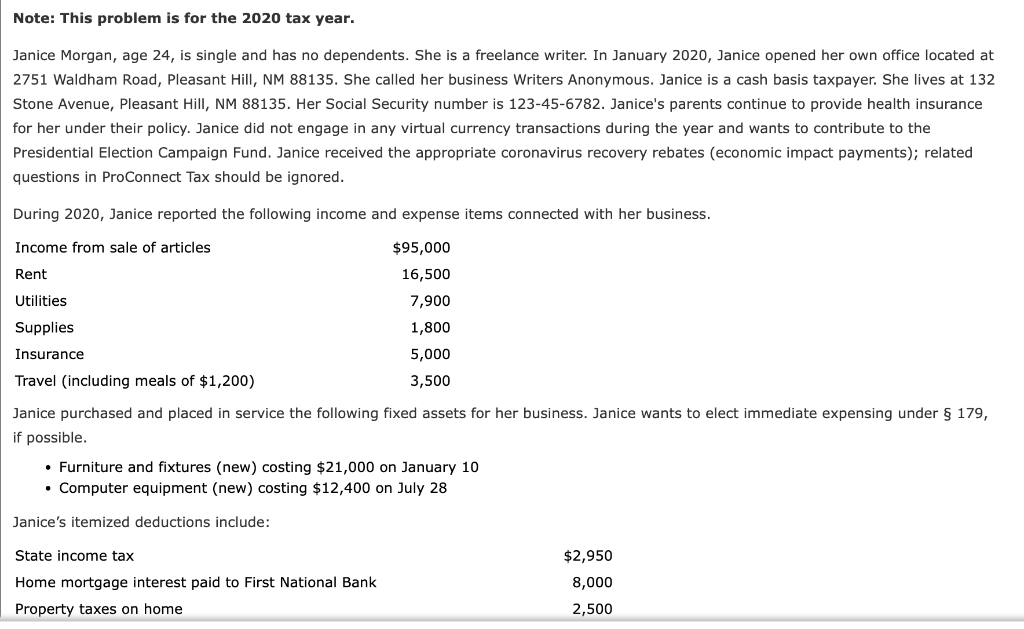

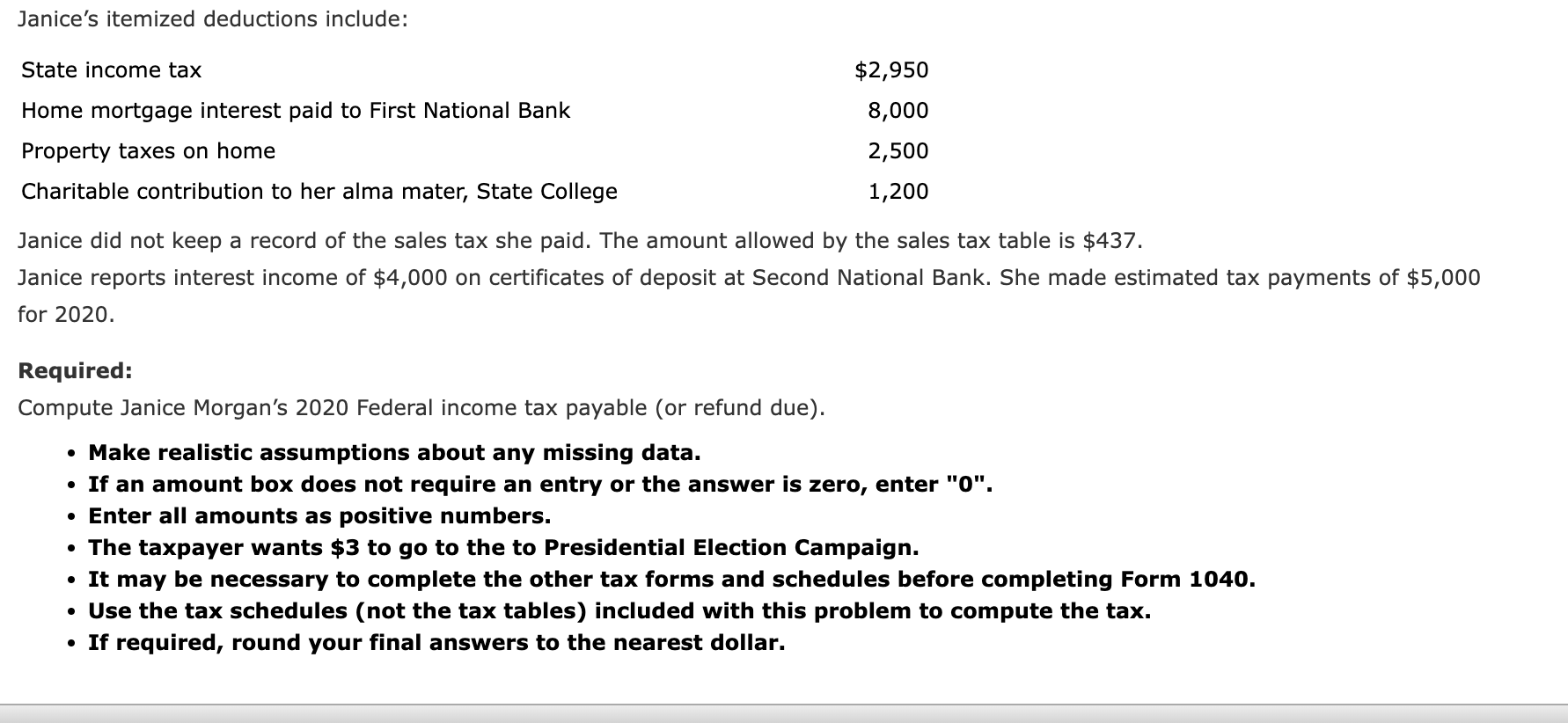

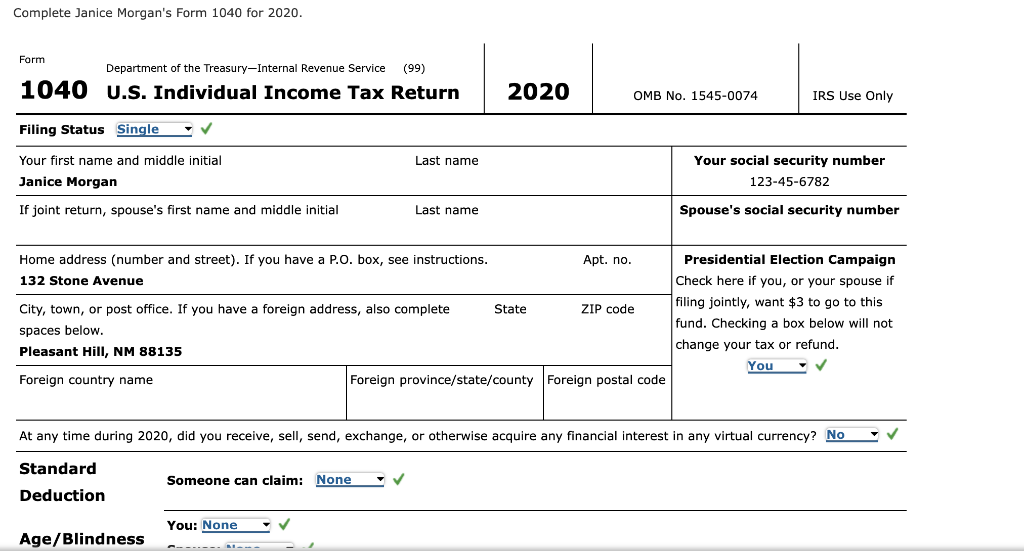

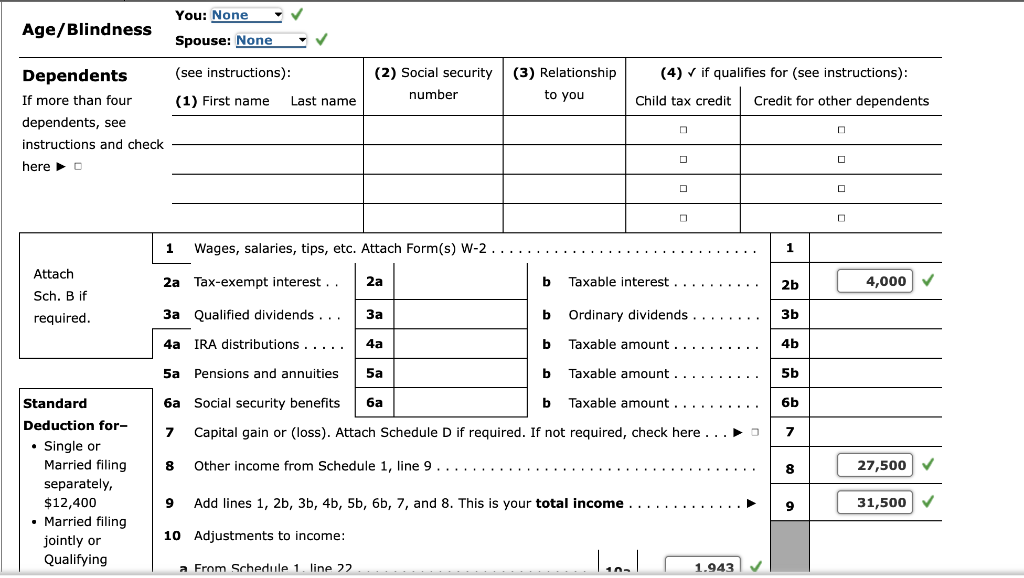

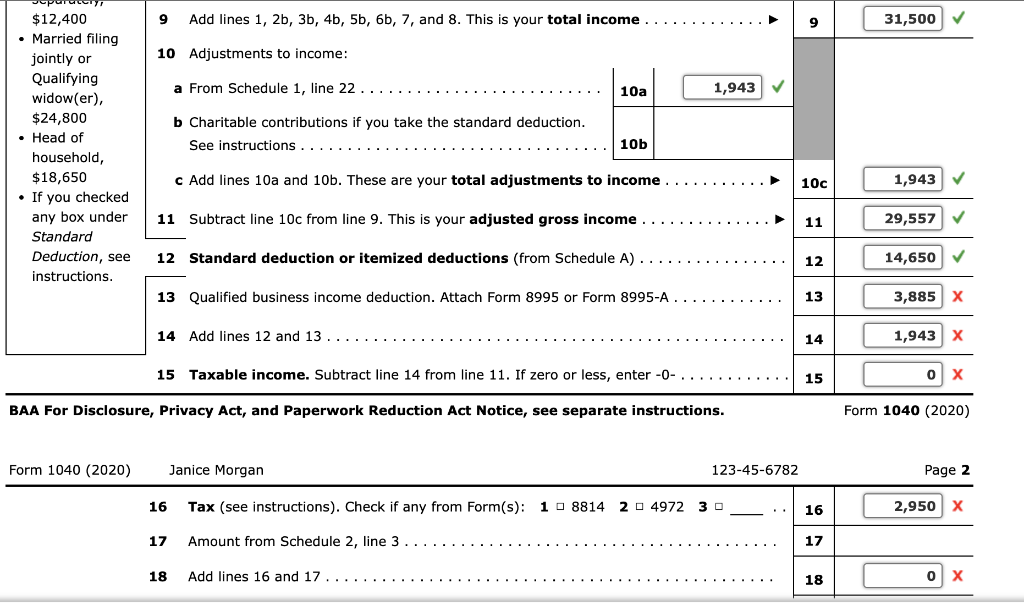

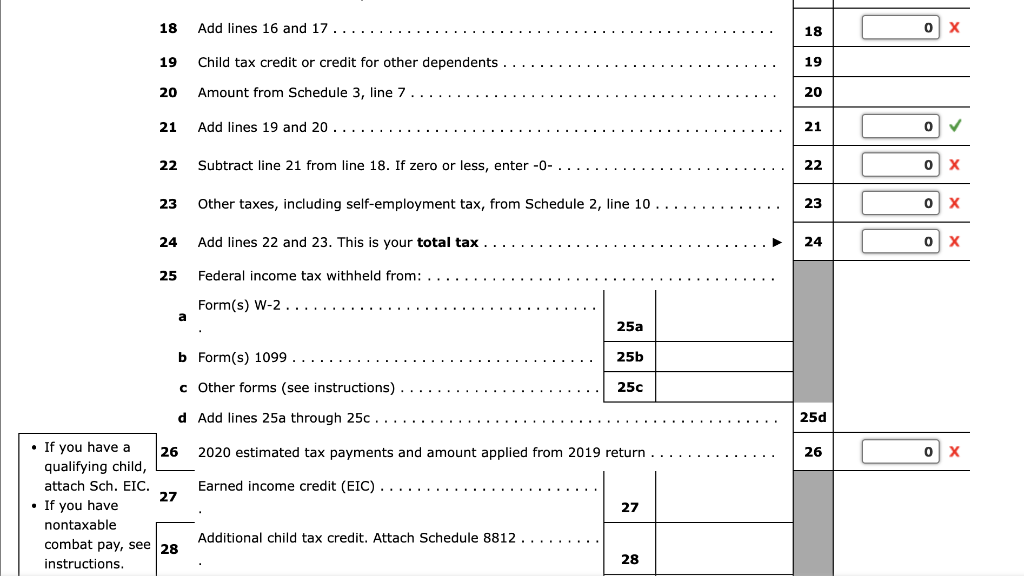

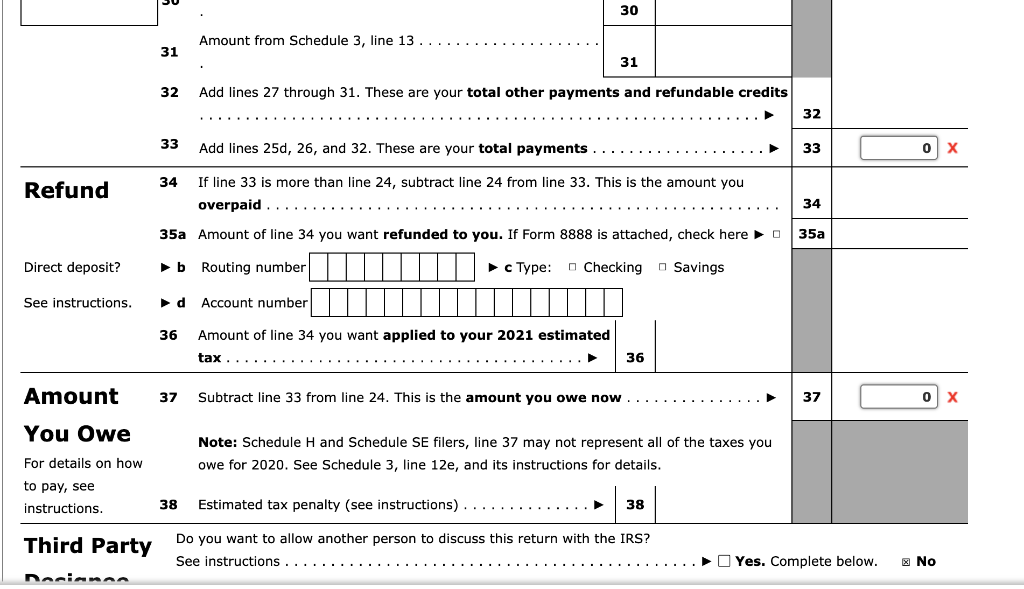

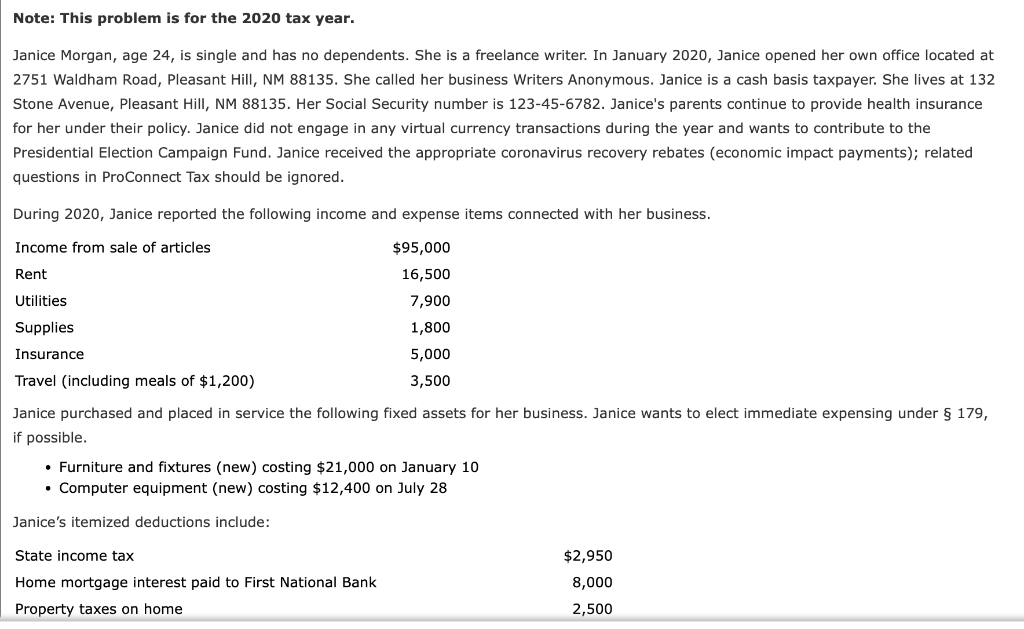

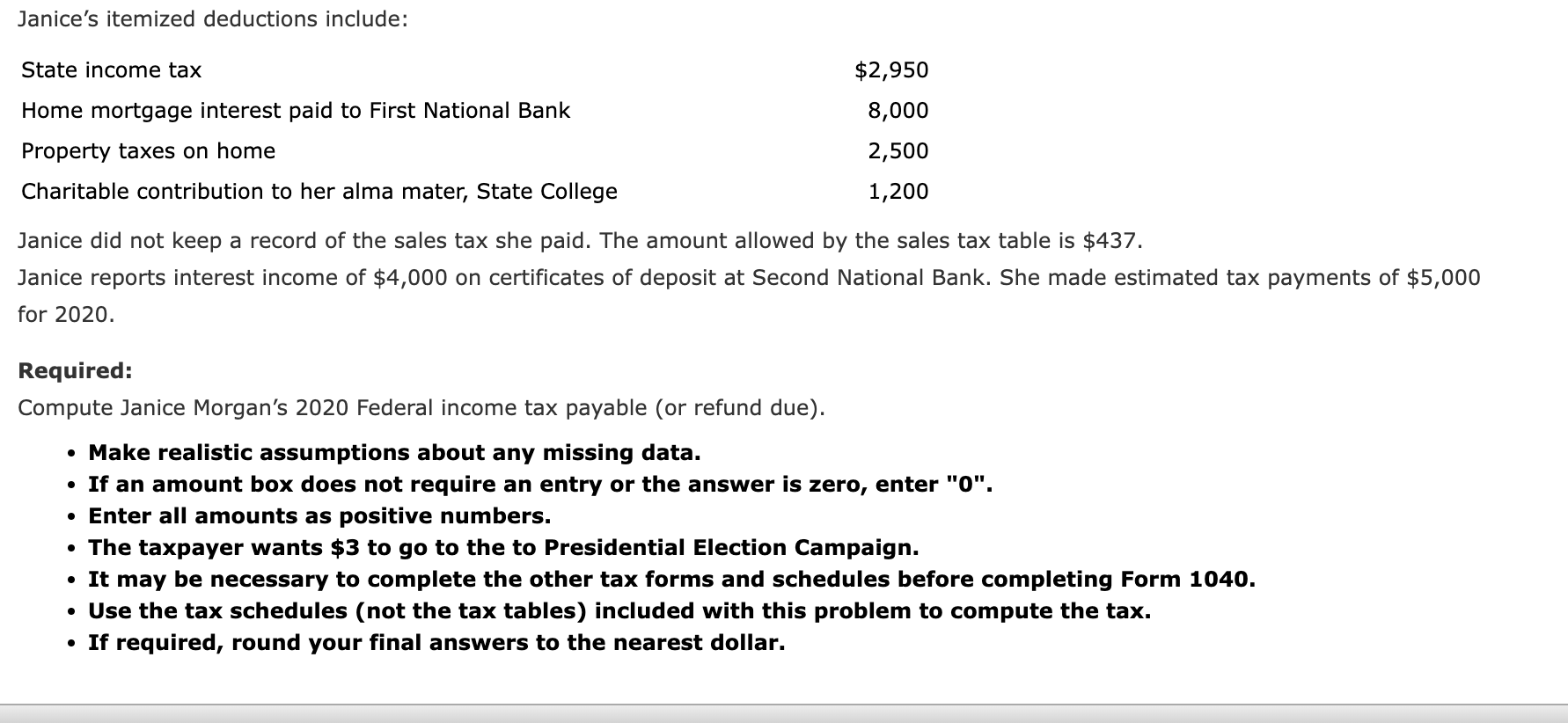

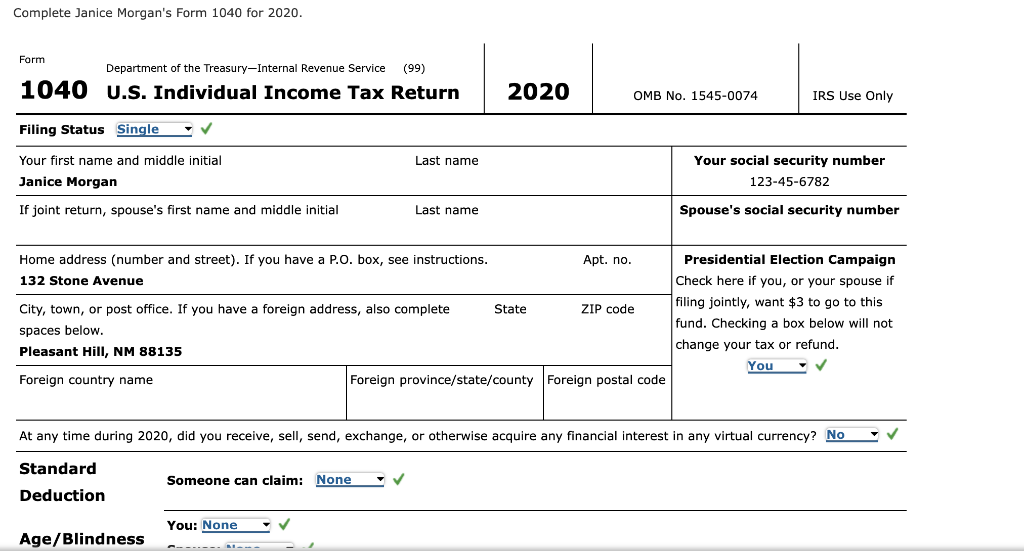

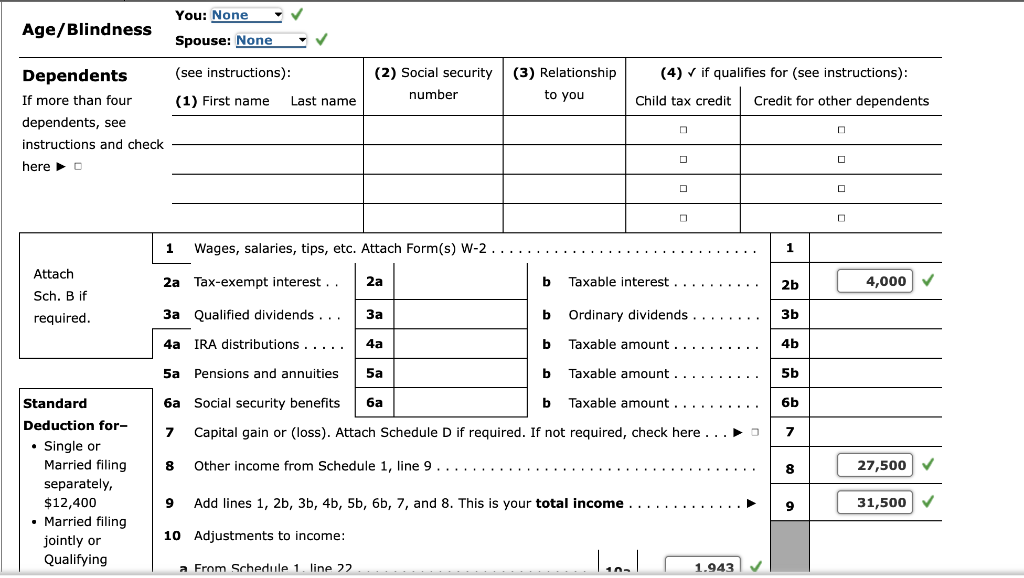

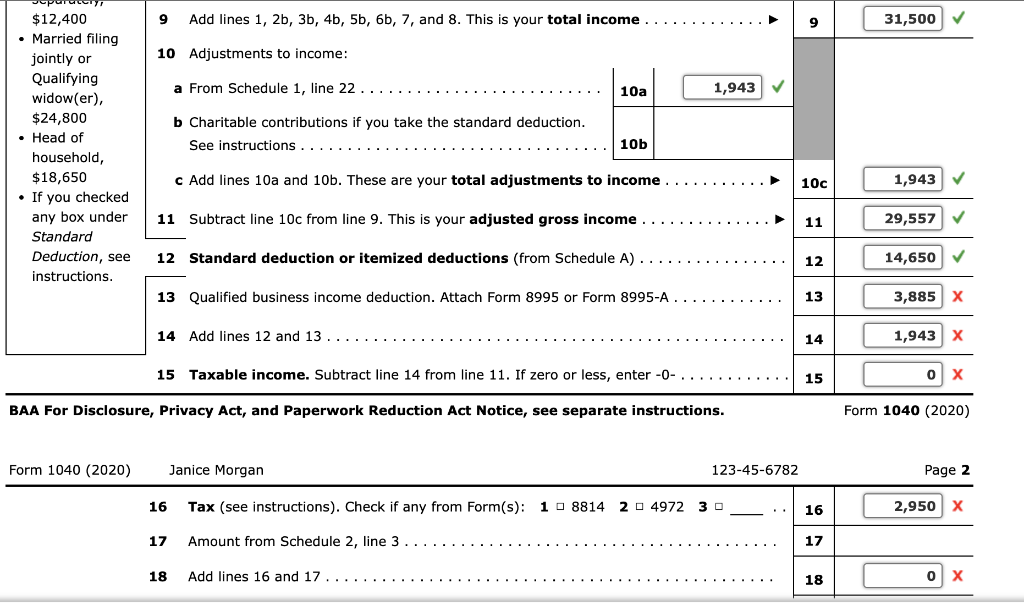

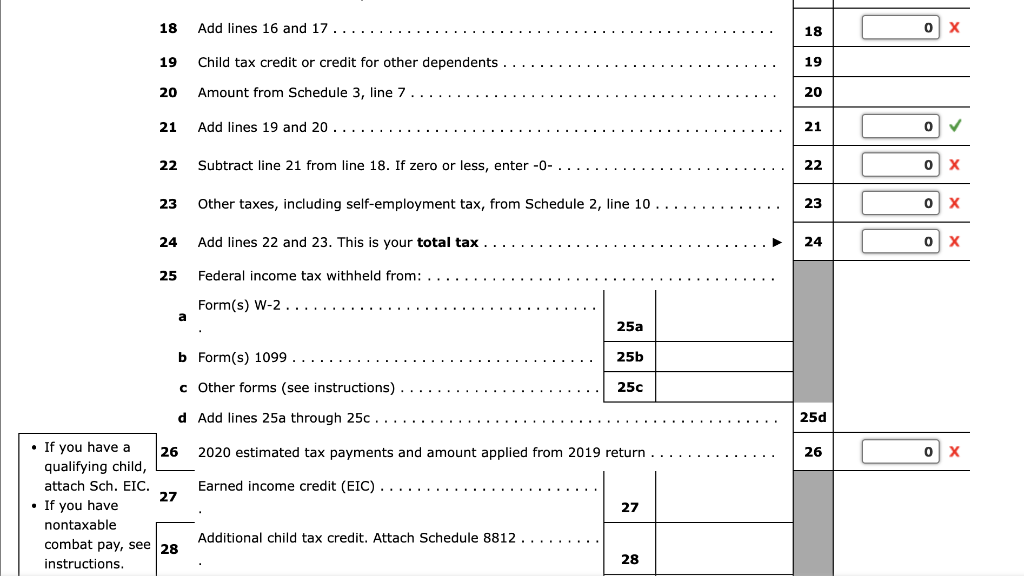

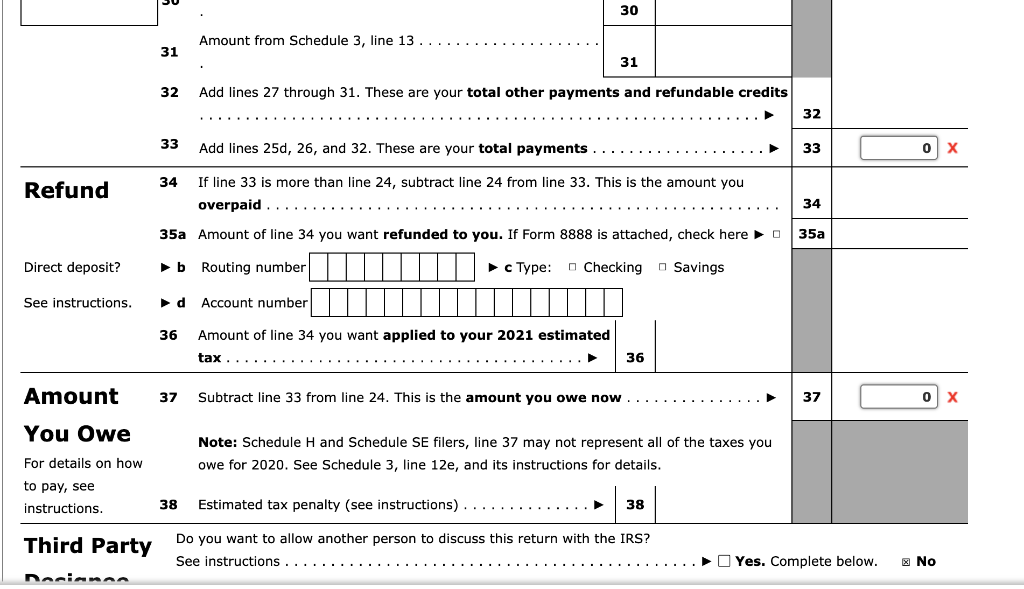

Note: This problem is for the 2020 tax year. Stone Avenue, Pleasant Hill, NM 88135. Her Social Security number is 123-45-6782. Janice's parents continue to provide health insurance questions in ProConnect Tax should be ignored. During 2020, Janice reported the following income and expense items connected with her business. Janice purchased and placed in service the following fixed assets for her business. Janice wants to elect immediate expensing under 179, if possible. - Furniture and fixtures (new) costing $21,000 on January 10 - Computer equipment (new) costing $12,400 on July 28 Janice did not keep a record of the sales tax she paid. The amount allowed by the sales tax table is $437. Janice reports interest income of $4,000 on certificates of deposit at Second National Bank. She made estimated tax payments of $5,000 for 2020 . Required: Compute Janice Morgan's 2020 Federal income tax payable (or refund due). - Make realistic assumptions about any missing data. - If an amount box does not require an entry or the answer is zero, enter "0". - Enter all amounts as positive numbers. - The taxpayer wants $3 to go to the to Presidential Election Campaign. - It may be necessary to complete the other tax forms and schedules before completing Form 1040. - Use the tax schedules (not the tax tables) included with this problem to compute the tax. - If required, round your final answers to the nearest dollar. Complete Janice Morgan's Form 1040 for 2020. - If you have a qualifying child, attach Sch. EIC. - If you have nontaxable combat pay, see instructions. 32 Add lines 27 through 31 . These are your total other payments and refundable credits Third Party Do you want to allow another person to discuss this return with the IRS? Note: This problem is for the 2020 tax year. Stone Avenue, Pleasant Hill, NM 88135. Her Social Security number is 123-45-6782. Janice's parents continue to provide health insurance questions in ProConnect Tax should be ignored. During 2020, Janice reported the following income and expense items connected with her business. Janice purchased and placed in service the following fixed assets for her business. Janice wants to elect immediate expensing under 179, if possible. - Furniture and fixtures (new) costing $21,000 on January 10 - Computer equipment (new) costing $12,400 on July 28 Janice did not keep a record of the sales tax she paid. The amount allowed by the sales tax table is $437. Janice reports interest income of $4,000 on certificates of deposit at Second National Bank. She made estimated tax payments of $5,000 for 2020 . Required: Compute Janice Morgan's 2020 Federal income tax payable (or refund due). - Make realistic assumptions about any missing data. - If an amount box does not require an entry or the answer is zero, enter "0". - Enter all amounts as positive numbers. - The taxpayer wants $3 to go to the to Presidential Election Campaign. - It may be necessary to complete the other tax forms and schedules before completing Form 1040. - Use the tax schedules (not the tax tables) included with this problem to compute the tax. - If required, round your final answers to the nearest dollar. Complete Janice Morgan's Form 1040 for 2020. - If you have a qualifying child, attach Sch. EIC. - If you have nontaxable combat pay, see instructions. 32 Add lines 27 through 31 . These are your total other payments and refundable credits Third Party Do you want to allow another person to discuss this return with the IRS