Answered step by step

Verified Expert Solution

Question

1 Approved Answer

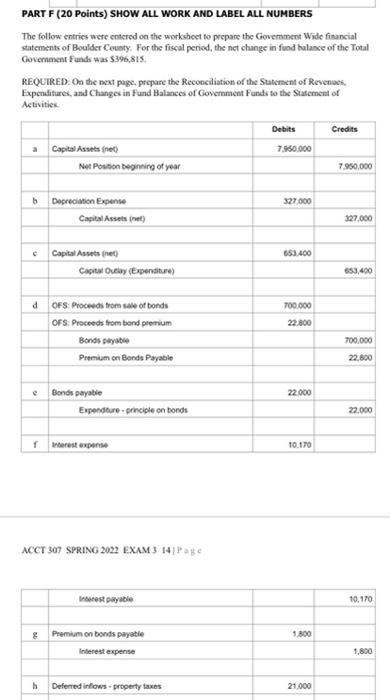

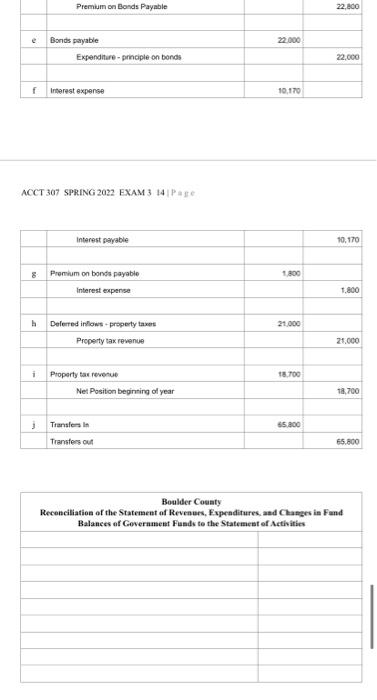

not sure why it keeps posting blurry PART F (20 Points) SHOW ALL WORK AND LABEL ALL NUMBERS The follow entries were entered on the

not sure why it keeps posting blurry

PART F (20 Points) SHOW ALL WORK AND LABEL ALL NUMBERS The follow entries were entered on the workshoet to prepare the Government Wide financial statements of Boulder County. For the fiscal period, the net change in fund balance of the Total Government Funds was $396,815. REQUIRED: On the next page, prepare the Reconciliation of the Statement of Revenues Expenditures, and Changes in Fund Balances of Government Funds to the Statement of Activities Debits Credits 7.850.000 Capital Assets net Net Position beginning of your 7.950,000 b 327.000 Depreciation Expense Capital Assets (net) 327.000 c 653.400 Capital Asset Cact Ouly (Expenditure 653.400 d 700.000 22.800 OFS: Proceeds from sale or bonds OFS: Proceeds from bond premium Bonds payable Premium on Bonds Payable 700.000 22.800 e 22.000 Bonds payable Expenditure-principle on bonds 22.000 1 restante 10.170 ACCT 307 SPRING 2022 EXAM 3 141 Page est payable 10.170 & 1.800 Premium on bonds payable Interest expense 1,800 Defened intows.property 21.000 Premium on Bonds Payable 22.800 e 22.000 Bonds payable Expenditure-principle on bonds 22.000 f Interest expense 10.170 ACCT 307 SPRING 2022 EXAM 3 14 Page Interest payable 10,170 1800 Premium on bonds payable Interest expense 1.800 21.000 Deferred inflows.property taxes Property tax revenue 21.000 i 18.700 Property tax revenue Net Position beginning of year 18.700 3 Transles in 65.200 Transfers out 65.800 Boulder County Reconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balances of Government Funds to the Statement of Activities PART F (20 Points) SHOW ALL WORK AND LABEL ALL NUMBERS The follow entries were entered on the workshoet to prepare the Government Wide financial statements of Boulder County. For the fiscal period, the net change in fund balance of the Total Government Funds was $396,815. REQUIRED: On the next page, prepare the Reconciliation of the Statement of Revenues Expenditures, and Changes in Fund Balances of Government Funds to the Statement of Activities Debits Credits 7.850.000 Capital Assets net Net Position beginning of your 7.950,000 b 327.000 Depreciation Expense Capital Assets (net) 327.000 c 653.400 Capital Asset Cact Ouly (Expenditure 653.400 d 700.000 22.800 OFS: Proceeds from sale or bonds OFS: Proceeds from bond premium Bonds payable Premium on Bonds Payable 700.000 22.800 e 22.000 Bonds payable Expenditure-principle on bonds 22.000 1 restante 10.170 ACCT 307 SPRING 2022 EXAM 3 141 Page est payable 10.170 & 1.800 Premium on bonds payable Interest expense 1,800 Defened intows.property 21.000 Premium on Bonds Payable 22.800 e 22.000 Bonds payable Expenditure-principle on bonds 22.000 f Interest expense 10.170 ACCT 307 SPRING 2022 EXAM 3 14 Page Interest payable 10,170 1800 Premium on bonds payable Interest expense 1.800 21.000 Deferred inflows.property taxes Property tax revenue 21.000 i 18.700 Property tax revenue Net Position beginning of year 18.700 3 Transles in 65.200 Transfers out 65.800 Boulder County Reconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balances of Government Funds to the Statement of Activities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started