Not sure if the information in the cells are right, the problem was given with info until 2020, I fill the rest but I am not sure if it is right.

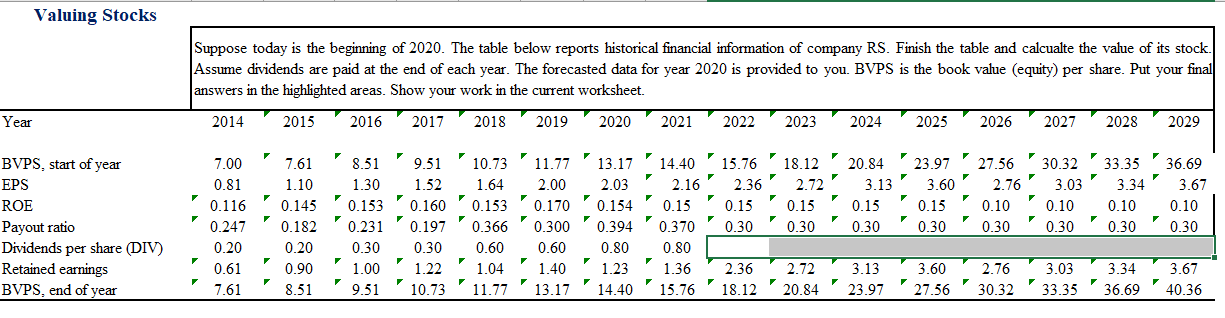

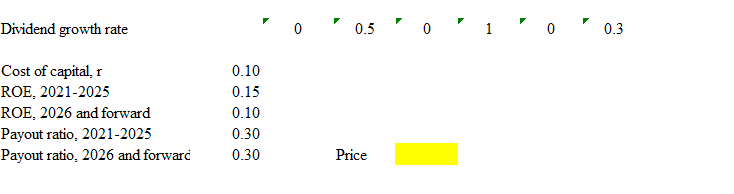

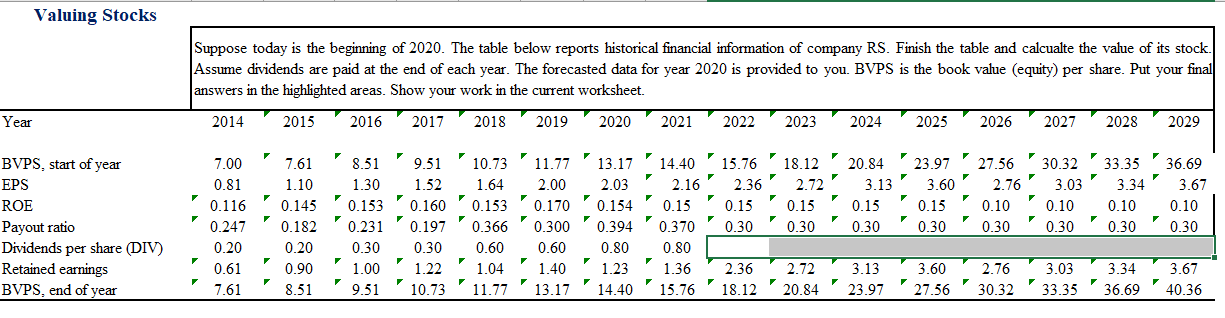

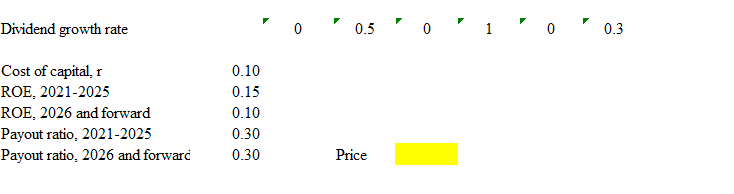

Valuing Stocks Suppose today is the beginning of 2020. The table below reports historical financial information of company RS. Finish the table and calcualte the value of its stock. Assume dividends are paid at the end of each year. The forecasted data for year 2020 is provided to you. BVPS is the book value (equity) per share. Put your final answers in the highlighted areas. Show your work in the current worksheet. Year 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 7.00 8.51 14.40 20.84 27.56 36.69 0.81 1.30 2.16 3.13 3.67 BVPS, start of year EPS ROE Payout ratio Dividends per share (DIV) Retained earnings BVPS, end of year 2.76' 7.61 1.10 0.145 0.182 0.20 0.90 8.51 9.51 1.52 0.160 0.197 0.30 1.22 10.73 10.73 1.64 0.153 0.366 0.60 1.04 11.77 15.76 2.36 0.15 0.30 11.77 2.00 0.170 0.300 0.60 1.40 13.17 18.12 2.72 0.15 0.30 13.17 2.03 0.154 0.394 0.80 1.23 14.40 23.97 3.60 0.15 0.30 30.32 3.03 0.10 0.30 0.116 0.247 0.20 0.61 7.61 33.35 3.34 0.10 0.30 0.153 0.231 0.30 1.00 0.15 0.30 0.10 0.30 0.10 0.30 0.15 0.370 0.80 1.36 15.76 2.76 9.51 2.36 18.12 2.72 20.84 4 3.13 23.97 3.60 27.56 3.03 33.35 3.34 36.69 3.67 40.36 30.32 Valuing Stocks Suppose today is the beginning of 2020. The table below reports historical financial information of company RS. Finish the table and calcualte the value of its stock. Assume dividends are paid at the end of each year. The forecasted data for year 2020 is provided to you. BVPS is the book value (equity) per share. Put your final answers in the highlighted areas. Show your work in the current worksheet. Year 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 7.00 8.51 14.40 20.84 27.56 36.69 0.81 1.30 2.16 3.13 3.67 BVPS, start of year EPS ROE Payout ratio Dividends per share (DIV) Retained earnings BVPS, end of year 2.76' 7.61 1.10 0.145 0.182 0.20 0.90 8.51 9.51 1.52 0.160 0.197 0.30 1.22 10.73 10.73 1.64 0.153 0.366 0.60 1.04 11.77 15.76 2.36 0.15 0.30 11.77 2.00 0.170 0.300 0.60 1.40 13.17 18.12 2.72 0.15 0.30 13.17 2.03 0.154 0.394 0.80 1.23 14.40 23.97 3.60 0.15 0.30 30.32 3.03 0.10 0.30 0.116 0.247 0.20 0.61 7.61 33.35 3.34 0.10 0.30 0.153 0.231 0.30 1.00 0.15 0.30 0.10 0.30 0.10 0.30 0.15 0.370 0.80 1.36 15.76 2.76 9.51 2.36 18.12 2.72 20.84 4 3.13 23.97 3.60 27.56 3.03 33.35 3.34 36.69 3.67 40.36 30.32