Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Note: Answer all 4 mcqs please it is regarding to International Taxation UAE The higher rate of income tax on savings income for tax

.

Note: Answer all 4 mcqs please it is regarding to International Taxation UAE

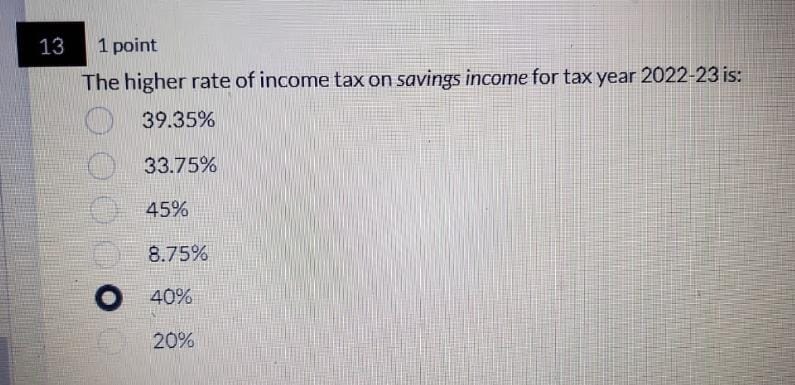

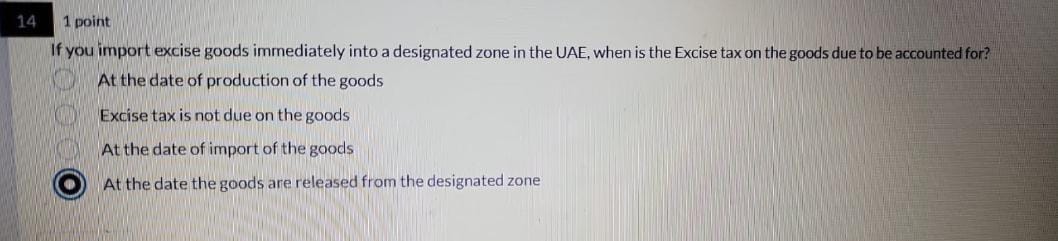

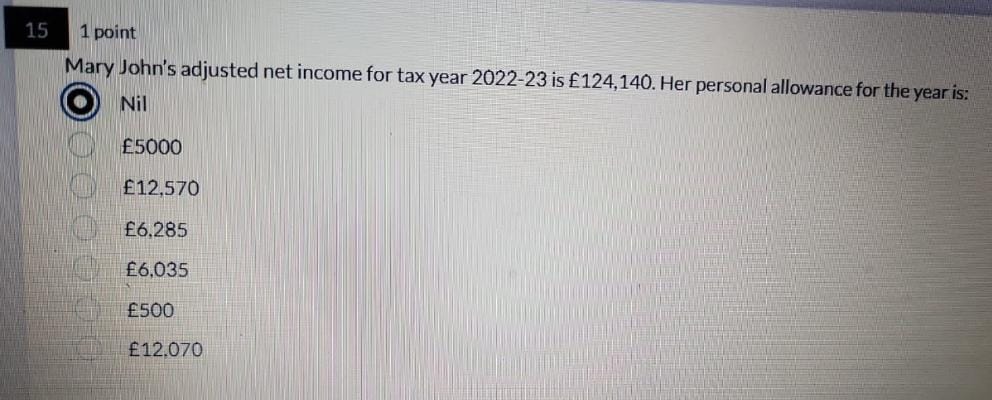

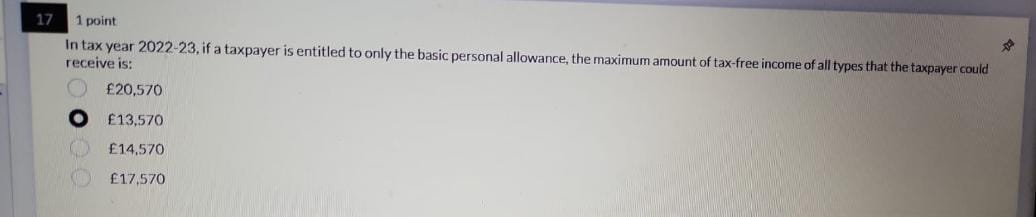

The higher rate of income tax on savings income for tax year 2022-23 is: 39.35% 33.75% 45% 8.75% 40% 20% If you import excise goods immediately into a designated zone in the UAE, when is the Excise tax on the goods due to be accounted for? At the date of production of the goods Excise tax is not due on the goods At the date of import of the goods At the date the goods are released from the designated zone Mary John's adjusted net income for tax year 202223 is 124,140. Her personal allowance for the year is: Nil 5000 12,570 6,285 6,035 500 12.070 In tax year 2022-23, if a taxpayer is entitled to only the basic personal allowance, the maximum amount of tax-free income of all types that the taxpayer could receive is: 20,570 13,570 14,570 17,570Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started