Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: Please answer as soon as you can. A sincere and complete answer would be rated positive instantly. Thank you Question 07 15 Marks Stamos

Note: Please answer as soon as you can. A sincere and complete answer would be rated positive instantly. Thank you

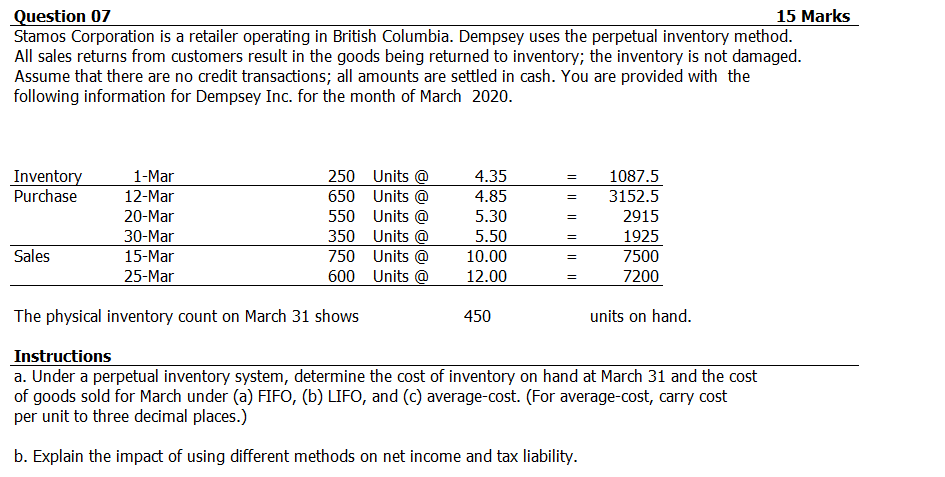

Question 07 15 Marks Stamos Corporation is a retailer operating in British Columbia. Dempsey uses the perpetual inventory method. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Dempsey Inc. for the month of March 2020. = Inventory Purchase = = 1-Mar 12-Mar 20-Mar 30-Mar 15-Mar 25-Mar 250 Units @ 650 Units @ 550 Units @ 350 Units @ 750 Units @ 600 Units @ 4.35 4.85 5.30 5.50 10.00 12.00 1087.5 3152.5 2915 1925 7500 7200 Sales = = The physical inventory count on March 31 shows 450 units on hand. Instructions a. Under a perpetual inventory system, determine the cost of inventory on hand at March 31 and the cost of goods sold for March under (a) FIFO, (b) LIFO, and (c) average-cost. (For average-cost, carry cost per unit to three decimal places.) b. Explain the impact of using different methods on net income and tax liabilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started