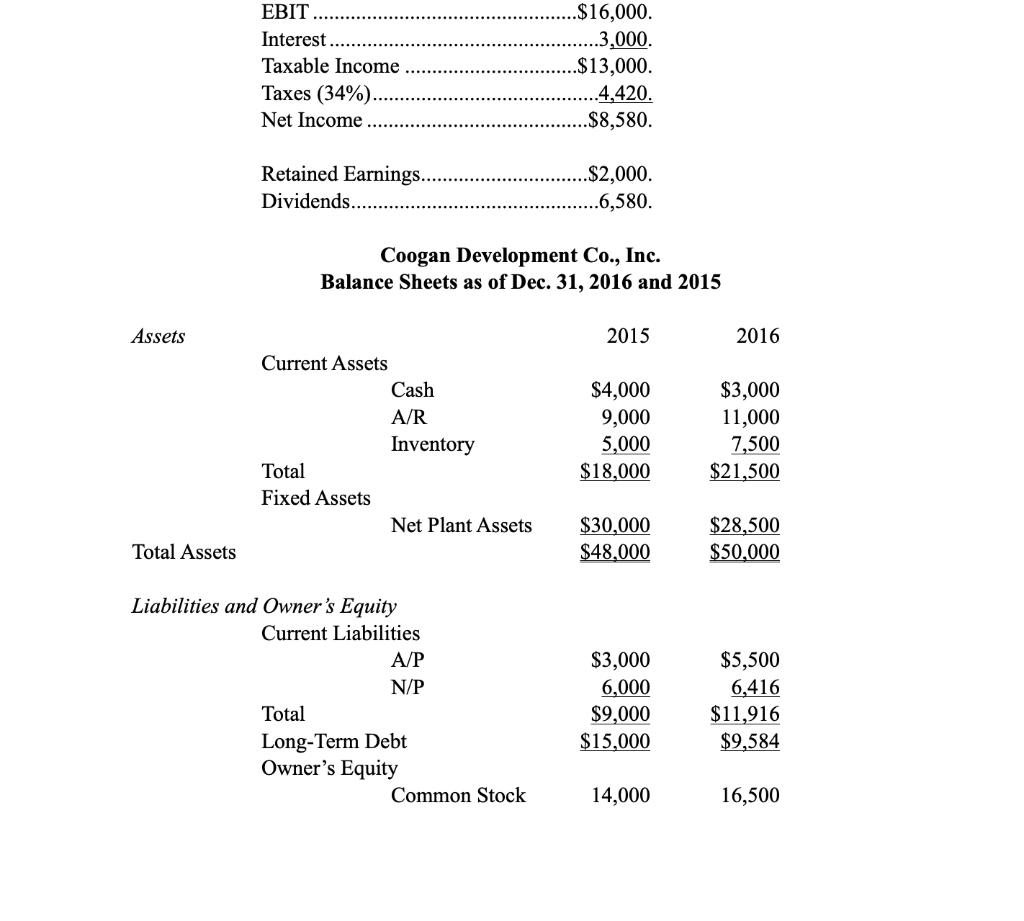

Not responsible for INTERVAL MEASURE, PRICE/SALES RATIO, ENTERPRISE VALUE, PEG RATIO, TOBINS Q RATIO Assets Total Assets Coogan Development Co., Inc. 2016 Income Statement

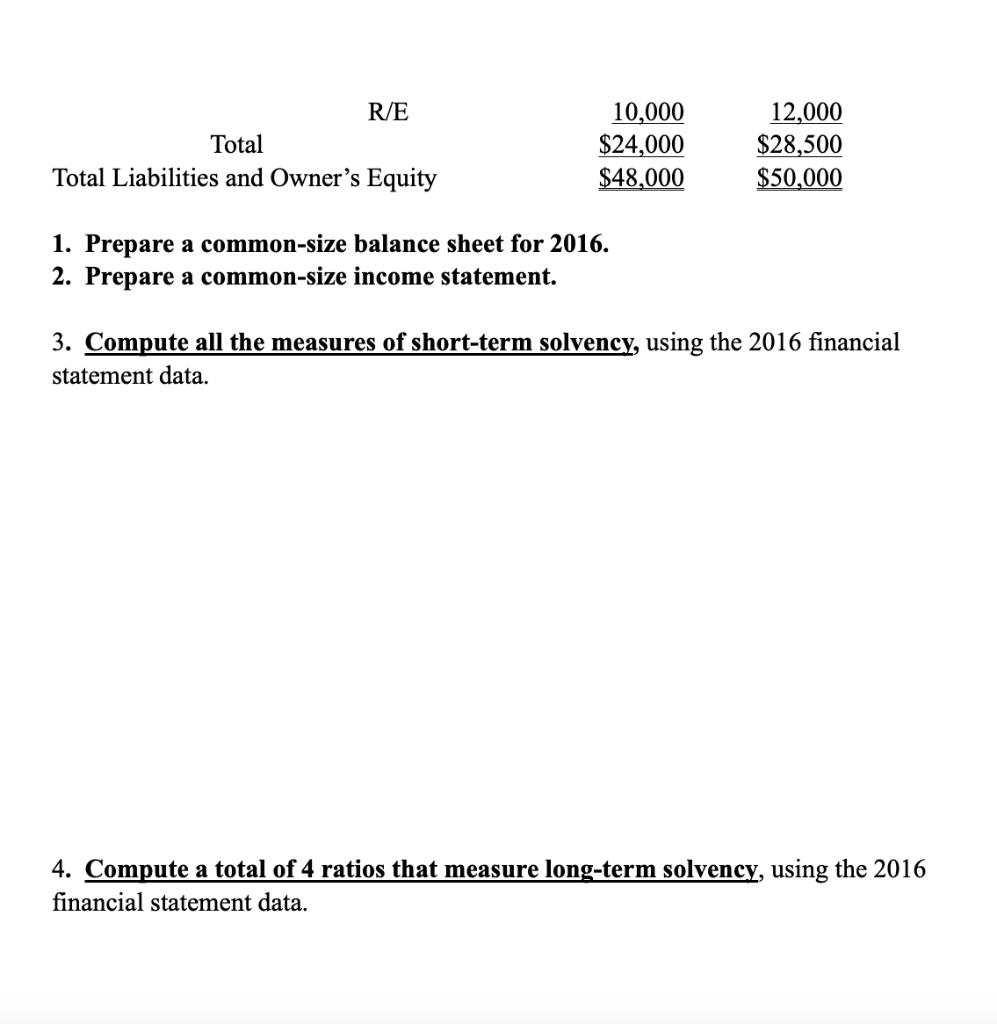

Not responsible for INTERVAL MEASURE, PRICE/SALES RATIO, ENTERPRISE VALUE, PEG RATIO, TOBINS Q RATIO Assets Total Assets Coogan Development Co., Inc. 2016 Income Statement Sales.. CofGS. Depreciation EBIT. Interest. Taxable Income Taxes (34%).. Net Income Retained Earnings.. Dividends............. Current Assets Total Fixed Assets Coogan Development Co., Inc. Balance Sheets as of Dec. 31, 2016 and 2015 Cash A/R Inventory Net Plant Assets ..$35,000. .16,000. ..3,000. .$16,000. ...3,000. $13,000. Liabilities and Owner's Equity Current Liabilities ..4,420. ..$8,580. ..$2,000. ..6,580. 2015 $4,000 9,000 5,000 $18,000 $30,000 $48,000 2016 $3,000 11,000 7,500 $21,500 $28,500 $50,000 Assets Total Assets EBIT Interest Taxable Income Taxes (34%)... Net Income Retained Earnings. Dividends.. Current Assets Total Fixed Assets Coogan Development Co., Inc. Balance Sheets as of Dec. 31, 2016 and 2015 Cash A/R Inventory Net Plant Assets Liabilities and Owner's Equity Current Liabilities A/P N/P Total Long-Term Debt Owner's Equity .$16,000. ...3,000. .$13,000. Common Stock ..4,420. ..$8,580. .$2,000. .....6,580. 2015 $4,000 9,000 5,000 $18,000 $30,000 $48,000 $3,000 6,000 $9,000 $15,000 14,000 2016 $3,000 11,000 7,500 $21,500 $28,500 $50,000 $5,500 6,416 $11,916 $9,584 16,500 R/E Total Total Liabilities and Owner's Equity 10,000 $24,000 $48,000 1. Prepare a common-size balance sheet for 2016. 2. Prepare a common-size income statement. 12,000 $28,500 $50,000 3. Compute all the measures of short-term solvency, using the 2016 financial statement data. 4. Compute a total of 4 ratios that measure long-term solvency, using the 2016 financial statement data. 6. Compute all the profitability measures using the 2016 balance sheet and income statement data. 7. Use the DuPont identity to compute return on equity for 2016 for Coogan Development. 8. Suppose that Coogan Development has 2,000 shares of common stock outstanding, and that the market price per share is $40. Compute EPS, the PE ratio and the market-to- book ratio for 2016. 5. Compute a total of 4 ratios that measure asset management using the 2016 financial statement data.

Step by Step Solution

★★★★★

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started