Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note 3: Show all your detailed workings and round to 4 decimal digits at each step for all calculations. Is the Corn futures curve upward

Note 3: Show all your detailed workings and round to 4 decimal digits at each step for all calculations.

- Is the Corn futures curve upward sloping or downward sloping? Explain your answer

- Is Corn in Normal Contango or in Normal Backwardation? Justify your answer.

- Peterman would like to exploit the shape of the futures curve to capture a roll yield. Detail how he might do so in the corn market characterized by the above quotes.

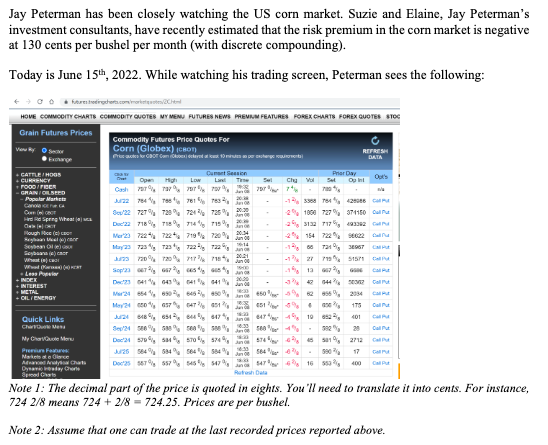

Jay Peterman has been closely watching the US corn market. Suzie and Elaine, Jay Peterman's investment consultants, have recently estimated that the risk premium in the corn market is negative at 130 cents per bushel per month (with discrete compounding). Today is June 15th, 2022. While watching his trading screen, Peterman sees the following: futures freelingshorts.com/marketique/2Cht HOME COMMODITY CHARTS COMMODITY QUOTES MY MENU FUTURES NEWS PREMIUM FEATURES FOREX CHARTS FOREX QUOTES STOC Grain Futures Prices Commodity Futures Price Quotes For Corn (Globex) (CBOT) ViewBy Secr for Bombex) dekayed at last 10 minutes pregunt REFRESH DATA Open High Low CumartSession Lank Time Prier Day Set +CATTLE/HOGS +CURRENCY +FOOD/FIBER -GRAIN/OILSEED Of Ind Out's Chg Vol 746 7080% Popular Markets Canola GA Hdd Spring Wheat Cash 797% 797% 787% JU22 784 788 761 S/22 727% 72% 724 Duc22 718% 78% 714% 722 719 723 722 20% 297% 707% 797% 7632 20:38 725% 20.20 785 % 20 720%u00 16:14 722 730%2021 96% -15368 76442086 -2% 1000 727% 374150 P 2% 3132 717% 493392 Ca -2% 154 722% 96022 Call -12/8 55 721%838957 Hough Nice (c) con Seybean Ole) Goyhaan (a) Mer 23 722 May 23 723 J 720% Sop/23 667 51571 CM Put Cal Put CMP W((ENT Les Por 667% 0 % 20:00 Dec 23 041 043% 041% 041% Cal Put Mar24 6541 602 648 2 850% A 651 175 Call Put May 24 20 657% 647 Juan st , Sep/24 588% 588% 500 % 88 14:20 Quick Links 401 J 647 4657 580 % 1030 580 % 19 10 2 4% Charte Mess CAPU Call Put Cal Put My Char/Quote Menu Doc'21 579% 584% 570% 574% 16:30 16:33 20 2712 17 574 Jul 25 564% 584% 566% 584% 8 584 %/ber Doc'25 567% 557% 545 9/g 547% en 547 % 6 45 521% 0 6 16 553 400 Premium Features Advanced Aty Charts GMP Markets of a Olere CMP Dyna beraday Crore Ruth Da Spread Cha Note 1: The decimal part of the price is quoted in eights. You'll need to translate it into cents. For instance, 724 2/8 means 724 + 2/8=724.25. Prices are per bushel. Note 2: Assume that one can trade at the last recorded prices reported above. INDEX +INTEREST METAL + OIL/ENERGY Jay Peterman has been closely watching the US corn market. Suzie and Elaine, Jay Peterman's investment consultants, have recently estimated that the risk premium in the corn market is negative at 130 cents per bushel per month (with discrete compounding). Today is June 15th, 2022. While watching his trading screen, Peterman sees the following: futures freelingshorts.com/marketique/2Cht HOME COMMODITY CHARTS COMMODITY QUOTES MY MENU FUTURES NEWS PREMIUM FEATURES FOREX CHARTS FOREX QUOTES STOC Grain Futures Prices Commodity Futures Price Quotes For Corn (Globex) (CBOT) ViewBy Secr for Bombex) dekayed at last 10 minutes pregunt REFRESH DATA Open High Low CumartSession Lank Time Prier Day Set +CATTLE/HOGS +CURRENCY +FOOD/FIBER -GRAIN/OILSEED Of Ind Out's Chg Vol 746 7080% Popular Markets Canola GA Hdd Spring Wheat Cash 797% 797% 787% JU22 784 788 761 S/22 727% 72% 724 Duc22 718% 78% 714% 722 719 723 722 20% 297% 707% 797% 7632 20:38 725% 20.20 785 % 20 720%u00 16:14 722 730%2021 96% -15368 76442086 -2% 1000 727% 374150 P 2% 3132 717% 493392 Ca -2% 154 722% 96022 Call -12/8 55 721%838957 Hough Nice (c) con Seybean Ole) Goyhaan (a) Mer 23 722 May 23 723 J 720% Sop/23 667 51571 CM Put Cal Put CMP W((ENT Les Por 667% 0 % 20:00 Dec 23 041 043% 041% 041% Cal Put Mar24 6541 602 648 2 850% A 651 175 Call Put May 24 20 657% 647 Juan st , Sep/24 588% 588% 500 % 88 14:20 Quick Links 401 J 647 4657 580 % 1030 580 % 19 10 2 4% Charte Mess CAPU Call Put Cal Put My Char/Quote Menu Doc'21 579% 584% 570% 574% 16:30 16:33 20 2712 17 574 Jul 25 564% 584% 566% 584% 8 584 %/ber Doc'25 567% 557% 545 9/g 547% en 547 % 6 45 521% 0 6 16 553 400 Premium Features Advanced Aty Charts GMP Markets of a Olere CMP Dyna beraday Crore Ruth Da Spread Cha Note 1: The decimal part of the price is quoted in eights. You'll need to translate it into cents. For instance, 724 2/8 means 724 + 2/8=724.25. Prices are per bushel. Note 2: Assume that one can trade at the last recorded prices reported above. INDEX +INTEREST METAL + OIL/ENERGY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started