Not sure which ones would work. A, D, G, and H were Not Correct.  Not sure which ones would work. A, D, G, and H were Not Correct.

Not sure which ones would work. A, D, G, and H were Not Correct.

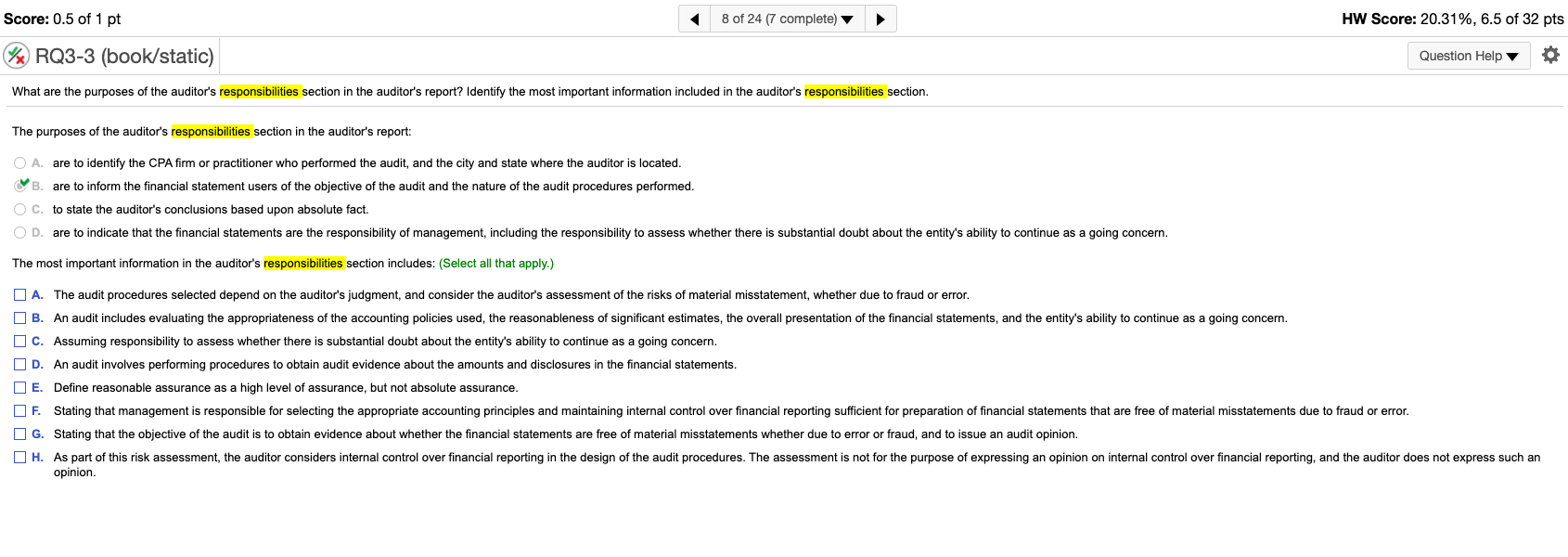

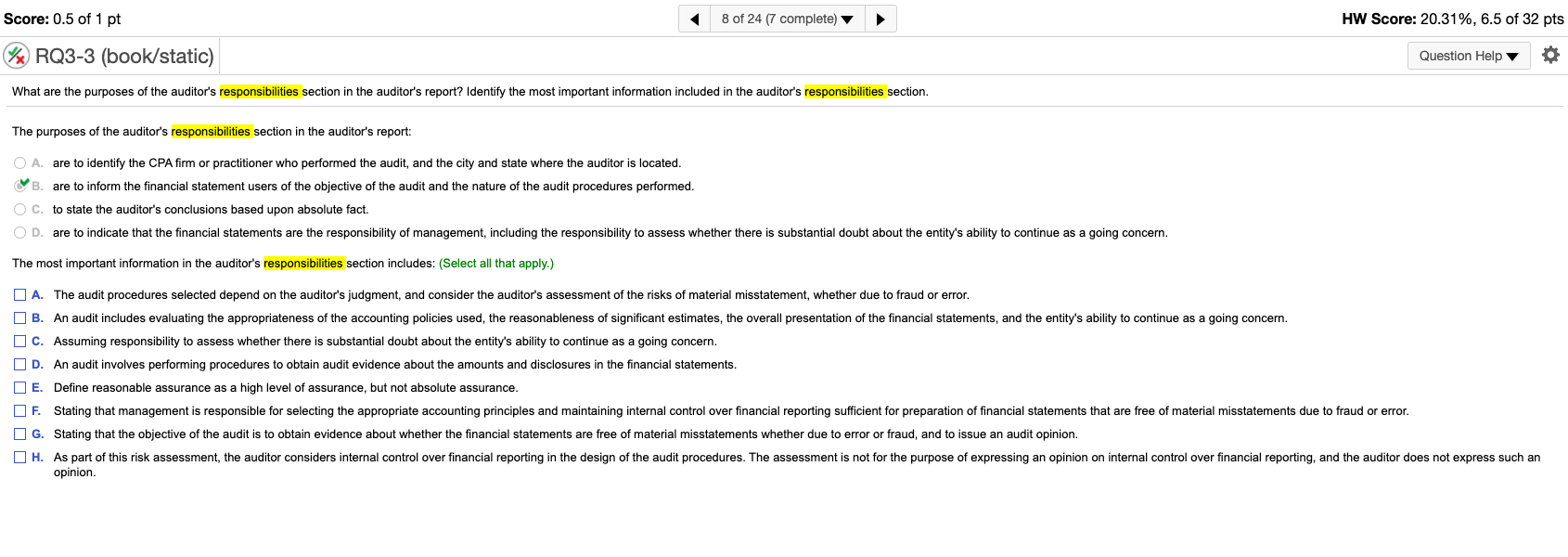

Score: 0.5 of 1 pt 8 of 24 (7 complete) HW Score: 20.31%, 6.5 of 32 pts RQ3-3 (book/static) Question Help What are the purposes of the auditor's responsibilities section in the auditor's report? Identify the most important information included in the auditor's responsibilities section. The purposes of the auditor's responsibilities section in the auditor's report: are to identify the CPA firm or practitioner who performed the audit, and the city and state where the auditor is located. B. are to inform the financial statement users of the objective of the audit and the nature of the audit procedures performed. O C. to state the auditor's conclusions based upon absolute fact. OD. are to indicate that the financial statements are the responsibility of management, including the responsibility to assess whether there is substantial doubt about the entity's ability to continue as a going concern. The most important information in the auditor's responsibilities section includes: (Select all that apply.) A. The audit procedures selected depend on the auditor's judgment, and consider the auditor's assessment of the risks of material misstatement, whether due to fraud or error. B. An audit includes evaluating the appropriateness of the accounting policies used, the reasonableness of significant estimates, the overall presentation of the financial statements, and the entity's ability to continue as a going concern. C. Assuming responsibility to assess whether there is substantial doubt about the entity's ability to continue as a going concern. OD. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. E. Define reasonable assurance as a high level of assurance, but not absolute assurance. OF. Stating that management is responsible for selecting the appropriate accounting principles and maintaining internal control over financial reporting sufficient for preparation of financial statements that are free of material misstatements due to fraud or error. G. Stating that the objective of the audit is to obtain evidence about whether the financial statements are free of material misstatements whether due to error or fraud, and to issue an audit opinion. H. As part of this risk assessment, the auditor considers internal control over financial reporting in the design of the audit procedures. The assessment is not for the purpose of expressing an opinion on internal control over financial reporting, and the auditor does not express such an opinion

Not sure which ones would work. A, D, G, and H were Not Correct.

Not sure which ones would work. A, D, G, and H were Not Correct.