Answered step by step

Verified Expert Solution

Question

1 Approved Answer

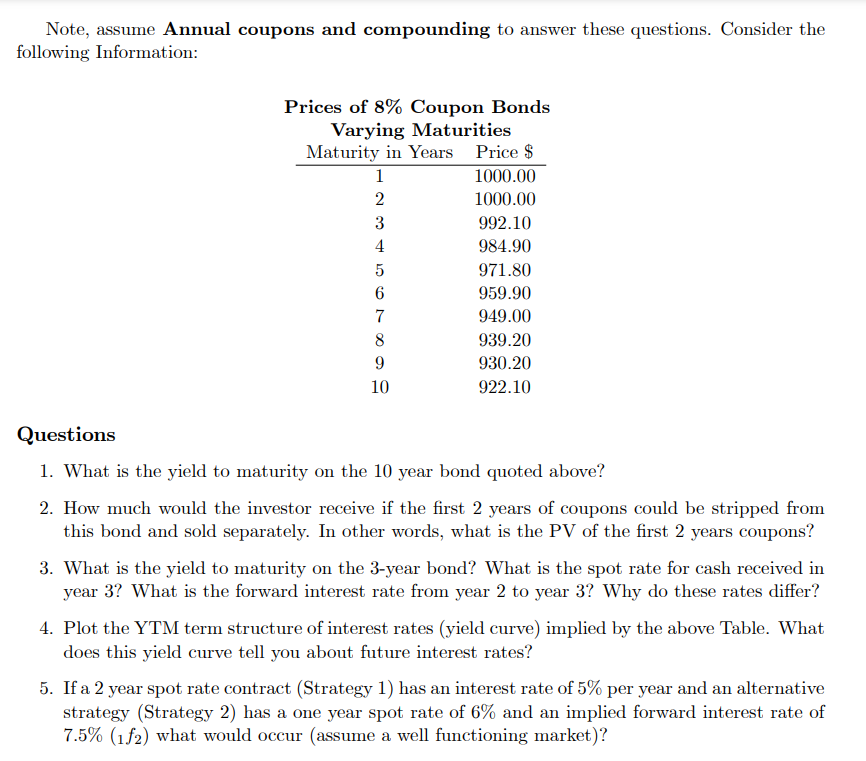

Note, assume Annual coupons and compounding to answer these questions. Consider the following Information: Questions 1. What is the yield to maturity on the 10

Note, assume Annual coupons and compounding to answer these questions. Consider the following Information: Questions 1. What is the yield to maturity on the 10 year bond quoted above? 2. How much would the investor receive if the first 2 years of coupons could be stripped from this bond and sold separately. In other words, what is the PV of the first 2 years coupons? 3. What is the yield to maturity on the 3-year bond? What is the spot rate for cash received in year 3? What is the forward interest rate from year 2 to year 3 ? Why do these rates differ? 4. Plot the YTM term structure of interest rates (yield curve) implied by the above Table. What does this yield curve tell you about future interest rates? 5. If a 2 year spot rate contract (Strategy 1 ) has an interest rate of 5% per year and an alternative strategy (Strategy 2) has a one year spot rate of 6% and an implied forward interest rate of 7.5%(1f2) what would occur (assume a well functioning market)

Note, assume Annual coupons and compounding to answer these questions. Consider the following Information: Questions 1. What is the yield to maturity on the 10 year bond quoted above? 2. How much would the investor receive if the first 2 years of coupons could be stripped from this bond and sold separately. In other words, what is the PV of the first 2 years coupons? 3. What is the yield to maturity on the 3-year bond? What is the spot rate for cash received in year 3? What is the forward interest rate from year 2 to year 3 ? Why do these rates differ? 4. Plot the YTM term structure of interest rates (yield curve) implied by the above Table. What does this yield curve tell you about future interest rates? 5. If a 2 year spot rate contract (Strategy 1 ) has an interest rate of 5% per year and an alternative strategy (Strategy 2) has a one year spot rate of 6% and an implied forward interest rate of 7.5%(1f2) what would occur (assume a well functioning market) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started