Note: This problem is for the 2020 tax year.

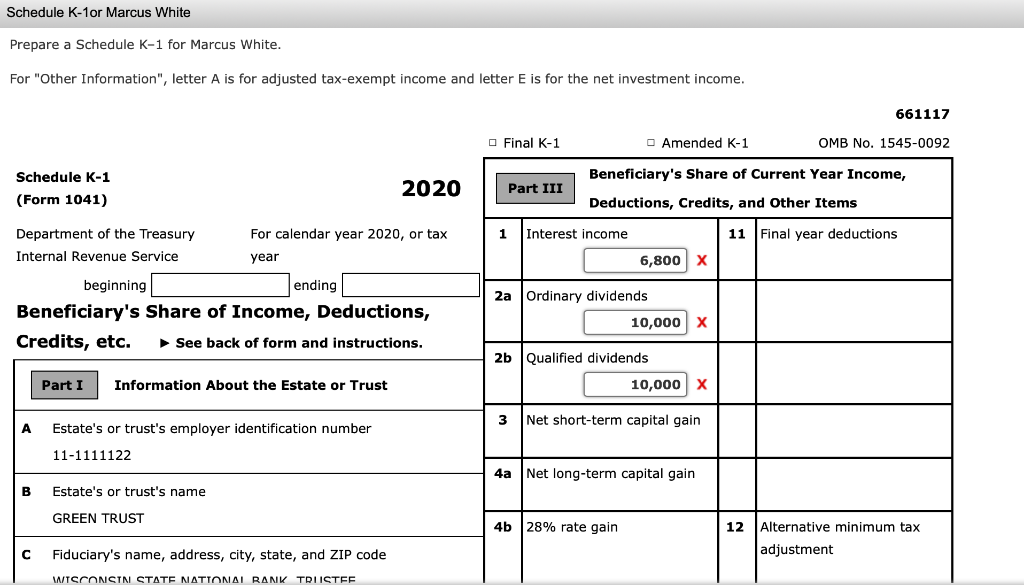

Prepare the 2020 fiduciary income tax return (Form 1041) for the Green Trust. In addition, determine the amount and character of the income and expense items that each beneficiary must report for the year, and prepare a Schedule K-1 for Marcus White. The trust is not subject to the AMT. The year's activities of the trust include the following.

| | |

| Dividend income, all qualified U.S. stocks | $10,000 |

| Taxable interest income | 50,000 |

| Tax-exempt interest income | 20,000 |

| Net long-term capital gain, incurred 11/1 | 25,000 |

| Trustee's fees | 6,000 |

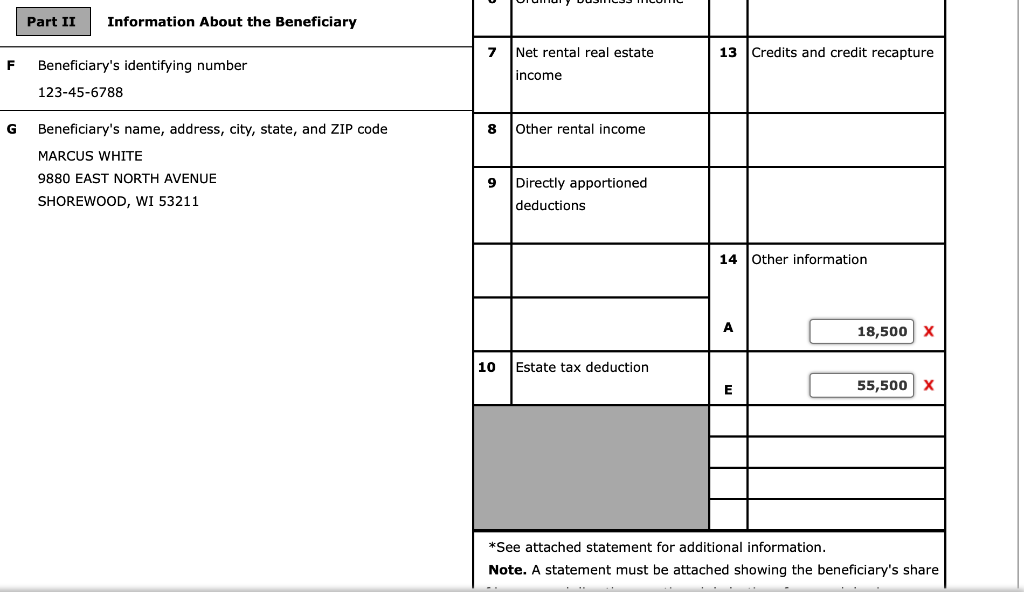

Under the terms of the trust instrument, cost recovery, net capital gains and losses, and fiduciary fees are allocable to corpus. The trustee is required to distribute $25,000 to Marcus every year. For the year, the trustee distributed $40,000 to Marcus and $40,000 to Marcus's sister, Ellen Hayes. No other distributions were made.

In computing DNI, the trustee properly assigned all of the deductible fiduciary's fees to the taxable interest income.

The trustee paid $4,000 in estimated taxes for the year on behalf of the trust. Any resulting refund is to be credited to the next tax year. The exempt income was not derived from private activity bonds.

The trust was created on December 14, 1953. It is not subject to any recapture taxes, nor can it claim any tax credits. None of its income was derived under a personal services contract. The trust has no economic interest in any foreign trust. Its Federal identification number is 11-1111122.

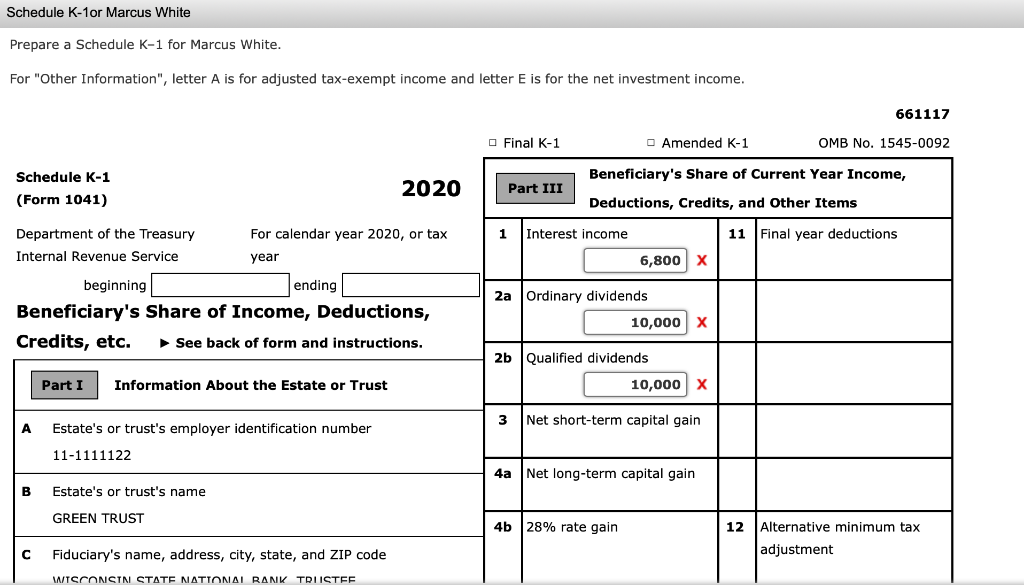

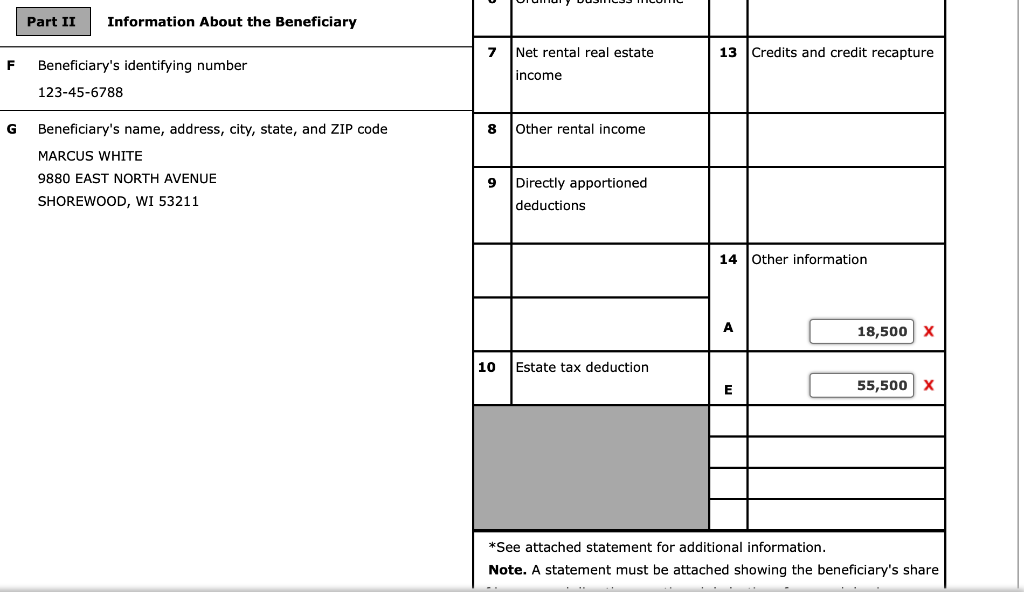

The trustee, Wisconsin State National Bank, is located at 3100 East Wisconsin Avenue, Milwaukee, WI 53201. Marcus lives at 9880 East North Avenue, Shorewood, WI 53211. His Social Security number is 123-45-6788. Ellen lives at 6772 East Oklahoma Avenue, Milwaukee, WI 53204. Her Social Security number is 987-65-4321.

Required:

Prepare the 2020 fiduciary income tax return (Form 1041) for the Green Trust. In addition, determine the amount and character of the income and expense items that each beneficiary must report for the year, and prepare a Schedule K-1 for Marcus White.

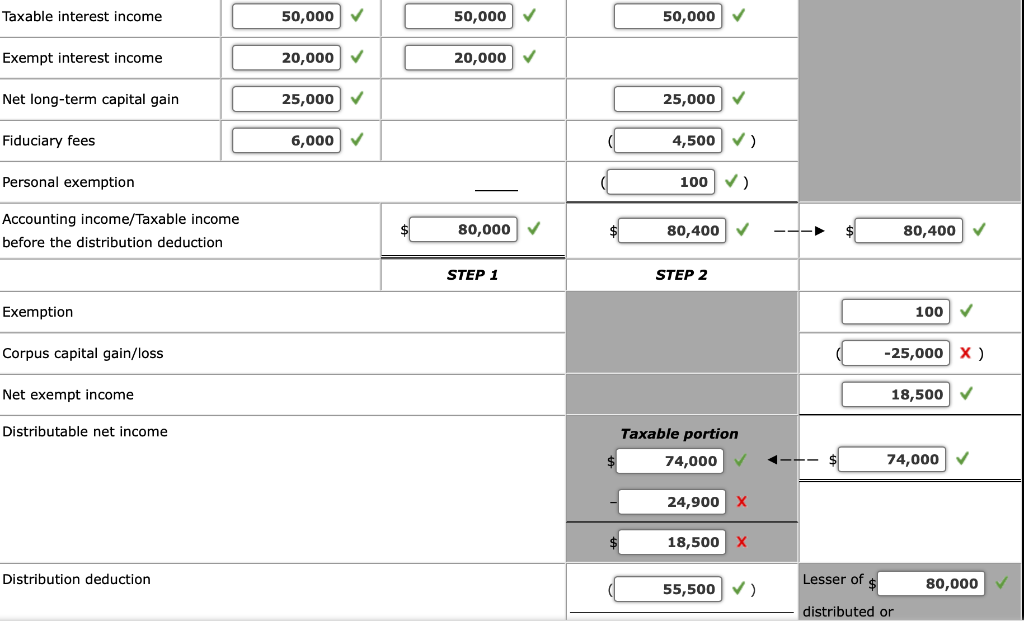

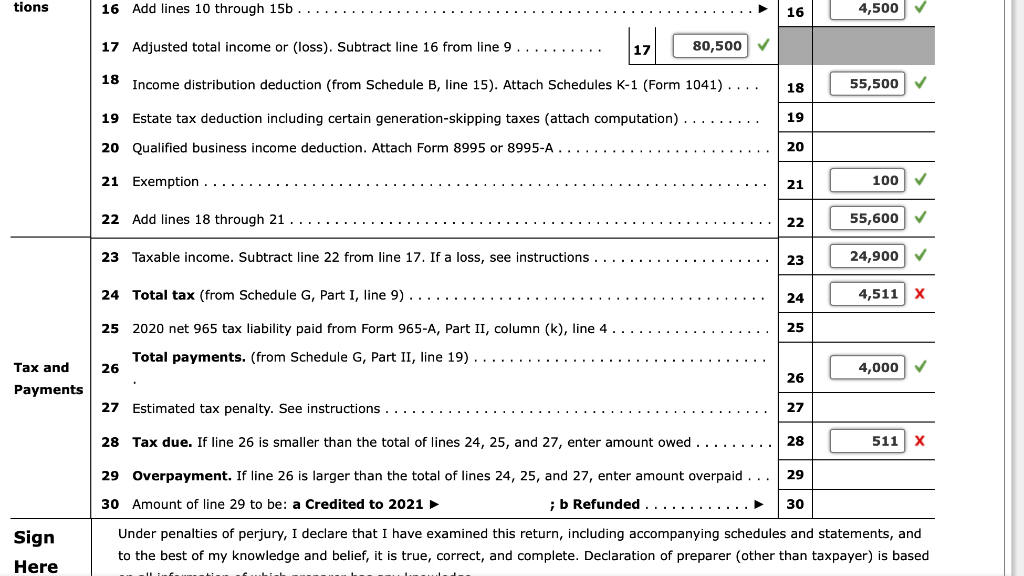

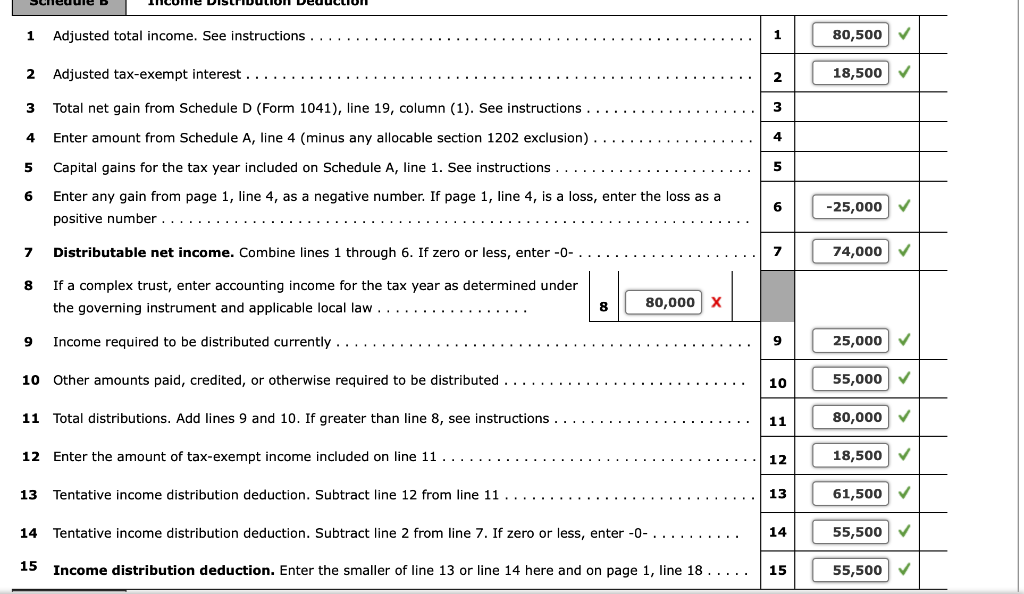

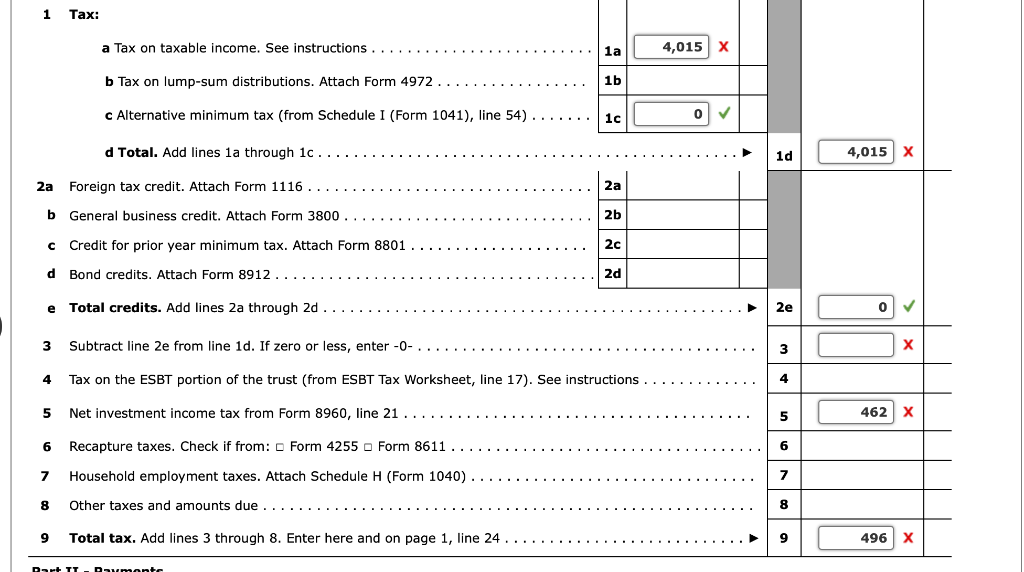

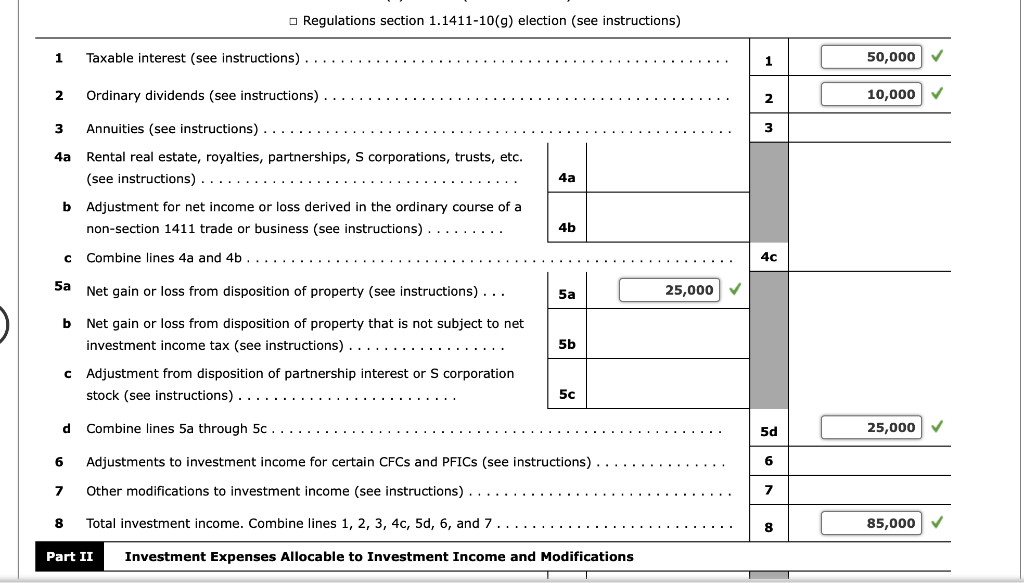

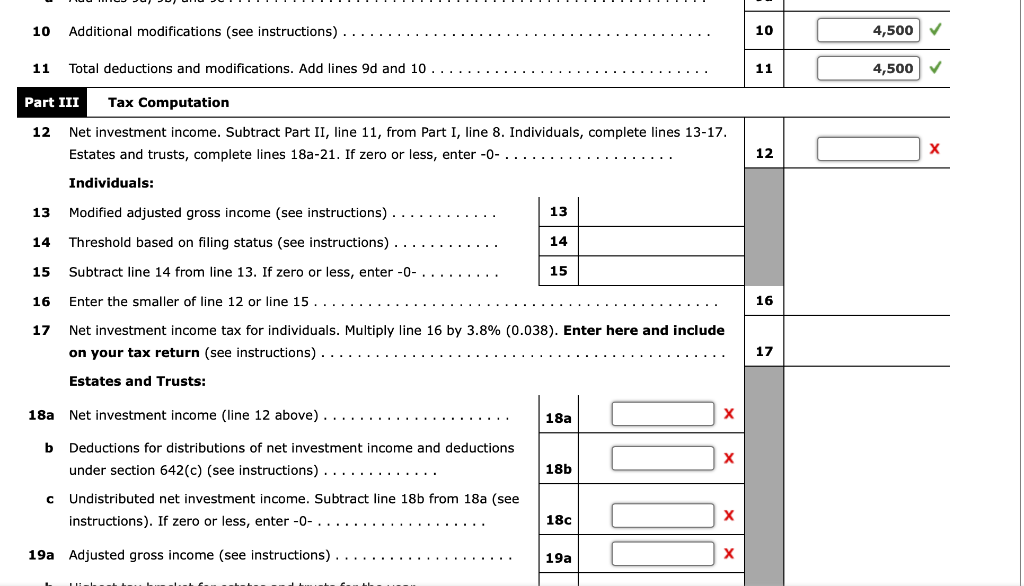

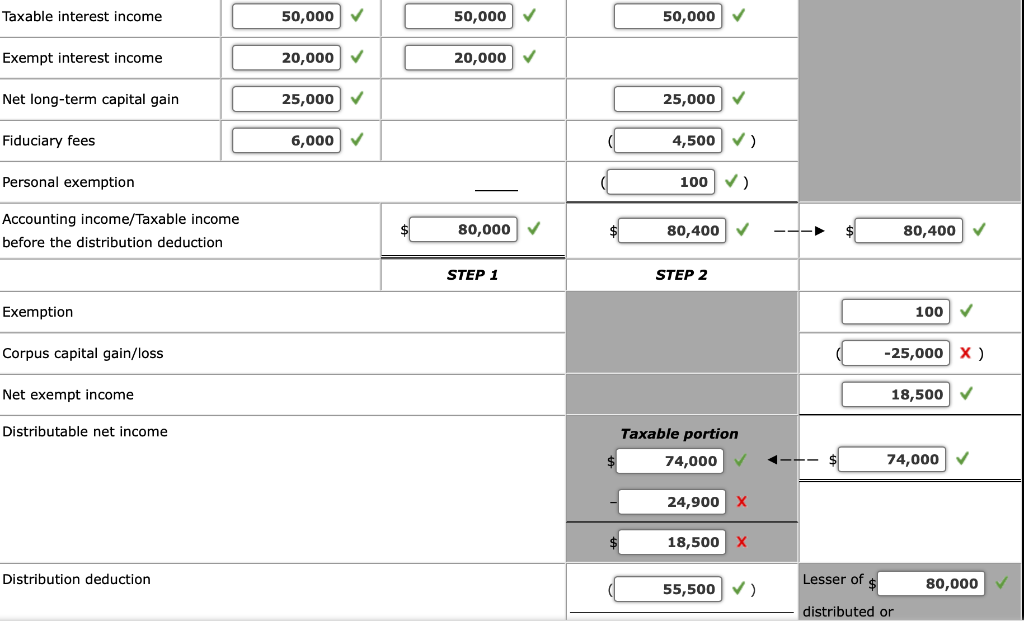

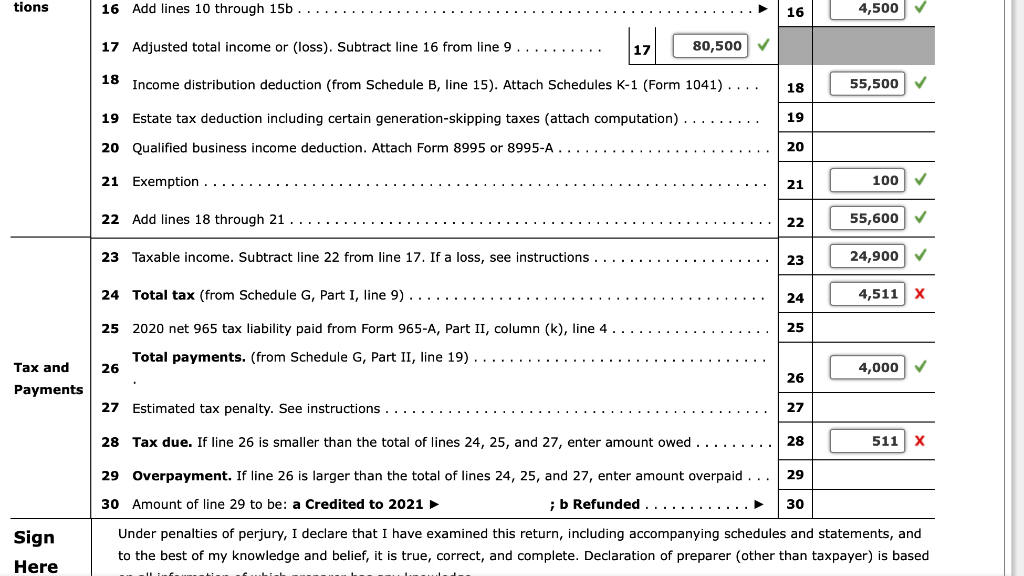

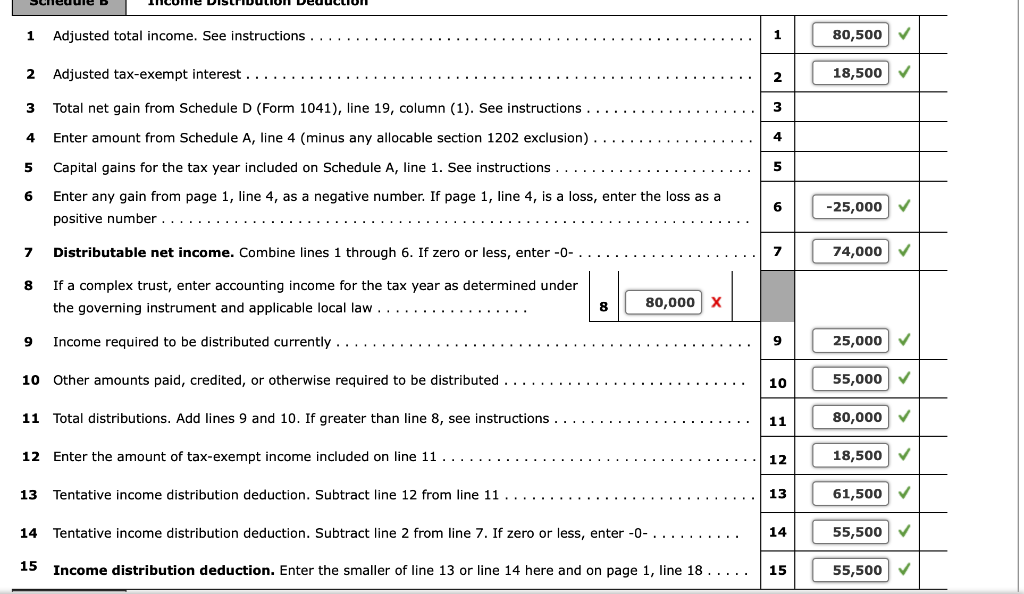

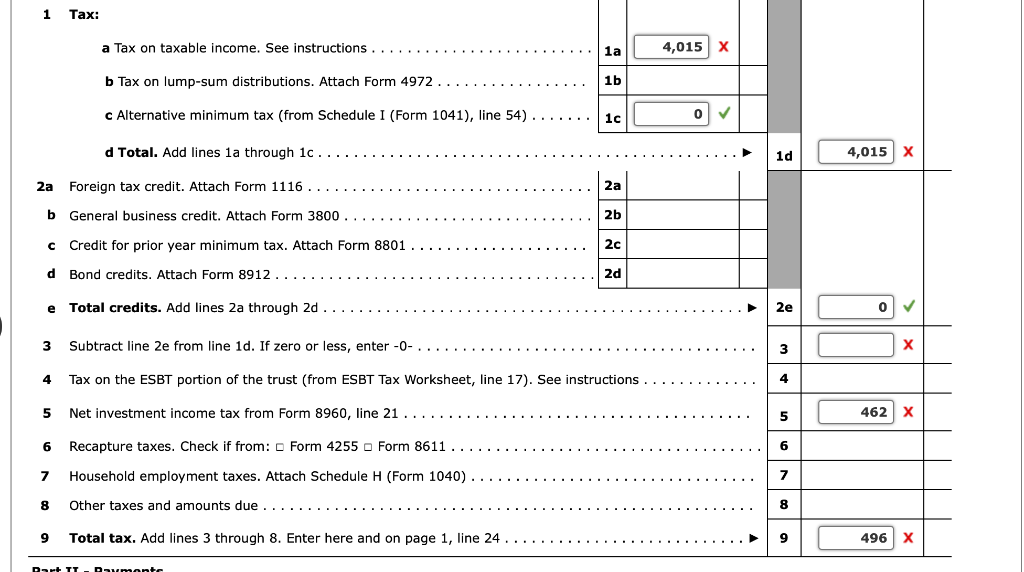

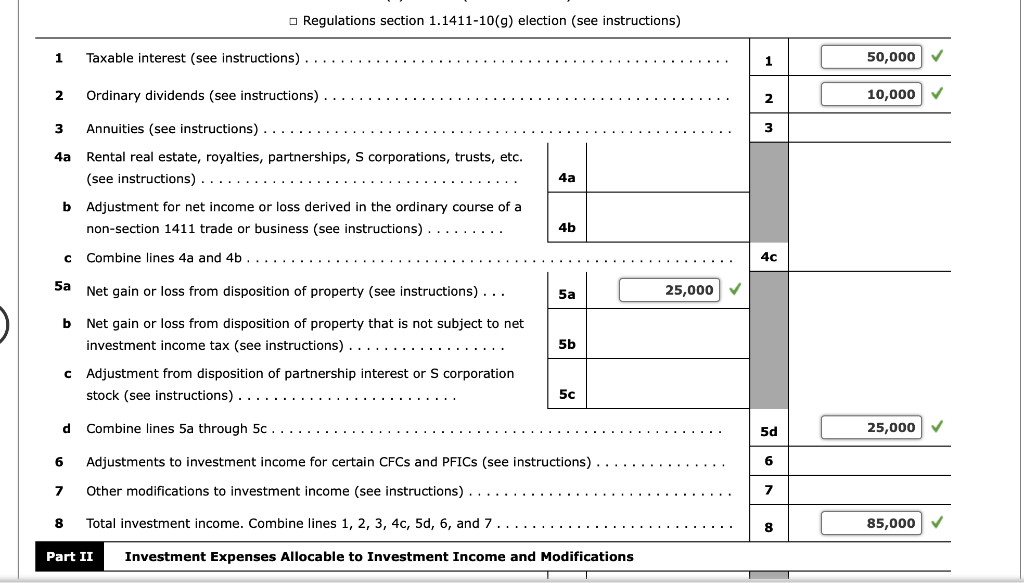

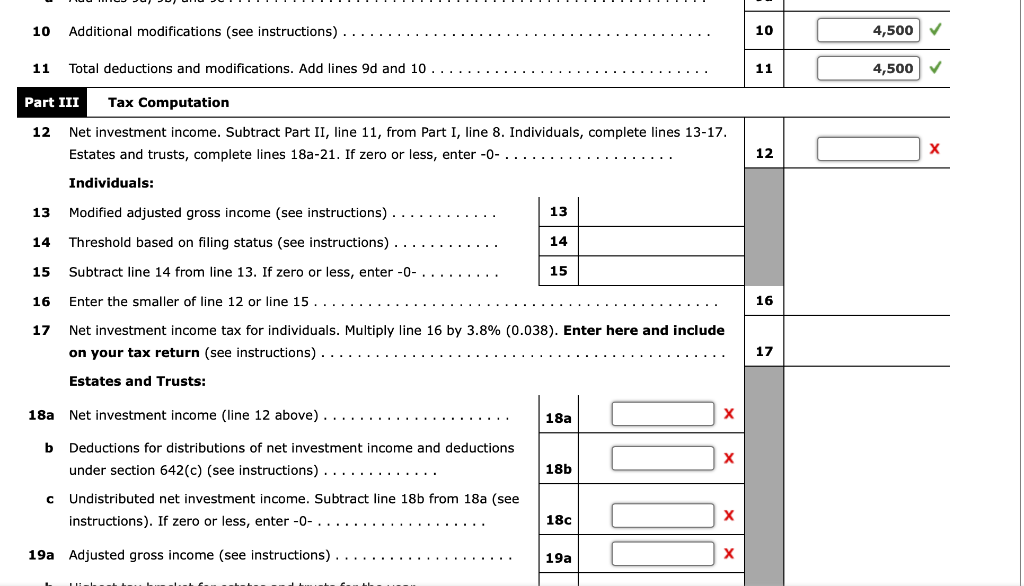

Taxable interest income Exempt interest income Net long-term capital gain Fiduciary fees Personal exemption Accounting income/Taxable income before the distribution deduction Exemption Corpus capital gain/loss Net exempt income Distributable net income Distribution deduction 50,000 20,000 25,000 6,000 50,000 20,000 80,000 STEP 1 50,000 25,000 4,500 ) 100 ) 80,400 STEP 2 Taxable portion 74,000 24,900 X 18,500 X 55,500 ) 80,400 100 -25,000 X ) 18,500 74,000 Lesser of $ distributed or 80,000 tions Tax and Payments Sign Here 16 Add lines 10 through 15b 16 4,500 17 Adjusted total income or (loss). Subtract line 16 from line 9 17 80,500 18 Income distribution deduction (from Schedule B, line 15). Attach Schedules K-1 (Form 1041)... 18 55,500 19 Estate tax deduction including certain generation-skipping taxes (attach computation) 19 20 Qualified business income deduction. Attach Form 8995 or 8995-A 20 21 Exemption. 100 21 22 Add lines 18 through 21 22 55,600 23 Taxable income. Subtract line 22 from line 17. If a loss, see instructions 23 24,900 24 Total tax (from Schedule G, Part I, line 9). 24 4,511 25 25 2020 net 965 tax liability paid from Form 965-A, Part II, column (k), line 4 Total payments. (from Schedule G, Part II, line 19) 26 4,000 26 27 Estimated tax penalty. See instructions....... 27 28 Tax due. If line 26 is smaller than the total of lines 24, 25, and 27, enter amount owed. 28 511 29 29 Overpayment. If line 26 is larger than the total of lines 24, 25, and 27, enter amount overpaid... 30 Amount of line 29 to be: a Credited to 2021 ; b Refunded..... 30 Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based X 1 1 Adjusted total income. See instructions 2 Adjusted tax-exempt interest .. 2 3 3 Total net gain from Schedule D (Form 1041), line 19, column (1). See instructions 4 4 Enter amount from Schedule A, line 4 (minus any allocable section 1202 exclusion).. 5 5 Capital gains for the tax year included on Schedule A, line 1. See instructions 6 6 Enter any gain from page 1, line 4, as a negative number. If page 1, line 4, is a loss, enter the loss as a positive number . . . . 7 7 Distributable net income. Combine lines 1 through 6. If zero or less, enter -0- 8 If a complex trust, enter accounting income for the tax year as determined under 8 80,000 X the governing instrument and applicable local law 9 9 Income required to be distributed currently.... 10 Other amounts paid, credited, or otherwise required to be distributed 10 11 Total distributions. Add lines 9 and 10. If greater than line 8, see instructions 11 12 Enter the amount of tax-exempt income included on line 11 ... 12 13 13 Tentative income distribution deduction. Subtract line 12 from line 11 14 14 Tentative income distribution deduction. Subtract line 2 from line 7. If zero or less, enter -0- 15 15 Income distribution deduction. Enter the smaller of line 13 or line 14 here and on page 1, line 18 80,500 18,500 -25,000 74,000 25,000 55,000 80,000 18,500 61,500 55,500 55,500 1 Tax: a Tax on taxable income. See instructions 1a b Tax on lump-sum distributions. Attach Form 4972 1b c Alternative minimum tax (from Schedule I (Form 1041), line 54) 1c d Total. Add lines 1a through 1c. 2a Foreign tax credit. Attach Form 1116. 2a b General business credit. Attach Form 3800 2b Credit for prior year minimum tax. Attach Form 8801 2c d Bond credits. Attach Form 8912. 2d e Total credits. Add lines 2a through 2d 3 Subtract line 2e from line 1d. If zero or less, enter -0- 4 Tax on the ESBT portion of the trust (from ESBT Tax Worksheet, line 17). See instructions 5 Net investment income tax from Form 8960, line 21... 6 Recapture taxes. Check if from: Form 4255 Form 8611 .... 7 Household employment taxes. Attach Schedule H (Form 1040). 8 Other taxes and amounts due ... 9 Total tax. Add lines 3 through 8. Enter here and on page 1, line 24. Part TT - Raymonte 4,015 X 0 1d 2e 3 4 5 6 7 8 9 4,015 X 0 X 462 X 496 X Regulations section 1.1411-10(g) election (see instructions) 1 Taxable interest (see instructions) 2 Ordinary dividends (see instructions) 3 Annuities (see instructions) 4a Rental real estate, royalties, partnerships, S corporations, trusts, etc. (see instructions) 4a b Adjustment for net income or loss derived in the ordinary course of a non-section 1411 trade or business (see instructions) 4b Combine lines 4a and 4b 5a Net gain or loss from disposition of property (see instructions)... 5a b Net gain or loss from disposition of property that is not subject to net investment income tax (see instructions). 5b Adjustment from disposition of partnership interest or S corporation stock (see instructions). 5c d Combine lines 5a through 5c 6 Adjustments investment income for ertain CFCs and PFICS (see tructions) 7 Other modifications to investment income (see instructions). 8 Total investment income. Combine lines 1, 2, 3, 4c, 5d, 6, and 7 Part II Investment Expenses Allocable to Investment Income and Modifications 25,000 1 2 3 4c 5d 6 7 8 50,000 10,000 25,000 85,000 10 Additional modifications (see instructions) 10 11 Total deductions and modifications. Add lines 9d and 10 11 Part III Tax Computation 12 Net investment income. Subtract Part II, line 11, from Part I, line 8. Individuals, complete lines 13-17. Estates and trusts, complete lines 18a-21. If zero or less, enter -0-. 12 Individuals: 13 Modified adjusted gross income (see instructions) 13 14 Threshold based on filing status (see instructions) 14 15 Subtract line 14 from line 13. If zero or less, enter -0- 15 16 Enter the smaller of line 12 or line 15.. 16 17 Net investment income tax for individuals. Multiply line 16 by 3.8% (0.038). Enter here and include on your tax return (see instructions) 17 Estates and Trusts: 18a Net investment income (line 12 above).. X 18a b Deductions for distributions of net investment income and deductions under section 642(c) (see instructions) ... X 18b Undistributed net investment income. Subtract line 18b from 18a (see instructions). If zero or less, enter -0- X 18c 19a Adjusted gross income (see instructions) X 19a 4,500 4,500 X Schedule K-1or Marcus White Prepare a Schedule K-1 for Marcus White. For "Other Information", letter A is for adjusted tax-exempt income and letter E is for the net investment income. Final K-1 Amended K-1 Schedule K-1 (Form 1041) 2020 Part III Beneficiary's Share of Current Year Income, Deductions, Credits, and Other Items 1 Interest income 11 Final year deductions Department of the Treasury Internal Revenue Service For calendar year 2020, or tax year 6,800 X beginning ending 2a Ordinary dividends 10,000 X Beneficiary's Share of Income, Deductions, Credits, etc. See back of form and instructions. 2b Qualified dividends Part I Information About the Estate or Trust 10,000 X 3 Net short-term capital gain A Estate's or trust's employer identification number 11-1111122 4a Net long-term capital gain B Estate's or trust's name GREEN TRUST 4b 28% rate gain 12 Alternative minimum tax adjustment Fiduciary's name, address, city, state, and ZIP code WISCONSIN STATE NATIONAL BANK TRUSTEE 661117 OMB No. 1545-0092 Part II Information About the Beneficiary F Beneficiary's identifying number 123-45-6788 G Beneficiary's name, address, city, state, and ZIP code MARCUS WHITE 9880 EAST NORTH AVENUE SHOREWOOD, WI 53211 Net rental real estate 13 Credits and credit recapture income Other rental income Directly apportioned deductions 14 Other information A 18,500 X 10 Estate tax deduction 55,500 X E *See attached statement for additional information. Note. A statement must be attached showing the beneficiary's share 7 8 9