Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note :- i want full answer not just hints.. 4) Must show your work on the submission. Make sure you reference your data sources (i.e.

Note :- i want full answer not just hints..

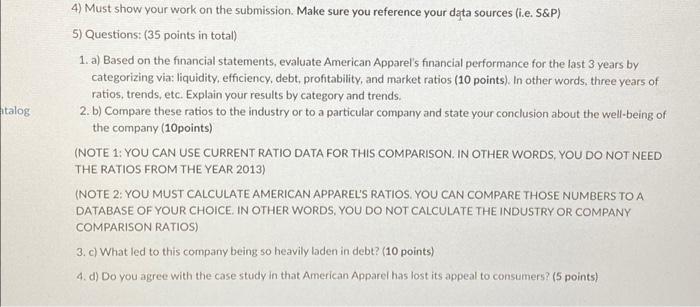

4) Must show your work on the submission. Make sure you reference your data sources (i.e. S&P) 5) Questions: (35 points in total) 1. a) Based on the financial statements, evaluate American Apparel's financial performance for the last 3 years by categorizing via: liquidity, efficiency, debt, profitability, and market ratios (10 points). In other words, three years of ratios, trends, etc. Explain your results by category and trends. 2. b) Compare these ratios to the industry or to a particular company and state your conclusion about the well-being of the company (10points) (NOTE 1: YOU CAN USE CURRENT RATIO DATA FOR THIS COMPARISON. IN OTHER WORDS, YOU DO NOT NEED THE RATIOS FROM THE YEAR 2013) (NOTE 2: YOU MUST CALCULATE AMERICAN APPAREL'S RATIOS. YOU CAN COMPARE THOSE NUMBERS TO A DATABASE OF YOUR CHOICE. IN OTHER WORDS, YOU DO NOT CALCULATE THE INDUSTRY OR COMPANY COMPARISON RATIOS) 3. c) What led to this company being so heavily laden in debt? (10 points) 4. d) Do you agree with the case study in that American Apparel has lost its appeal to consumers? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started