Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note. In all questions, if your answer is a decimal number, then write your answer to three decimal places by rounding it off at the

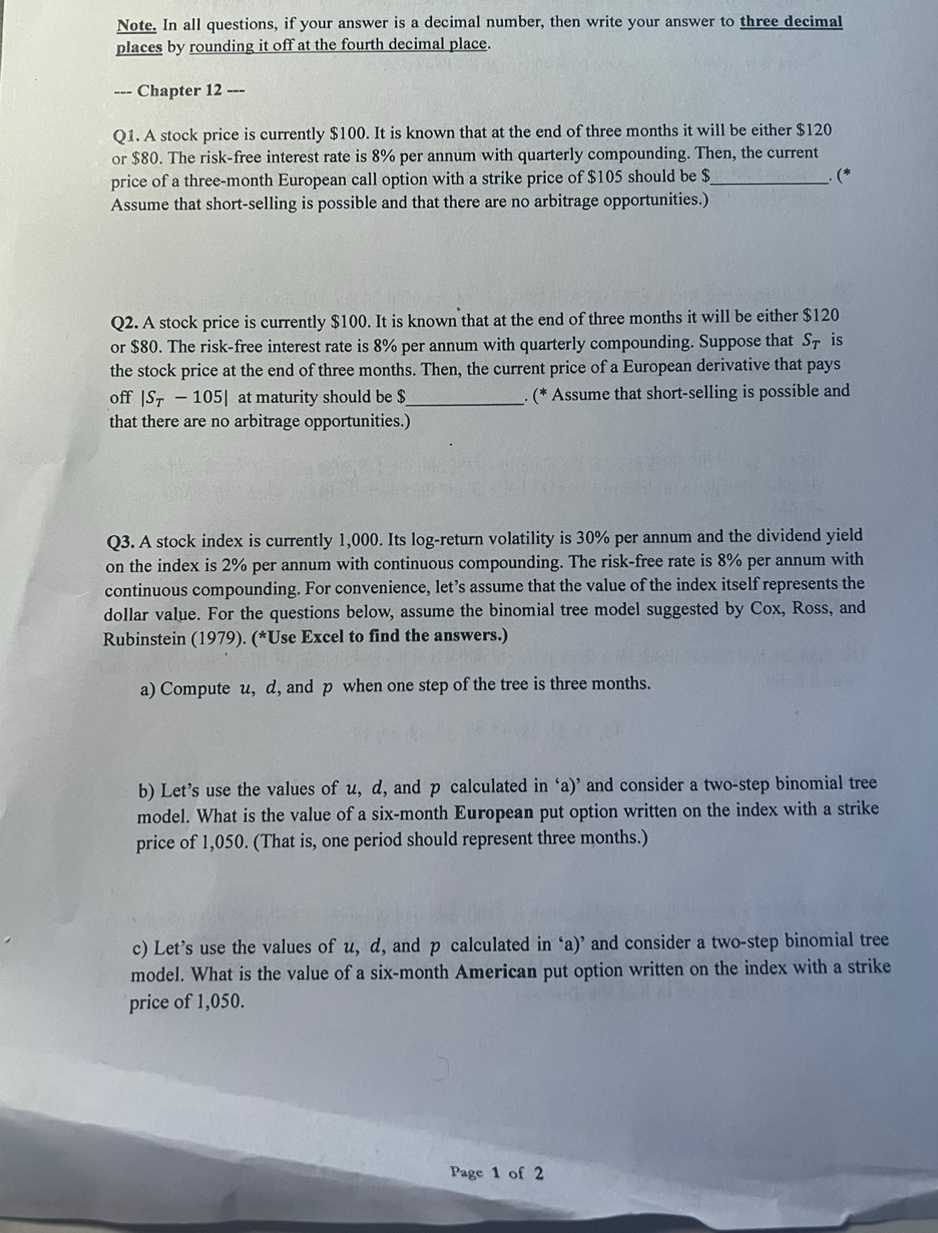

Note. In all questions, if your answer is a decimal number, then write your answer to three decimal places by rounding it off at the fourth decimal place. -- Chapter 12 -- Q1. A stock price is currently $100. It is known that at the end of three months it will be either $120 or $80. The risk-free interest rate is 8% per annum with quarterly compounding. Then, the current price of a three-month European call option with a strike price of $105 should be : Assume that short-selling is possible and that there are no arbitrage opportunities.) Q2. A stock price is currently $100. It is known that at the end of three months it will be either $120 or $80. The risk-free interest rate is 8% per annum with quarterly compounding. Suppose that ST is the stock price at the end of three months. Then, the current price of a European derivative that pays off ST105 at maturity should be (*Assume that short-selling is possible and that there are no arbitrage opportunities.) Q3. A stock index is currently 1,000. Its log-return volatility is 30% per annum and the dividend yield on the index is 2% per annum with continuous compounding. The risk-free rate is 8% per annum with continuous compounding. For convenience, let's assume that the value of the index itself represents the dollar value. For the questions below, assume the binomial tree model suggested by Cox, Ross, and Rubinstein (1979). (*Use Excel to find the answers.) a) Compute u,d, and p when one step of the tree is three months. b) Let's use the values of u,d, and p calculated in 'a)' and consider a two-step binomial tree model. What is the value of a six-month European put option written on the index with a strike price of 1,050 . (That is, one period should represent three months.) c) Let's use the values of u,d, and p calculated in 'a)' and consider a two-step binomial tree model. What is the value of a six-month American put option written on the index with a strike price of 1,050

Note. In all questions, if your answer is a decimal number, then write your answer to three decimal places by rounding it off at the fourth decimal place. -- Chapter 12 -- Q1. A stock price is currently $100. It is known that at the end of three months it will be either $120 or $80. The risk-free interest rate is 8% per annum with quarterly compounding. Then, the current price of a three-month European call option with a strike price of $105 should be : Assume that short-selling is possible and that there are no arbitrage opportunities.) Q2. A stock price is currently $100. It is known that at the end of three months it will be either $120 or $80. The risk-free interest rate is 8% per annum with quarterly compounding. Suppose that ST is the stock price at the end of three months. Then, the current price of a European derivative that pays off ST105 at maturity should be (*Assume that short-selling is possible and that there are no arbitrage opportunities.) Q3. A stock index is currently 1,000. Its log-return volatility is 30% per annum and the dividend yield on the index is 2% per annum with continuous compounding. The risk-free rate is 8% per annum with continuous compounding. For convenience, let's assume that the value of the index itself represents the dollar value. For the questions below, assume the binomial tree model suggested by Cox, Ross, and Rubinstein (1979). (*Use Excel to find the answers.) a) Compute u,d, and p when one step of the tree is three months. b) Let's use the values of u,d, and p calculated in 'a)' and consider a two-step binomial tree model. What is the value of a six-month European put option written on the index with a strike price of 1,050 . (That is, one period should represent three months.) c) Let's use the values of u,d, and p calculated in 'a)' and consider a two-step binomial tree model. What is the value of a six-month American put option written on the index with a strike price of 1,050 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started