Answered step by step

Verified Expert Solution

Question

1 Approved Answer

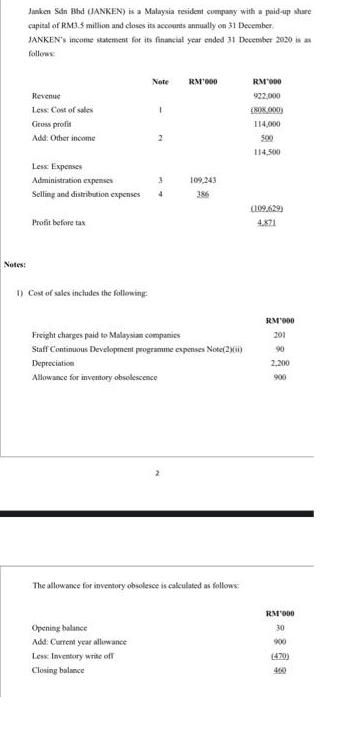

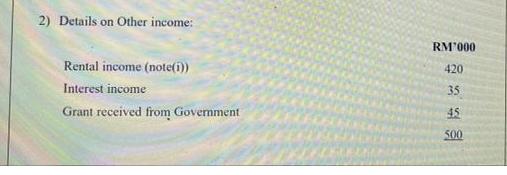

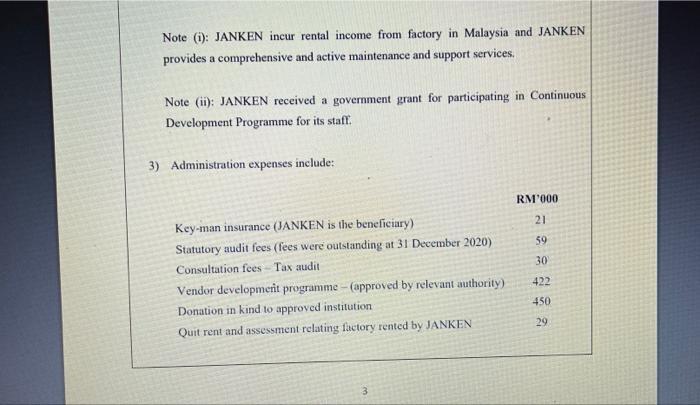

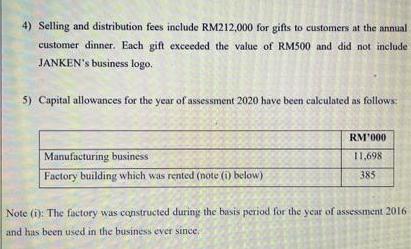

Notes: Janken Sdn Bhd (JANKEN) is a Malaysia resident company with a paid-up share capital of RM3.5 million and closes its accounts annually on

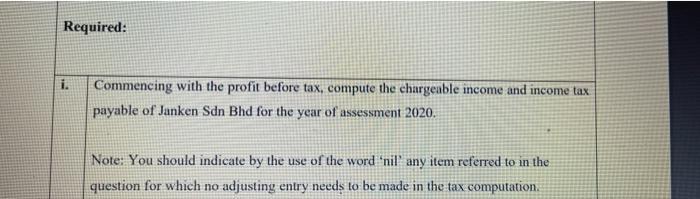

Notes: Janken Sdn Bhd (JANKEN) is a Malaysia resident company with a paid-up share capital of RM3.5 million and closes its accounts annually on 31 December JANKEN's income statement for its financial year ended 31 December 2020 is a follows: Revenue Less: Cost of sales Gross profit Add: Other income Profit before tax 1) Cost of sales includes the following: Note Less Expenses Administration expenses 3 Selling and distribution expenses 4 I 2 Opening balance Add: Current year allowance Less: Inventory write off Closing balance RM'000 109,243 Freight charges paid to Malaysian companies Staff Continuous Development programme expenses Note(2)() Depreciation Allowance for inventory obsolescence The allowance for inventory obsolesce is calculated as follows: RM'000 922,000 (808,000) 114,000 500 114,500 (109.629) 4.871 RM'000 201 90 2,200 900 RM'000 30 900 (470) 460 2) Details on Other income: Rental income (note(i)) Interest income Grant received from Government RM'000 420 35 45 500 Note (i): JANKEN incur rental income from factory in Malaysia and JANKEN provides a comprehensive and active maintenance and support services. Note (ii): JANKEN received a government grant for participating in Continuous Development Programme for its staff. 3) Administration expenses include: Key-man insurance (JANKEN is the beneficiary) Statutory audit fees (fees were outstanding at 31 December 2020) Consultation fees - Tax audit Vendor development programme - (approved by relevant authority) Donation in kind to approved institution Quit rent and assessment relating factory rented by JANKEN RM'000 21 59 30 422 450 29 4) Selling and distribution fees include RM212,000 for gifts to customers at the annual customer dinner. Each gift exceeded the value of RM500 and did not include JANKEN's business logo. 5) Capital allowances for the year of assessment 2020 have been calculated as follows: Manufacturing business Factory building which was rented (note (1) below) RM'000 11,698 385 Note (i): The factory was constructed during the basis period for the year of assessment 2016 and has been used in the business ever since, Required: Commencing with the profit before tax, compute the chargeable income and income tax payable of Janken Sdn Bhd for the year of assessment 2020. Note: You should indicate by the use of the word 'nil' any item referred to in the question for which no adjusting entry needs to be made in the tax computation.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

In the books of JANKEN Profit and Loss for the yeare ended 31122020 Note RM000 Revenue Less cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started