Not sure why I keep getting this question wrong, I think I might be adding up the amount of days wrong. Please explain in detail. I also attached a Help Me Solve this

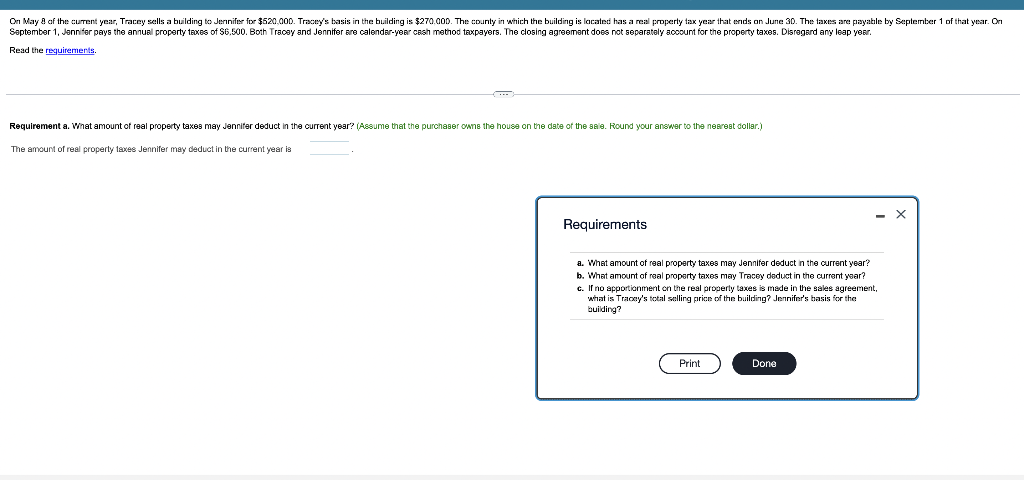

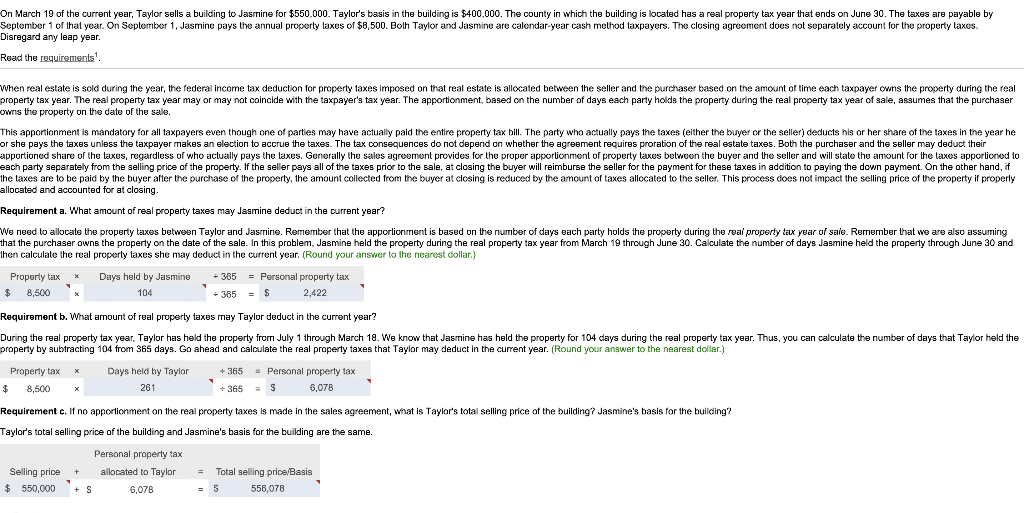

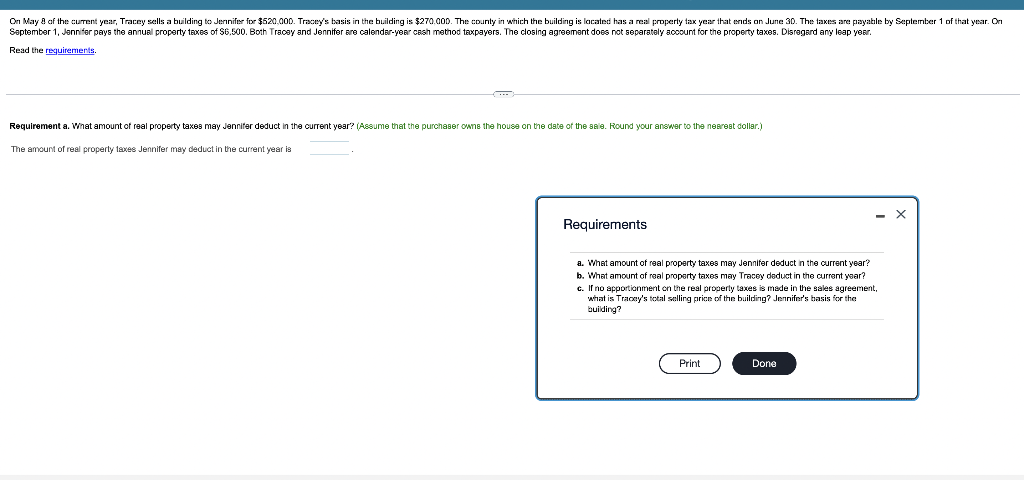

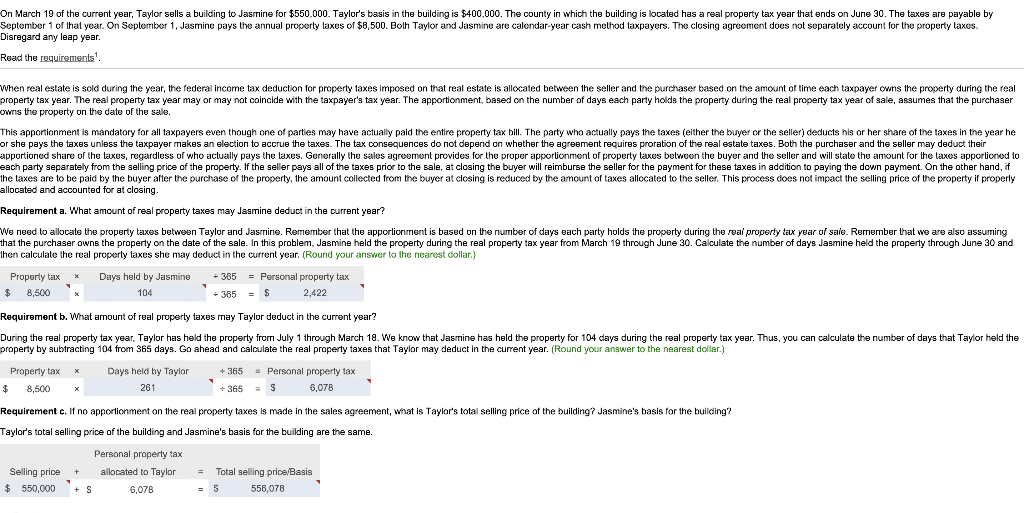

On May of the current year, Tracey sells a building to Jennifer for $520,000. Tracey's basis in the building is $270.000. The county in which the building is located has a real property tax year that ends on June 30. The taxes are payatile by September 1 of that year. On September 1, Jannifer pays the annual property taxes of S6.500. Both Tracey and Jennifer are calendar-year cash method taxpayers. The closing agreemant does not separately account for the property taxes. Disregard any leap year. Read the requirements. Requirement a. What amount of real property taxes may Jennifer deduct in the current year? (Assume that the purchaser owns the house on the date of the sale. Round your answer to the nearest dollar.) The amount of real property taxes Jennifer may deduct in the current year is X Requirements a. What amount of real property taxes may Jennifer deduct n the current year? b. What amount of real property taxes may Tracey deduct in the current year? c. If no apportionment on the real property taxes is made in the sales agreement, what is Tracey's total selling price of the building? Jennifer's basis for the building? Print Done On March 19 of the current year, Taylor sells a building to Jasmine for $550.000. Taylor's basis in the building is $400,000. The county in which the building is located has a real property tax year that ends on June 30. The taxes are payable by September 1 of that year. On September 1, Jasmine pays the annual property taxes of $6,500. Both Taylor and Jasmine are calendar-year cash method taxpayers. The closing agreement does not separately account for the property taxes. Disregard any leap year. Read the requirements! When real estate is sold during the year, the federal income tax deduction for property taxes imposed on that real estate is allocated between the seller and the purchaser based on the amount of time each taxpayer owns the property during the real property tax year. The real property tax year may or may not coincide with the taxpayer's tax year. The apportionment, based on the number of days each party holds the property during the real property tax year of sale, assumes that the purchaser owns the property on the date of the sale. This apportionment is mandatory for all taxpayers even though one of parties may have actually paid the entire property tax bill. The party who actually pays the taxes (either the buyer or the seller) deducts his or her share of the taxes in the year he or she pays the taxes unless the taxpayer makes an election to accrue the taxes. The tax consequences do not depend on whether the agreement requires proration of the real estate taxes. Both the purchaser and the seller may deduct their apportioned share of the taxes, regardless of who actually pays the taxes. Generally the sales agreement provides for the proper apportionment of property taxes between the buyer and the seller and will state the amount for the taxes apportioned to each party separately from the selling price of the property. If the seller pays all of the taxes prior to the sale, at closing the buyer will reimburse the seller for the payment for these taxes in addition to paying the down payment. On the other hand, if the taxes are to be paid by the buyer after the purchase of the property, the amount collected from the buyer at closing is reduced by the amount of taxes allocated to the seller. This process does not impact the selling price of the property if properly allocated and accounted for at closing. Requirement a. What amount of real property taxes may Jasmine deduct in the current year? We need to allocate the property taxes between Taylor and Jasmine. Remember that the apportionment is based on the number of days each party holds the property during the real property tax year of sale. Remember that we are also assuming . that the purchaser owns the property on the date of the sale. In this problem, Jasmine held the property during the real property tax year from March 19 through June 30. Calculate the number of days Jasmine held the property through June 30 and then calculate the real property taxes she may deduct in the current year. (Round your answer to the nearest dollar) Property tax * Days held by Jasmine + 385 = Personal property tax $ 8,500 104 + 385 = $ 2,422 Requirement b. What amount of real property taxes may Taylor deduct in the current year? During the real property tax year, Taylor has held the property from July 1 through March 18. We know that Jasmine has held the property for 104 days during the real property tax year. Thus, you can calculate the number of days that Taylor held the property by subtracting 104 from 365 days. Go ahead and calculate the real property taxes that Taylor may deduct in the current year. (Round your answer to the nearest dollar.) x Property tax $ 8.500 Days held by Taylor 261 + 365 Personal property tax + 365 - S 6,078 Requirement c. If no apportionment on the real property taxes is made in the sales agreement, what is Taylor's total selling price of the building? Jasmine's basis for the building? Taylor's total selling price of the building and Jasmine's basis for the building are the same. Selling price $ 550,000 Personal property tax + allocated to Taylor + S 6,078 = Total selling price/Basis S 556,078 On May of the current year, Tracey sells a building to Jennifer for $520,000. Tracey's basis in the building is $270.000. The county in which the building is located has a real property tax year that ends on June 30. The taxes are payatile by September 1 of that year. On September 1, Jannifer pays the annual property taxes of S6.500. Both Tracey and Jennifer are calendar-year cash method taxpayers. The closing agreemant does not separately account for the property taxes. Disregard any leap year. Read the requirements. Requirement a. What amount of real property taxes may Jennifer deduct in the current year? (Assume that the purchaser owns the house on the date of the sale. Round your answer to the nearest dollar.) The amount of real property taxes Jennifer may deduct in the current year is X Requirements a. What amount of real property taxes may Jennifer deduct n the current year? b. What amount of real property taxes may Tracey deduct in the current year? c. If no apportionment on the real property taxes is made in the sales agreement, what is Tracey's total selling price of the building? Jennifer's basis for the building? Print Done On March 19 of the current year, Taylor sells a building to Jasmine for $550.000. Taylor's basis in the building is $400,000. The county in which the building is located has a real property tax year that ends on June 30. The taxes are payable by September 1 of that year. On September 1, Jasmine pays the annual property taxes of $6,500. Both Taylor and Jasmine are calendar-year cash method taxpayers. The closing agreement does not separately account for the property taxes. Disregard any leap year. Read the requirements! When real estate is sold during the year, the federal income tax deduction for property taxes imposed on that real estate is allocated between the seller and the purchaser based on the amount of time each taxpayer owns the property during the real property tax year. The real property tax year may or may not coincide with the taxpayer's tax year. The apportionment, based on the number of days each party holds the property during the real property tax year of sale, assumes that the purchaser owns the property on the date of the sale. This apportionment is mandatory for all taxpayers even though one of parties may have actually paid the entire property tax bill. The party who actually pays the taxes (either the buyer or the seller) deducts his or her share of the taxes in the year he or she pays the taxes unless the taxpayer makes an election to accrue the taxes. The tax consequences do not depend on whether the agreement requires proration of the real estate taxes. Both the purchaser and the seller may deduct their apportioned share of the taxes, regardless of who actually pays the taxes. Generally the sales agreement provides for the proper apportionment of property taxes between the buyer and the seller and will state the amount for the taxes apportioned to each party separately from the selling price of the property. If the seller pays all of the taxes prior to the sale, at closing the buyer will reimburse the seller for the payment for these taxes in addition to paying the down payment. On the other hand, if the taxes are to be paid by the buyer after the purchase of the property, the amount collected from the buyer at closing is reduced by the amount of taxes allocated to the seller. This process does not impact the selling price of the property if properly allocated and accounted for at closing. Requirement a. What amount of real property taxes may Jasmine deduct in the current year? We need to allocate the property taxes between Taylor and Jasmine. Remember that the apportionment is based on the number of days each party holds the property during the real property tax year of sale. Remember that we are also assuming . that the purchaser owns the property on the date of the sale. In this problem, Jasmine held the property during the real property tax year from March 19 through June 30. Calculate the number of days Jasmine held the property through June 30 and then calculate the real property taxes she may deduct in the current year. (Round your answer to the nearest dollar) Property tax * Days held by Jasmine + 385 = Personal property tax $ 8,500 104 + 385 = $ 2,422 Requirement b. What amount of real property taxes may Taylor deduct in the current year? During the real property tax year, Taylor has held the property from July 1 through March 18. We know that Jasmine has held the property for 104 days during the real property tax year. Thus, you can calculate the number of days that Taylor held the property by subtracting 104 from 365 days. Go ahead and calculate the real property taxes that Taylor may deduct in the current year. (Round your answer to the nearest dollar.) x Property tax $ 8.500 Days held by Taylor 261 + 365 Personal property tax + 365 - S 6,078 Requirement c. If no apportionment on the real property taxes is made in the sales agreement, what is Taylor's total selling price of the building? Jasmine's basis for the building? Taylor's total selling price of the building and Jasmine's basis for the building are the same. Selling price $ 550,000 Personal property tax + allocated to Taylor + S 6,078 = Total selling price/Basis S 556,078