Not sure how to record these please help

Not sure how to record these please help

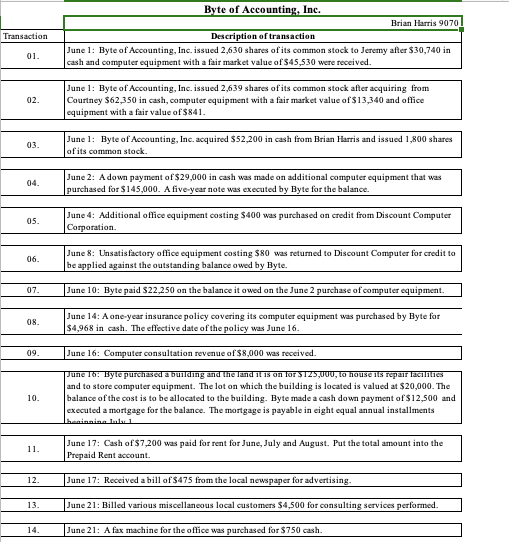

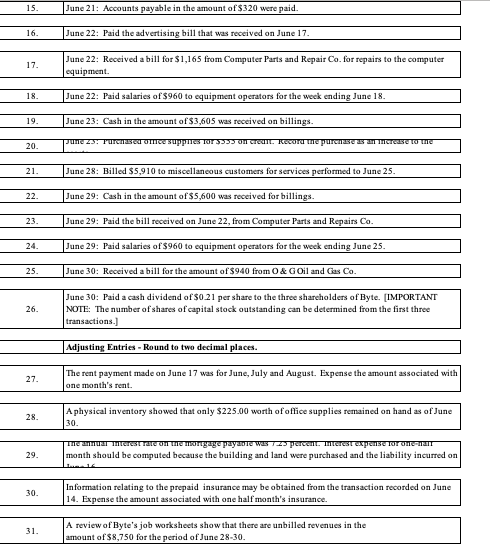

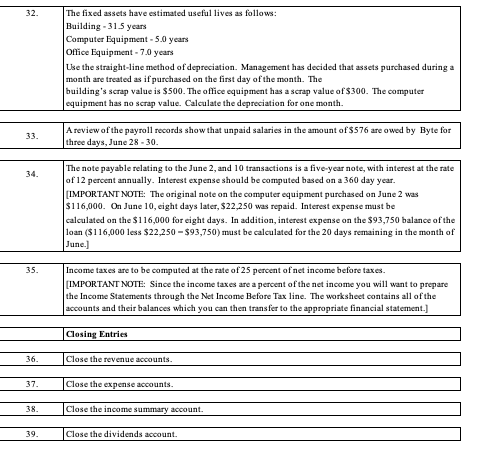

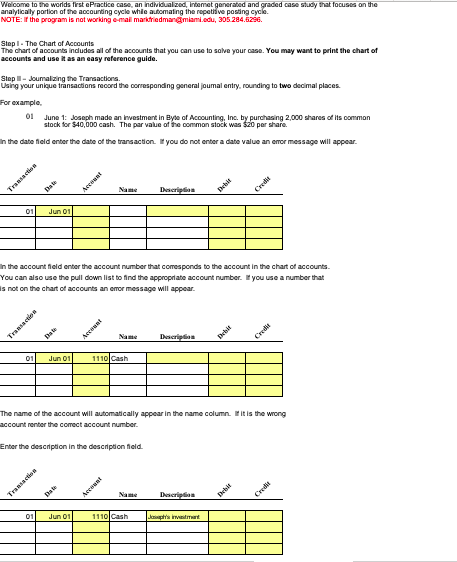

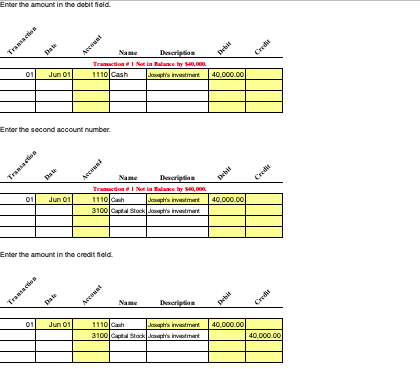

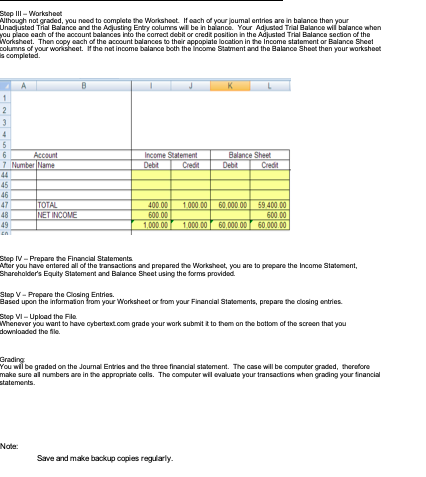

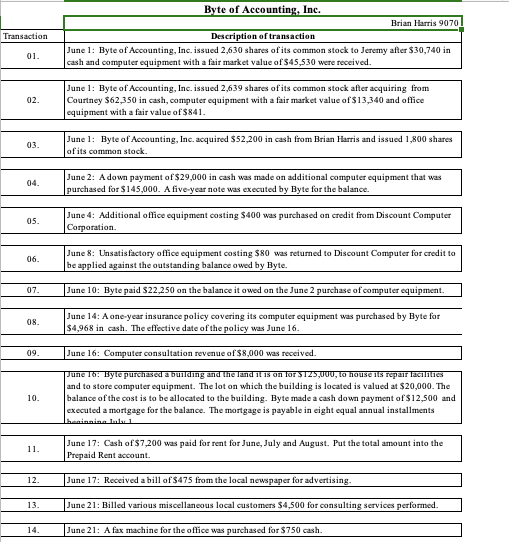

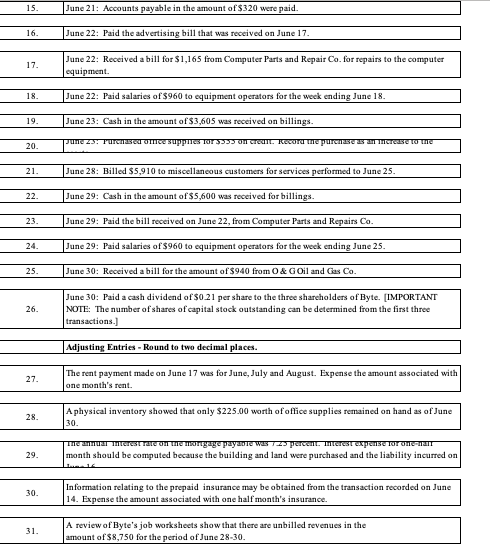

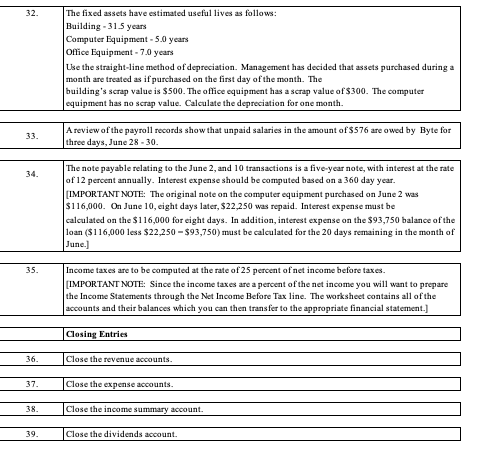

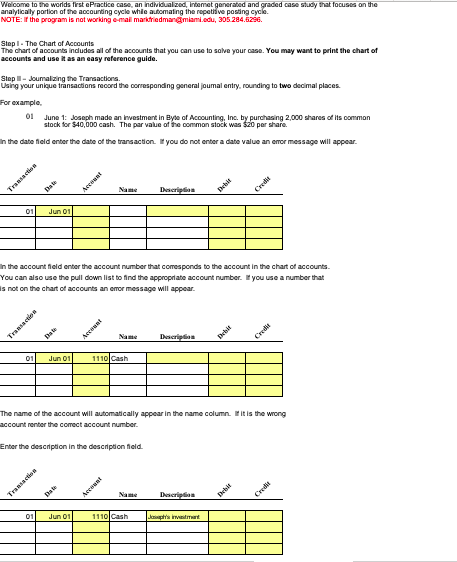

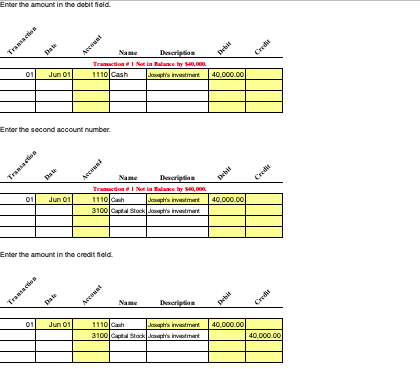

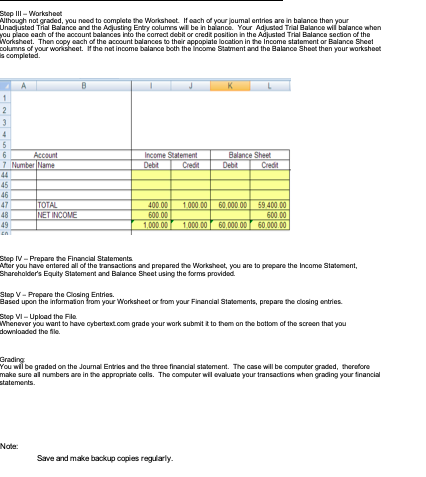

Transaction Byte of Accounting, Inc. Brian Harris 90701 Description of transaction June 1: Byte of Accounting, Inc. issued 2.6.30 shares of its common stock to Jeremy after $30.740 in cash and computer equipment with a fair market value of $45,530 were received 02. June 1: Byte of Accounting, Inc. issued 2,639 shares of its common stock after acquiring from Courtney $62,350 in cash, computer equipment with a fair market value of $13,340 and office equipment with a fair value of $841. June 1: Byte of Accounting, Inc. acquired $52,200 in cash from Brian Harris and issued 1,800 shares of its common stock. June 2: A down payment of $29,000 in cash was made on additional computer equipment that was purchased for $145,000. A five-year note was executed by Byte for the balance. June 4: Additional office equipment costing $400 was purchased on credit from Discount Computer Corporation June : Unsatisfactory office equipment costing $80 was retumed to Discount Computer for credit to be applied against the outstanding balance owed by Byte. June 10: Byte paid $22.250 on the balance it owed on the June 2 purchase of computer equipment. 08. June 14: A one-year insurance policy covering its computer equipment was purchased by Byte for $4,968 in cash. The effective date of the policy was June 16. 09. June 16: Computer consultation revenue of $8,000 was received. 10. und To: Eyle purchase a bun i c and it is on for TZSUUU, to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $20,000. The balance of the cost is to be allocated to the building. Byte made a cash down payment of $12,500 and executed a mortgage for the balance. The mortgage is payable in eight equal annual installments 11. June 17: Cash of $7,200 was paid for rent for Junc, July and August. Put the total amount into the Prepaid Rent account. 12. June 17: Received a bill of $475 from the local newspaper for advertising. 13 June 21: Billed various miscellaneous local customers $4.500 for consulting services performed June 21: A fax machine for the office was purchased for $750 cash 15. June 21: Accounts payable in the amount of $320 were paid. 16 June 22: Paid the advertising bill that was received on June 17. 17. June 22: Received a bill for $1,165 from Computer Parts and Repair Co.for repairs to the computer equipment. 18 June 22: Paid salaries of $960 to equipment operators for the week ending June 18. 19. June 23: Cash in the amount of $3,605 was received on billings. - 20 T O T priestor 33 of creat. TECUT THE PUT IT TO 21 June 28: Billed $5,910 to miscellaneous customers for services performed to June 25. 22 June 29: Cash in the amount of $5,600 was received for billings. 23 June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co. 24. June 29: Paid salaries of $960 ta equipment operators for the week ending June 25. 25 June 30: Received a bill for the amount of $940 from O&G Oil and Gas Co. - 26. June 30: Paid a cash dividend of $0.21 per share to the three shareholders of Byte. (IMPORTANT NOTE: The number of shares of capital stock outstanding can be determined from the first three transactions. Adjusting Entries - Round to two decimal places. 27. The rent payment made on June 17 was for June, July and August. Expense the amount associated with one month's rent. A physical inventory showed that only $225.00 worth of office supplies remained on hand as of June 10 29. TEST TO OTE Pay WIST . TETEST IS TOYOTA month should be computed because the building and land were purchased and the liability incurred on 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance A review of Byte's job worksheets show that there are unbilled revenues in the amount of $8.750 for the period of June 28-30 The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment -70 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $500. The office equipment has a scrap value of $300. The computer equipment has no scrap value. Calculate the depreciation for one month. A review of the payroll records show that unpaid salaries in the amount of $576 are owed by Hyte for three days, June 28 - 30. The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $116,000. On June 10, cight days later, $22,250 was repaid. Interest expense must be calculated on the $116,000 for eight days. In addition, interest expense on the $93.750 balance of the loan ($116,000 less $22,250 - 593,750) must be calculated for the 20 days remaining in the month of June. Income taxes are to be computed at the rate of 25 percent of net income before taxes [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement. Closing Entries 36. Close the revenue accounts. 37. Close the expense accounts. 38. Close the income summary account. 39. Close the dividends account. "Welcome to the worlds first Practice as an individualized internet generated and graded case study that focuses on the analytically portion of the accounting cycle while automating the repetitive posting cycle NOTE: the program is not working email markedmaramiami. 305 284.5256 Step 1. The Chart of Accounts The chart of accounts indudes all of the accounts that you can use to save your case. You may want to print the chart of accounts and use it as an easy reference guide Stop the Transactions Using your unique transaction record the corresponding general maltry, rounding to two decimal places For example 01 Junet Joseph made an investment in Byte of Accounting, Inc. by purchasing 2.000 shares of its common stock for $40.000 cash. The par value of the common stock was $20 per share In the date field enter the date of the transaction you do not enter a date value an error message will appear. 01 Jun 01 in the account Neld enter the account number that comesponds to the account in the chart of accounts You can also use the pull down list to find the appropriate account number. you use a number that s not on the chart of accounts an amor message will appear. 01 Jun 01 1110 Cash it is the wrong The name of the account will automatically appear in the name column account t he corect account number Enter the description in the description field 1110 Cash Enter the amount in the debited 01 Jun 01 1110 Cash Enter the second account number Name Description 011 Jun 011 n 40.000 1110 3100 i 's Stack Enter the amount in the credit field Juno 1110 She Wish mouch ogradedyou need to complete the Worksheet each of your journal entries are in balance then your Unasusted Trial Balance and the Austing Entry columns will be in balance Your Adusted Trial Balance will balance when place each of the account balances to the comed or credit position in the Austed Trail Balance section of the e Than Yeach of the account balances to their appaiate location in the income stane on the Ingma r Balance Sheet columns of your worksheet the net income balance both the income Statment and the Balance She then your workshok W Income Statement Debt Credit Blance Sheet Debt Deo 40000 100000 60 000 0059400.00 TTOTAL INET INCOME 500.00 600.00 1,000.00 1.000.00 60,000.00 60.000.00 Step IV - Prepare the Financial Statements Nor you have entered all of the Vansactions and prepared the Worksheet, you are to prepare the income Statement, Shareholder's Equity Statement and Balance Sheet using the forms provided Step V - Prepare the Closing Entries. Based upon the information from your Worksheet or from your Financial Statements, prepare the closing entries Sep vi-upload the File Whenever you want to have cybertext.com grade your work submit to them on the bottom of the screen that you downloaded the file Trading You will be graded on the Journal Entries and the three financial statement. The case will be computer graded, therefore make sure al numbers are in the appropriate . The computer wil evaluate your transactions when grading your financial statements Note: Save and make backup copies regularly Transaction Byte of Accounting, Inc. Brian Harris 90701 Description of transaction June 1: Byte of Accounting, Inc. issued 2.6.30 shares of its common stock to Jeremy after $30.740 in cash and computer equipment with a fair market value of $45,530 were received 02. June 1: Byte of Accounting, Inc. issued 2,639 shares of its common stock after acquiring from Courtney $62,350 in cash, computer equipment with a fair market value of $13,340 and office equipment with a fair value of $841. June 1: Byte of Accounting, Inc. acquired $52,200 in cash from Brian Harris and issued 1,800 shares of its common stock. June 2: A down payment of $29,000 in cash was made on additional computer equipment that was purchased for $145,000. A five-year note was executed by Byte for the balance. June 4: Additional office equipment costing $400 was purchased on credit from Discount Computer Corporation June : Unsatisfactory office equipment costing $80 was retumed to Discount Computer for credit to be applied against the outstanding balance owed by Byte. June 10: Byte paid $22.250 on the balance it owed on the June 2 purchase of computer equipment. 08. June 14: A one-year insurance policy covering its computer equipment was purchased by Byte for $4,968 in cash. The effective date of the policy was June 16. 09. June 16: Computer consultation revenue of $8,000 was received. 10. und To: Eyle purchase a bun i c and it is on for TZSUUU, to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $20,000. The balance of the cost is to be allocated to the building. Byte made a cash down payment of $12,500 and executed a mortgage for the balance. The mortgage is payable in eight equal annual installments 11. June 17: Cash of $7,200 was paid for rent for Junc, July and August. Put the total amount into the Prepaid Rent account. 12. June 17: Received a bill of $475 from the local newspaper for advertising. 13 June 21: Billed various miscellaneous local customers $4.500 for consulting services performed June 21: A fax machine for the office was purchased for $750 cash 15. June 21: Accounts payable in the amount of $320 were paid. 16 June 22: Paid the advertising bill that was received on June 17. 17. June 22: Received a bill for $1,165 from Computer Parts and Repair Co.for repairs to the computer equipment. 18 June 22: Paid salaries of $960 to equipment operators for the week ending June 18. 19. June 23: Cash in the amount of $3,605 was received on billings. - 20 T O T priestor 33 of creat. TECUT THE PUT IT TO 21 June 28: Billed $5,910 to miscellaneous customers for services performed to June 25. 22 June 29: Cash in the amount of $5,600 was received for billings. 23 June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co. 24. June 29: Paid salaries of $960 ta equipment operators for the week ending June 25. 25 June 30: Received a bill for the amount of $940 from O&G Oil and Gas Co. - 26. June 30: Paid a cash dividend of $0.21 per share to the three shareholders of Byte. (IMPORTANT NOTE: The number of shares of capital stock outstanding can be determined from the first three transactions. Adjusting Entries - Round to two decimal places. 27. The rent payment made on June 17 was for June, July and August. Expense the amount associated with one month's rent. A physical inventory showed that only $225.00 worth of office supplies remained on hand as of June 10 29. TEST TO OTE Pay WIST . TETEST IS TOYOTA month should be computed because the building and land were purchased and the liability incurred on 30. Information relating to the prepaid insurance may be obtained from the transaction recorded on June 14. Expense the amount associated with one half month's insurance A review of Byte's job worksheets show that there are unbilled revenues in the amount of $8.750 for the period of June 28-30 The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment -70 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $500. The office equipment has a scrap value of $300. The computer equipment has no scrap value. Calculate the depreciation for one month. A review of the payroll records show that unpaid salaries in the amount of $576 are owed by Hyte for three days, June 28 - 30. The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $116,000. On June 10, cight days later, $22,250 was repaid. Interest expense must be calculated on the $116,000 for eight days. In addition, interest expense on the $93.750 balance of the loan ($116,000 less $22,250 - 593,750) must be calculated for the 20 days remaining in the month of June. Income taxes are to be computed at the rate of 25 percent of net income before taxes [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement. Closing Entries 36. Close the revenue accounts. 37. Close the expense accounts. 38. Close the income summary account. 39. Close the dividends account. "Welcome to the worlds first Practice as an individualized internet generated and graded case study that focuses on the analytically portion of the accounting cycle while automating the repetitive posting cycle NOTE: the program is not working email markedmaramiami. 305 284.5256 Step 1. The Chart of Accounts The chart of accounts indudes all of the accounts that you can use to save your case. You may want to print the chart of accounts and use it as an easy reference guide Stop the Transactions Using your unique transaction record the corresponding general maltry, rounding to two decimal places For example 01 Junet Joseph made an investment in Byte of Accounting, Inc. by purchasing 2.000 shares of its common stock for $40.000 cash. The par value of the common stock was $20 per share In the date field enter the date of the transaction you do not enter a date value an error message will appear. 01 Jun 01 in the account Neld enter the account number that comesponds to the account in the chart of accounts You can also use the pull down list to find the appropriate account number. you use a number that s not on the chart of accounts an amor message will appear. 01 Jun 01 1110 Cash it is the wrong The name of the account will automatically appear in the name column account t he corect account number Enter the description in the description field 1110 Cash Enter the amount in the debited 01 Jun 01 1110 Cash Enter the second account number Name Description 011 Jun 011 n 40.000 1110 3100 i 's Stack Enter the amount in the credit field Juno 1110 She Wish mouch ogradedyou need to complete the Worksheet each of your journal entries are in balance then your Unasusted Trial Balance and the Austing Entry columns will be in balance Your Adusted Trial Balance will balance when place each of the account balances to the comed or credit position in the Austed Trail Balance section of the e Than Yeach of the account balances to their appaiate location in the income stane on the Ingma r Balance Sheet columns of your worksheet the net income balance both the income Statment and the Balance She then your workshok W Income Statement Debt Credit Blance Sheet Debt Deo 40000 100000 60 000 0059400.00 TTOTAL INET INCOME 500.00 600.00 1,000.00 1.000.00 60,000.00 60.000.00 Step IV - Prepare the Financial Statements Nor you have entered all of the Vansactions and prepared the Worksheet, you are to prepare the income Statement, Shareholder's Equity Statement and Balance Sheet using the forms provided Step V - Prepare the Closing Entries. Based upon the information from your Worksheet or from your Financial Statements, prepare the closing entries Sep vi-upload the File Whenever you want to have cybertext.com grade your work submit to them on the bottom of the screen that you downloaded the file Trading You will be graded on the Journal Entries and the three financial statement. The case will be computer graded, therefore make sure al numbers are in the appropriate . The computer wil evaluate your transactions when grading your financial statements Note: Save and make backup copies regularly

Not sure how to record these please help

Not sure how to record these please help