Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: Where discount factors are required, use only the present value tables (Appendix 1 and 2) that appear after the formula sheet. REQUIRED Study the

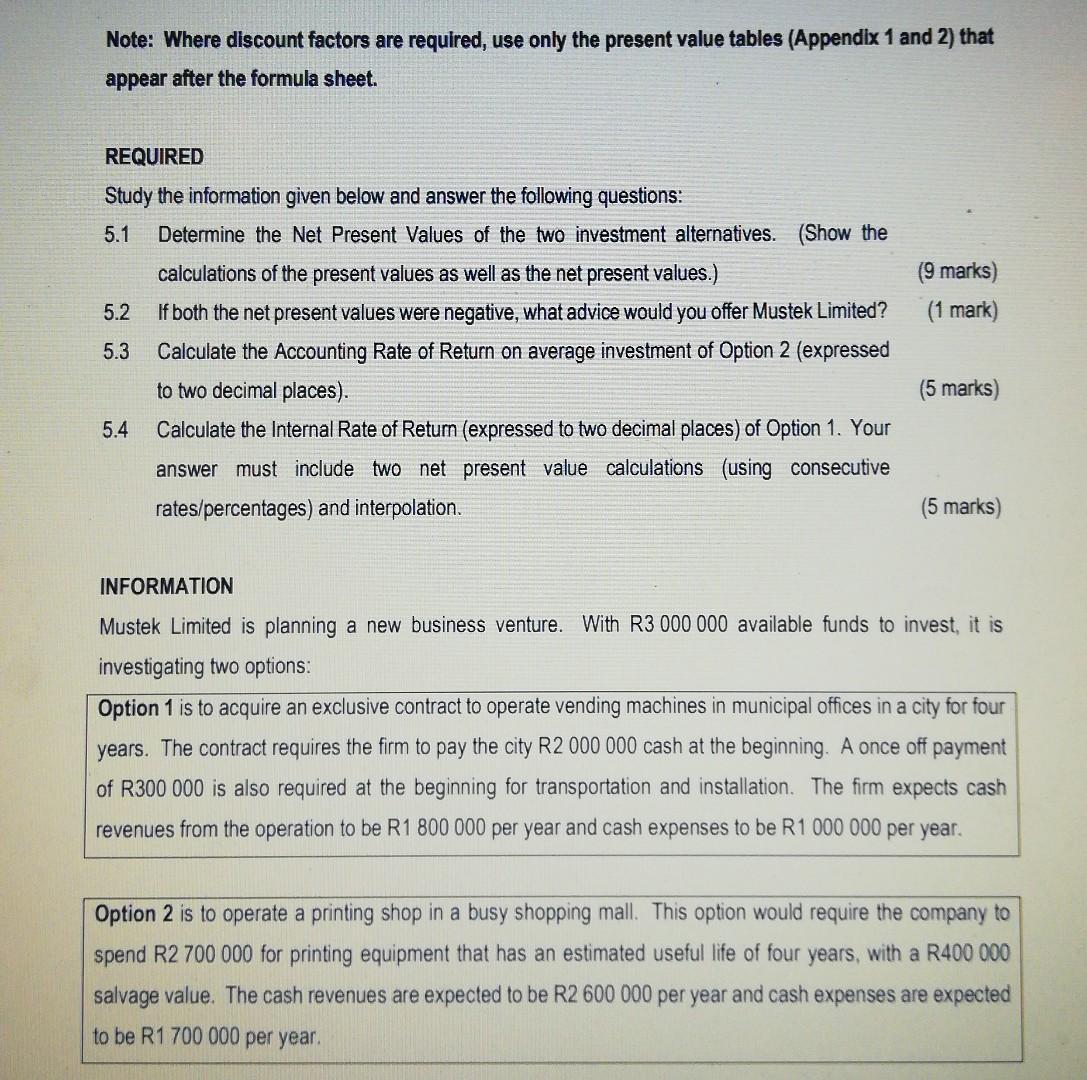

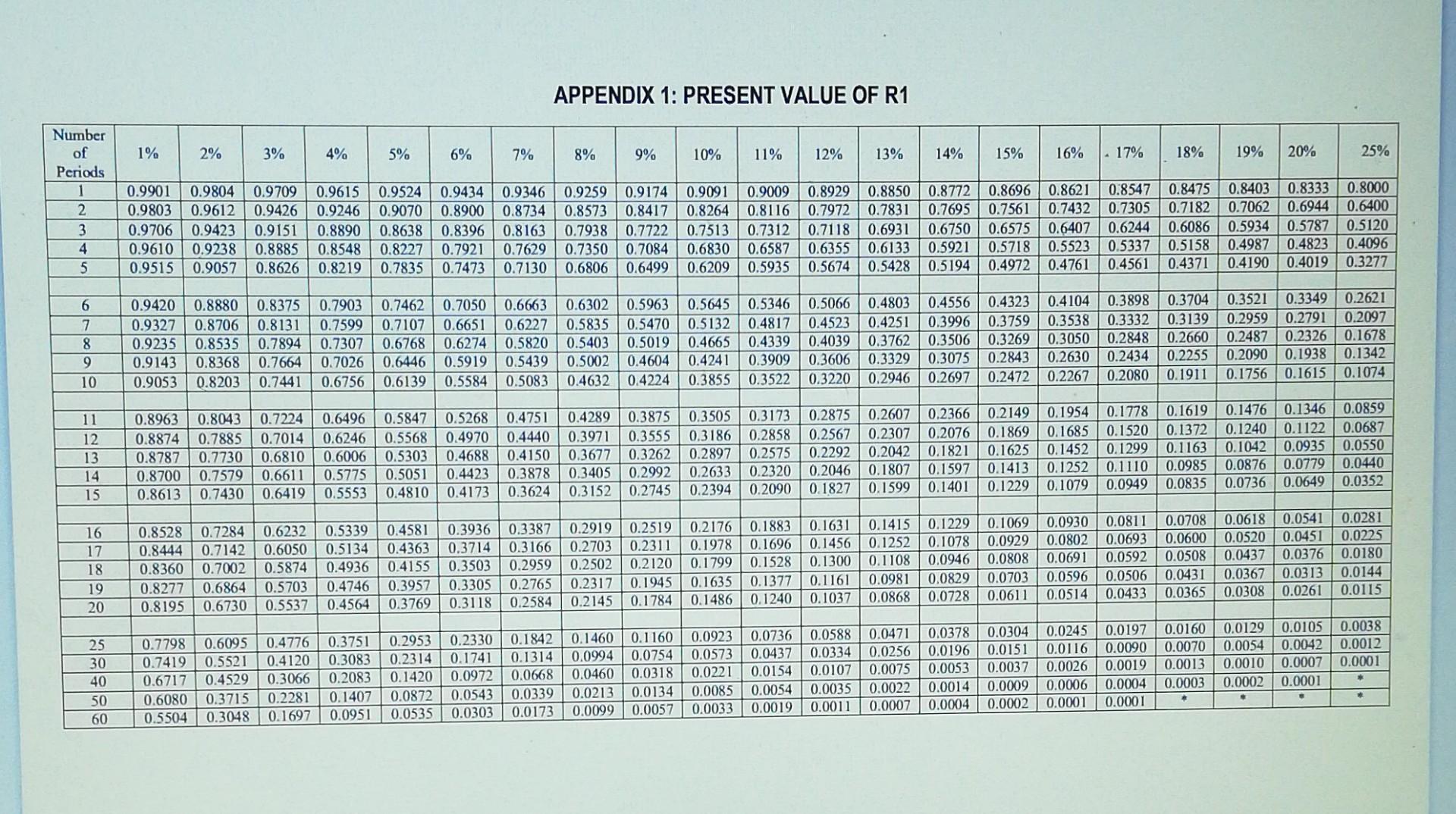

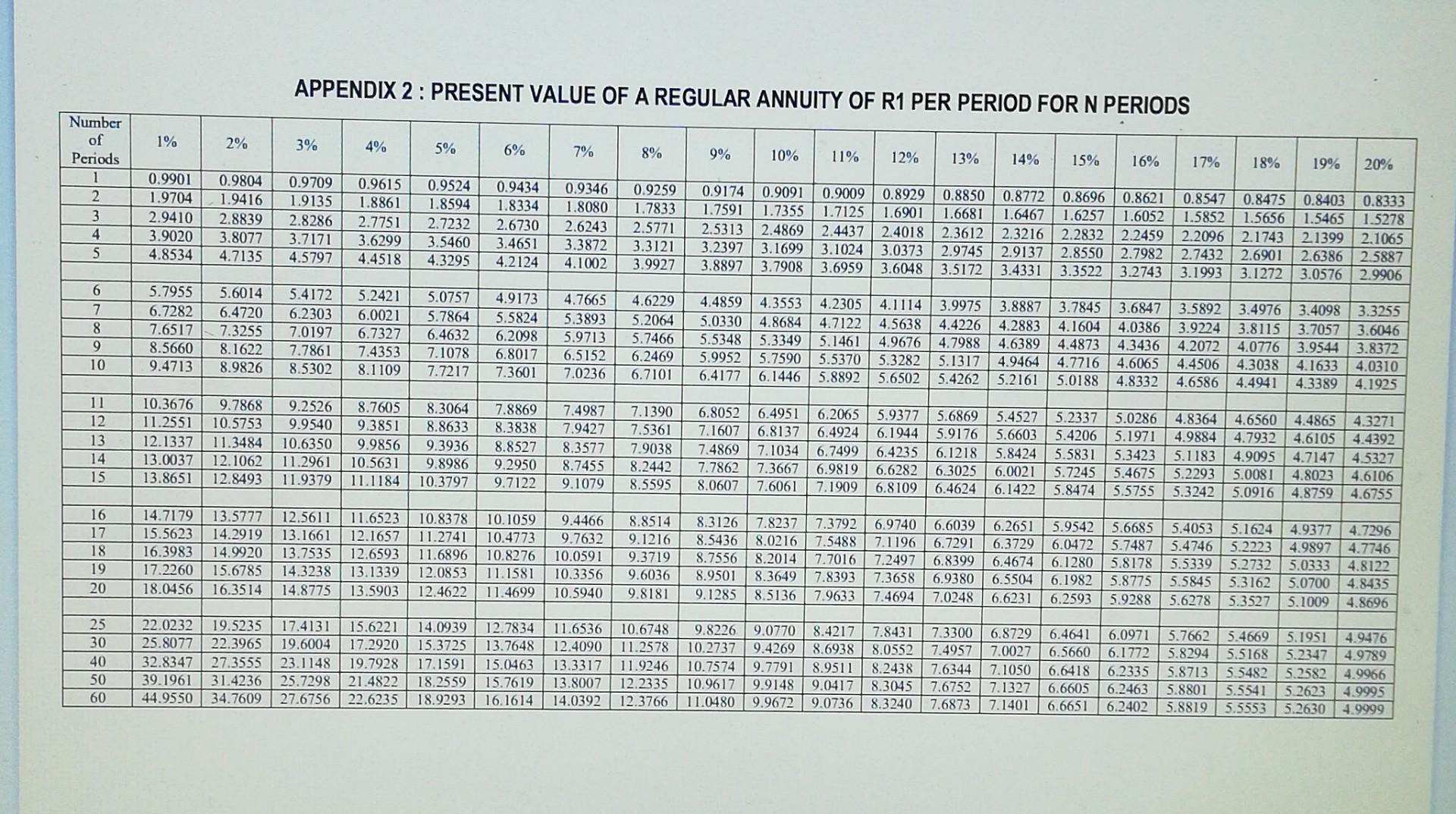

Note: Where discount factors are required, use only the present value tables (Appendix 1 and 2) that appear after the formula sheet. REQUIRED Study the information given below and answer the following questions: 5.1 Determine the Net Present Values of the two investment alternatives. (Show the calculations of the present values as well as the net present values.) (9 marks) 5.2 If both the net present values were negative, what advice would you offer Mustek Limited? (1 mark) 5.3 Calculate the Accounting Rate of Return on average investment of Option 2 (expressed to two decimal places). (5 marks) 5.4 Calculate the Internal Rate of Return (expressed to two decimal places) of Option 1. Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. (5 marks) INFORMATION Mustek Limited is planning a new business venture. With R3 000000 available funds to invest, it is investigating two options: Option 1 is to acquire an exclusive contract to operate vending machines in municipal offices in a city for four years. The contract requires the firm to pay the city R2 000000 cash at the beginning. A once off payment of R300 000 is also required at the beginning for transportation and installation. The firm expects cash revenues from the operation to be R1 800000 per year and cash expenses to be R1 000000 per year. Option 2 is to operate a printing shop in a busy shopping mall. This option would require the company to spend R2700 000 for printing equipment that has an estimated useful life of four years, with a R400 000 salvage value. The cash revenues are expected to be R2 600000 per year and cash expenses are expected to be R1 700000 per year. APPENDIX 1: PRESENT VALUE OF R1 APPENDIX 2 : PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FOR N PERIODS Note: Where discount factors are required, use only the present value tables (Appendix 1 and 2) that appear after the formula sheet. REQUIRED Study the information given below and answer the following questions: 5.1 Determine the Net Present Values of the two investment alternatives. (Show the calculations of the present values as well as the net present values.) (9 marks) 5.2 If both the net present values were negative, what advice would you offer Mustek Limited? (1 mark) 5.3 Calculate the Accounting Rate of Return on average investment of Option 2 (expressed to two decimal places). (5 marks) 5.4 Calculate the Internal Rate of Return (expressed to two decimal places) of Option 1. Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. (5 marks) INFORMATION Mustek Limited is planning a new business venture. With R3 000000 available funds to invest, it is investigating two options: Option 1 is to acquire an exclusive contract to operate vending machines in municipal offices in a city for four years. The contract requires the firm to pay the city R2 000000 cash at the beginning. A once off payment of R300 000 is also required at the beginning for transportation and installation. The firm expects cash revenues from the operation to be R1 800000 per year and cash expenses to be R1 000000 per year. Option 2 is to operate a printing shop in a busy shopping mall. This option would require the company to spend R2700 000 for printing equipment that has an estimated useful life of four years, with a R400 000 salvage value. The cash revenues are expected to be R2 600000 per year and cash expenses are expected to be R1 700000 per year. APPENDIX 1: PRESENT VALUE OF R1 APPENDIX 2 : PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FOR N PERIODS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started