Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: there is information in the case that relates to Part II (i.e., the foreign subsidiary). You will not be using all the information

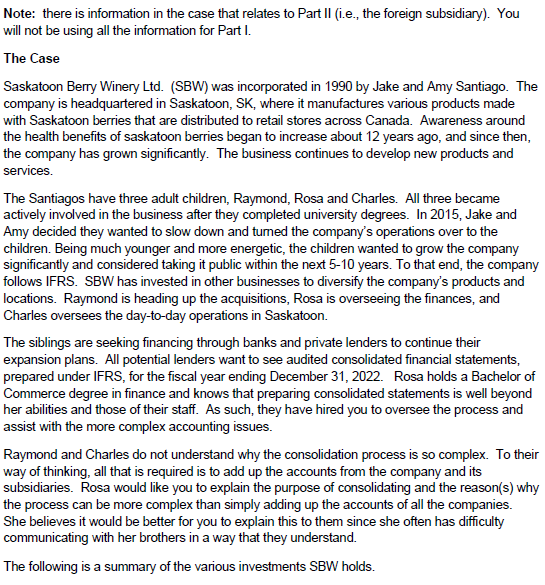

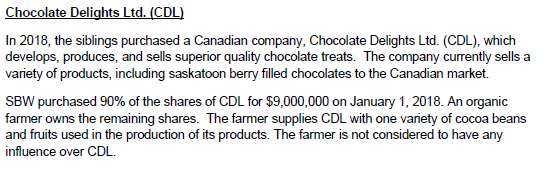

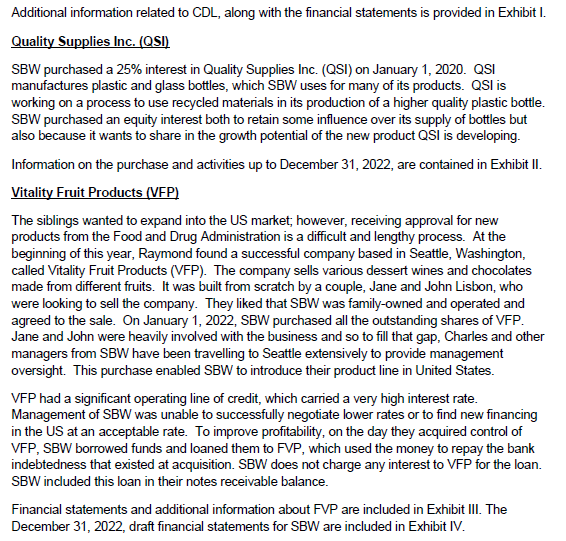

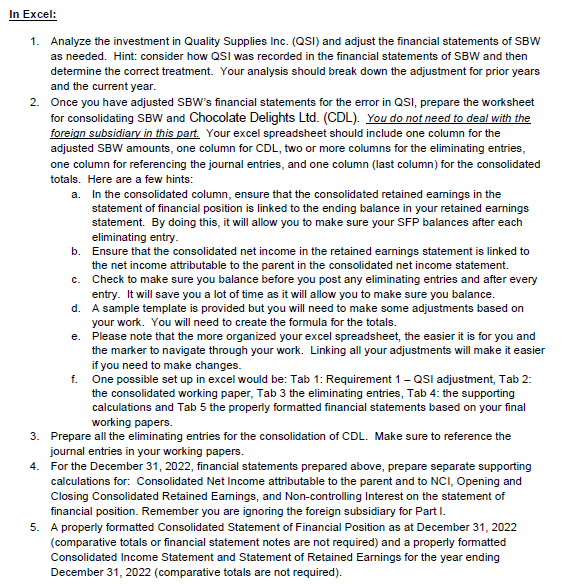

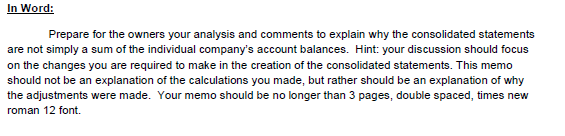

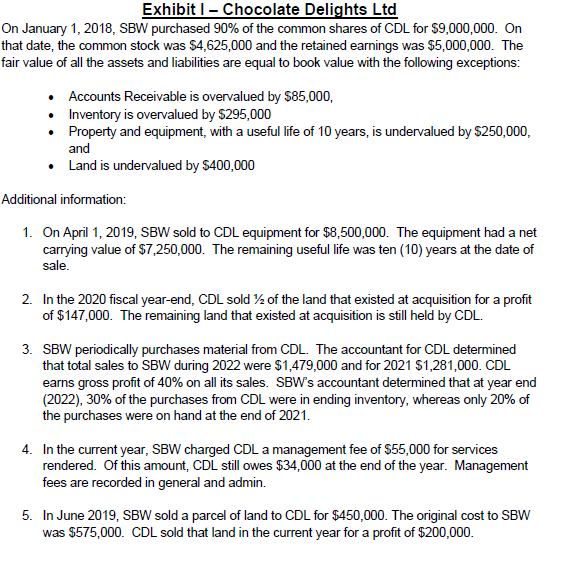

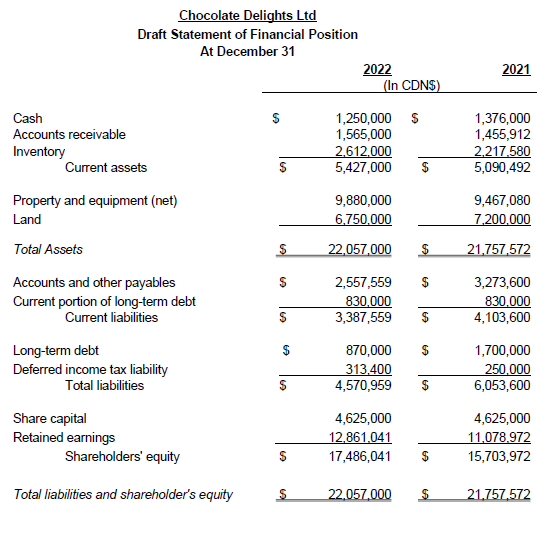

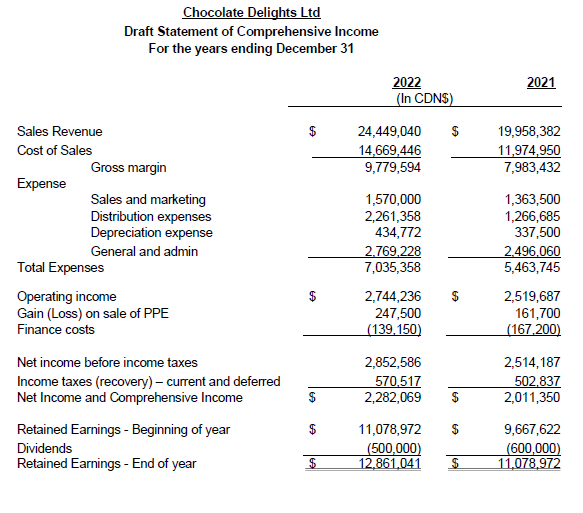

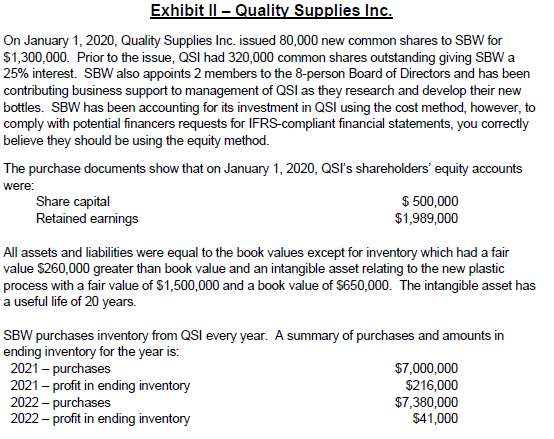

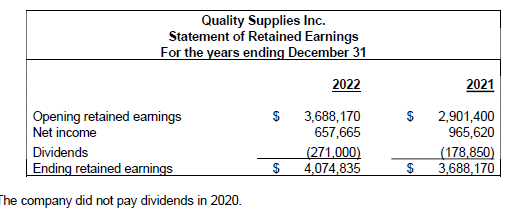

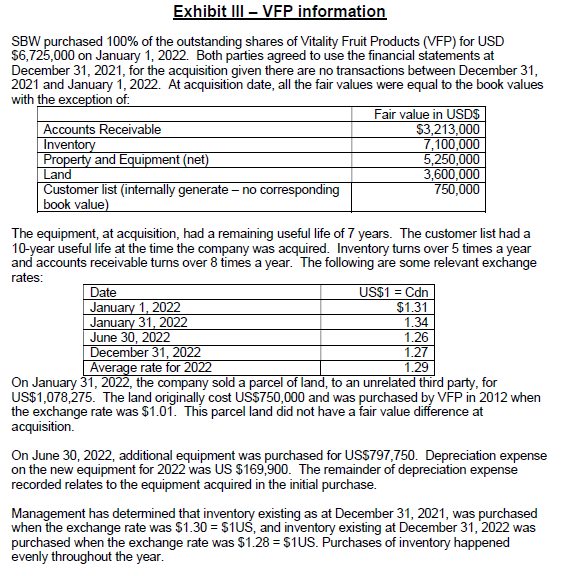

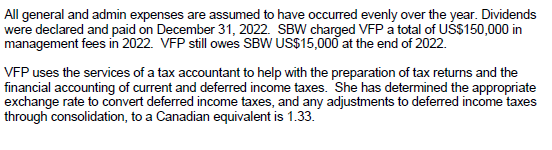

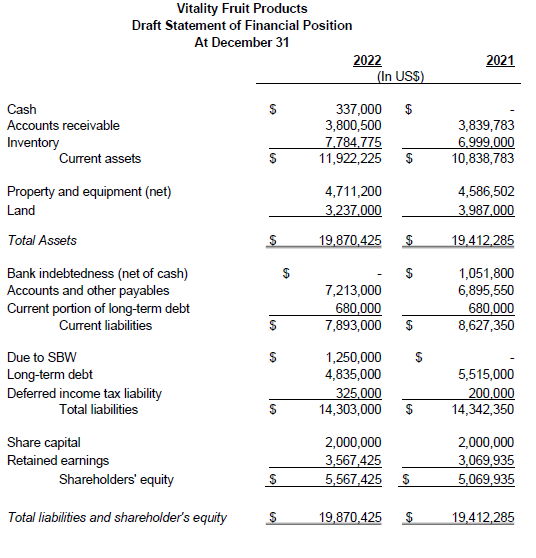

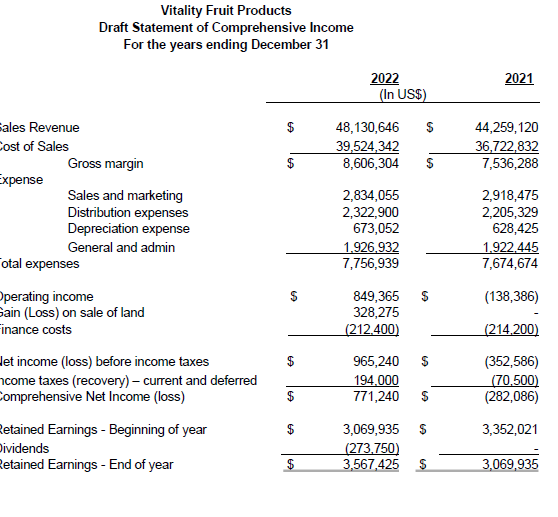

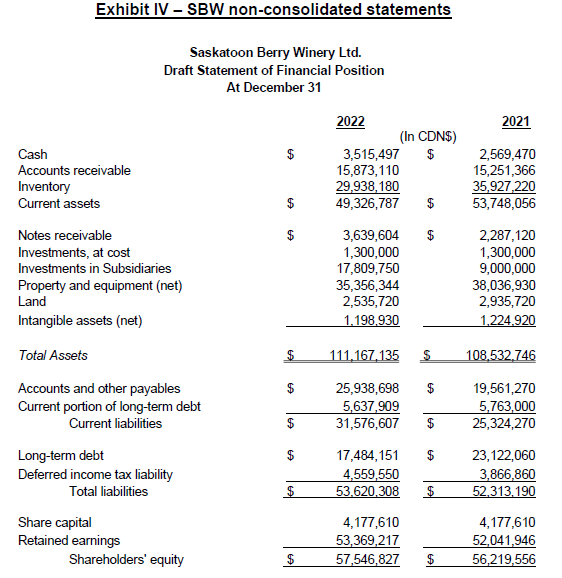

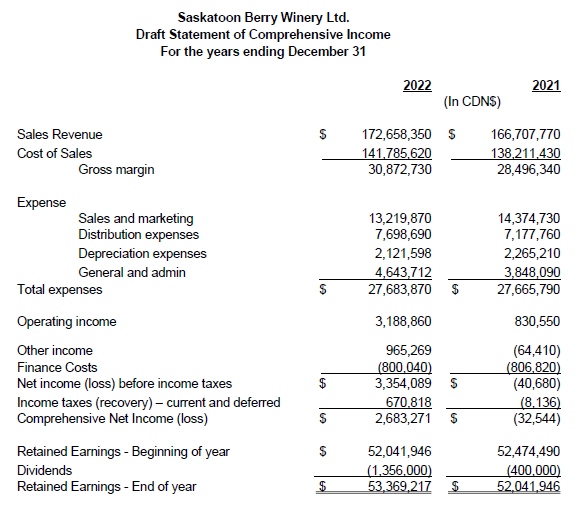

Note: there is information in the case that relates to Part II (i.e., the foreign subsidiary). You will not be using all the information for Part I. The Case Saskatoon Berry Winery Ltd. (SBW) was incorporated in 1990 by Jake and Amy Santiago. The company is headquartered in Saskatoon, SK, where it manufactures various products made with Saskatoon berries that are distributed to retail stores across Canada. Awareness around the health benefits of saskatoon berries began to increase about 12 years ago, and since then, the company has grown significantly. The business continues to develop new products and services. The Santiagos have three adult children, Raymond, Rosa and Charles. All three became actively involved in the business after they completed university degrees. In 2015, Jake and Amy decided they wanted to slow down and turned the company's operations over to the children. Being much younger and more energetic, the children wanted to grow the company significantly and considered taking it public within the next 5-10 years. To that end, the company follows IFRS. SBW has invested in other businesses to diversify the company's products and locations. Raymond is heading up the acquisitions, Rosa is overseeing the finances, and Charles oversees the day-to-day operations in Saskatoon. The siblings are seeking financing through banks and private lenders to continue their expansion plans. All potential lenders want to see audited consolidated financial statements, prepared under IFRS, for the fiscal year ending December 31, 2022. Rosa holds a Bachelor of Commerce degree in finance and knows that preparing consolidated statements is well beyond her abilities and those of their staff. As such, they have hired you to oversee the process and assist with the more complex accounting issues. Raymond and Charles do not understand why the consolidation process is so complex. To their way of thinking, all that is required is to add up the accounts from the company and its subsidiaries. Rosa would like you to explain the purpose of consolidating and the reason(s) why the process can be more complex than simply adding up the accounts of all the companies. She believes it would be better for you to explain this to them since she often has difficulty communicating with her brothers in a way that they understand. The following is a summary of the various investments SBW holds. Chocolate Delights Ltd. (CDL) In 2018, the siblings purchased a Canadian company, Chocolate Delights Ltd. (CDL), which develops, produces, and sells superior quality chocolate treats. The company currently sells a variety of products, including saskatoon berry filled chocolates to the Canadian market. SBW purchased 90% of the shares of CDL for $9,000,000 on January 1, 2018. An organic farmer owns the remaining shares. The farmer supplies CDL with one variety of cocoa beans and fruits used in the production of its products. The farmer is not considered to have any influence over CDL. Additional information related to CDL, along with the financial statements is provided in Exhibit I. Quality Supplies Inc. (QSI) SBW purchased a 25% interest in Quality Supplies Inc. (QSI) on January 1, 2020. QSI manufactures plastic and glass bottles, which SBW uses for many of its products. QSI is working on a process to use recycled materials in its production of a higher quality plastic bottle. SBW purchased an equity interest both to retain some influence over its supply of bottles but also because it wants to share in the growth potential of the new product QSI is developing. Information on the purchase and activities up to December 31, 2022, are contained in Exhibit II. Vitality Fruit Products (VFP) The siblings wanted to expand into the US market; however, receiving approval for new products from the Food and Drug Administration is a difficult and lengthy process. At the beginning of this year, Raymond found a successful company based in Seattle, Washington, called Vitality Fruit Products (VFP). The company sells various dessert wines and chocolates made from different fruits. It was built from scratch by a couple, Jane and John Lisbon, who were looking to sell the company. They liked that SBW was family-owned and operated and agreed to the sale. On January 1, 2022, SBW purchased all the outstanding shares of VFP. Jane and John were heavily involved with the business and so to fill that gap, Charles and other managers from SBW have been travelling to Seattle extensively to provide management oversight. This purchase enabled SBW to introduce their product line in United States. VFP had a significant operating line of credit, which carried a very high interest rate. Management of SBW was unable to successfully negotiate lower rates or to find new financing in the US at an acceptable rate. To improve profitability, on the day they acquired control of VFP, SBW borrowed funds and loaned them to FVP, which used the money to repay the bank indebtedness that existed at acquisition. SBW does not charge any interest to VFP for the loan. SBW included this loan in their notes receivable balance. Financial statements and additional information about FVP are included in Exhibit III. The December 31, 2022, draft financial statements for SBW are included in Exhibit IV. Required: Prepare a package for the auditors. The package will be completed in two parts. You may assume the effective tax rate for all companies is 20% Note: there is information in the case that relates to Part II (i.e., the foreign subsidiary). You will not be using all the information for Part I. In Excel: 1. Analyze the investment in Quality Supplies Inc. (QSI) and adjust the financial statements of SBW as needed. Hint: consider how QSI was recorded in the financial statements of SBW and then determine the correct treatment. Your analysis should break down the adjustment for prior years and the current year. 2. Once you have adjusted SBW's financial statements for the error in QSI, prepare the worksheet for consolidating SBW and Chocolate Delights Ltd. (CDL). You do not need to deal with the foreign subsidiary in this part. Your excel spreadsheet should include one column for the adjusted SBW amounts, one column for CDL, two or more columns for the eliminating entries, one column for referencing the journal entries, and one column (last column) for the consolidated totals. Here are a few hints: a. In the consolidated column, ensure that the consolidated retained earnings in the statement of financial position is linked to the ending balance in your retained earnings statement. By doing this, it will allow you to make sure your SFP balances after each eliminating entry. b. Ensure that the consolidated net income in the retained earnings statement is linked to the net income attributable to the parent in the consolidated net income statement. c. Check to make sure you balance before you post any eliminating entries and after every entry. It will save you a lot of time as it will allow you to make sure you balance. d. A sample template is provided but you will need to make some adjustments based on your work. You will need to create the formula for the totals. e. Please note that the more organized your excel spreadsheet, the easier it is for you and the marker to navigate through your work. Linking all your adjustments will make it easier if you need to make changes. f. One possible set up in excel would be: Tab 1: Requirement 1 - QSI adjustment, Tab 2: the consolidated working paper, Tab 3 the eliminating entries, Tab 4: the supporting calculations and Tab 5 the properly formatted financial statements based on your final working papers. 3. Prepare all the eliminating entries for the consolidation of CDL. Make sure to reference the journal entries in your working papers. 4. For the December 31, 2022, financial statements prepared above, prepare separate supporting calculations for: Consolidated Net Income attributable to the parent and to NCI, Opening and Closing Consolidated Retained Earnings, and Non-controlling Interest on the statement of financial position. Remember you are ignoring the foreign subsidiary for Part I. 5. A properly formatted Consolidated Statement of Financial Position as at December 31, 2022 (comparative totals or financial statement notes are not required) and a properly formatted Consolidated Income Statement and Statement of Retained Earnings for the year ending December 31, 2022 (comparative totals are not required). In Word: Prepare for the owners your analysis and comments to explain why the consolidated statements are not simply a sum of the individual company's account balances. Hint: your discussion should focus on the changes you are required to make in the creation of the consolidated statements. This memo should not be an explanation of the calculations you made, but rather should be an explanation of why the adjustments were made. Your memo should be no longer than 3 pages, double spaced, times new roman 12 font. Exhibit I - Chocolate Delights Ltd On January 1, 2018, SBW purchased 90% of the common shares of CDL for $9,000,000. On that date, the common stock was $4,625,000 and the retained earnings was $5,000,000. The fair value of all the assets and liabilities are equal to book value with the following exceptions: Accounts Receivable is overvalued by $85,000, Inventory is overvalued by $295,000 Property and equipment, with a useful life of 10 years, is undervalued by $250,000, and Land is undervalued by $400,000 Additional information: 1. On April 1, 2019, SBW sold to CDL equipment for $8,500,000. The equipment had a net carrying value of $7,250,000. The remaining useful life was ten (10) years at the date of sale. 2. In the 2020 fiscal year-end, CDL sold 12 of the land that existed at acquisition for a profit of $147,000. The remaining land that existed at acquisition is still held by CDL. 3. SBW periodically purchases material from CDL. The accountant for CDL determined that total sales to SBW during 2022 were $1,479,000 and for 2021 $1,281,000. CDL earns gross profit of 40% on all its sales. SBW's accountant determined that at year end (2022), 30% of the purchases from CDL were in ending inventory, whereas only 20% of the purchases were on hand at the end of 2021. 4. In the current year, SBW charged CDL a management fee of $55,000 for services rendered. Of this amount, CDL still owes $34,000 at the end of the year. Management fees are recorded in general and admin. 5. In June 2019, SBW sold a parcel of land to CDL for $450,000. The original cost to SBW was $575,000. CDL sold that land in the current year for a profit of $200,000. Chocolate Delights Ltd Draft Statement of Financial Position At December 31 2022 2021 (In CDNS) Cash 1,250,000 $ 1,376,000 Accounts receivable 1,565,000 1,455,912 Inventory 2,612,000 2,217,580 Current assets $ 5,427,000 $ 5,090,492 Property and equipment (net) 9,880,000 9,467,080 Land 6,750,000 7,200,000 Total Assets S 22,057,000 $ 21,757,572 Accounts and other payables $ 2,557,559 $ 3,273,600 Current portion of long-term debt 830,000 830,000 Current liabilities $ 3,387,559 $ 4,103,600 Long-term debt $ 870,000 $ 1,700,000 Deferred income tax liability 313,400 250,000 Total liabilities $ 4,570,959 $ 6,053,600 Share capital 4,625,000 4,625,000 Retained earnings 12,861,041 11,078,972 Shareholders' equity $ 17,486,041 $ 15,703,972 Total liabilities and shareholder's equity 22,057,000 $ 21,757,572 Chocolate Delights Ltd Draft Statement of Comprehensive Income For the years ending December 31 2022 2021 (In CDN$) Sales Revenue 24,449,040 $ 19,958,382 Cost of Sales 14,669,446 11,974,950 Gross margin 9,779,594 7,983,432 Expense Sales and marketing 1,570,000 1,363,500 Distribution expenses 2,261,358 1,266,685 Depreciation expense 434,772 337,500 General and admin 2,769,228 2,496,060 Total Expenses 7,035,358 5,463,745 Operating income Gain (Loss) on sale of PPE Finance costs 2,744,236 2,519,687 247,500 161,700 (139,150) (167,200) Net income before income taxes 2,852,586 2,514,187 Income taxes (recovery) - current and deferred 570,517 502,837 Net Income and Comprehensive Income 2,282,069 $ 2,011,350 Retained Earnings - Beginning of year Dividends 11,078,972 $ 9,667,622 (500,000) (600,000) Retained Earnings - End of year $ 12,861,041 $ 11,078,972 Exhibit II - Quality Supplies Inc. On January 1, 2020, Quality Supplies Inc. issued 80,000 new common shares to SBW for $1,300,000. Prior to the issue, QSI had 320,000 common shares outstanding giving SBW a 25% interest. SBW also appoints 2 members to the 8-person Board of Directors and has been contributing business support to management of QSI as they research and develop their new bottles. SBW has been accounting for its investment in QSI using the cost method, however, to comply with potential financers requests for IFRS-compliant financial statements, you correctly believe they should be using the equity method. The purchase documents show that on January 1, 2020, QSI's shareholders' equity accounts were: Share capital Retained earnings $ 500,000 $1,989,000 All assets and liabilities were equal to the book values except for inventory which had a fair value $260,000 greater than book value and an intangible asset relating to the new plastic process with a fair value of $1,500,000 and a book value of $650,000. The intangible asset has a useful life of 20 years. SBW purchases inventory from QSI every year. A summary of purchases and amounts in ending inventory for the year is: 2021 - purchases 2021-profit in ending inventory 2022-purchases 2022-profit in ending inventory $7,000,000 $216,000 $7,380,000 $41,000 Quality Supplies Inc. Statement of Retained Earnings For the years ending December 31 2022 2021 Opening retained earnings $ 3,688,170 $ 2,901,400 Net income 657,665 965,620 Dividends Ending retained earnings The company did not pay dividends in 2020. (271,000) (178,850) 4,074,835 $ 3,688,170 Exhibit III - VFP information SBW purchased 100% of the outstanding shares of Vitality Fruit Products (VFP) for USD $6,725,000 on January 1, 2022. Both parties agreed to use the financial statements at December 31, 2021, for the acquisition given there are no transactions between December 31, 2021 and January 1, 2022. At acquisition date, all the fair values were equal to the book values with the exception of. Accounts Receivable Inventory Property and Equipment (net) Land Customer list (internally generate - no corresponding book value) Fair value in USD$ $3,213,000 7,100,000 5,250,000 3,600,000 750,000 The equipment, at acquisition, had a remaining useful life of 7 years. The customer list had a 10-year useful life at the time the company was acquired. Inventory turns over 5 times a year and accounts receivable turns over 8 times a year. The following are some relevant exchange rates: Date January 1, 2022 January 31, 2022 June 30, 2022 December 31, 2022 Average rate for 2022 US$1 = Cdn $1.31 1.34 1.26 1.27 1.29 On January 31, 2022, the company sold a parcel of land, to an unrelated third party, for US$1,078,275. The land originally cost US$750,000 and was purchased by VFP in 2012 when the exchange rate was $1.01. This parcel land did not have a fair value difference at acquisition. On June 30, 2022, additional equipment was purchased for US$797,750. Depreciation expense on the new equipment for 2022 was US $169,900. The remainder of depreciation expense recorded relates to the equipment acquired in the initial purchase. Management has determined that inventory existing as at December 31, 2021, was purchased when the exchange rate was $1.30 = $1US, and inventory existing at December 31, 2022 was purchased when the exchange rate was $1.28 = $1US. Purchases of inventory happened evenly throughout the year. All general and admin expenses are assumed to have occurred evenly over the year. Dividends were declared and paid on December 31, 2022. SBW charged VFP a total of US$150,000 in management fees in 2022. VFP still owes SBW US$15,000 at the end of 2022. VFP uses the services of a tax accountant to help with the preparation of tax returns and the financial accounting of current and deferred income taxes. She has determined the appropriate exchange rate to convert deferred income taxes, and any adjustments to deferred income taxes through consolidation, to a Canadian equivalent is 1.33. Vitality Fruit Products Draft Statement of Financial Position At December 31 2022 2021 (In US$) Cash Accounts receivable Inventory Current assets $ 337,000 $ 3,800,500 3,839,783 7,784,775 6.999,000 $ 11,922,225 $ 10,838,783 Property and equipment (net) 4,711,200 4,586,502 Land 3,237,000 3,987,000 Total Assets 19,870,425 $ 19,412,285 Bank indebtedness (net of cash) $ $ 1,051,800 Accounts and other payables 7,213,000 6,895,550 Current portion of long-term debt 680,000 680,000 Current liabilities $ 7,893,000 $ 8,627,350 Due to SBW $ 1,250,000 $ Long-term debt 4,835,000 5,515,000 Deferred income tax liability 325,000 200,000 Total liabilities S 14,303,000 $ 14,342,350 Share capital 2,000,000 2,000,000 Retained earnings 3,567,425 3,069,935 Shareholders' equity $ 5,567,425 $ 5,069,935 Total liabilities and shareholder's equity 19,870,425 $ 19,412,285 Vitality Fruit Products Draft Statement of Comprehensive Income For the years ending December 31 2022 2021 (In US$) Sales Revenue $ 48,130,646 $ 44,259,120 Cost of Sales 39,524,342 36,722,832 Gross margin $ 8,606,304 $ 7,536,288 Expense Sales and marketing 2,834,055 2,918,475 Distribution expenses 2,322,900 2,205,329 Depreciation expense 673,052 628,425 General and admin 1,926,932 1,922,445 otal expenses Operating income Gain (Loss) on sale of land inance costs let income (loss) before income taxes ncome taxes (recovery) - current and deferred Comprehensive Net Income (loss) Retained Earnings - Beginning of year Dividends Retained Earnings - End of year 7,756,939 7,674,674 849,365 $ (138,386) 328,275 (212.400) (214,200) 965,240 $ (352,586) 194,000 (70,500) 69 69 771,240 $ (282,086) 3,069,935 $ 3,352,021 (273,750) $ 3,567,425 $ 3,069,935 Exhibit IV - SBW non-consolidated statements Saskatoon Berry Winery Ltd. Draft Statement of Financial Position At December 31 2022 2021 (In CDN$) Cash 3,515,497 $ 2,569,470 Accounts receivable 15,873,110 15,251,366 Inventory Current assets 29,938,180 35,927,220 49,326,787 53,748,056 Notes receivable 3,639,604 2,287,120 Investments, at cost 1,300,000 1,300,000 Investments in Subsidiaries 17,809,750 9,000,000 Property and equipment (net) 35,356,344 38,036,930 Land 2,535,720 2,935,720 Intangible assets (net) 1,198,930 1,224,920 Total Assets 111,167,135 S 108,532,746 Accounts and other payables $ 25,938,698 $ 19,561,270 Current portion of long-term debt 5,637,909 5,763,000 Current liabilities $ 31,576,607 $ 25,324,270 Long-term debt $ 17,484,151 $ 23,122,060 Deferred income tax liability 4,559,550 3,866,860 Total liabilities $ 53.620,308 $ 52,313,190 Share capital 4,177,610 4,177,610 Retained earnings 53,369,217 52,041,946 Shareholders' equity $ 57,546,827 $ 56,219,556 Total liabilities and shareholder's equity 111,167,135 $ 108,532,746 Saskatoon Berry Winery Ltd. Draft Statement of Comprehensive Income For the years ending December 31 Sales Revenue Cost of Sales 2022 2021 (In CDN$) $ 172,658,350 $ 166,707,770 141,785,620 138,211,430 Gross margin 30,872,730 28,496,340 Expense Sales and marketing 13,219,870 14,374,730 Distribution expenses 7,698,690 7,177,760 Depreciation expenses 2,121,598 2,265,210 General and admin 4,643,712 3,848,090 Total expenses $ 27,683,870 $ 27,665,790 Operating income 3,188,860 830,550 Other income 965,269 (64,410) Finance Costs (800,040) (806,820) Net income (loss) before income taxes $ 3,354,089 $ (40,680) Income taxes (recovery) - current and deferred 670,818 (8.136) Comprehensive Net Income (loss) $ 2,683,271 $ (32,544) Retained Earnings - Beginning of year 52,041,946 52,474,490 Dividends (1,356,000) (400,000) Retained Earnings - End of year 53,369,217 $ 52,041,946

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started