Answered step by step

Verified Expert Solution

Question

1 Approved Answer

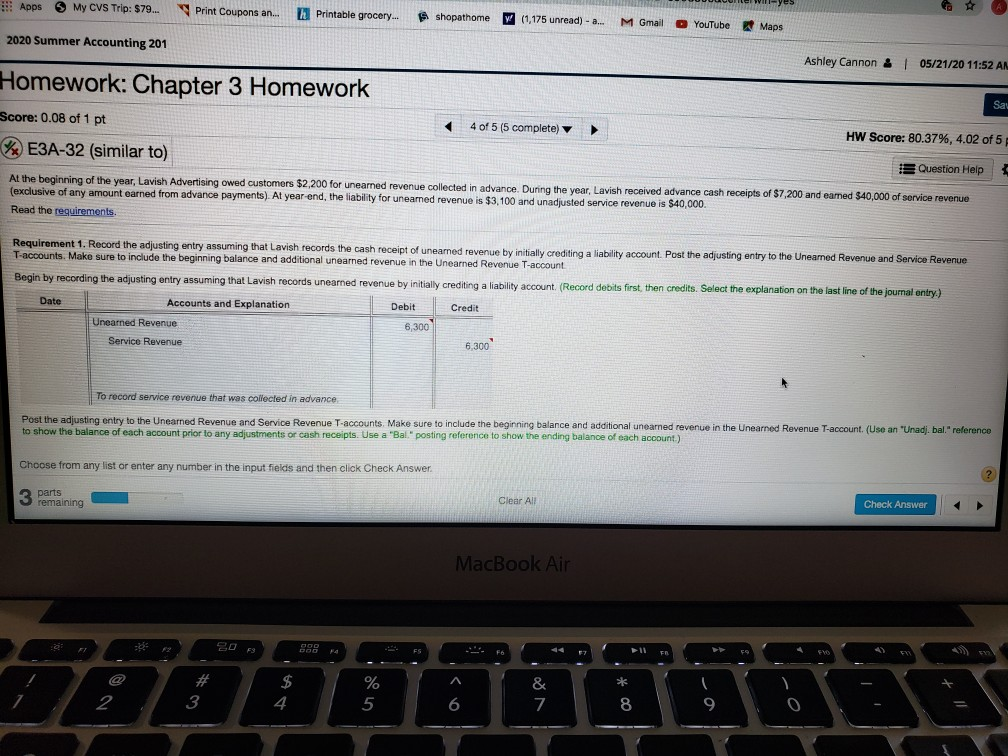

not sure how to work this problem. help braking it down please. Apps My CVS Trip: $79... Print Coupons an... Printable grocery S shopathome W

not sure how to work this problem. help braking it down please.

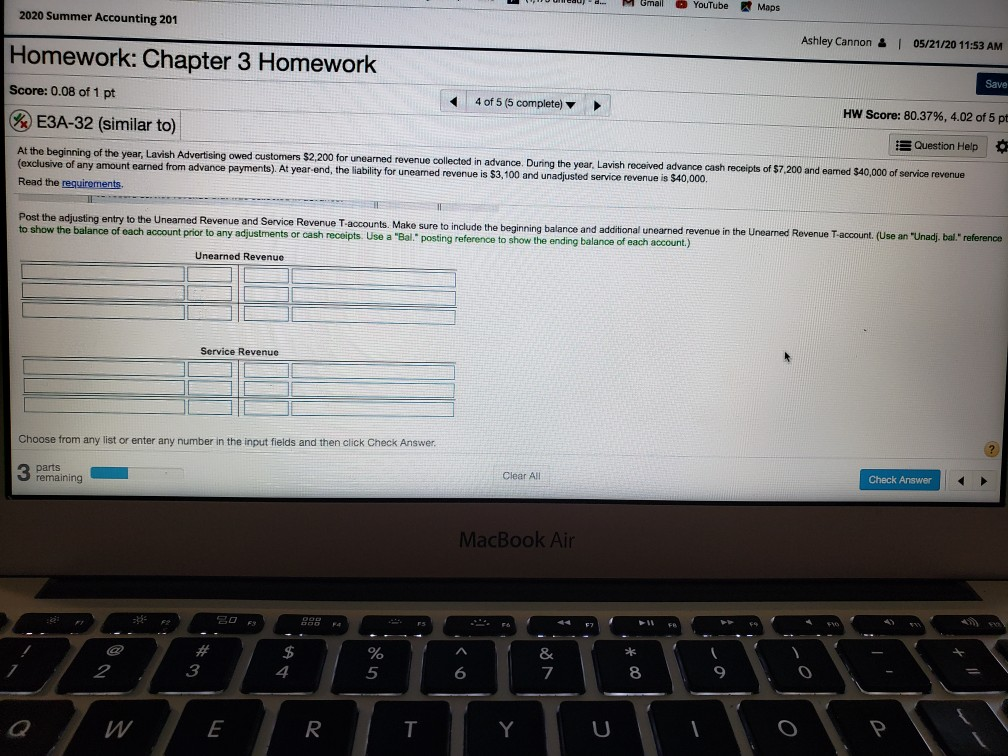

Apps My CVS Trip: $79... Print Coupons an... Printable grocery S shopathome W (1,175 unread) - a... M Gmail O YouTube Maps 2020 Summer Accounting 201 Ashley Cannon & 1 05/21/20 11:52 AM Homework: Chapter 3 Homework Sau Score: 0.08 of 1 pt 4 of 5 (5 complete) HW Score: 80.37%, 4.02 of 5 %E3A-32 (similar to) Question Help At the beginning of the year, Lavish Advertising owed customers $2,200 for unearned revenue collected in advance. During the year, Lavish received advance cash receipts of $7,200 and eamed $40,000 of service revenue (exclusive of any amount earned from advance payments). At year-end, the liability for unearned revenue is $3,100 and unadjusted service revenue is $40,000 Read the requirements. Requirement 1. Record the adjusting entry assuming that Lavish records the cash receipt of uneamed revenue by initially crediting a liability account. Post the adjusting entry to the Unearned Revenue and Service Revenue T-accounts. Make sure to include the beginning balance and additional unearned revenue in the Unearned Revenue T-account Begin by recording the adjusting entry assuming that Lavish records unearned revenue by initially crediting a liability account. (Record debits first, then credits. Select the explanation on the last line of the journal entry) Date Accounts and Explanation Debit Credit Unearned Revenue 6,300 Service Revenue 6.300 To record service revenue that was collected in advance Post the adjusting entry to the Unearned Revenue and Service Revenue T-accounts. Make sure to include the beginning balance and additional unearned revenue in the Unearned Revenue T-account. (Use an "Unadj. bal." reference to show the balance of each account prior to any adjustments or cash receipts. Use a "Bal" posting reference to show the ending balance of each account.) Choose from any list or enter any number in the input fields and then click Check Answer ? 3 parts remaining Clear All Check Answer MacBook Air -- 20 S 000 EV @ # sk $ 4 2 % 5 3 & 7 6 8 9 0 Gmail YouTube Maps 2020 Summer Accounting 201 Ashley Cannon & 05/21/20 11:53 AM Homework: Chapter 3 Homework Save Score: 0.08 of 1 pt 4 of 5 (5 complete) HW Score: 80.37%, 4.02 of 5 pt E3A-32 (similar to) Question Help At the beginning of the year, Lavish Advertising owed customers $2,200 for unearned revenue collected in advance. During the year. Lavish received advance cash receipts of $7.200 and eamed $40,000 of service revenue (exclusive of any amount earned from advance payments). At year end, the liability for uneared revenue is $3,100 and unadjusted service revenue is $40,000 Read the requirements Post the adjusting entry to the Uneamed Revenue and Service Revenue T-accounts. Make sure to include the beginning balance and additional unearned revenue in the Uneared Revenue T-account. (Use an "Unadj. bal." reference to show the balance of each account prior to any adjustments or cash receipts. Use a "Bal" posting reference to show the ending balance of each account.) Unearned Revenue Service Revenue Choose from any list or enter any number in the input fields and then click Check Answer. ? 3 parts remaining Clear All Check Answer MacBook Air -8 DOC FS - - # 3 % 5 & 7 2 4 6 8 9 0 E R T YStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started