Answered step by step

Verified Expert Solution

Question

1 Approved Answer

note please show working ( no Excel) and thank you. QUESTION 4 A stock's expected return has the following distribution: Outcome Probability Return Recession 25%

note please show working ( no Excel) and thank you.

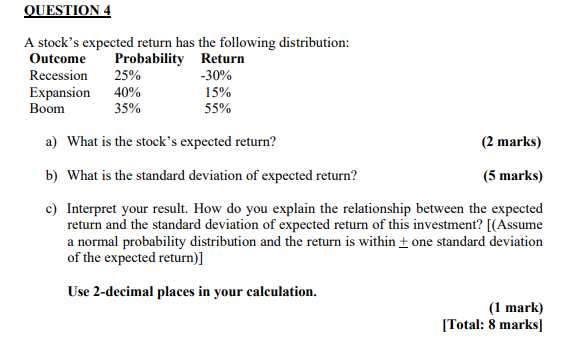

QUESTION 4 A stock's expected return has the following distribution: Outcome Probability Return Recession 25% -30% Expansion 40% 15% Boom 35% 55% a) What is the stock's expected return? (2 marks) b) What is the standard deviation of expected return? (5 marks) c) Interpret your result. How do you explain the relationship between the expected return and the standard deviation of expected return of this investment? [(Assume a normal probability distribution and the return is within + one standard deviation of the expected return)] Use 2-decimal places in your calculation. (1 mark) [Total: 8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started