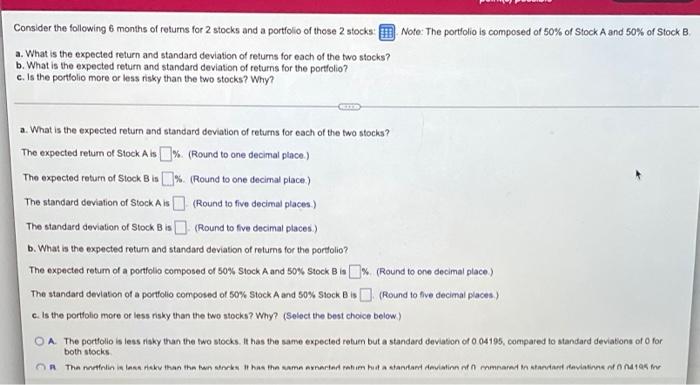

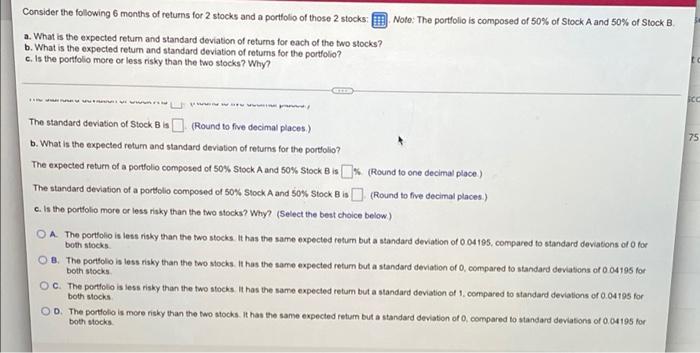

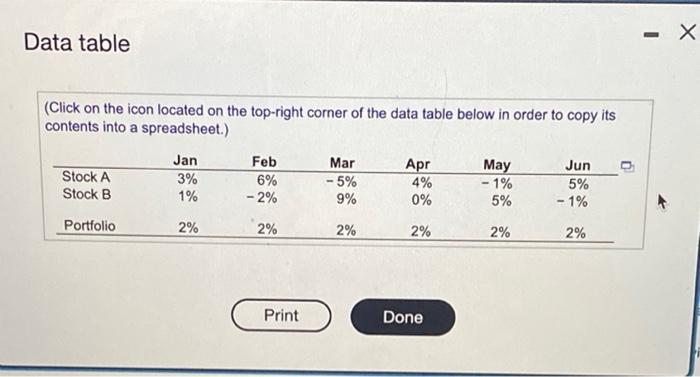

Note: The portfolio is composed of 50% of Stock A and 50% of Stock B Consider the following 6 months of returns for 2 stocks and a portfolio of those 2 stocks: a. What is the expected return and standard deviation of returns for each of the two stocks? b. What is the expected return and standard deviation of returns for the portfolio? c. Is the portfolio more or less risky than the two stocks? Why? a. What is the expected return and standard deviation of returns for each of the two stocka? The expected return of Stock Als % (Round to one decimal place) The expected return of Stock Bis 1% (Round to one decimal place) The standard deviation of Stock As (Round to five decimal places) The standard deviation of Stock B is (Round to five decimal places) 1 b. What is the expected return and standard deviation of returns for the portfolio? The expected retum of a portfolio composed of 50% Stock A and 50% Stock B % (Round to one decimal place) The standard deviation of a portfolio composed of 50% Stock A and 50% Stock (Round to five decimal places) c. Is the portfolio more or less risky than the two stocka? Why? (Select the best choice below) A. The portfolio is less risky than the two stocks. It has the same expected retum but a standard deviation of 004195, compared to standard deviation of for Tha miellin in lana. Haku than the work has the same martor rohimosta standard deviation of martin standard deviationen 4196 kv * both stocks Note: The portfolio is composed of 50% of Stock A and 50% of Stock B. Consider the following 6 months of retums for 2 stocks and a portfolio of those 2 stocks: a. What is the expected return and standard deviation of returns for each of the two stocks? b. What is the expected retum and standard deviation of returns for the portfolio? c. is the portfolio more or less risky than the two stocks? Why? GTE sce 75 The standard deviation of Stock B is (Round to five decimal places) b. What is the expected return and standard deviation of returns for the portfolio? The expected retum of a portfolio composed of 50% Stock A and 80% Stock Bis % (Round to one decimal place) The standard deviation of a portfolio composed of 50% Stock A and 50% Stock 8 i (Round to five decimal places.) c. Is the portfolio more or less risky than the two stocks? Why? (Select the best choice below) A The portfolio is less risky than the two stocks. It has the same expected retum but a standard deviation of 0 04195, compared to standard deviations of O top 08. The portfolio is less risky than the two stocks. It has the same expected retum but a standard deviation of 0, compared to standard deviations of 0.04196 for OC. The portfolio is less risky than the two stocks It has the same expected retum but a standard deviation of 1, compared to standard deviations of 0.04198 for OD. The portfolio is more risky than the two stocks. It has the same expected return but a standard deviation of O, compared to standard deviations of 0.04195 for both stocks both stocks both Mocks both stocks Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Jan Feb Mar Apr May Jun Stock A 3% 6% - 5% 4% - 1% 5% Stock B - 2% 9% 0% 5% - 1% Portfolio 2% 2% 2% 2% 2% 1% 2% Print Done