Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note:Both are subparts of the same question .Do not consider it as separate Gordon Growth company has identified the two mutually projects. Both project A

Note:Both are subparts of the same question .Do not consider it as separate

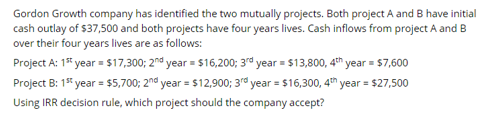

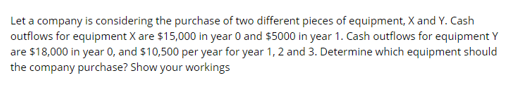

Gordon Growth company has identified the two mutually projects. Both project A and B have initial cash outlay of $37,500 and both projects have four years lives. Cash inflows from project A and B over their four years lives are as follows: Project A: 1st year = $17,300; 2nd year = $16,200; 3rd year = $13,800, 4th year = $7,600 Project B: 15 year = $5,700; 2nd year = $12,900; 3rd year = $16,300, 4th year = $27,500 Using IRR decision rule, which project should the company accept? Let a company is considering the purchase of two different pieces of equipment, X and Y. Cash outflows for equipment X are $15,000 in year 0 and $5000 in year 1. Cash outflows for equipment Y are $18,000 in year 0, and $10,500 per year for year 1, 2 and 3. Determine which equipment should the company purchase? Show your workingsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started