*NOTE : Please just answer question 6,7 and 8 .Using the MS Excel Spreadsheet Template

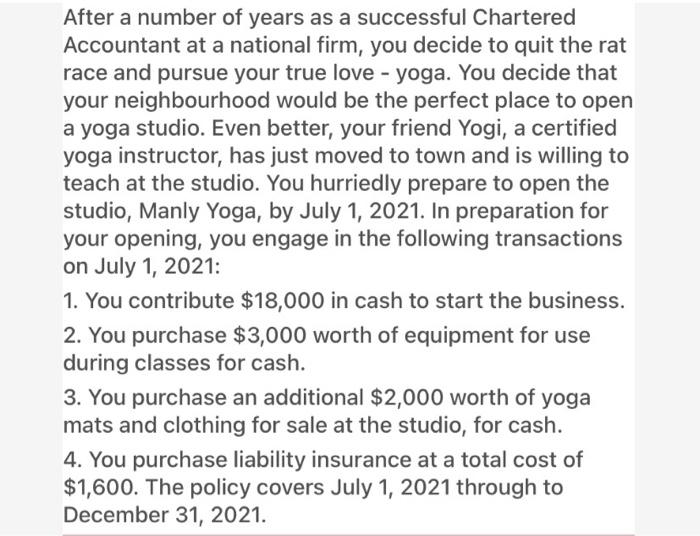

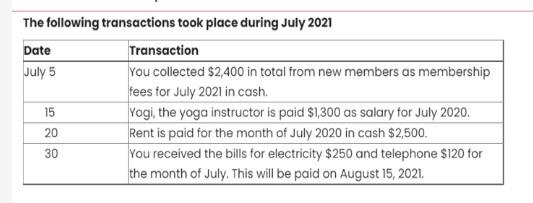

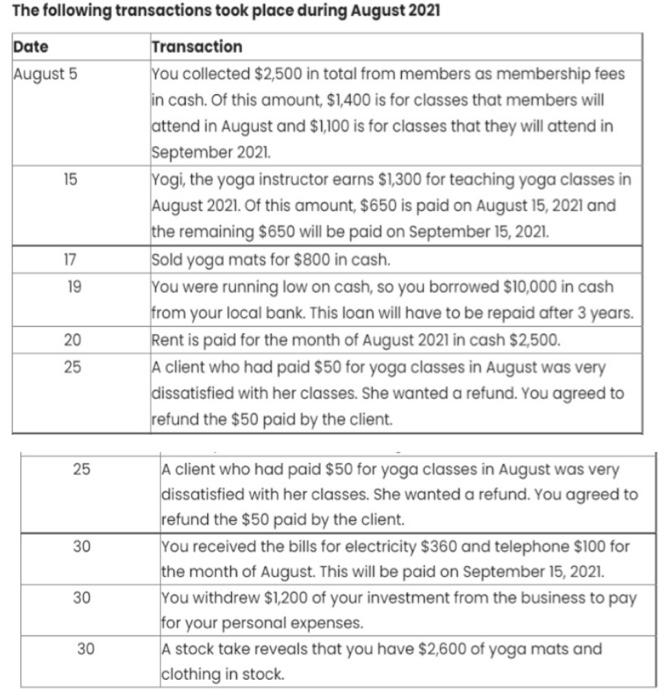

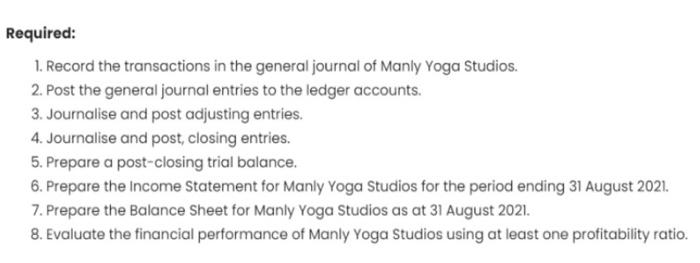

After a number of years as a successful Chartered Accountant at a national firm, you decide to quit the rat race and pursue your true love - yoga. You decide that your neighbourhood would be the perfect place to open a yoga studio. Even better, your friend Yogi, a certified yoga instructor, has just moved to town and is willing to teach at the studio. You hurriedly prepare to open the studio, Manly Yoga, by July 1, 2021. In preparation for your opening, you engage in the following transactions on July 1, 2021: 1. You contribute $18,000 in cash to start the business. 2. You purchase $3,000 worth of equipment for use during classes for cash. 3. You purchase an additional $2,000 worth of yoga mats and clothing for sale at the studio, for cash. 4. You purchase liability insurance at a total cost of $1,600. The policy covers July 1, 2021 through to December 31, 2021. The following transactions took place during July 2021 Date Transaction July 5 You collected $2,400 in total from new members as membership fees for July 2021 in cash 15 Yogi, the yoga instructor is paid $1,300 as salary for July 2020. 20 Rent is paid for the month of July 2020 in cash $2,500. You received the bills for electricity $250 and telephone $120 for the month of July. This will be paid on August 15, 2021. 30 The following transactions took place during August 2021 Date August 5 15 Transaction You collected $2,500 in total from members as membership fees in cash. Of this amount $1,400 is for classes that members will attend in August and $1,100 is for classes that they will attend in September 2021. Yogi , the yoga instructor earns $1,300 for teaching yoga classes in August 2021. Of this amount, $650 is paid on August 15, 2021 and the remaining $650 will be paid on September 15, 2021. Sold yoga mats for $800 in cash. You were running low on cash, so you borrowed $10,000 in cash from your local bank. This loan will have to be repaid after 3 years. Rent is paid for the month of August 2021 in cash $2,500. A client who had paid $50 for yoga classes in August was very dissatisfied with her classes. She wanted a refund. You agreed to refund the $50 paid by the client. 17 19 20 25 25 30 A client who had paid $50 for yoga classes in August was very dissatisfied with her classes. She wanted a refund. You agreed to refund the $50 paid by the client. You received the bills for electricity $360 and telephone $100 for the month of August. This will be paid on September 15, 2021. You withdrew $1,200 of your investment from the business to pay for your personal expenses. A stock take reveals that you have $2,600 of yoga mats and clothing in stock. 30 30 Required: 1. Record the transactions in the general journal of Manly Yoga Studios. 2. Post the general journal entries to the ledger accounts. 3. Journalise and post adjusting entries. 4. Journalise and post, closing entries. 5. Prepare a post-closing trial balance. 6. Prepare the income Statement for Manly Yoga Studios for the period ending 31 August 2021. 7. Prepare the Balance Sheet for Manly Yoga Studios as at 31 August 2021. 8. Evaluate the financial performance of Manly Yoga Studios using at least one profitability ratio