Answered step by step

Verified Expert Solution

Question

1 Approved Answer

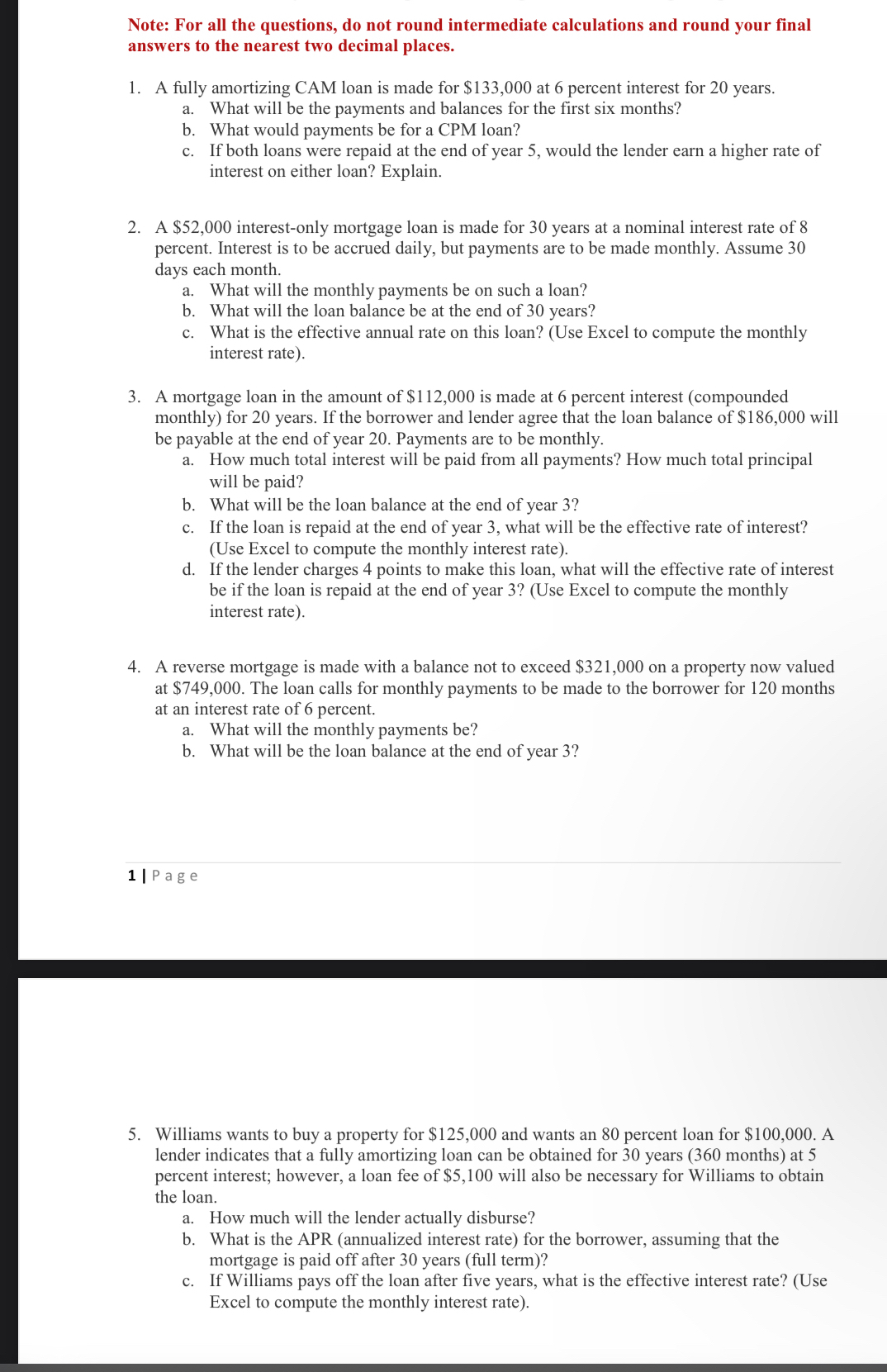

Note: For all the questions, do not round intermediate calculations and round your final answers to the nearest two decimal places. 1. A fully

Note: For all the questions, do not round intermediate calculations and round your final answers to the nearest two decimal places. 1. A fully amortizing CAM loan is made for $133,000 at 6 percent interest for 20 years. a. What will be the payments and balances for the first six months? b. What would payments be for a CPM loan? c. If both loans were repaid at the end of year 5, would the lender earn a higher rate of interest on either loan? Explain. 2. A $52,000 interest-only mortgage loan is made for 30 years at a nominal interest rate of 8 percent. Interest is to be accrued daily, but payments are to be made monthly. Assume 30 days each month. a. What will the monthly payments be on such a loan? b. What will the loan balance be at the end of 30 years? c. What is the effective annual rate on this loan? (Use Excel to compute the monthly interest rate). 3. A mortgage loan in the amount of $112,000 is made at 6 percent interest (compounded monthly) for 20 years. If the borrower and lender agree that the loan balance of $186,000 will be payable at the end of year 20. Payments are to be monthly. a. How much total interest will be paid from all payments? How much total principal will be paid? b. What will be the loan balance at the end of year 3? c. If the loan is repaid at the end of year 3, what will be the effective rate of interest? (Use Excel to compute the monthly interest rate). d. If the lender charges 4 points to make this loan, what will the effective rate of interest be if the loan is repaid at the end of year 3? (Use Excel to compute the monthly interest rate). 4. A reverse mortgage is made with a balance not to exceed $321,000 on a property now valued at $749,000. The loan calls for monthly payments to be made to the borrower for 120 months at an interest rate of 6 percent. a. What will the monthly payments be? b. What will be the loan balance at the end of year 3? 1 Page 5. Williams wants to buy a property for $125,000 and wants an 80 percent loan for $100,000. A lender indicates that a fully amortizing loan can be obtained for 30 years (360 months) at 5 percent interest; however, a loan fee of $5,100 will also be necessary for Williams to obtain the loan. a. How much will the lender actually disburse? b. What is the APR (annualized interest rate) for the borrower, assuming that the C. mortgage is paid off after 30 years (full term)? If Williams pays off the loan after five years, what is the effective interest rate? (Use Excel to compute the monthly interest rate).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started