Answered step by step

Verified Expert Solution

Question

1 Approved Answer

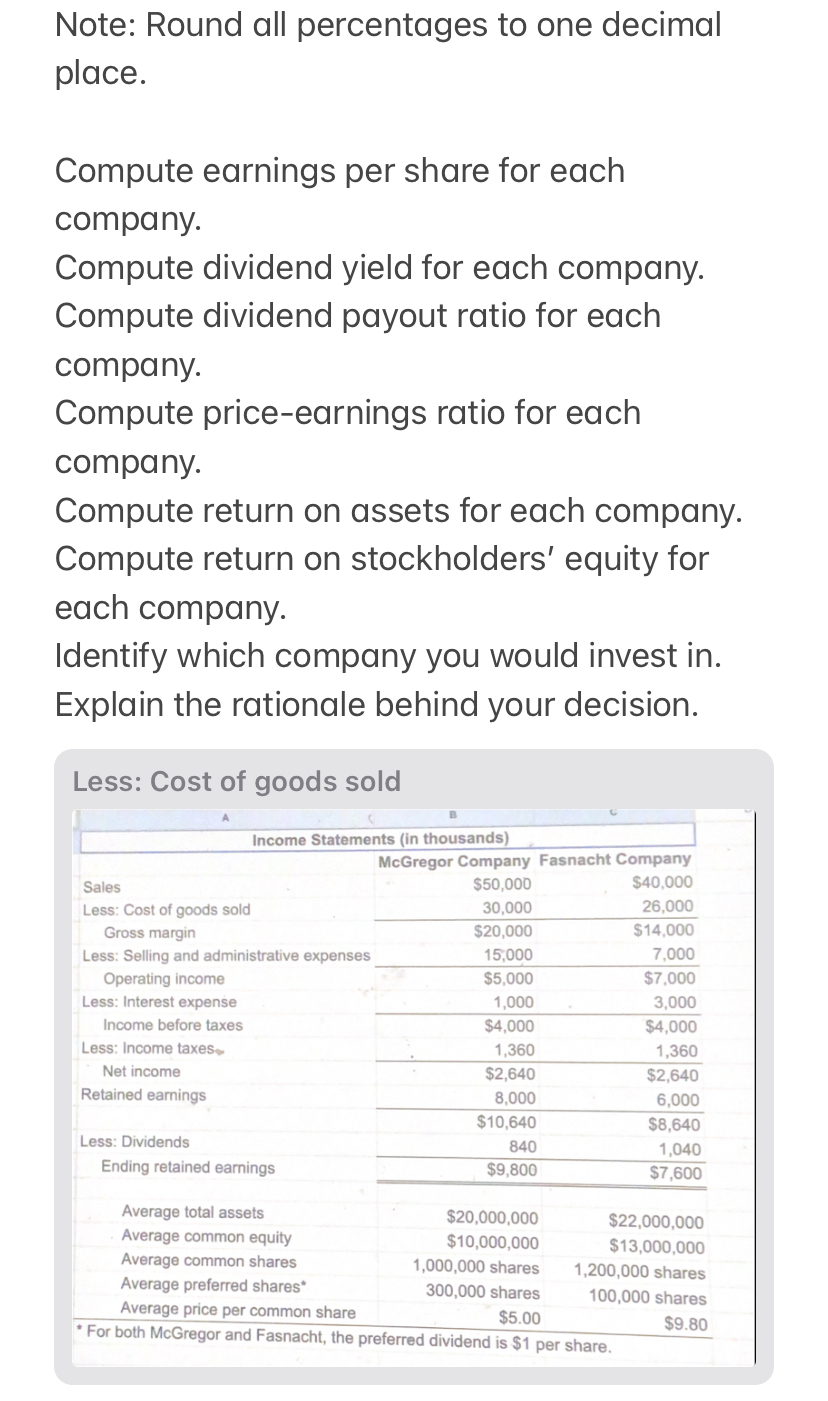

Note: Round all percentages to one decimal place. Compute earnings per share for each company. Compute dividend yield for each company. Compute dividend payout

Note: Round all percentages to one decimal place. Compute earnings per share for each company. Compute dividend yield for each company. Compute dividend payout ratio for each company. Compute price-earnings ratio for each company. Compute return on assets for each company. Compute return on stockholders' equity for each company. Identify which company you would invest in. Explain the rationale behind your decision. Less: Cost of goods sold A B Income Statements (in thousands) McGregor Company Fasnacht Company Sales $50,000 $40,000 Less: Cost of goods sold 30,000 26,000 Gross margin $20,000 $14,000 Less: Selling and administrative expenses 15,000 7,000 Operating income $5,000 $7,000 Less: Interest expense 1,000 3,000 Income before taxes $4,000 $4,000 Less: Income taxes Net income 1,360 1,360 $2,640 $2,640 Retained earnings 8,000 6,000 $10,640 $8,640 Less: Dividends Ending retained earnings 840 $9,800 1,040 $7,600 Average total assets $20,000,000 $22,000,000 Average common equity Average common shares Average preferred shares* Average price per common share 100,000 shares For both McGregor and Fasnacht, the preferred dividend is $1 per share. $10,000,000 $13,000,000 1,000,000 shares 1,200,000 shares 300,000 shares $5.00 $9.80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started