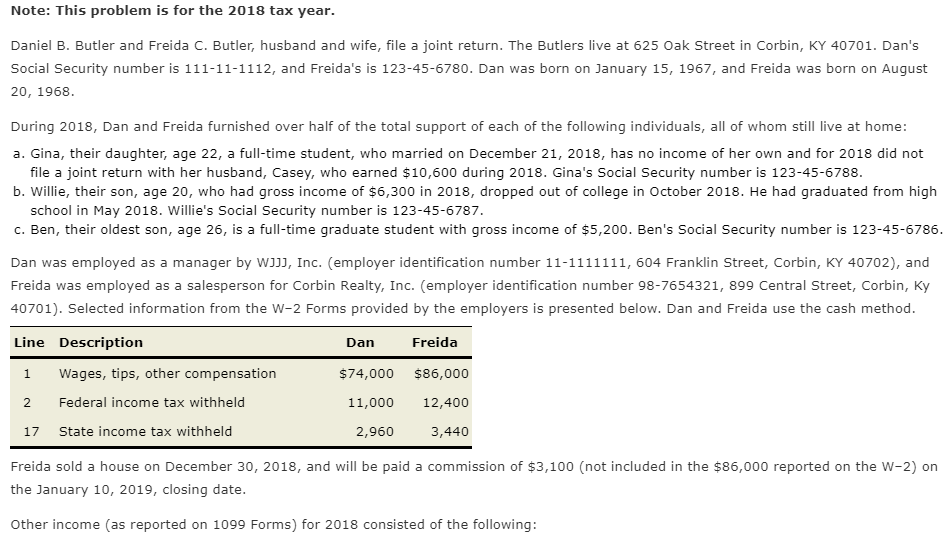

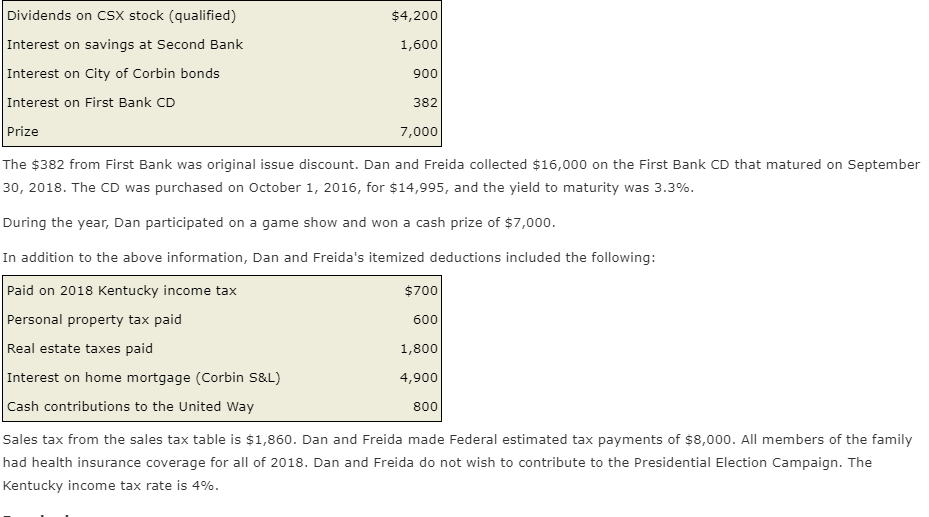

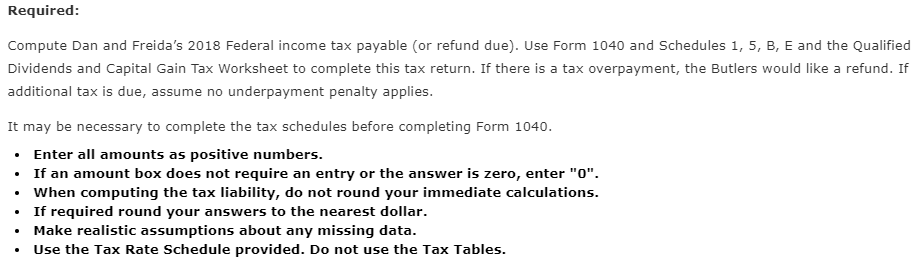

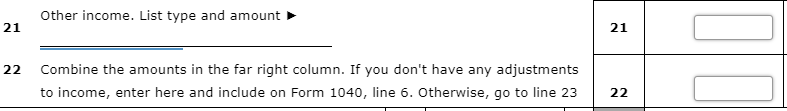

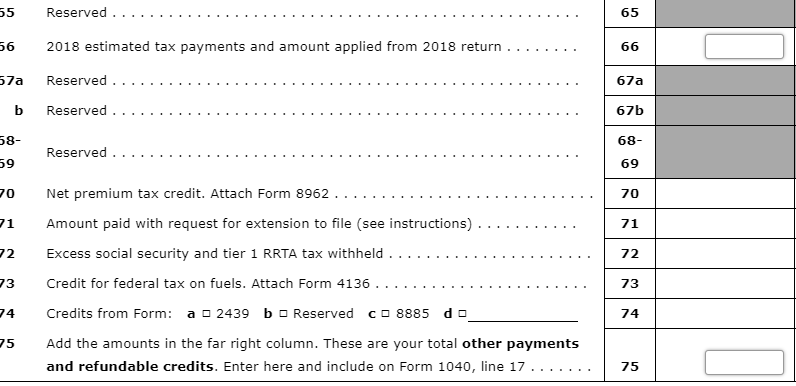

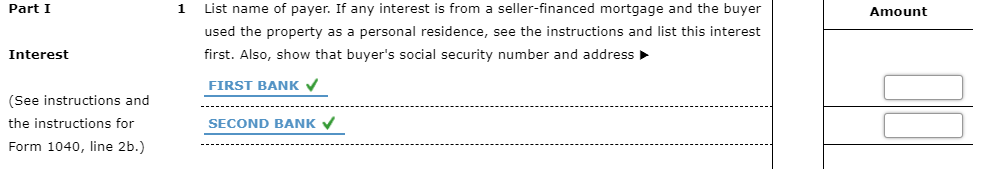

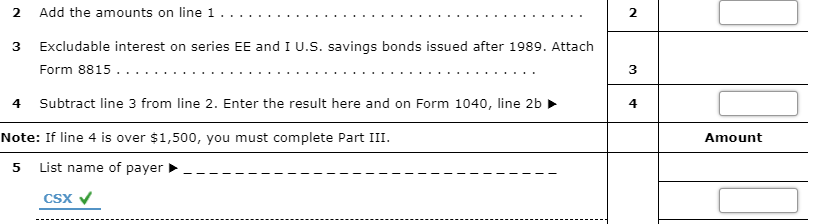

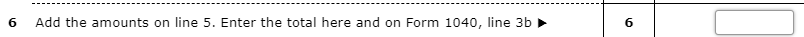

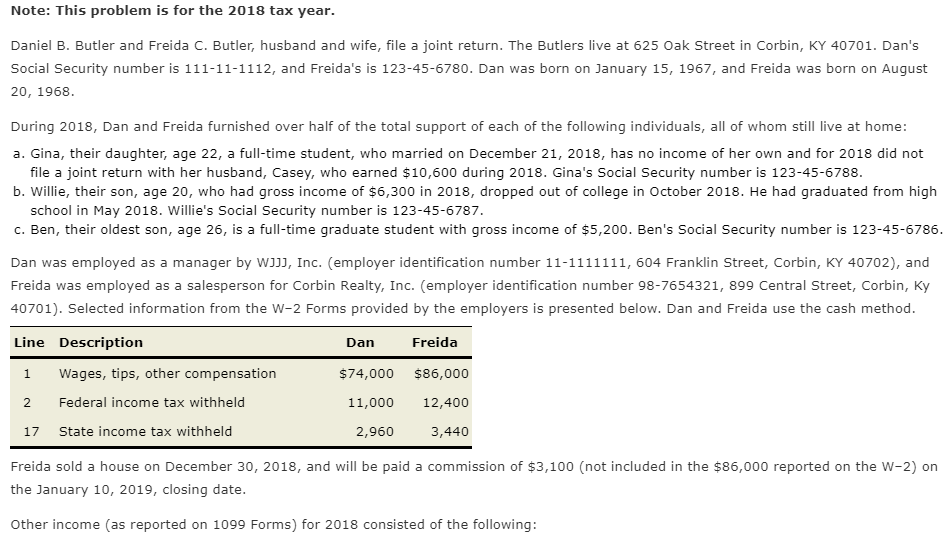

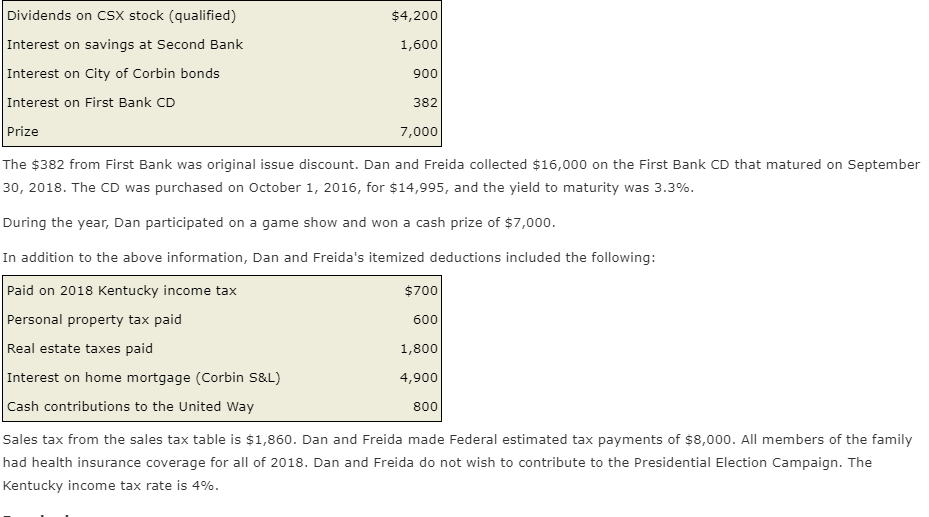

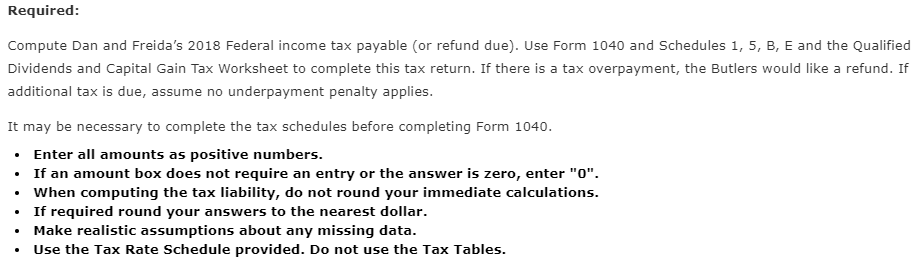

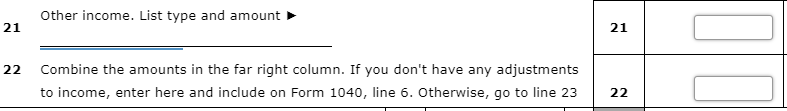

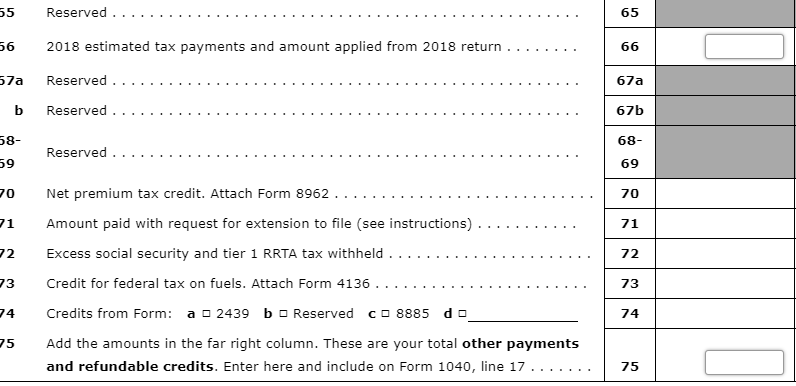

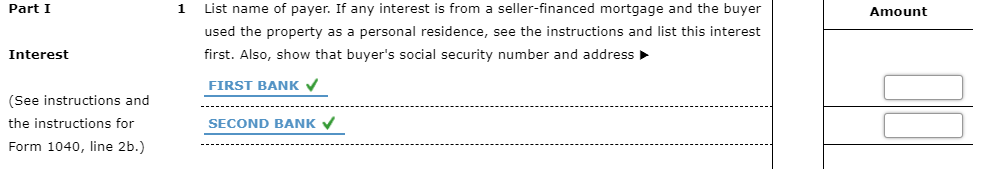

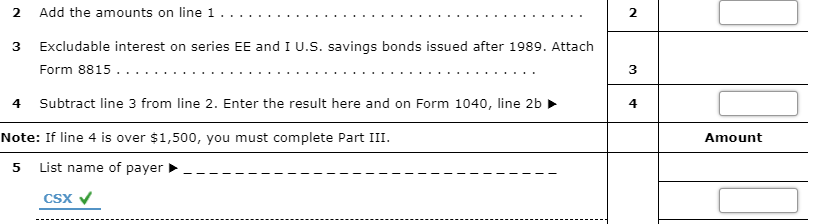

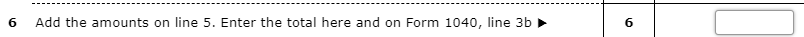

Note: This problem is for the 2018 tax year. Daniel B. Butler and Freida C. Butler, husband and wife, file a joint return. The Butlers live at 625 Oak Street in Corbin, KY 40701. Dan's Social Security number is 111-11-1112, and Freida's is 123-45-6780. Dan was born on January 15, 1967, and Freida was born on August 20, 1968. During 2018, Dan and Freida furnished over half of the total support of each of the following individuals, all of whom still live at home: a. Gina, their daughter, age 22, a full-time student, who married on December 21, 2018, has no income of her own and for 2018 did not file a joint return with her husband, Casey, who earned $10,600 during 2018. Gina's Social Security number is 123-45-6788. b. Willie, their son, age 20, who had gross income of $6,300 in 2018, dropped out of college in October 2018. He had graduated from high school in May 2018. Willie's Social Security number is 123-45-6787. C. Ben, their oldest son, age 26, is a full-time graduate student with gross income of $5,200. Ben's Social Security number is 123-45-6786. Dan was employed as a manager by W]]], Inc. (employer identification number 11-1111111, 604 Franklin Street, Corbin, KY 40702), and Freida was employed as a salesperson for Corbin Realty, Inc. (employer identification number 98-7654321, 899 Central Street, Corbin, Ky 40701). Selected information from the W-2 Forms provided by the employers is presented below. Dan and Freida use the cash method. Line Description Dan Freida 1 $74,000 $86,000 2 Wages, tips, other compensation Federal income tax withheld State income tax withheld 11,000 12,400 17 2,960 3,440 Freida sold a house on December 30, 2018, and will be paid a commission of $3,100 (not included in the $86,000 reported on the W-2) on the January 10, 2019, closing date. Other income (as reported on 1099 Forms) for 2018 consisted of the following: $4,200 1,600 Dividends on CSX stock (qualified) Interest on savings at Second Bank Interest on City of Corbin bonds Interest on First Bank CD 900 382 Prize 7,000 The $382 from First Bank was original issue discount. Dan and Freida collected $16,000 on the First Bank CD that matured on September 30, 2018. The CD was purchased on October 1, 2016, for $14,995, and the yield to maturity was 3.3%. During the year, Dan participated on a game show and won a cash prize of $7,000. In addition to the above information, Dan and Freida's itemized deductions included the following: Paid on 2018 Kentucky income tax $700 Personal property tax paid 600 Real estate taxes paid 1,800 Interest on home mortgage (Corbin S&L) 4,900 Cash contributions to the United Way 800 Sales tax from the sales tax table is $1,860. Dan and Freida made Federal estimated tax payments of $8,000. All members of the family had health insurance coverage for all of 2018. Dan and Freida do not wish to contribute to the Presidential Election Campaign. The Kentucky income tax rate is 4%. Required: Compute Dan and Freida's 2018 Federal income tax payable (or refund due). Use Form 1040 and Schedules 1, 5, B, E and the Qualified Dividends and Capital Gain Tax Worksheet to complete this tax return. If there is a tax overpayment, the Butlers would like a refund. If additional tax is due, assume no underpayment penalty applies. It may be necessary to complete the tax schedules before completing Form 1040. Enter all amounts as positive numbers. If an amount box does not require an entry or the answer is zero, enter "O". When computing the tax liability, do not round your immediate calculations. If required round your answers to the nearest dollar. Make realistic assumptions about any missing data. Use the Tax Rate Schedule provided. Do not use the Tax Tables. Other income. List type and amount 21 21 22 Combine the amounts in the far right column. If you don't have any adjustments to income, enter here and include on Form 1040, line 6. Otherwise, go to line 23 22 55 Reserved 65 56 2018 estimated tax payments and amount applied from 2018 return .. 66 57a Reserved 67a b Reserved 67b 58- 59 Reserved 68- 69 70 70 71 71 72 72 73 Net premium tax credit. Attach Form 8962 .. Amount paid with request for extension to file (see instructions). Excess social security and tier 1 RRTA tax withheld . Credit for federal tax on fuels. Attach Form 4136 ... Credits from Form: a 2439 b 0 Reserved co8885 do Add the amounts in the far right column. These are your total other payments and refundable credits. Enter here and include on Form 1040, line 17 73 74 74 75 75 Part I 1 Amount List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the instructions and list this interest first. Also, show that buyer's social security number and address Interest FIRST BANK (See instructions and the instructions for Form 1040, line 2b.) SECOND BANK 2 Add the amounts on line 1... 2 3 Excludable interest on series EE and I U.S. savings bonds issued after 1989. Attach Form 8815... 3 4 4 Amount Subtract line 3 from line 2. Enter the result here and on Form 1040, line 2b Note: If line 4 is over $1,500, you must complete Part III. 5 List name of payer CSX 6 Add the amounts on line 5. Enter the total here and on Form 1040, line 3b 6 Note: This problem is for the 2018 tax year. Daniel B. Butler and Freida C. Butler, husband and wife, file a joint return. The Butlers live at 625 Oak Street in Corbin, KY 40701. Dan's Social Security number is 111-11-1112, and Freida's is 123-45-6780. Dan was born on January 15, 1967, and Freida was born on August 20, 1968. During 2018, Dan and Freida furnished over half of the total support of each of the following individuals, all of whom still live at home: a. Gina, their daughter, age 22, a full-time student, who married on December 21, 2018, has no income of her own and for 2018 did not file a joint return with her husband, Casey, who earned $10,600 during 2018. Gina's Social Security number is 123-45-6788. b. Willie, their son, age 20, who had gross income of $6,300 in 2018, dropped out of college in October 2018. He had graduated from high school in May 2018. Willie's Social Security number is 123-45-6787. C. Ben, their oldest son, age 26, is a full-time graduate student with gross income of $5,200. Ben's Social Security number is 123-45-6786. Dan was employed as a manager by W]]], Inc. (employer identification number 11-1111111, 604 Franklin Street, Corbin, KY 40702), and Freida was employed as a salesperson for Corbin Realty, Inc. (employer identification number 98-7654321, 899 Central Street, Corbin, Ky 40701). Selected information from the W-2 Forms provided by the employers is presented below. Dan and Freida use the cash method. Line Description Dan Freida 1 $74,000 $86,000 2 Wages, tips, other compensation Federal income tax withheld State income tax withheld 11,000 12,400 17 2,960 3,440 Freida sold a house on December 30, 2018, and will be paid a commission of $3,100 (not included in the $86,000 reported on the W-2) on the January 10, 2019, closing date. Other income (as reported on 1099 Forms) for 2018 consisted of the following: $4,200 1,600 Dividends on CSX stock (qualified) Interest on savings at Second Bank Interest on City of Corbin bonds Interest on First Bank CD 900 382 Prize 7,000 The $382 from First Bank was original issue discount. Dan and Freida collected $16,000 on the First Bank CD that matured on September 30, 2018. The CD was purchased on October 1, 2016, for $14,995, and the yield to maturity was 3.3%. During the year, Dan participated on a game show and won a cash prize of $7,000. In addition to the above information, Dan and Freida's itemized deductions included the following: Paid on 2018 Kentucky income tax $700 Personal property tax paid 600 Real estate taxes paid 1,800 Interest on home mortgage (Corbin S&L) 4,900 Cash contributions to the United Way 800 Sales tax from the sales tax table is $1,860. Dan and Freida made Federal estimated tax payments of $8,000. All members of the family had health insurance coverage for all of 2018. Dan and Freida do not wish to contribute to the Presidential Election Campaign. The Kentucky income tax rate is 4%. Required: Compute Dan and Freida's 2018 Federal income tax payable (or refund due). Use Form 1040 and Schedules 1, 5, B, E and the Qualified Dividends and Capital Gain Tax Worksheet to complete this tax return. If there is a tax overpayment, the Butlers would like a refund. If additional tax is due, assume no underpayment penalty applies. It may be necessary to complete the tax schedules before completing Form 1040. Enter all amounts as positive numbers. If an amount box does not require an entry or the answer is zero, enter "O". When computing the tax liability, do not round your immediate calculations. If required round your answers to the nearest dollar. Make realistic assumptions about any missing data. Use the Tax Rate Schedule provided. Do not use the Tax Tables. Other income. List type and amount 21 21 22 Combine the amounts in the far right column. If you don't have any adjustments to income, enter here and include on Form 1040, line 6. Otherwise, go to line 23 22 55 Reserved 65 56 2018 estimated tax payments and amount applied from 2018 return .. 66 57a Reserved 67a b Reserved 67b 58- 59 Reserved 68- 69 70 70 71 71 72 72 73 Net premium tax credit. Attach Form 8962 .. Amount paid with request for extension to file (see instructions). Excess social security and tier 1 RRTA tax withheld . Credit for federal tax on fuels. Attach Form 4136 ... Credits from Form: a 2439 b 0 Reserved co8885 do Add the amounts in the far right column. These are your total other payments and refundable credits. Enter here and include on Form 1040, line 17 73 74 74 75 75 Part I 1 Amount List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the instructions and list this interest first. Also, show that buyer's social security number and address Interest FIRST BANK (See instructions and the instructions for Form 1040, line 2b.) SECOND BANK 2 Add the amounts on line 1... 2 3 Excludable interest on series EE and I U.S. savings bonds issued after 1989. Attach Form 8815... 3 4 4 Amount Subtract line 3 from line 2. Enter the result here and on Form 1040, line 2b Note: If line 4 is over $1,500, you must complete Part III. 5 List name of payer CSX 6 Add the amounts on line 5. Enter the total here and on Form 1040, line 3b 6