Notes: Please answer all questions below. Note that you must show all of your work to receive full marks. An answer that shows only part of your work may receive part marks, an answer that shows no work but writes a correct answer will receive no marks. This includes formulas used, working through the formulas, cash flow assumptions, etc. Please reach out to your instructor with any questions. A few hints that might help you: 1) I am asking you to use real world data in some questions. Google is your friend. The numbers you need to use are not hard to find. 2) For question 1, drawing a cash flow diagram may be very helpful.

Notes: Please answer all questions below. Note that you must show all of your work to receive full marks. An answer that shows only part of your work may receive part marks, an answer that shows no work but writes a correct answer will receive no marks. This includes formulas used, working through the formulas, cash flow assumptions, etc. Please reach out to your instructor with any questions. A few hints that might help you: 1) I am asking you to use real world data in some questions. Google is your friend. The numbers you need to use are not hard to find. 2) For question 1, drawing a cash flow diagram may be very helpful.

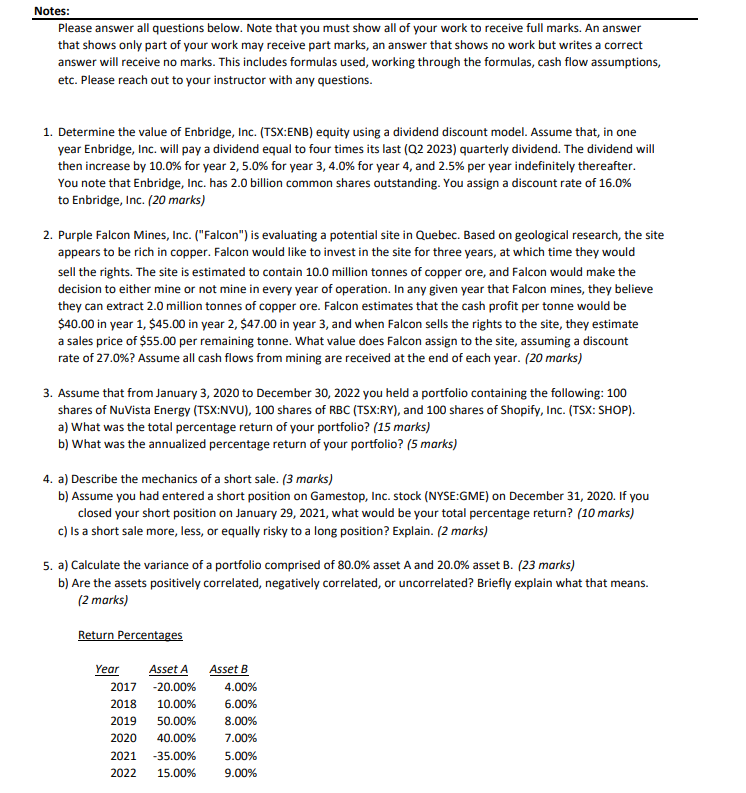

Please answer all questions below. Note that you must show all of your work to receive full marks. An answer that shows only part of your work may receive part marks, an answer that shows no work but writes a correct answer will receive no marks. This includes formulas used, working through the formulas, cash flow assumptions, etc. Please reach out to your instructor with any questions. 1. Determine the value of Enbridge, Inc. (TSX:ENB) equity using a dividend discount model. Assume that, in one year Enbridge, Inc. will pay a dividend equal to four times its last (Q2 2023) quarterly dividend. The dividend will then increase by 10.0% for year 2,5.0% for year 3,4.0% for year 4 , and 2.5% per year indefinitely thereafter. You note that Enbridge, Inc. has 2.0 billion common shares outstanding. You assign a discount rate of 16.0% to Enbridge, Inc. (20 marks) 2. Purple Falcon Mines, Inc. ("Falcon") is evaluating a potential site in Quebec. Based on geological research, the site appears to be rich in copper. Falcon would like to invest in the site for three years, at which time they would sell the rights. The site is estimated to contain 10.0 million tonnes of copper ore, and Falcon would make the decision to either mine or not mine in every year of operation. In any given year that Falcon mines, they believe they can extract 2.0 million tonnes of copper ore. Falcon estimates that the cash profit per tonne would be $40.00 in year 1,$45.00 in year 2,$47.00 in year 3 , and when Falcon sells the rights to the site, they estimate a sales price of $55.00 per remaining tonne. What value does Falcon assign to the site, assuming a discount rate of 27.0% ? Assume all cash flows from mining are received at the end of each year. (20 marks) 3. Assume that from January 3, 2020 to December 30, 2022 you held a portfolio containing the following: 100 shares of NuVista Energy (TSX:NVU), 100 shares of RBC (TSX:RY), and 100 shares of Shopify, Inc. (TSX: SHOP). a) What was the total percentage return of your portfolio? (15 marks) b) What was the annualized percentage return of your portfolio? (5 marks) 4. a) Describe the mechanics of a short sale. (3 marks) b) Assume you had entered a short position on Gamestop, Inc. stock (NYSE:GME) on December 31, 2020. If you closed your short position on January 29, 2021, what would be your total percentage return? (10 marks) c) Is a short sale more, less, or equally risky to a long position? Explain. (2 marks) 5. a) Calculate the variance of a portfolio comprised of 80.0% asset A and 20.0% asset B. (23 marks) b) Are the assets positively correlated, negatively correlated, or uncorrelated? Briefly explain what that means. (2 marks) ReturnPercentages

Notes: Please answer all questions below. Note that you must show all of your work to receive full marks. An answer that shows only part of your work may receive part marks, an answer that shows no work but writes a correct answer will receive no marks. This includes formulas used, working through the formulas, cash flow assumptions, etc. Please reach out to your instructor with any questions. A few hints that might help you: 1) I am asking you to use real world data in some questions. Google is your friend. The numbers you need to use are not hard to find. 2) For question 1, drawing a cash flow diagram may be very helpful.

Notes: Please answer all questions below. Note that you must show all of your work to receive full marks. An answer that shows only part of your work may receive part marks, an answer that shows no work but writes a correct answer will receive no marks. This includes formulas used, working through the formulas, cash flow assumptions, etc. Please reach out to your instructor with any questions. A few hints that might help you: 1) I am asking you to use real world data in some questions. Google is your friend. The numbers you need to use are not hard to find. 2) For question 1, drawing a cash flow diagram may be very helpful.