Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: Marks will be awarded for numerical examples used to support your advice Tom Jones, aged 60, has been running his business for many years.

Note: Marks will be awarded for numerical examples used to support your advice

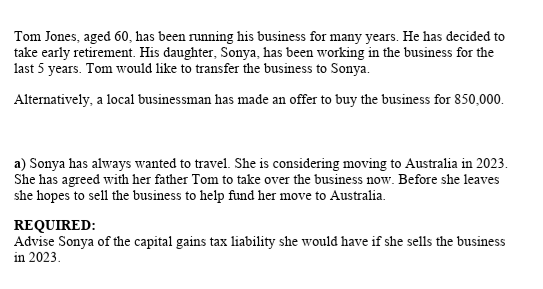

Tom Jones, aged 60, has been running his business for many years. He has decided to take early retirement. His daughter, Sonya, has been working in the business for the last 5 years. Tom would like to transfer the business to Sonya. Alternatively, a local businessman has made an offer to buy the business for 850,000. a) Sonya has always wanted to travel. She is considering moving to Australia in 2023. She has agreed with her father Tom to take over the business now. Before she leaves she hopes to sell the business to help fund her move to Australia. REQUIRED: Advise Sonya of the capital gains tax liability she would have if she sells the business in 2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started