Answered step by step

Verified Expert Solution

Question

1 Approved Answer

] NOTE: for my revision purposes, please can you clearly state everything including: -writing the name of the formula being used e.g. (Ke = Cost

]

]

NOTE: for my revision purposes, please can you clearly state everything including:

-writing the name of the formula being used e.g. (Ke = Cost of Equity, followed by the formula, then formula with the figures). This will help me when revising.

-Clearly state the steps used to get the final answer

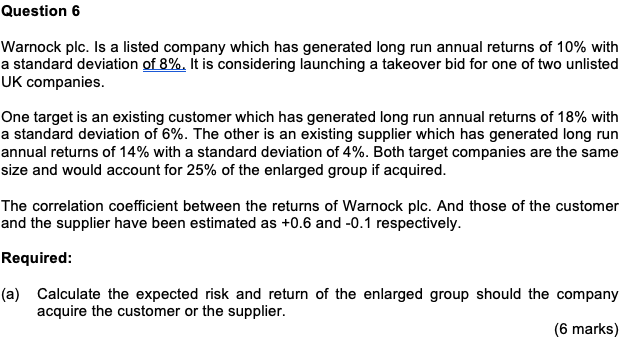

Question 6 Warnock plc. Is a listed company which has generated long run annual returns of 10% with a standard deviation of 8%. It is considering launching a takeover bid for one of two unlisted UK companies. One target is an existing customer which has generated long run annual returns of 18% with a standard deviation of 6%. The other is an existing supplier which has generated long run annual returns of 14% with a standard deviation of 4%. Both target companies are the same size and would account for 25% of the enlarged group if acquired. The correlation coefficient between the returns of Warnock plc. And those of the customer and the supplier have been estimated as +0.6 and -0.1 respectively. Required: (a) Calculate the expected risk and return of the enlarged group should the company acquire the customer or the supplier. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started