Answered step by step

Verified Expert Solution

Question

1 Approved Answer

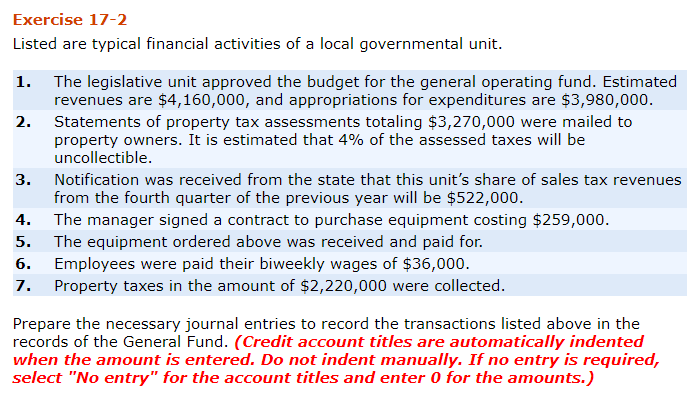

Note: You can right-click the image then open in a new tab to better see the problem Exercise 17-2 Listed are typical financial activities of

Note: You can right-click the image then open in a new tab to better see the problem

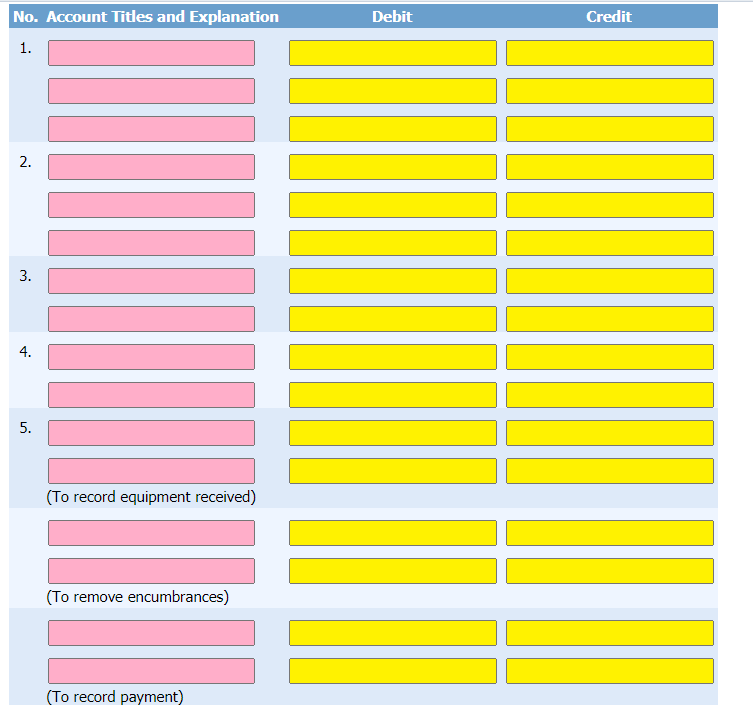

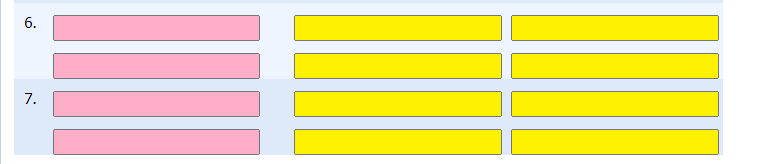

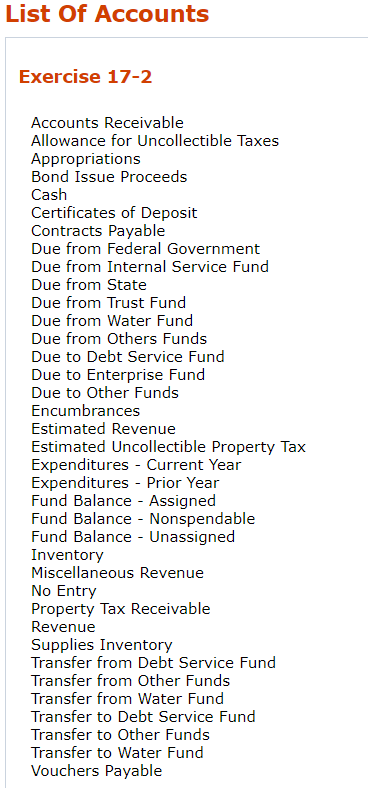

Exercise 17-2 Listed are typical financial activities of a local governmental unit. 1. The legislative unit approved the budget for the general operating fund. Estimated revenues are $4,160,000, and appropriations for expenditures are $3,980,000. 2. Statements of property tax assessments totaling $3,270,000 were mailed to property owners. It is estimated that 4% of the assessed taxes will be uncollectible. 3. Notification was received from the state that this unit's share of sales tax revenues from the fourth quarter of the previous year will be $522,000. 4. The manager signed a contract to purchase equipment costing $259,000. 5. The equipment ordered above was received and paid for. 6. Employees were paid their biweekly wages of $36,000. 7. Property taxes in the amount of $2,220,000 were collected. Prepare the necessary journal entries to record the transactions listed above in the records of the General Fund. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit 1. 2. 3. 4. 5. (To record equipment received) (To remove encumbrances) (To record payment) 5. 7. List of Accounts Exercise 17-2 Accounts Receivable Allowance for Uncollectible Taxes Appropriations Bond Issue Proceeds Cash Certificates of Deposit Contracts Payable Due from Federal Government Due from Internal Service Fund Due from State Due from Trust Fund Due from Water Fund Due from Others Funds Due to Debt Service Fund Due to Enterprise Fund Due to Other Funds Encumbrances Estimated Revenue Estimated Uncollectible Property Tax Expenditures - Current Year Expenditures - Prior Year Fund Balance - Assigned Fund Balance - Nonspendable Fund Balance - Unassigned Inventory Miscellaneous Revenue No Entry Property Tax Receivable Revenue Supplies Inventory Transfer from Debt Service Fund Transfer from Other Funds Transfer from Water Fund Transfer to Debt Service Fund Transfer to Other Funds Transfer to Water Fund Vouchers PayableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started