Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: Please put your answers only in the section below the Bold Red sentence at the end of the Required section below. Here is

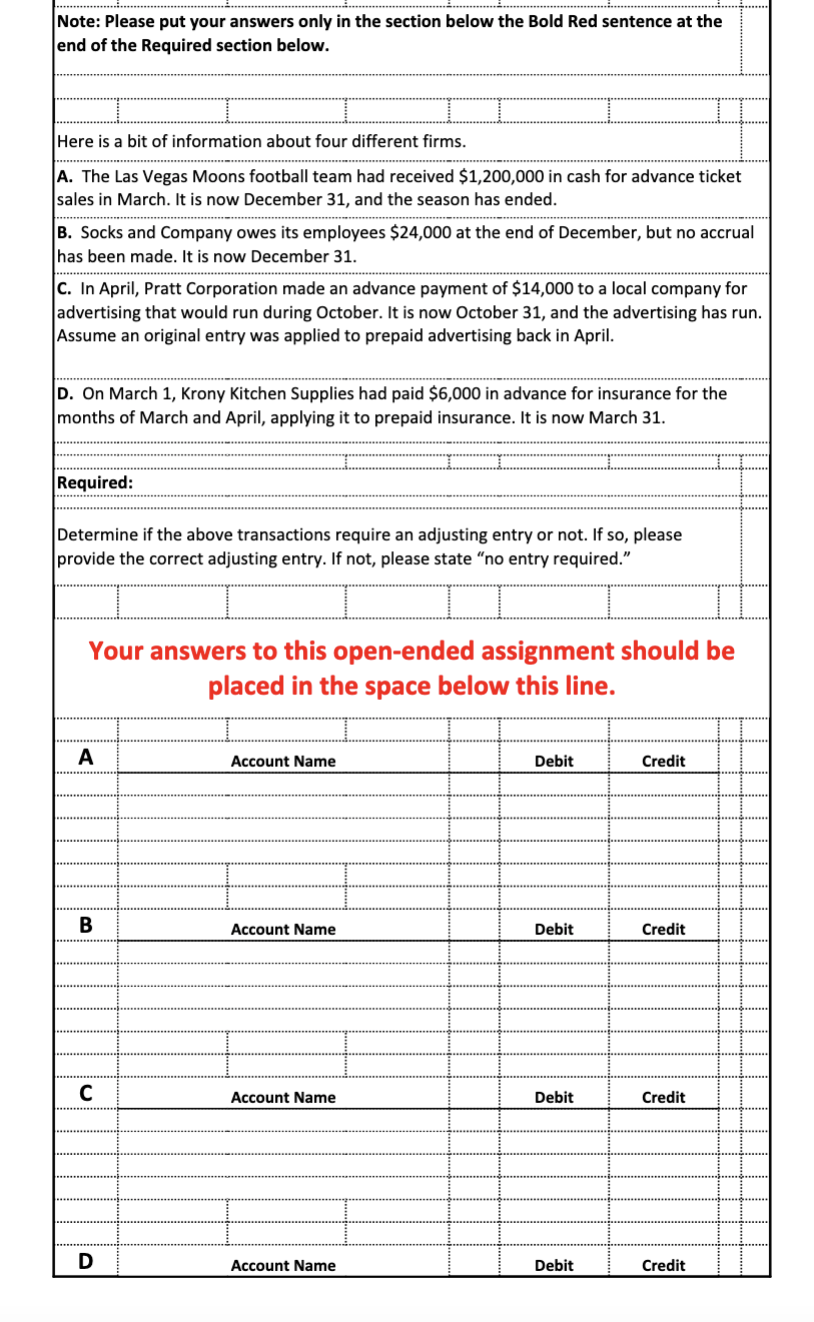

Note: Please put your answers only in the section below the Bold Red sentence at the end of the Required section below. Here is a bit of information about four different firms. A. The Las Vegas Moons football team had received $1,200,000 in cash for advance ticket sales in March. It is now December 31, and the season has ended. B. Socks and Company owes its employees $24,000 at the end of December, but no accrual has been made. It is now December 31. C. In April, Pratt Corporation made an advance payment of $14,000 to a local company for advertising that would run during October. It is now October 31, and the advertising has run. Assume an original entry was applied to prepaid advertising back in April. D. On March 1, Krony Kitchen Supplies had paid $6,000 in advance for insurance for the months of March and April, applying it to prepaid insurance. It is now March 31. Required: Determine if the above transactions require an adjusting entry or not. If so, please provide the correct adjusting entry. If not, please state "no entry required." Your answers to this open-ended assignment should be placed in the space below this line. A Account Name Debit Credit B Account Name Debit Credit Account Name Debit Credit D Account Name Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started