Answered step by step

Verified Expert Solution

Question

1 Approved Answer

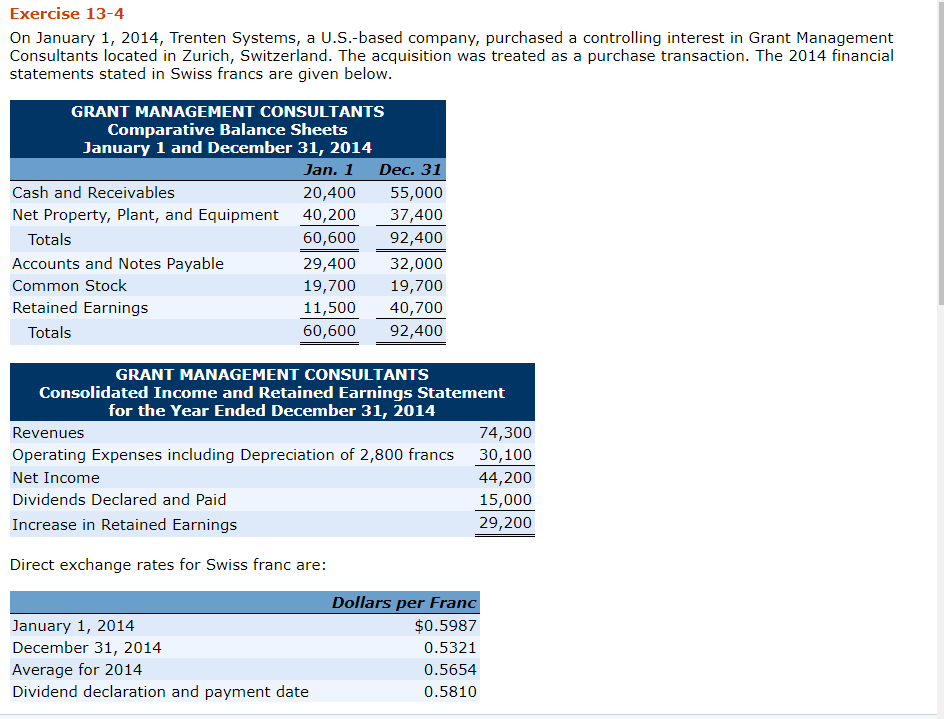

Note: You can right-click the image then open in a new tab to better see the problem Exercise 13-4 On January 1, 2014, Trenten Systems,

Note: You can right-click the image then open in a new tab to better see the problem

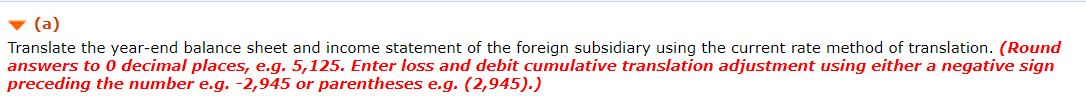

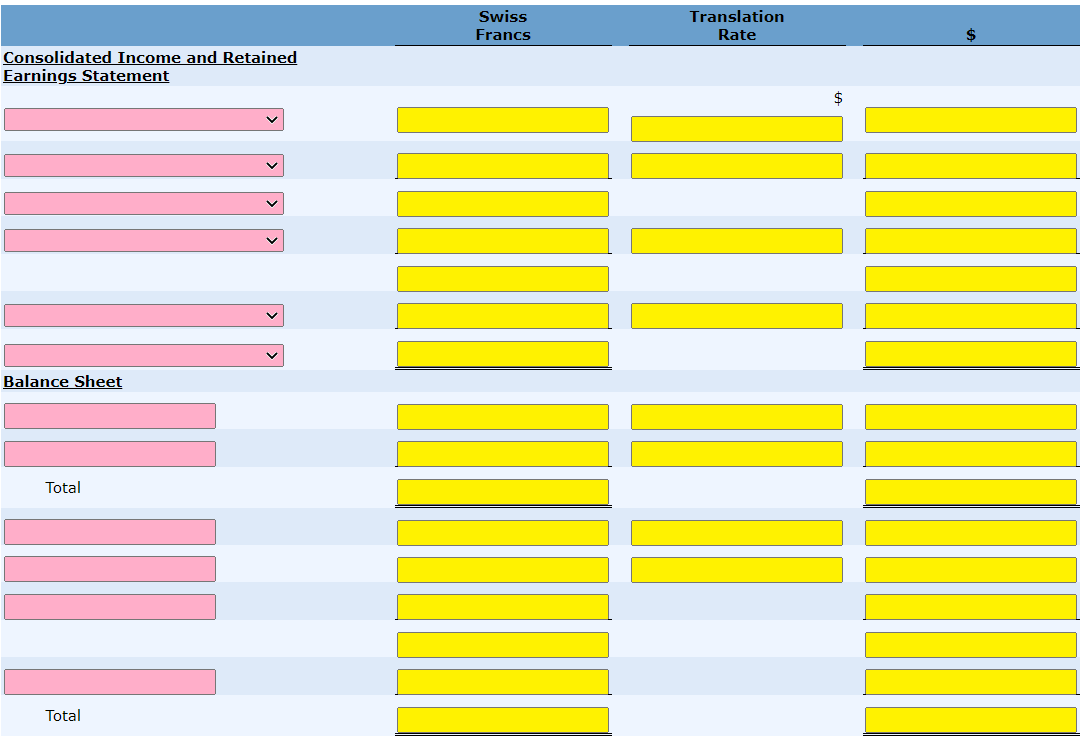

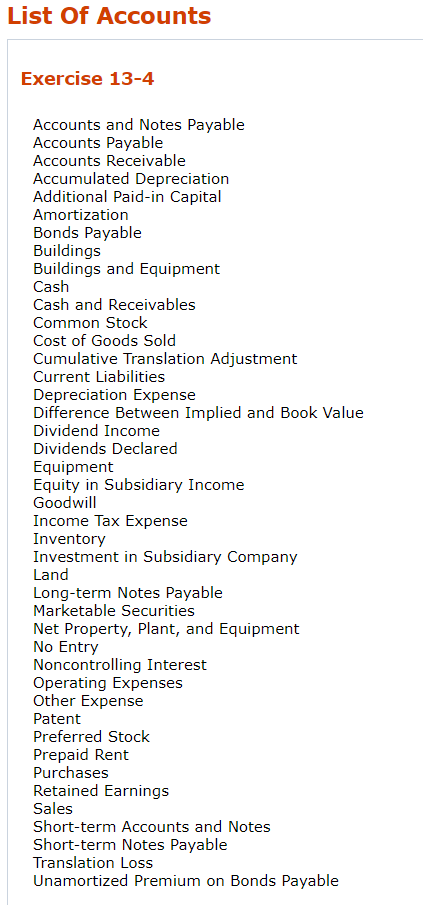

Exercise 13-4 On January 1, 2014, Trenten Systems, a U.S.-based company, purchased a controlling interest in Grant Management Consultants located in Zurich, Switzerland. The acquisition was treated as a purchase transaction. The 2014 financial statements stated in Swiss francs are given below. GRANT MANAGEMENT CONSULTANTS Comparative Balance Sheets January 1 and December 31, 2014 Jan. 1 Dec. 31 Cash and Receivables 20,400 55,000 Net Property, Plant, and Equipment 40,200 37,400 Totals 60,600 92,400 Accounts and Notes Payable 29,400 32,000 Common Stock 19,700 19,700 Retained Earnings 11,500 40,700 Totals 60,600 92,400 GRANT MANAGEMENT CONSULTANTS Consolidated Income and Retained Earnings Statement for the Year Ended December 31, 2014 Revenues 74,300 Operating Expenses including Depreciation of 2,800 francs 30,100 Net Income 44,200 Dividends Declared and Paid 15,000 Increase in Retained Earnings 29,200 Direct exchange rates for Swiss franc are: January 1, 2014 December 31, 2014 Average for 2014 Dividend declaration and payment date Dollars per Franc $0.5987 0.5321 0.5654 0.5810 (a) Translate the year-end balance sheet and income statement of the foreign subsidiary using the current rate method of translation. (Round answers to 0 decimal places, e.g. 5,125. Enter loss and debit cumulative translation adjustment using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) Swiss Francs Translation Rate Consolidated Income and Retained Earnings Statement Balance Sheet Total Total List Of Accounts Exercise 13-4 Accounts and Notes Payable Accounts Payable Accounts Receivable Accumulated Depreciation Additional Paid-in Capital Amortization Bonds Payable Buildings Buildings and Equipment Cash Cash and Receivables Common Stock Cost of Goods Sold Cumulative Translation Adjustment Current Liabilities Depreciation Expense Difference Between Implied and Book Value Dividend Income Dividends Declared Equipment Equity in Subsidiary Income Goodwill Income Tax Expense Inventory Investment in Subsidiary Company Land Long-term Notes Payable Marketable Securities Net Property, Plant, and Equipment No Entry Noncontrolling Interest Operating Expenses Other Expense Patent Preferred Stock Prepaid Rent Purchases Retained Earnings Sales Short-term Accounts and Notes Short-term Notes Payable Translation Loss Unamortized Premium on Bonds PayableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started