Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note : Please don't just make a table and post it.I want to know the calculations inbetween.Thanks. The J.F. Manning Metal Co. is considering the

Note : Please don't just make a table and post it.I want to know the calculations inbetween.Thanks.

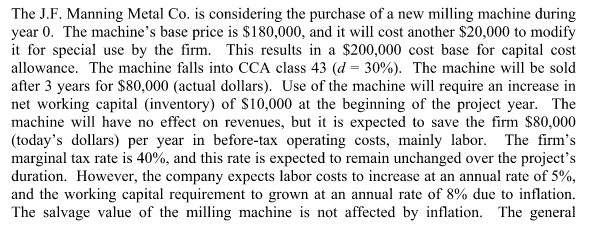

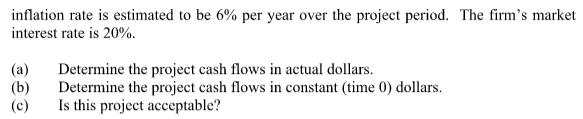

The J.F. Manning Metal Co. is considering the purchase of a new milling machine during year 0. The machine's base price is $180,000, and it will cost another $20,000 to modify it for special use by the firm. This results in a $200,000 cost base for capital cost allowance. The machine falls into CCA class 43 (d= 30%). The machine will be sold after 3 years for $80,000 (actual dollars). Use of the machine will require an increase in net working capital (inventory) of S10,000 at the beginning of the project year. The machine will have no effect on revenues, but it is expected to save the firm $80,000 (today's dollars) per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 40%, and this rate is expected to remain unchanged over the project's duration. However, the company expects labor costs to increase at an annual rate of 5%. and the working capital requirement to grown at an annual rate of 8% due to inflation. The salvage value of the milling machine is not affected by inflation. The generalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started