Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (20 points) Passie Smart is preparing a tax report for Salmo Pesto. Passie notices that his income has dropped from the year

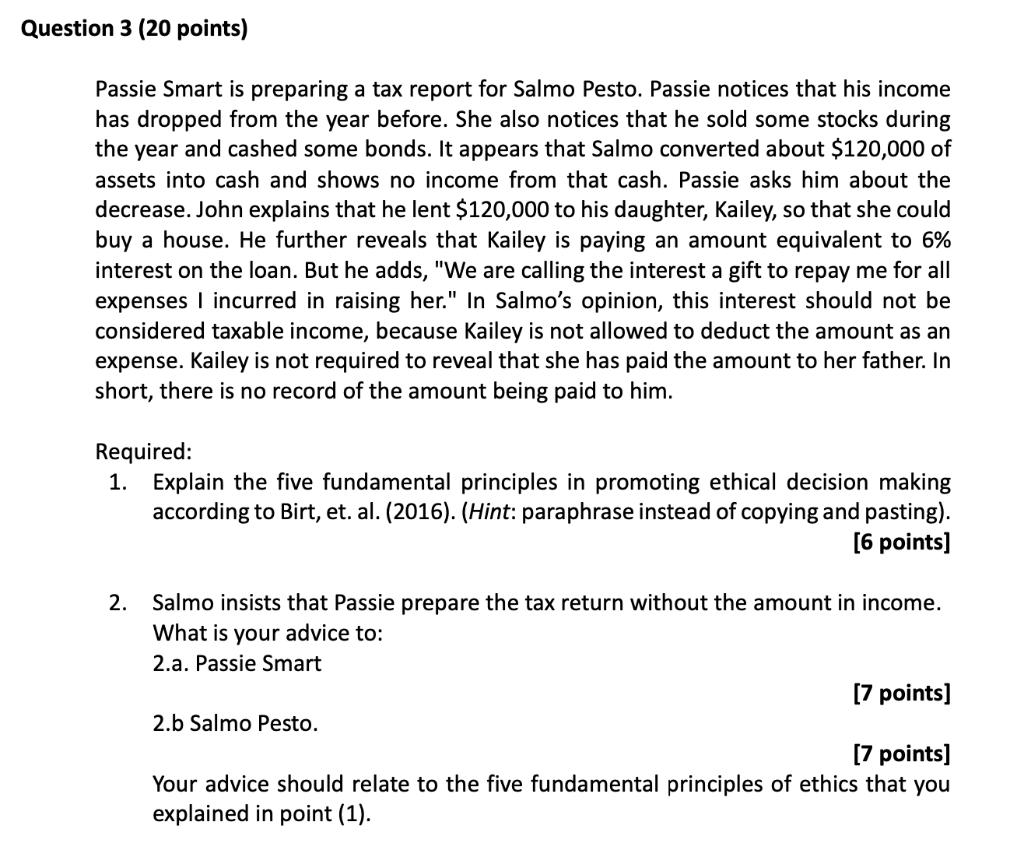

Question 3 (20 points) Passie Smart is preparing a tax report for Salmo Pesto. Passie notices that his income has dropped from the year before. She also notices that he sold some stocks during the year and cashed some bonds. It appears that Salmo converted about $120,000 of assets into cash and shows no income from that cash. Passie asks him about the decrease. John explains that he lent $120,000 to his daughter, Kailey, so that she could buy a house. He further reveals that Kailey is paying an amount equivalent to 6% interest on the loan. But he adds, "We are calling the interest a gift to repay me for all expenses I incurred in raising her." In Salmo's opinion, this interest should not be considered taxable income, because Kailey is not allowed to deduct the amount as an expense. Kailey is not required to reveal that she has paid the amount to her father. In short, there is no record of the amount being paid to him. Required: 1. Explain the five fundamental principles in promoting ethical decision making according to Birt, et. al. (2016). (Hint: paraphrase instead of copying and pasting). [6 points] 2. Salmo insists that Passie prepare the tax return without the amount in income. What is your advice to: 2.a. Passie Smart [7 points] 2.b Salmo Pesto. [7 points] Your advice should relate to the five fundamental principles of ethics that you explained in point (1).

Step by Step Solution

★★★★★

3.30 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

The five fundamental principles in promoting ethical decision making according to B irt et al 2016 are as follows 1 Respect for autonomy This principle requires that individuals be treated as autonomo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started