Answered step by step

Verified Expert Solution

Question

1 Approved Answer

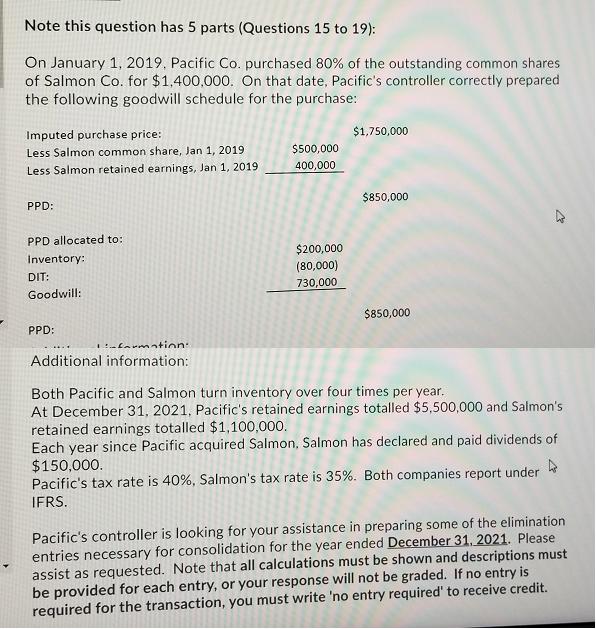

Note this question has 5 parts (Questions 15 to 19): On January 1, 2019, Pacific Co. purchased 80% of the outstanding common shares of

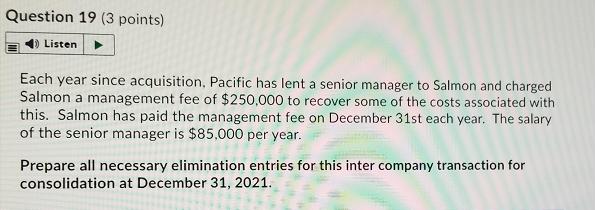

Note this question has 5 parts (Questions 15 to 19): On January 1, 2019, Pacific Co. purchased 80% of the outstanding common shares of Salmon Co. for $1,400,000. On that date, Pacific's controller correctly prepared the following goodwill schedule for the purchase: Imputed purchase price: Less Salmon common share, Jan 1, 2019 Less Salmon retained earnings, Jan 1, 2019 PPD: PPD allocated to: Inventory: DIT: Goodwill: PPD: Li-farmation: Additional information: $500,000 400,000 $200,000 (80,000) 730,000 $1,750,000 $850,000 $850,000 Both Pacific and Salmon turn inventory over four times per year. At December 31, 2021, Pacific's retained earnings totalled $5,500,000 and Salmon's retained earnings totalled $1,100,000. Each year since Pacific acquired Salmon, Salmon has declared and paid dividends of $150,000. 4 Pacific's tax rate is 40%, Salmon's tax rate is 35%. Both companies report under IFRS. Pacific's controller is looking for your assistance in preparing some of the elimination entries necessary for consolidation for the year ended December 31, 2021. Please assist as requested. Note that all calculations must be shown and descriptions must be provided for each entry, or your response will not be graded. If no entry is required for the transaction, you must write 'no entry required' to receive credit. Question 19 (3 points) Listen Each year since acquisition, Pacific has lent a senior manager to Salmon and charged Salmon a management fee of $250,000 to recover some of the costs associated with this. Salmon has paid the management fee on December 31st each year. The salary of the senior manager is $85,000 per year. Prepare all necessary elimination entries for this inter company transaction for consolidation at December 31, 2021.

Step by Step Solution

★★★★★

3.29 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Unrealised gain 300000 35 30 31...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started