Question

NOTE: NEED PLAGIARISM FREE ANSWER Taryn would like to open a new business as an interior designer, to funds her ambition she sold some of

NOTE: NEED PLAGIARISM FREE ANSWER

Taryn would like to open a new business as an interior designer, to funds her ambition she sold some of the following assets:

1. Antique Painting that was given to Taryn by her father 5 years ago. Taryns father bought it on 20 August 1984 for $2,500. Taryn sold it on 1st June 2020 for $25,000

2. Taryn sold her car (Toyota Corolla) for the amount of $12,000 on 20th May 2020, she bought on 1st January 2015 for the amount of $20,000

3. Taryn sold her Harry Potters collection for the amount of $1,500 on 4th January 2020, she bought it second hand on 10th October 2018 for $350.

4. Taryn sold her gold necklace for $2,000 on 20th March 2020, she bought it for $1,200 on 8th August 2018

5. Taryn sold a sculpture for $6,000 on 1 January 2020, she bought it on December 1994 for $1,500

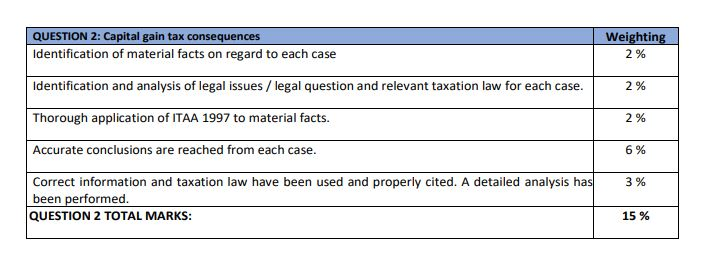

Advise the Capital Gain Tax Consequences for the above transactions, please have a look at the matrix below on how to answer the question

Answer in around 1000 words (acceptable to be 10% above or below this word limit).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started