Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(NOTE: ENTER YOUR ANSWER WITHOUT THE $ AND COMMA, ROUNDED TO THE NEAREST DOLLAR, for instance as 10023, not as $10,022.78. Insert the negative sign

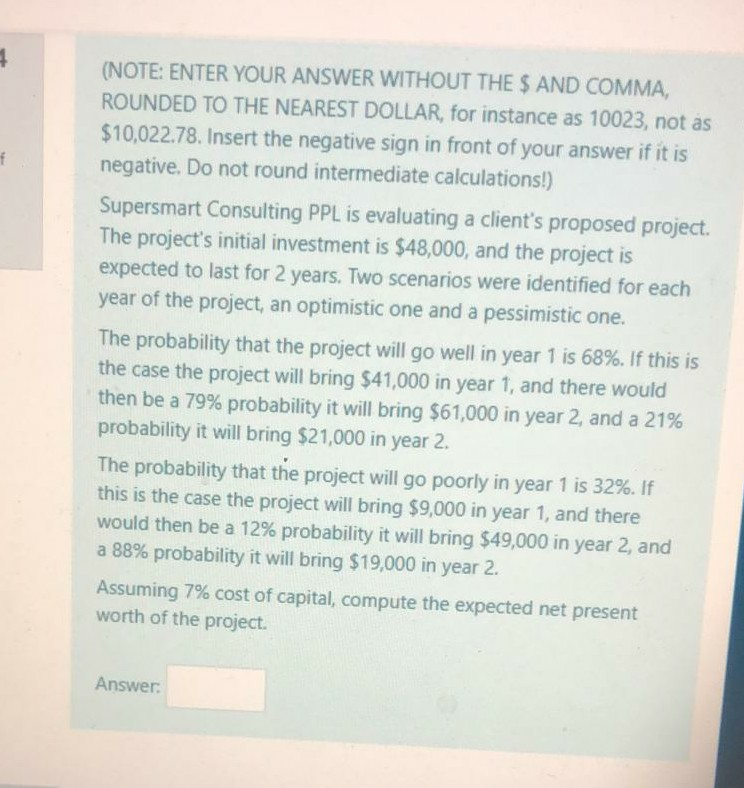

(NOTE: ENTER YOUR ANSWER WITHOUT THE $ AND COMMA, ROUNDED TO THE NEAREST DOLLAR, for instance as 10023, not as $10,022.78. Insert the negative sign in front of your answer if it is negative. Do not round intermediate calculations!) Supersmart Consulting PPL is evaluating a client's proposed project. The project's initial investment is $48,000, and the project is expected to last for 2 years. Two scenarios were identified for each year of the project, an optimistic one and a pessimistic one. The probability that the project will go well in year 1 is 68%. If this is the case the project will bring $41,000 in year 1, and there would then be a 79% probability it will bring $61,000 in year 2, and a 21% probability it will bring $21,000 in year 2. The probability that the project will go poorly in year 1 is 32%. If this is the case the project will bring $9,000 in year 1, and there would then be a 12% probability it will bring $49,000 in year 2, and a 88% probability it will bring $19,000 in year 2. Assuming 7% cost of capital, compute the expected net present worth of the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started