Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NOTE: please number answers in list fashion; thank you Bleanor enjoys eating bananas and apples. Both cost $1 each, and she ailocates $100 to spend

NOTE: please number answers in list fashion; thank you

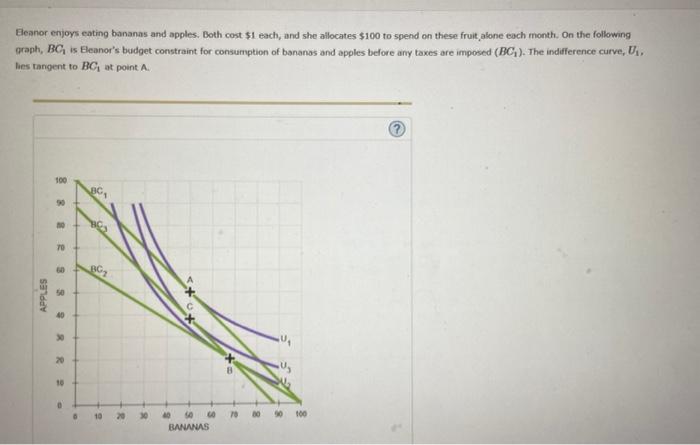

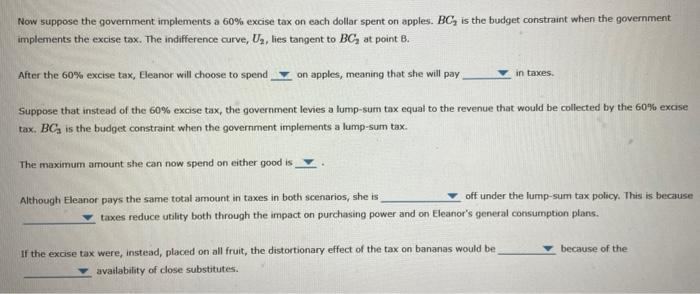

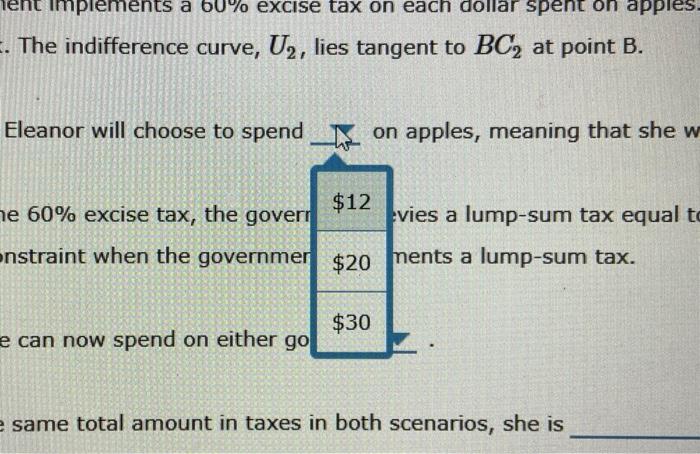

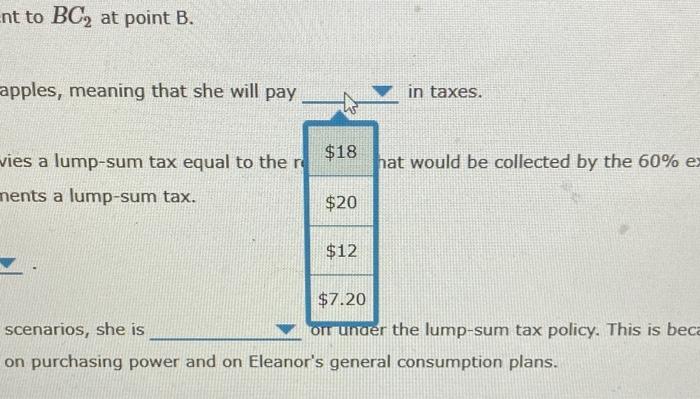

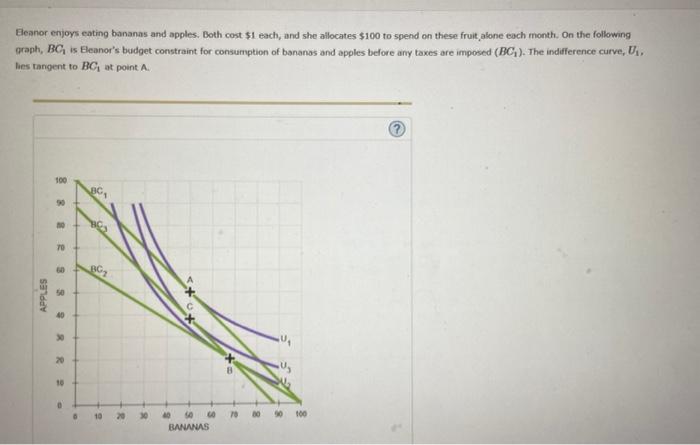

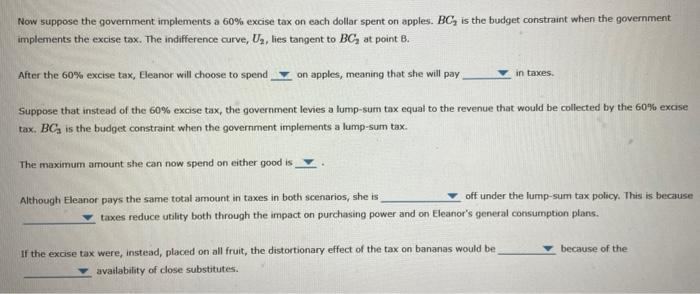

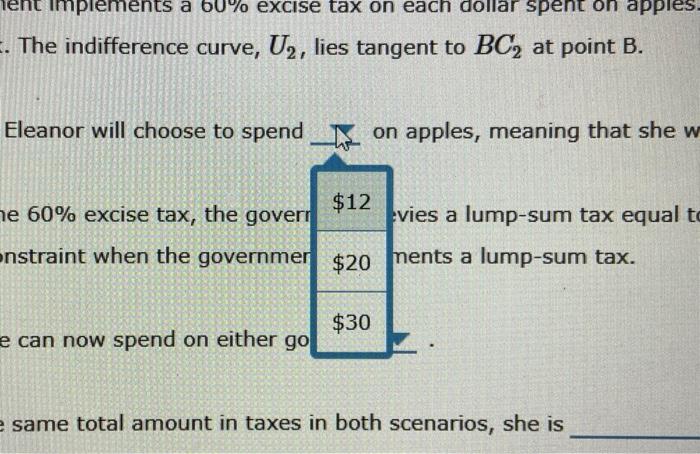

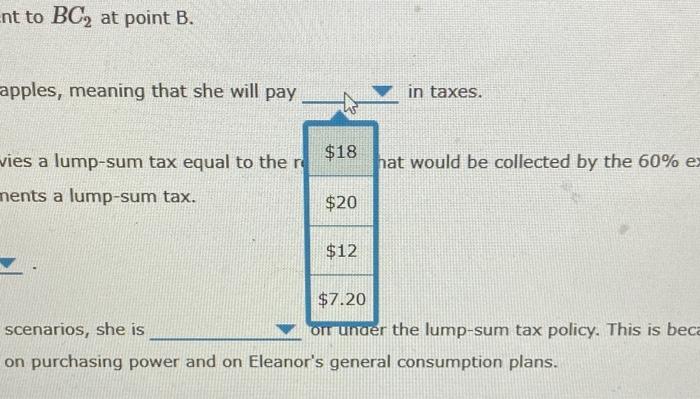

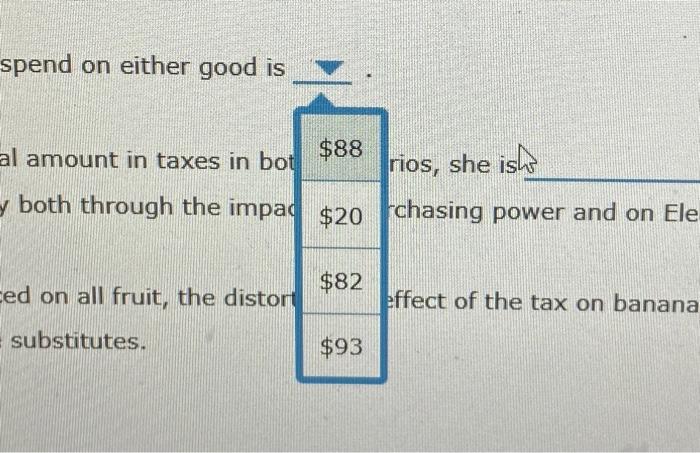

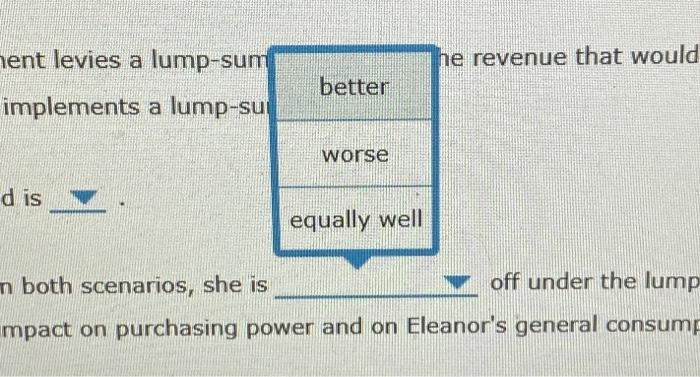

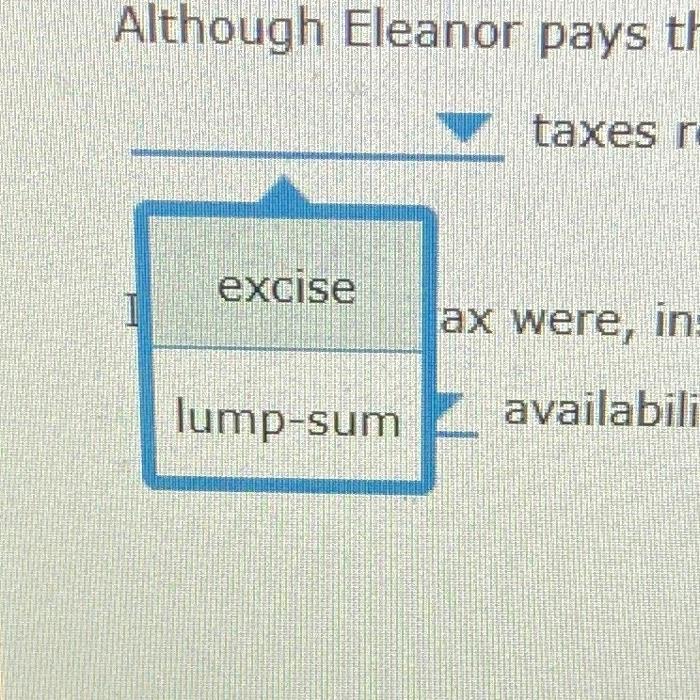

Bleanor enjoys eating bananas and apples. Both cost \$1 each, and she ailocates $100 to spend on these fruit, alone each month. On the following graph, BC1 is Eleanor's budget constraint for consumption of bananos and apples before any taxes are imposed (BC1). The indifference curve, U1, lies tangent to BC1 at point A. Now suppose the government implements a 60% excise tax on each dollar spent on apples. BC2 is the budget constraint when the government implements the excise tax. The indifference curve, U2, lies tangent to BC2 at point B. After the 60% excise tax, Eleanor will choose to spend on apples, meaning that she will pay Suppose that instead of the 60% excise tax, the government levies a lump-sum tax equal to the revenue that would be collected by the 60% excise tax. BCa is the budget constraint when the government implements a lump-sum tax. The maximum amount she can now spend on either good is Although Eleanor pays the same total amount in taxes in both scenarios, she is off under the lump-sum tax policy. This is because taxes reduce utilaty both through the impact on purchasing power and on Eleanor's general consumption plans. If the excise tax were, instead, placed on all fruit, the distortionary effect of the tax on bananas would be because of the avatlability of close substitutes. The indifference curve, U2, lies tangent to BC2 at point B. Eleanor will choose to spend on apples, meaning that she w 60% excise tax, the govern $12 vies a lump-sum tax equal nstraint when the governmer $20 nents a lump-sum tax. can now spend on either go $30 same total amount in taxes in both scenarios, she is in taxes. apples, meaning that she will pay in taxes. \begin{tabular}{|l|l|} \hline vies a lump-sum tax equal to the ram. & $18 \\ \hline nents a lump-sum tax. & $20 \\ \hline & $12 \\ \hline & $7.20 \\ \hline \end{tabular} scenarios, she is on under the lump-sum tax policy. This is bece on purchasing power and on Eleanor's general consumption plans. rios, she ish chasing power and on Ele ffect of the tax on banana ient levies a lump-sum Ie revenue that would implements a lump-su n both scenarios, she is off under the lump mpact on purchasing power and on Eleanor's general consump Although Eleanor pays t taxes off und smaller p-sum tax policy. This is becau power and on Eleanor's gene ption plans. f the tax on bananas would be because of the The maximum amount she can now s Althouah Eleanor pays the same total \begin{tabular}{|l|l} narrower & taxes reduce utility \\ & tax were, instead, placed \end{tabular} availability of close sub

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started