Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: Kindly provide comparison between both years and analysis of latest year as well as formulas for calculation of ratios. The following summarised figures relate

Note:

Kindly provide comparison between both years and analysis of latest year as well as formulas for calculation of ratios.

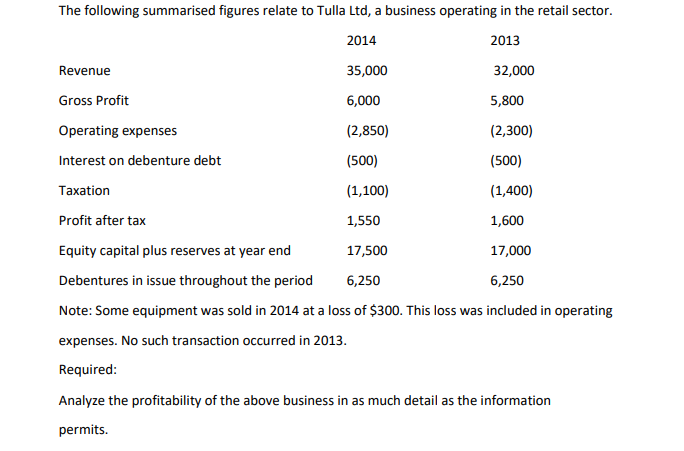

The following summarised figures relate to Tulla Ltd, a business operating in the retail sector. 2014 2013 (500) Revenue 35,000 32,000 Gross Profit 6,000 5,800 Operating expenses (2,850) (2,300) Interest on debenture debt (500) Taxation (1,100) (1,400) Profit after tax 1,550 1,600 Equity capital plus reserves at year end 17,500 17,000 Debentures in issue throughout the period 6,250 6,250 Note: Some equipment was sold in 2014 at a loss of $300. This loss was included in operating expenses. No such transaction occurred in 2013. Required: Analyze the profitability of the above business in as much detail as the information permitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started