Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NOTE: PLEASE DON'T ROUND OFF OR ELSE I WILL DOWNVOTE Donahue Company is preparing budgets for the third quarter ending Sept 30, 2017. Budgeted sales

NOTE: PLEASE DON'T ROUND OFF OR ELSE I WILL DOWNVOTE

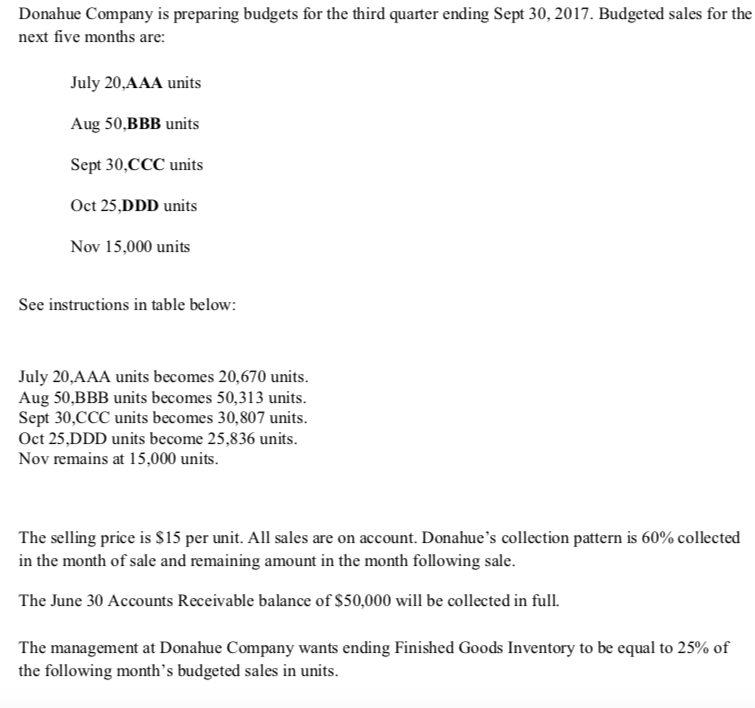

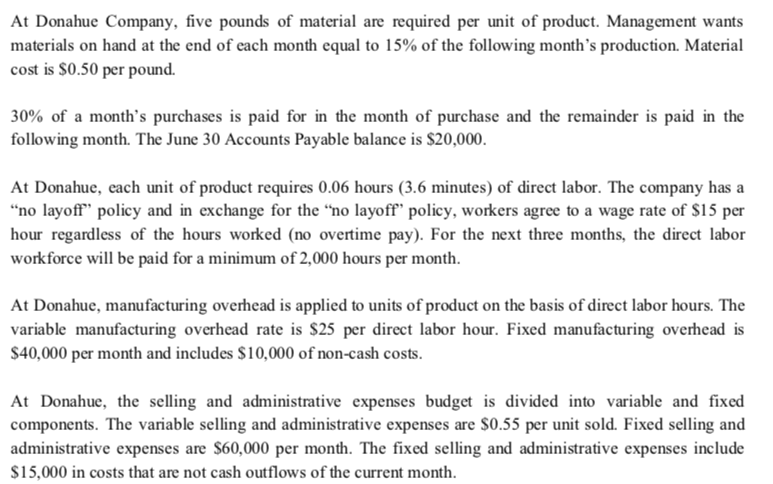

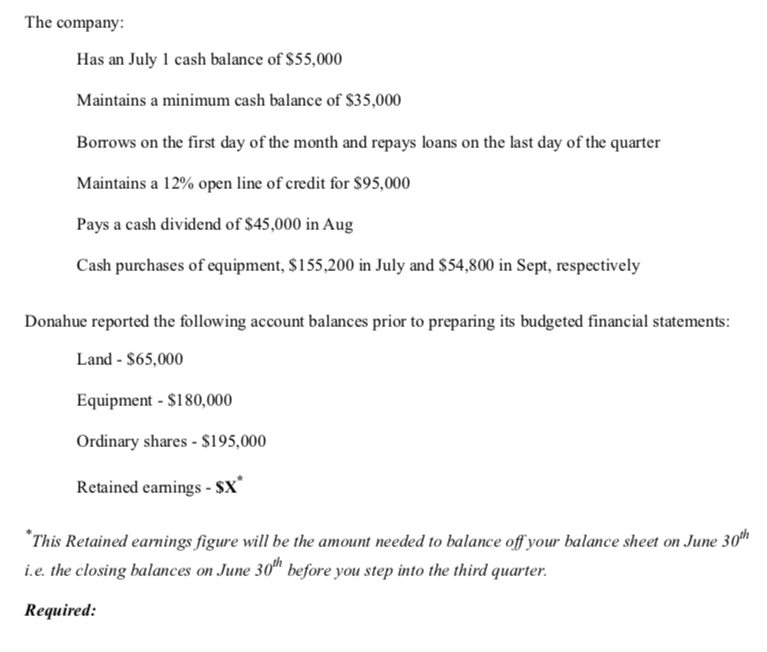

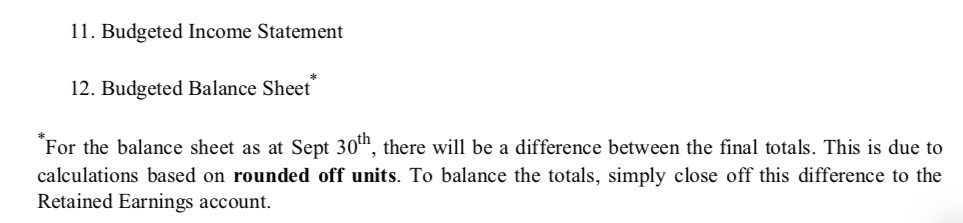

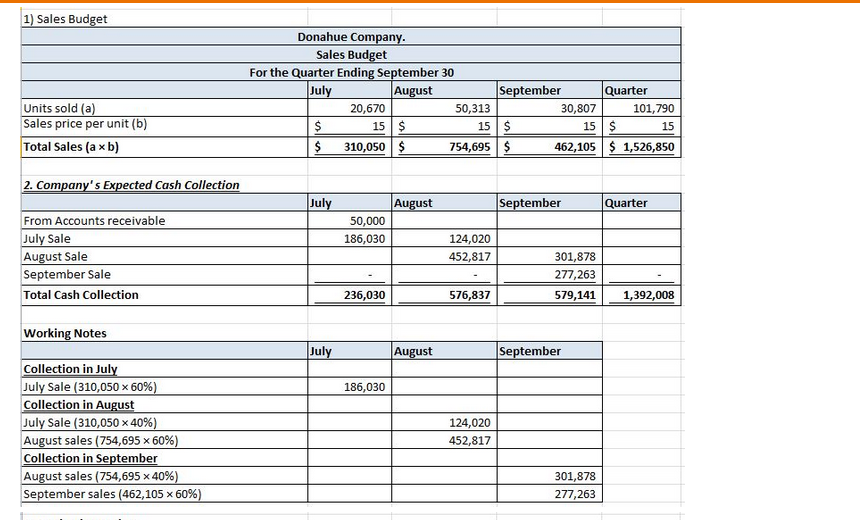

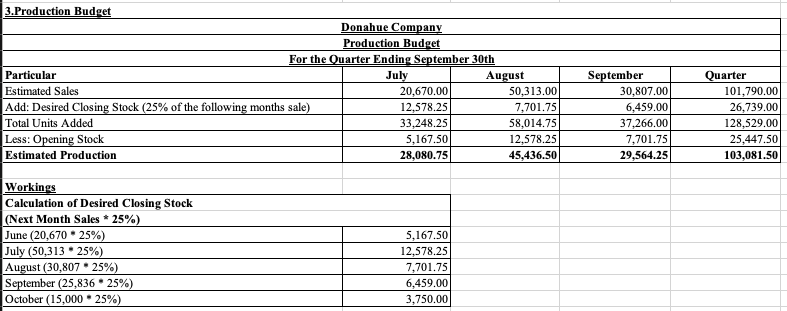

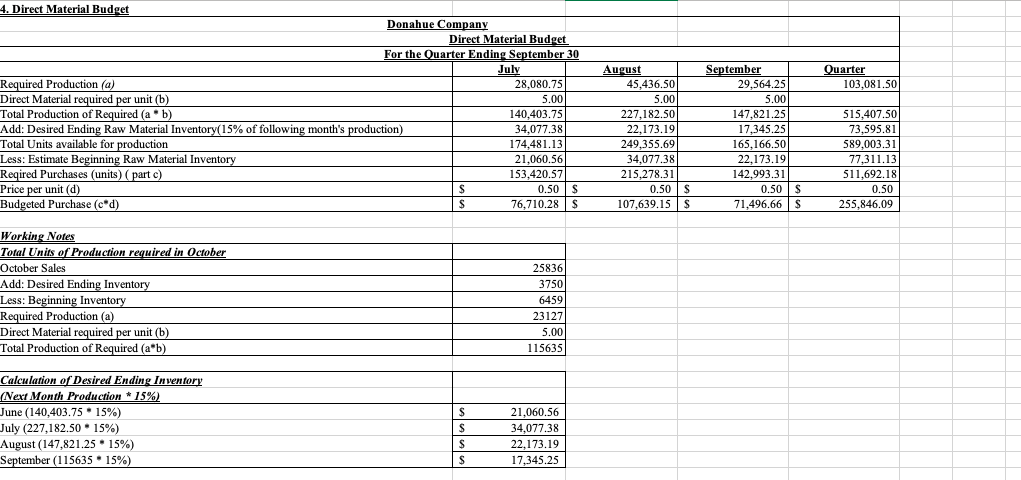

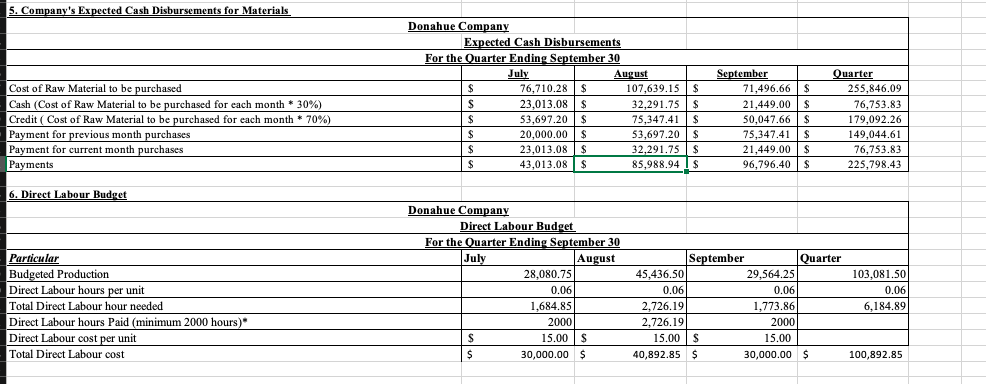

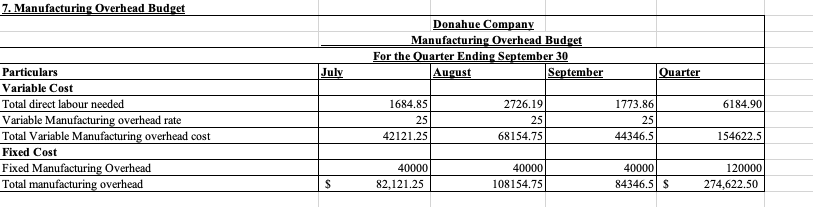

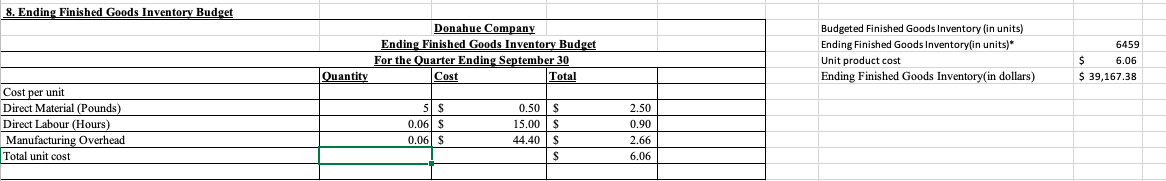

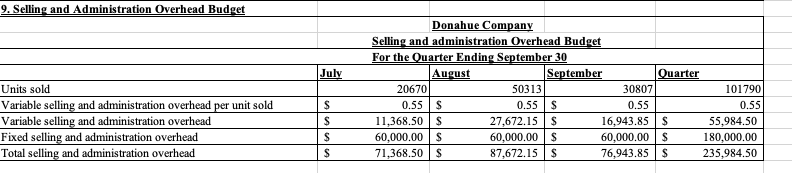

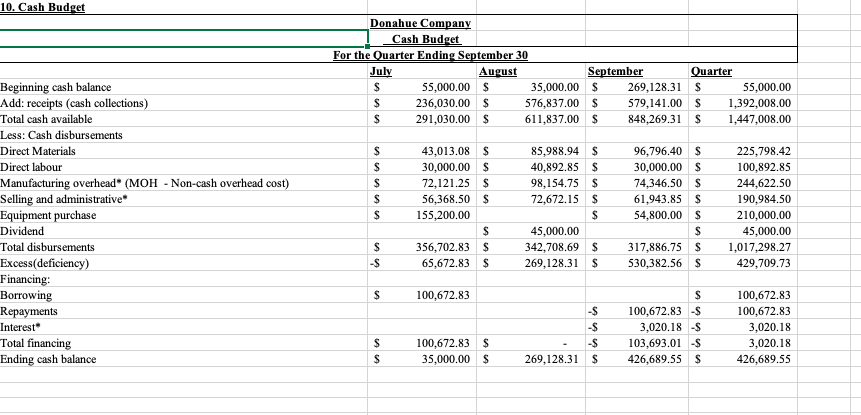

Donahue Company is preparing budgets for the third quarter ending Sept 30, 2017. Budgeted sales for the next five months are: July 20,AAA units Aug 50,BBB units Sept 30,CCC units Oct 25,DDD units Nov 15,000 units See instructions in table below: July 20,AAA units becomes 20,670 units. Aug 50,BBB units becomes 50,313 units. Sept 30,CCC units becomes 30,807 units. Oct 25,DDD units become 25,836 units. Nov remains at 15,000 units. The selling price is $15 per unit. All sales are on account. Donahue's collection pattern is 60% collected in the month of sale and remaining amount in the month following sale. The June 30 Accounts Receivable balance of $50,000 will be collected in full. The management at Donahue Company wants ending Finished Goods Inventory to be equal to 25% of the following month's budgeted sales in units. At Donahue Company, five pounds of material are required per unit of product. Management wants materials on hand at the end of each month equal to 15% of the following month's production. Material cost is $0.50 per pound. 30% of a month's purchases is paid for in the month of purchase and the remainder is paid in the following month. The June 30 Accounts Payable balance is $20,000. At Donahue, each unit of product requires 0.06 hours (3.6 minutes) of direct labor. The company has a "no layoft" policy and in exchange for the "no layoff" policy, workers agree to a wage rate of $15 per hour regardless of the hours worked (no overtime pay). For the next three months, the direct labor workforce will be paid for a minimum of 2,000 hours per month. At Donahue, manufacturing overhead is applied to units of product on the basis of direct labor hours. The variable manufacturing overhead rate is $25 per direct labor hour. Fixed manufacturing overhead is $40,000 per month and includes $10,000 of non-cash costs. At Donahue, the selling and administrative expenses budget is divided into variable and fixed components. The variable selling and administrative expenses are $0.55 per unit sold. Fixed selling and administrative expenses are $60,000 per month. The fixed selling and administrative expenses include $15,000 in costs that are not cash outflows of the current month. The company: Has an July 1 cash balance of $55,000 Maintains a minimum cash balance of $35,000 Borrows on the first day of the month and repays loans on the last day of the quarter Maintains a 12% open line of credit for $95,000 Pays a cash dividend of $45,000 in Aug Cash purchases of equipment, $155,200 in July and $54,800 in Sept, respectively Donahue reported the following account balances prior to preparing its budgeted financial statements Land - $65,000 Equipment - $180,000 Ordinary shares - $195,000 Retained eamings - $X *This Retained earnings figure will be the amount needed to balance off your balance sheet on June 30th i.e. the closing balances on June 30" before you step into the third quarter. Required: 11. Budgeted Income Statement 12. Budgeted Balance Sheet For the balance sheet as at Sept 30th, there will be a difference between the final totals. This is due to calculations based on rounded off units. To balance the totals, simply close off this difference to the Retained Earnings account. 3.Production Budget Donahue Company Production Budget For the Quarter Ending September 30th Particular July August Estimated Sales 20,670.00 50,313.00 Add: Desired Closing Stock (25% of the following months sale) 12,578.25 7,701.75 Total Units Added 33,248.25 58,014.75 Less: Opening Stock 5,167.50 12,578.251 Estimated Production 28,080.751 45,436.50 September 30,807.00 30,807.00 | 6,459.00 37,266.00 7,701.75 29,564.25 Quarter 101.790.00 26,739.00 128,529.00 25,447.50 103,081.50 Workings Calculation of Desired Closing Stock (Next Month Sales * 25%) June (20,670.25%) July (50,313 . 25%) August (30,807 25%) September (25,836 25%) October (15,000 25%) 5,167.50 12,578.25 7,701.75 6,459.00 3,750.00 7. Manufacturing Overhead Budget Donahue Company Manufacturing Overhead Budget For the Quarter Ending September 30 August September Quarter Particulars Variable Cost Total direct labour needed 1684.85 2726.191 1773.86 6184.90 251 42121.25 68154.751 44346.5 154622.5 Variable Manufacturing overhead rate Total Variable Manufacturing overhead cost Fixed Cost Fixed Manufacturing Overhead Total manufacturing overhead 40000 82.121.25 40000 108154.75 40000 84346.5 120000 274,622.50 S 8. Ending Finished Goods Inventory Budget Donahue Company Ending Finished Goods Inventory Budget For the Quarter Ending September 30 Cost Total Budgeted Finished Goods Inventory (in units) Ending Finished Goods Inventory(in units)* Unit product cost Ending Finished Goods Inventory(in dollars) 6459 $ 6.06 $ 39,167.38 Quantity Cost per unit Direct Material (Pounds) Direct Labour (Hours) Manufacturing Overhead Total unit cost 5 $ 0.06 $ 0.06 S 0.50 $ 15.00 $ 44.40S $ 2.50 0.90 2.66 6.06 9. Selling and Administration Overhead Budget July Units sold Donahue Company Selling and administration Overhead Budget For the Quarter Ending September 30 August September Quarter 20670 50313 30807 101790 0.55 $ 0.55 $ 0.55 0.55 11,368.50 $ 27,672.15 $ 16,943.85 $ 55,984.50 60,000.00 $ 60,000.00 $ 60,000.00 $ 180,000.00 71,368.50 $ 87,672.15 $ 76,943.85 $ 235,984.50 $ Variable selling and administration overhead per unit sold Variable selling and administration overhead Fixed selling and administration overhead Total selling and administration overhead 10. Cash Budget Donahue Company Cash Budget For the Quarter Ending September 30 July August 55,000.00 $ 35,000.00 $ 236,030.00 $ 576,837.00 291,030.00 $ 611,837.00 September Quarter $ 269,128.31 $ 55,000.00 $ 579,141.00 $ 1,392,008.00 $ 848,269.31 $ 1,447,008.00 S 43,013.08 30,000.00 72,121.25 56,368.50 155,200.00 $ $ $ $ 85,988.94 40,892.85 98,154.75 72,672.15 $ $ $ S S 96,796.40 30,000.00 74,346.50 61,943.85 54,800.00 Beginning cash balance Add: receipts (cash collections) Total cash available Less: Cash disbursements Direct Materials Direct labour Manufacturing overhead" (MOH - Non-cash overhead cost) Selling and administrative Equipment purchase Dividend Total disbursements Excess(deficiency) Financing: Borrowing Repayments Interest Total financing Ending cash balance $ $ $ $ $ $ $ $ 225,798.42 100,892.85 244.622.50 190,984.50 210,000.00 45,000.00 1,017,298.27 429.709.73 $ 356,702.83 65,672.83 % $ 45,000.00 342,708.69 269,128.31 $ $ 317,886.75 530,382.56 $ 100,672.83 -$ -$ $ $ 100,672.83 $ 3,020.18 $ 103,693.01 -$ 426,689.55 $ 100,672.83 100,672.83 3,020.18 3,020.18 426,689.55 100,672.83 35,000.00 S $ 269,128.31 Donahue Company is preparing budgets for the third quarter ending Sept 30, 2017. Budgeted sales for the next five months are: July 20,AAA units Aug 50,BBB units Sept 30,CCC units Oct 25,DDD units Nov 15,000 units See instructions in table below: July 20,AAA units becomes 20,670 units. Aug 50,BBB units becomes 50,313 units. Sept 30,CCC units becomes 30,807 units. Oct 25,DDD units become 25,836 units. Nov remains at 15,000 units. The selling price is $15 per unit. All sales are on account. Donahue's collection pattern is 60% collected in the month of sale and remaining amount in the month following sale. The June 30 Accounts Receivable balance of $50,000 will be collected in full. The management at Donahue Company wants ending Finished Goods Inventory to be equal to 25% of the following month's budgeted sales in units. At Donahue Company, five pounds of material are required per unit of product. Management wants materials on hand at the end of each month equal to 15% of the following month's production. Material cost is $0.50 per pound. 30% of a month's purchases is paid for in the month of purchase and the remainder is paid in the following month. The June 30 Accounts Payable balance is $20,000. At Donahue, each unit of product requires 0.06 hours (3.6 minutes) of direct labor. The company has a "no layoft" policy and in exchange for the "no layoff" policy, workers agree to a wage rate of $15 per hour regardless of the hours worked (no overtime pay). For the next three months, the direct labor workforce will be paid for a minimum of 2,000 hours per month. At Donahue, manufacturing overhead is applied to units of product on the basis of direct labor hours. The variable manufacturing overhead rate is $25 per direct labor hour. Fixed manufacturing overhead is $40,000 per month and includes $10,000 of non-cash costs. At Donahue, the selling and administrative expenses budget is divided into variable and fixed components. The variable selling and administrative expenses are $0.55 per unit sold. Fixed selling and administrative expenses are $60,000 per month. The fixed selling and administrative expenses include $15,000 in costs that are not cash outflows of the current month. The company: Has an July 1 cash balance of $55,000 Maintains a minimum cash balance of $35,000 Borrows on the first day of the month and repays loans on the last day of the quarter Maintains a 12% open line of credit for $95,000 Pays a cash dividend of $45,000 in Aug Cash purchases of equipment, $155,200 in July and $54,800 in Sept, respectively Donahue reported the following account balances prior to preparing its budgeted financial statements Land - $65,000 Equipment - $180,000 Ordinary shares - $195,000 Retained eamings - $X *This Retained earnings figure will be the amount needed to balance off your balance sheet on June 30th i.e. the closing balances on June 30" before you step into the third quarter. Required: 11. Budgeted Income Statement 12. Budgeted Balance Sheet For the balance sheet as at Sept 30th, there will be a difference between the final totals. This is due to calculations based on rounded off units. To balance the totals, simply close off this difference to the Retained Earnings account. 3.Production Budget Donahue Company Production Budget For the Quarter Ending September 30th Particular July August Estimated Sales 20,670.00 50,313.00 Add: Desired Closing Stock (25% of the following months sale) 12,578.25 7,701.75 Total Units Added 33,248.25 58,014.75 Less: Opening Stock 5,167.50 12,578.251 Estimated Production 28,080.751 45,436.50 September 30,807.00 30,807.00 | 6,459.00 37,266.00 7,701.75 29,564.25 Quarter 101.790.00 26,739.00 128,529.00 25,447.50 103,081.50 Workings Calculation of Desired Closing Stock (Next Month Sales * 25%) June (20,670.25%) July (50,313 . 25%) August (30,807 25%) September (25,836 25%) October (15,000 25%) 5,167.50 12,578.25 7,701.75 6,459.00 3,750.00 7. Manufacturing Overhead Budget Donahue Company Manufacturing Overhead Budget For the Quarter Ending September 30 August September Quarter Particulars Variable Cost Total direct labour needed 1684.85 2726.191 1773.86 6184.90 251 42121.25 68154.751 44346.5 154622.5 Variable Manufacturing overhead rate Total Variable Manufacturing overhead cost Fixed Cost Fixed Manufacturing Overhead Total manufacturing overhead 40000 82.121.25 40000 108154.75 40000 84346.5 120000 274,622.50 S 8. Ending Finished Goods Inventory Budget Donahue Company Ending Finished Goods Inventory Budget For the Quarter Ending September 30 Cost Total Budgeted Finished Goods Inventory (in units) Ending Finished Goods Inventory(in units)* Unit product cost Ending Finished Goods Inventory(in dollars) 6459 $ 6.06 $ 39,167.38 Quantity Cost per unit Direct Material (Pounds) Direct Labour (Hours) Manufacturing Overhead Total unit cost 5 $ 0.06 $ 0.06 S 0.50 $ 15.00 $ 44.40S $ 2.50 0.90 2.66 6.06 9. Selling and Administration Overhead Budget July Units sold Donahue Company Selling and administration Overhead Budget For the Quarter Ending September 30 August September Quarter 20670 50313 30807 101790 0.55 $ 0.55 $ 0.55 0.55 11,368.50 $ 27,672.15 $ 16,943.85 $ 55,984.50 60,000.00 $ 60,000.00 $ 60,000.00 $ 180,000.00 71,368.50 $ 87,672.15 $ 76,943.85 $ 235,984.50 $ Variable selling and administration overhead per unit sold Variable selling and administration overhead Fixed selling and administration overhead Total selling and administration overhead 10. Cash Budget Donahue Company Cash Budget For the Quarter Ending September 30 July August 55,000.00 $ 35,000.00 $ 236,030.00 $ 576,837.00 291,030.00 $ 611,837.00 September Quarter $ 269,128.31 $ 55,000.00 $ 579,141.00 $ 1,392,008.00 $ 848,269.31 $ 1,447,008.00 S 43,013.08 30,000.00 72,121.25 56,368.50 155,200.00 $ $ $ $ 85,988.94 40,892.85 98,154.75 72,672.15 $ $ $ S S 96,796.40 30,000.00 74,346.50 61,943.85 54,800.00 Beginning cash balance Add: receipts (cash collections) Total cash available Less: Cash disbursements Direct Materials Direct labour Manufacturing overhead" (MOH - Non-cash overhead cost) Selling and administrative Equipment purchase Dividend Total disbursements Excess(deficiency) Financing: Borrowing Repayments Interest Total financing Ending cash balance $ $ $ $ $ $ $ $ 225,798.42 100,892.85 244.622.50 190,984.50 210,000.00 45,000.00 1,017,298.27 429.709.73 $ 356,702.83 65,672.83 % $ 45,000.00 342,708.69 269,128.31 $ $ 317,886.75 530,382.56 $ 100,672.83 -$ -$ $ $ 100,672.83 $ 3,020.18 $ 103,693.01 -$ 426,689.55 $ 100,672.83 100,672.83 3,020.18 3,020.18 426,689.55 100,672.83 35,000.00 S $ 269,128.31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started