Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note - involve comparing recorded accounting data with historical information, budget expectations or external benchmarks. These procedures enable the auditors to assess the overall

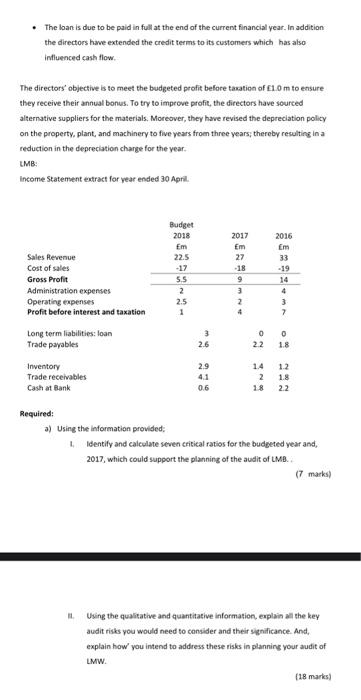

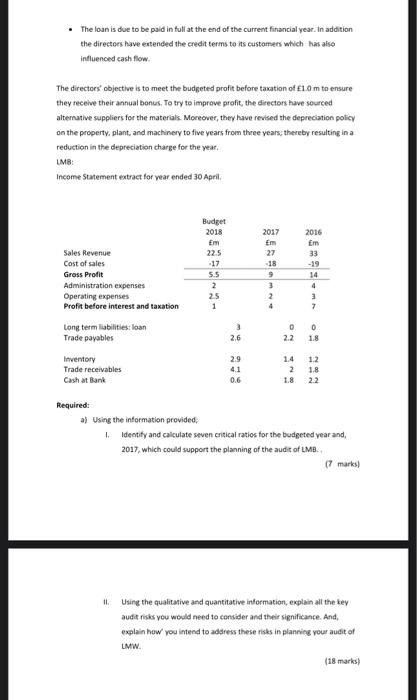

Note - involve comparing recorded accounting data with historical information, budget expectations or external benchmarks. These procedures enable the auditors to assess the overall reasonableness of account balances and they produce analytical evidence. Question LMB, an Automobile Engineers You are an audit senior at Rodda and Partners; scheduled to start planning an audit for LMB, an Automobile Engineers for the Year Ended 30 April 2018. The company employs a team of people that specialists in the design, manufacture and testing of car. The business also performs the distribution, marketing, sales and after-sales care of cars in-house. The directors of LMW provided you with the following information during the preliminary meeting: LMB has struggled this financial year because of the uncertainty in the market place due to the protracted negotiations of Brexit as a result, revenue has decreased, demand has fallen to the point that completed cars are sitting on the forecourt. The directors are considering lowering the selling price of specific models. Furthermore, the manufacturers had to recall thousands of vehicles due to a problem related to the car battery and fuse box; incurring further additional costs as the company provided courtesy cars to existing customers. To sustain operations and cash flow, the directors borrowed 3 million from the bank during the year. The loan is due to be paid in full at the end of the current financial year. In addition the directors have extended the credit terms to its customers which has also influenced cash flow. The directors' objective is to meet the budgeted profit before taxation of 1.0 m to ensure they receive their annual bonus. To try to improve profit, the directors have sourced alternative suppliers for the materials. Moreover, they have revised the depreciation policy on the property, plant, and machinery to five years from three years, thereby resulting in a reduction in the depreciation charge for the year. LMB: Income Statement extract for year ended 30 April. Sales Revenue Cost of sales Gross Profit Administration expenses Operating expenses Profit before interest and taxation Long term liabilities: loan Trade payables Inventory Trade receivables Cash at Bank Required: Budget IL ******* 2018 Em 22.5 -17 5.5 2 2.5 1 3 2.6 2.9 4.1 0.6 2017 Em 27 -18 9 3 2 4 NO 2016 Em 33 -19 14 4 3 7 0 2.2 1.8 14 2 1.2 18 1.8 2.2 a) Using the information provided; 1. Identify and calculate seven critical ratios for the budgeted year and, 2017, which could support the planning of the audit of LMB. (7 marks) Using the qualitative and quantitative information, explain all the key audit risks you would need to consider and their significance. And, explain how you intend to address these risks in planning your audit of LMW. (18 marks) The loan is due to be paid in full at the end of the current financial year. In addition the directors have extended the credit terms to its customers which has also influenced cash flow. The directors objective is to meet the budgeted profit before taxation of 1.0m to ensure they receive their annual bonus. To try to improve profit, the directors have sourced alternative suppliers for the materials. Moreover, they have revised the depreciation policy on the property, plant, and machinery to five years from three years; thereby resulting in a reduction in the depreciation charge for the year. LMB: Income Statement extract for year ended 30 April. Sales Revenue Cost of sales Gross Profit Administration expenses Operating expenses Profit before interest and taxation Long term liabilities: loan Trade payables Inventory Trade receivables Cash at Bank Required: a) Using the information provided, 1. 11. j****-*- Budget 2018 22.5 -17 5.5 2.5 1 3 2,6 2.9 4.1 0.6 2017 Em 27 -18 9 3 2 4 2016 Em 33 1.8 -19 14 4 3 7 0 1.8 2.2 14 1.2 2 1.8 2.2 Identify and calculate seven critical ratios for the budgeted year and, 2017, which could support the planning of the audit of LMB. (7 marks) Using the qualitative and quantitative information, explain all the key audit risks you would need to consider and their significance. And, explain how you intend to address these risks in planning your audit of LMW. (18 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer b Audit Risks and Mitigation Risk Loan Repayment Theres a risk associated with the ability of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started