Answered step by step

Verified Expert Solution

Question

1 Approved Answer

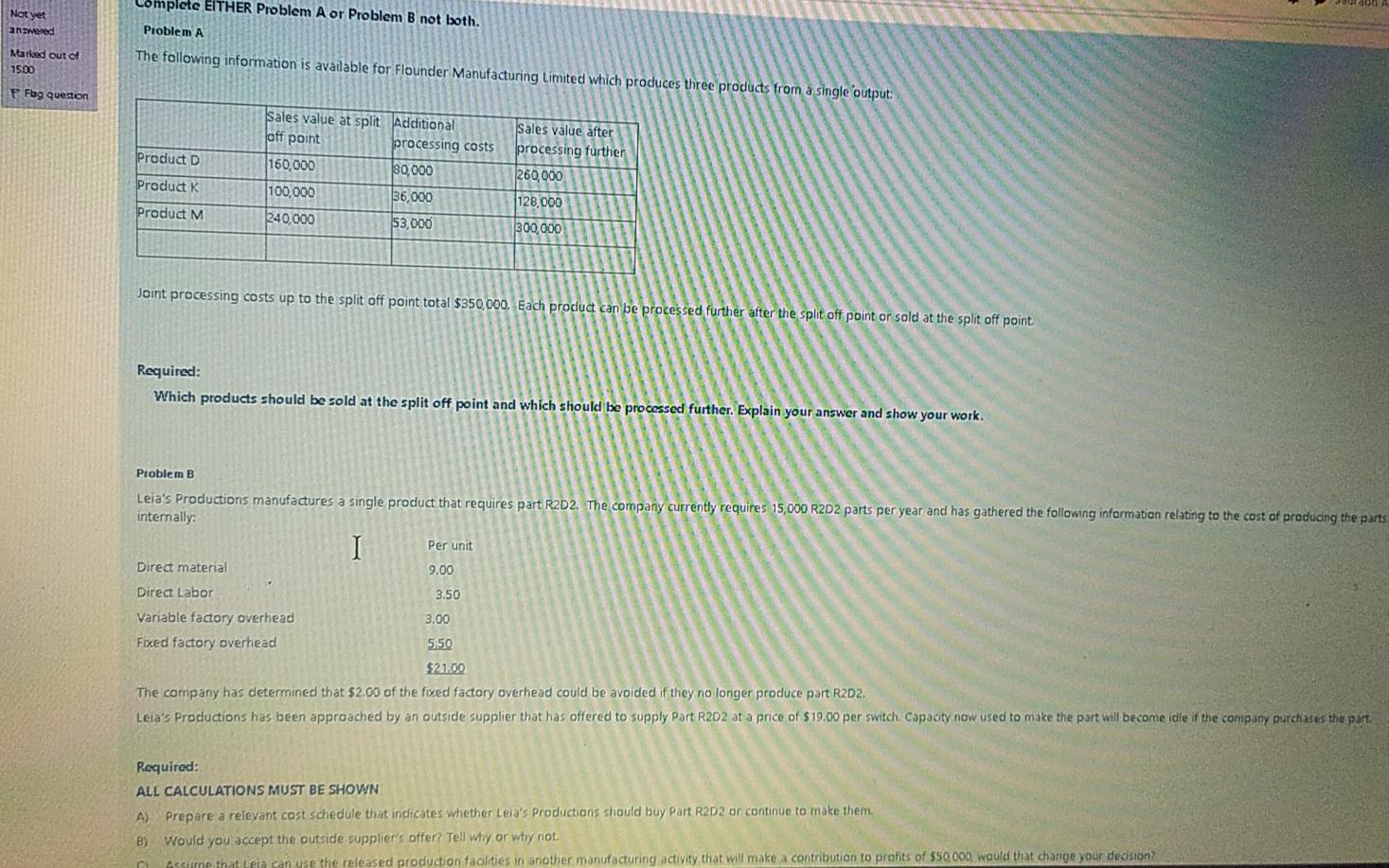

Not yet answered Complete EITHER Problem A or Problem B not both. Problem A The following information is available for Flounder Manufacturing Limited which produces

Not yet answered Complete EITHER Problem A or Problem B not both. Problem A The following information is available for Flounder Manufacturing Limited which produces three products from a single output Matlied out of 1500 F Fbg question Sales value at split Additional off point processing costs Sales value after processing further Product D 160,000 80,000 260,000 Product K 100,000 36,000 1128.000 Product M 240,000 53,000 300,000 Joint processing costs up to the split off point total $350,000. Each product can be processed further after the split off point or sold at the split off point Required: Which products should be sold at the split off point and which should be processed further. Explain your answer and show your work. Problem B Leia's Productions manufactures a single product that requires part R2D2. The company currently requires 15,000 R2D2 parts per year and has gathered the following information relating to the cost of producing the parts internally: I Per unit Direct material 9.00 Direct Labor 3.50 3.00 Variable factory overhead Fixed factory overhead 5.50 $21.00 The company has determined that $2.00 of the fived factory overhead could be avoided if they no longer produce part R2D2. Leia's Productions has been approached by an outside supplier that has offered to supply Part R2D2 at a price of $19.00 per switch. Capacity now used to make the part will become idle if the company purchases the part. Required: ALL CALCULATIONS MUST BE SHOWN A) Prepare a relevant cost schedule that indicates whether Leia's Productions should buy Part R2D2 or continue to make them. B) Would you accept the outside supplier's offer? Tell why or why not. assume that cea can use the released production facilities in another manufacturing activity that will make a contribution to profits of $50.000 would that change your decision Not yet answered Complete EITHER Problem A or Problem B not both. Problem A The following information is available for Flounder Manufacturing Limited which produces three products from a single output Matlied out of 1500 F Fbg question Sales value at split Additional off point processing costs Sales value after processing further Product D 160,000 80,000 260,000 Product K 100,000 36,000 1128.000 Product M 240,000 53,000 300,000 Joint processing costs up to the split off point total $350,000. Each product can be processed further after the split off point or sold at the split off point Required: Which products should be sold at the split off point and which should be processed further. Explain your answer and show your work. Problem B Leia's Productions manufactures a single product that requires part R2D2. The company currently requires 15,000 R2D2 parts per year and has gathered the following information relating to the cost of producing the parts internally: I Per unit Direct material 9.00 Direct Labor 3.50 3.00 Variable factory overhead Fixed factory overhead 5.50 $21.00 The company has determined that $2.00 of the fived factory overhead could be avoided if they no longer produce part R2D2. Leia's Productions has been approached by an outside supplier that has offered to supply Part R2D2 at a price of $19.00 per switch. Capacity now used to make the part will become idle if the company purchases the part. Required: ALL CALCULATIONS MUST BE SHOWN A) Prepare a relevant cost schedule that indicates whether Leia's Productions should buy Part R2D2 or continue to make them. B) Would you accept the outside supplier's offer? Tell why or why not. assume that cea can use the released production facilities in another manufacturing activity that will make a contribution to profits of $50.000 would that change your decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started