Answered step by step

Verified Expert Solution

Question

1 Approved Answer

not sure what part a answer is Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during

not sure what part a answer is

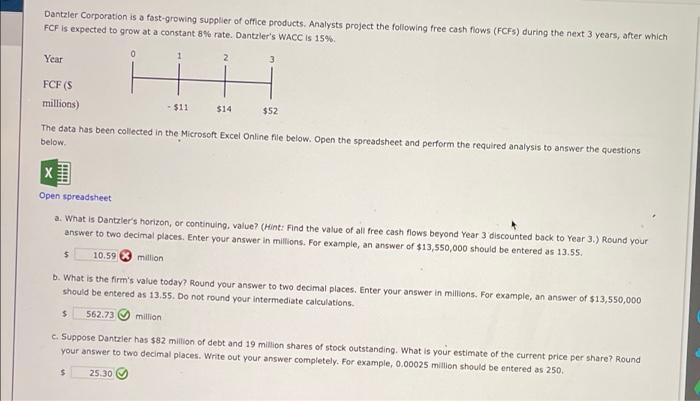

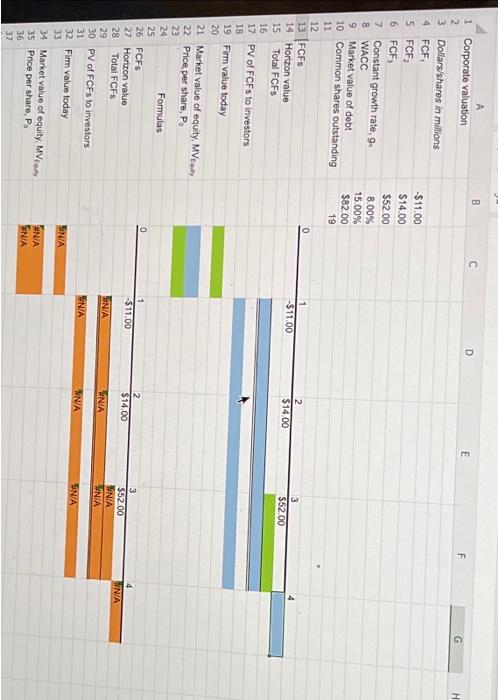

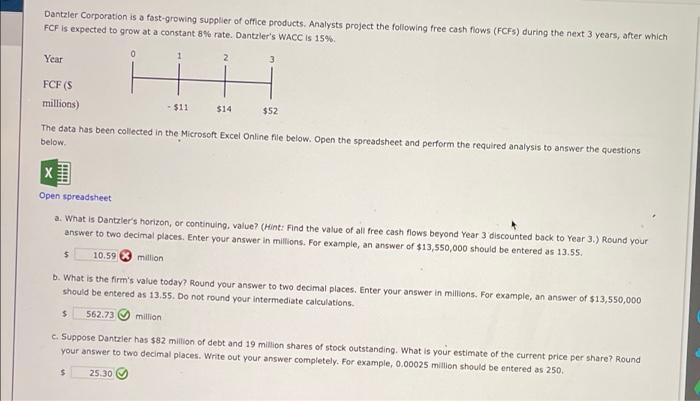

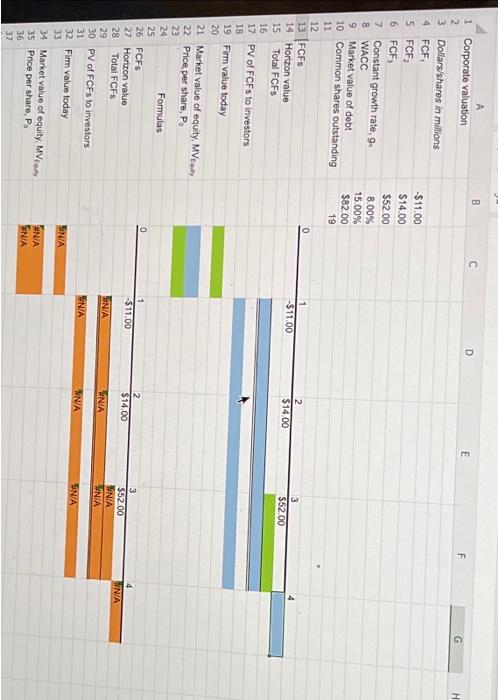

Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 8% rate. Dantzler's WACC is 15%. Year FCF (S millions) H - $11 $ 2 $14 $ 3 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. $52 Open spreadsheet a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. 10.59 million b. What is the firm's value today? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round your intermediate calculations. $ 562.73 million c. Suppose Dantzler has $82 million of debt and 19 million shares of stock outstanding. What is your estimate of the current price per share? Round your answer to two decimal places. Write out your answer completely. For example, 0.00025 million should be entered as 250. 25.30 1 2 3 4 A Corporate valuation Dollars/shares in millions FCF FCF FCF 5 6 7 8 9 10 11 12 13 FCFS 14 Horizon value 15 Total FCFS 16 17 18. 19 20 Constant growth rate, g WACC Market value of debt Common shares outstanding 23 24 PV of FCFs to investors Firm value today 21 Market value of equity, MVE 22 Price per share, Pa Formulas 25 26 FCFS 27 Horizon value 28 Total FCFS 29 30 PV of FCFs to investors 31 32 Firm value today 33 34 Market value of equity, MVcer 35 Price per share, Pa 36 37 B -$11.00 $14.00 $52.00 8.00% 15.00% $82.00 19 0 0 N/A N/A N/A -$11.00 1 -$11.00 #N/A N/A D 2 $14.00 2 $14.00 IN/A N/A E 3 $52.00 3 $52.00 N/A SNIA SN/A F #N/A G H

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started