Answered step by step

Verified Expert Solution

Question

1 Approved Answer

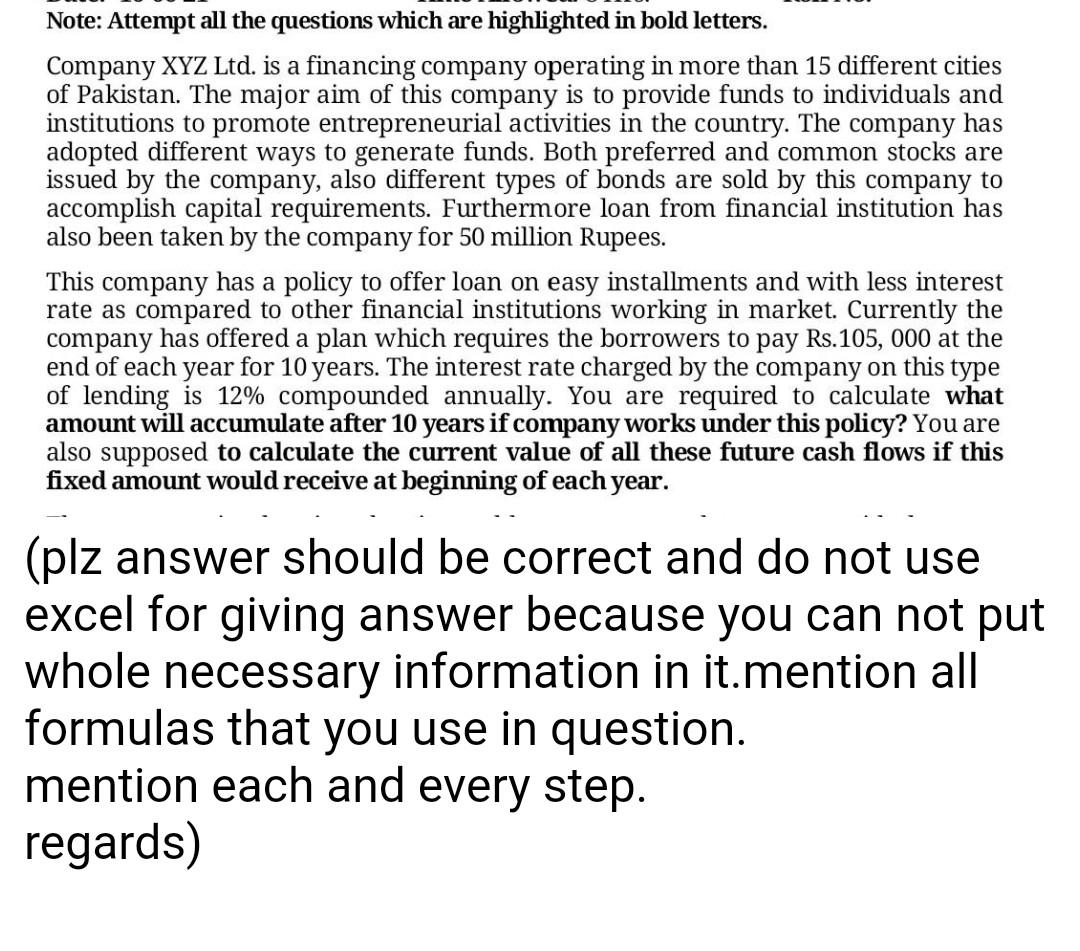

Note: Attempt all the questions which are highlighted in bold letters. Company XYZ Ltd. is a financing company operating in more than 15 different cities

Note: Attempt all the questions which are highlighted in bold letters. Company XYZ Ltd. is a financing company operating in more than 15 different cities of Pakistan. The major aim of this company is to provide funds to individuals and institutions to promote entrepreneurial activities in the country. The company has adopted different ways to generate funds. Both preferred and common stocks are issued by the company, also different types of bonds are sold by this company to accomplish capital requirements. Furthermore loan from financial institution has also been taken by the company for 50 million Rupees. This company has a policy to offer loan on easy installments and with less interest rate as compared to other financial institutions working in market. Currently the company has offered a plan which requires the borrowers to pay Rs. 105, 000 at the end of each year for 10 years. The interest rate charged by the company on this type of lending is 12% compounded annually. You are required to calculate what amount will accumulate after 10 years if company works under this policy? You are also supposed to calculate the current value of all these future cash flows if this fixed amount would receive at beginning of each year. (plz answer should be correct and do not use excel for giving answer because you can not put whole necessary information in it.mention all formulas that you use in question. mention each and every step. regards)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started