Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: Question is complete Question 4: Activity Based Costing (20 marks in total) You have recently attended a seminar on activity-based costing (ABC). FOL's accounting

Note: Question is complete

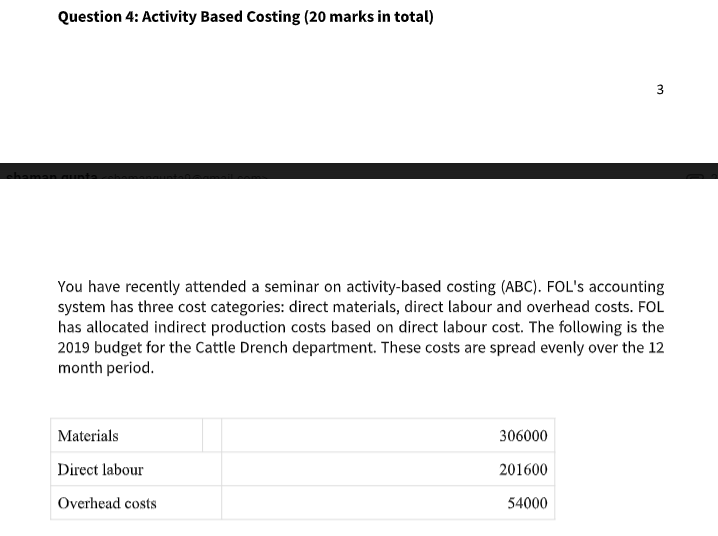

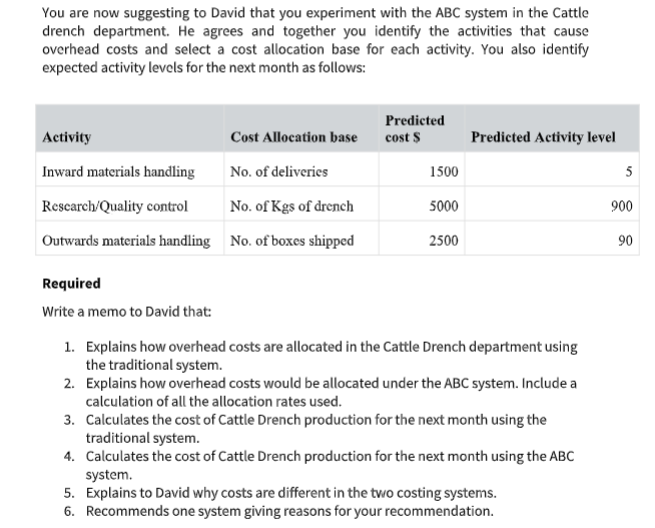

Question 4: Activity Based Costing (20 marks in total) You have recently attended a seminar on activity-based costing (ABC). FOL's accounting system has three cost categories: direct materials, direct labour and overhead costs. FOL has allocated indirect production costs based on direct labour cost. The following is the 2019 budget for the Cattle Drench department. These costs are spread evenly over the 12 month period. Materials 306000 Direct labour 201600 Overhead costs 54000 You are now suggesting to David that you experiment with the ABC system in the Cattle drench department. He agrees and together you identify the activities that cause overhead costs and select a cost allocation base for each activity. You also identify expected activity levels for the next month as follows: Activity Cost Allocation base Predicted cost $ Predicted Activity level Inward materials handling No. of deliveries 1500 Rescarch/Quality control No. of Kgs of drench 5000 Outwards materials handling No. of boxes shipped 2500 90 Required Write a memo to David that: 1. Explains how overhead costs are allocated in the Cattle Drench department using the traditional system. 2. Explains how overhead costs would be allocated under the ABC system. Include a calculation of all the allocation rates used. 3. Calculates the cost of Cattle Drench production for the next month using the traditional system. 4. Calculates the cost of Cattle Drench production for the next month using the ABC system. 5. Explains to David why costs are different in the two costing systems. 6. Recommends one system giving reasons for your recommendation. Question 4: Activity Based Costing (20 marks in total) You have recently attended a seminar on activity-based costing (ABC). FOL's accounting system has three cost categories: direct materials, direct labour and overhead costs. FOL has allocated indirect production costs based on direct labour cost. The following is the 2019 budget for the Cattle Drench department. These costs are spread evenly over the 12 month period. Materials 306000 Direct labour 201600 Overhead costs 54000 You are now suggesting to David that you experiment with the ABC system in the Cattle drench department. He agrees and together you identify the activities that cause overhead costs and select a cost allocation base for each activity. You also identify expected activity levels for the next month as follows: Activity Cost Allocation base Predicted cost $ Predicted Activity level Inward materials handling No. of deliveries 1500 Rescarch/Quality control No. of Kgs of drench 5000 Outwards materials handling No. of boxes shipped 2500 90 Required Write a memo to David that: 1. Explains how overhead costs are allocated in the Cattle Drench department using the traditional system. 2. Explains how overhead costs would be allocated under the ABC system. Include a calculation of all the allocation rates used. 3. Calculates the cost of Cattle Drench production for the next month using the traditional system. 4. Calculates the cost of Cattle Drench production for the next month using the ABC system. 5. Explains to David why costs are different in the two costing systems. 6. Recommends one system giving reasons for your recommendationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started