Notes: The Accounts for each question are already provided. Please find the amounts for each journal entry AND follow all rounding rules indicated in the questions.

Accounting Problem

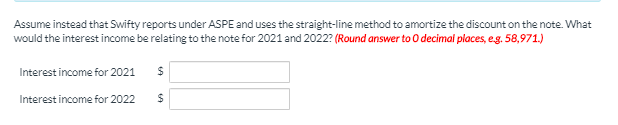

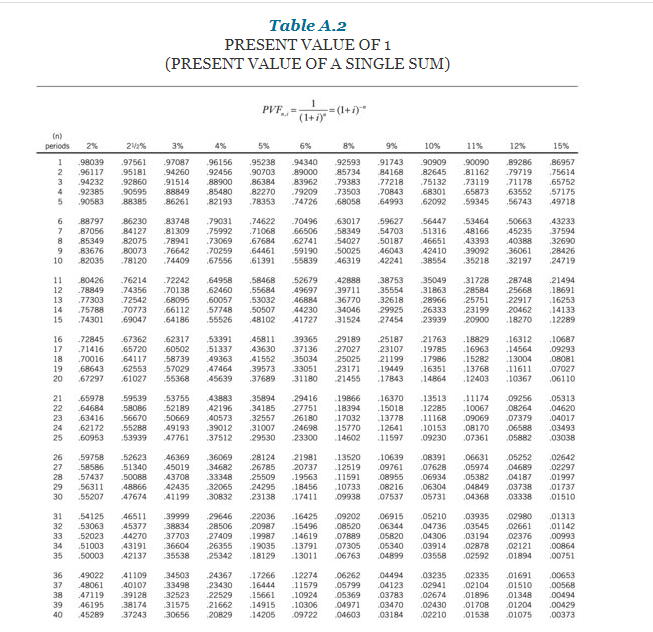

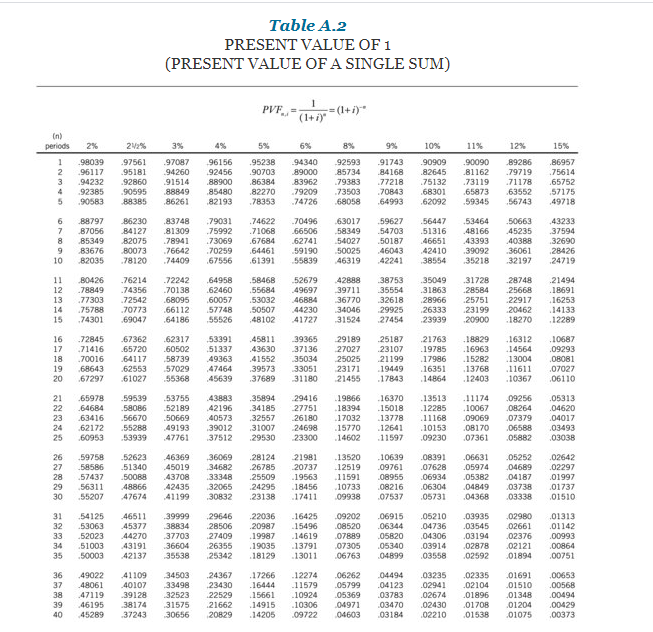

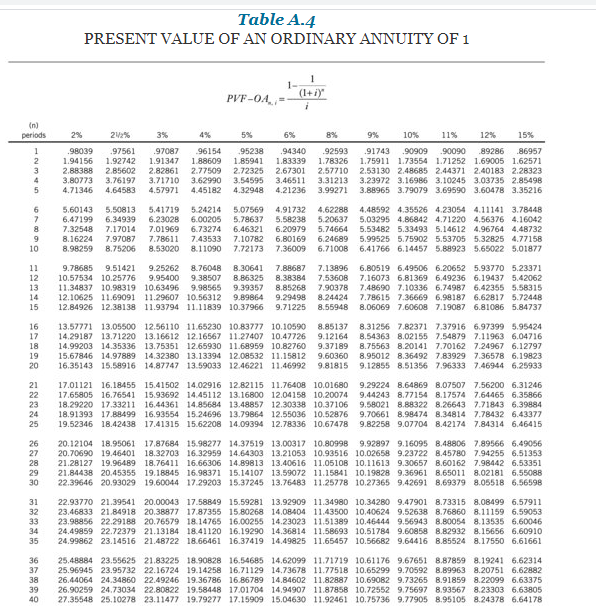

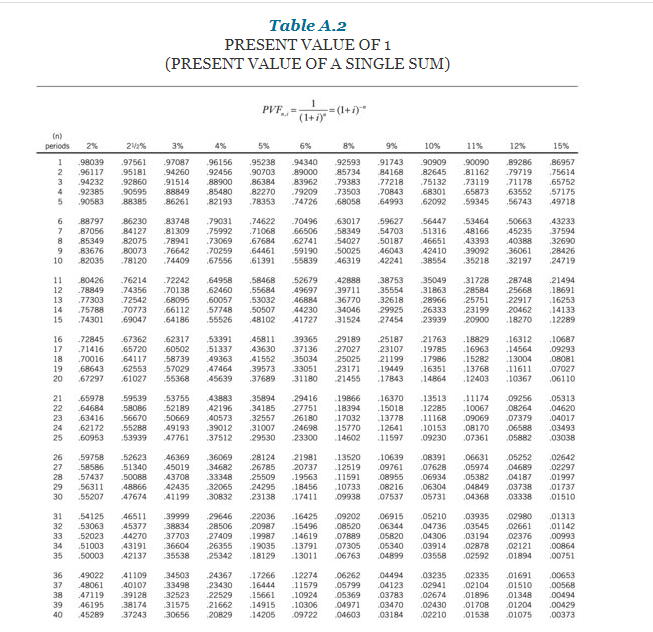

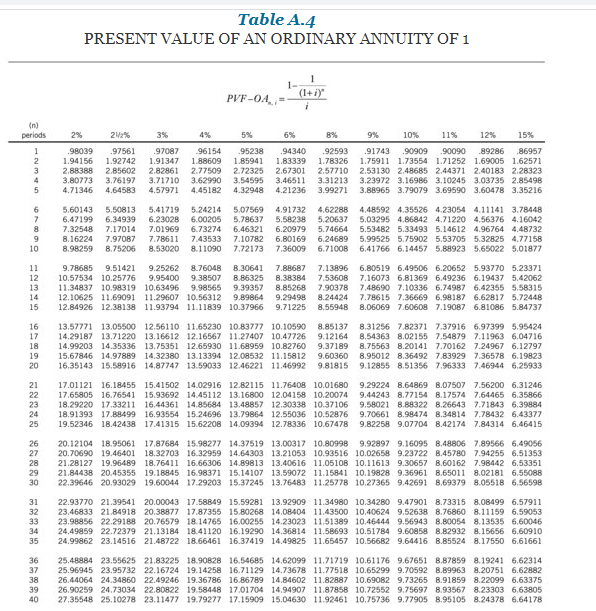

By December 31, 2020,SwiftyCorp. had performed a significant amount of environmental consulting services forWildhorseLtd.Wildhorsewas short of cash, andSwiftyagreed to accept a $277,000, non-interest-bearing note due December 31, 2022, as payment in full.Wildhorseis a bit of a credit risk and typically borrows funds at a rate of12%.Swiftyis much more creditworthy and has various lines of credit at9%.SwiftyCorp. reports under IFRS. Please Use the tables provided to solve Part 1, Part 2, and Part 3

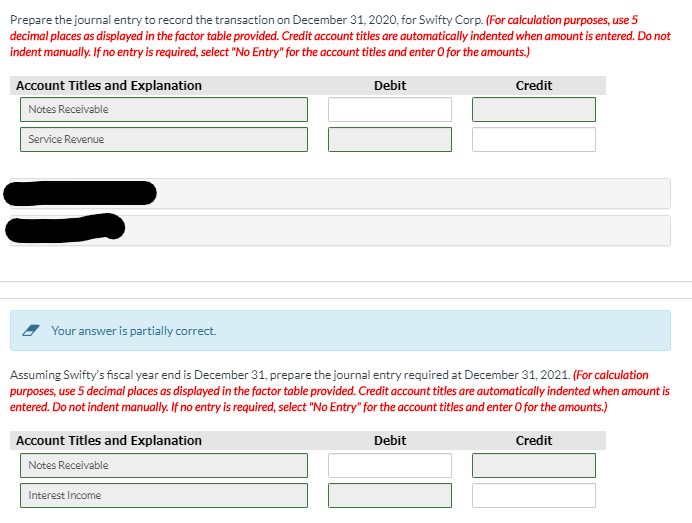

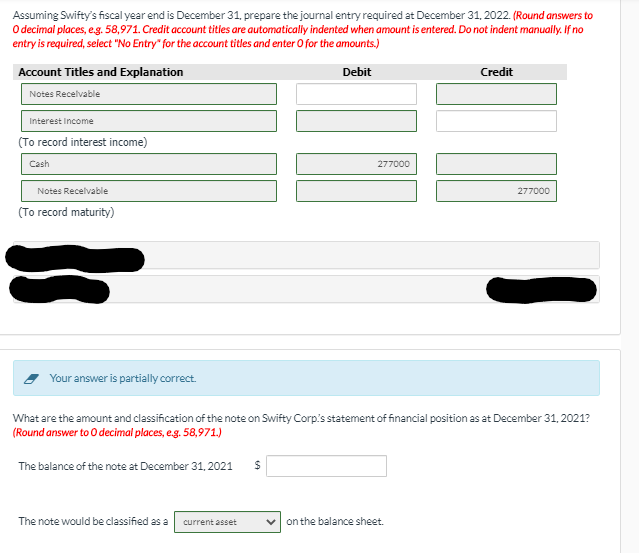

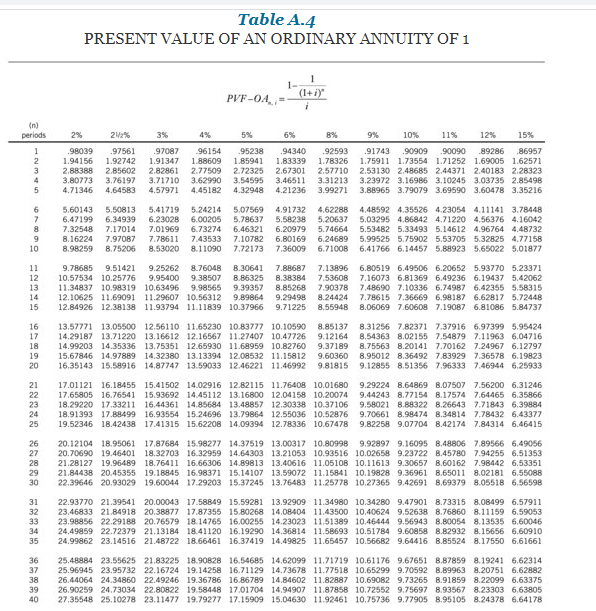

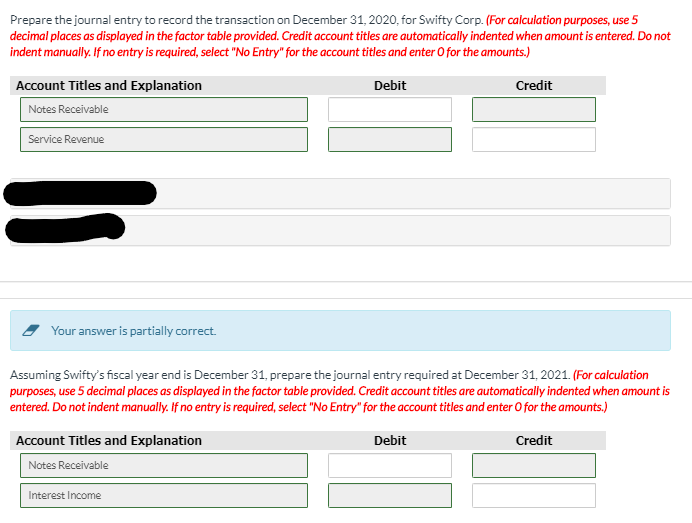

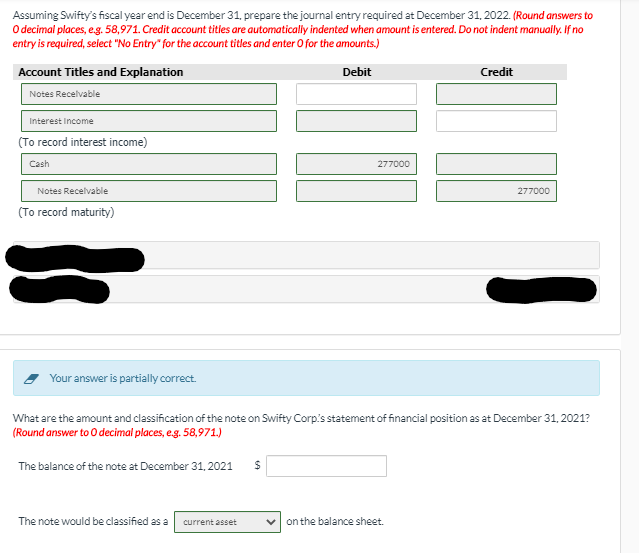

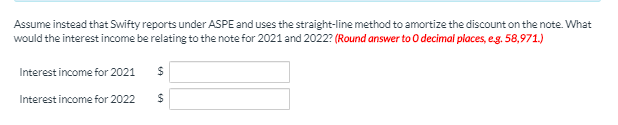

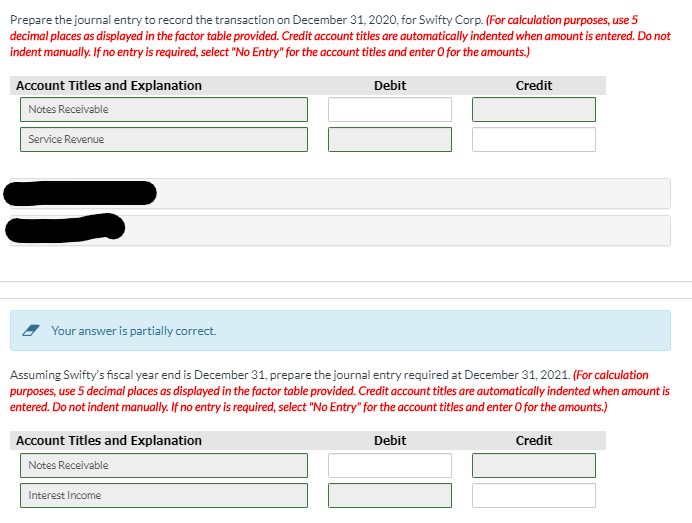

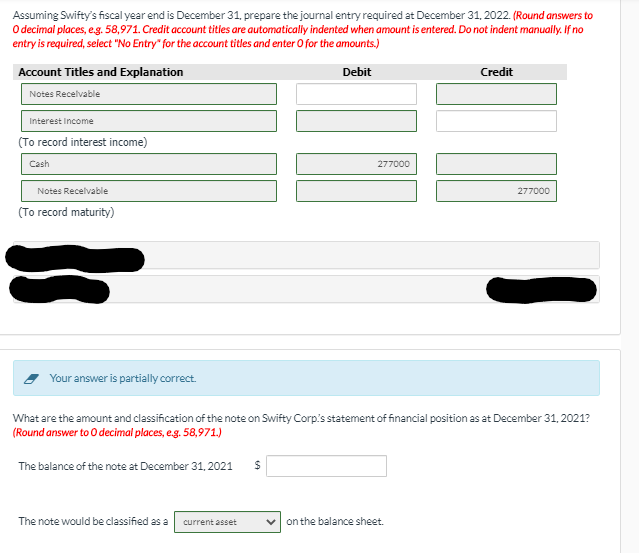

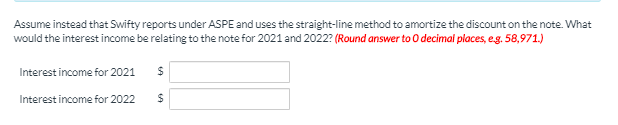

Prepare the journal entry to record the transaction on December 31, 2020, for Swifty Corp. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Notes Receivable Service Revenue Your answer is partially correct. Assuming Swifty's fiscal year end is December 31, prepare the journal entry required at December 31, 2021. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Notes Receivable Interest IncomeAssuming Swifty's fiscal year end is December 31, prepare the journal entry required at December 31, 2022. (Round answers to O decimal places, e.g. 58,971. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Notes Receivable Interest Income (To record interest income) Cash 277000 Notes Receivable 277000 (To record maturity) Your answer is partially correct. What are the amount and classification of the note on Swifty Corp's statement of financial position as at December 31, 2021? (Round answer to O decimal places, e.g. 58,971.) The balance of the note at December 31, 2021 $ The note would be classified as a current asset on the balance sheet.Assume instead that Swifty reports under ASPE and uses the straight-line method to amortize the discount on the note. What would the interest income be relating to the note for 2021 and 2022? (Round answer to O decimal places, e.g. 58,971.) Interest income for 2021 Interest income for 2022\fTable A.4 PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 PVF-OA= (1+ 1) (nj periods 242% 3% 5%% 9% 10%% 11% 12% 15%% .98039 .97561 .97087 .96154 .95238 .94340 92593 .91743 .90909 .90090 .89286 .86957 1.94156 1.92742 1.91347 1.88609 1 85941 1.83339 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.88388 2.85602 2.82861 2.77505 2.72325 2.67301 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.80773 3.76197 3.71710 3.62990 3.54595 3.46511 3.31213 3.23972 3.16984 3.10245 3.03735 2.85498 4.71346 4.64583 4.57971 4.45182 4.32948 4.21236 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 5.60143 5.50813 5.41719 5 24214 5.07569 4.91732 4.62288 4,48592 4.35526 4.23054 4.11141 3.78448 6,47199 6.34939 6.23028 6.00205 5,78637 5.58238 5.20437 5,03295 4.86842 4.71220 4.56376 4.16042 7.32548 7.17014 7.01969 6.73274 6.46321 6.20979 5.74664 5.53482 12 5.33493 5.14612 4.96764 4.48732 9 8.16224 7.97087 7.78611 7.43533 7.10782 6.80169 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 10 8,98259 8.75206 8,53020 8.11090 7.72173 7.36009 6.71008 6,41766 6.14457 5.68923 5.65022 5.01877 11 9.78685 9.51421 9.25262 8.76048 B.30641 7.88687 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 12 10.57534 10.25776 9.95400 9.38507 B.86325 8.38384 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 13 11.34837 10.98319 10.63496 9.98565 9.39357 8.85268 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 14 12.10625 11.69091 11.29507 10.56312 9.89864 9.29498 8.24424 7.78615 7:35669 6.98187 6.62817 5.72448 15 12.84926 12.38138 11.93794 11.11839 10.37966 9.71225 8.56948 8.06069 760608 7.19087 6.81086 5.84737 16 13.57771 13.05500 12.56110 11.65230 10.83777 10.10590 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 17 18 14,29187 13,71220 1 13.16612 12.16567 11.27407 10.47726 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 14.35336 13.75351 12 65930 11 68959 10.82760 9.37189 8.75563 3 8.20141 7.70162 7.24967 6.12797 19 14.99203 15.67846 14.97889 14.32380 13.13394 12.08532 11.15812 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 20 16.35143 15.58916 14,87747 13 59093 12.46221 11.46992 9.81815 9.12855 8.5 7.96333 7.46944 6.25933 21 17.01121 16.18455 15.41502 14.02916 12 82115 11.76408 10.01680 9.29224 8.64869 8.07507 7.56200 6.31246 22 17.65805 16.76541 15.93692 14.45112 13.16800 12.04158 10.20074 9.44243 8.77154 8.17574 7.64465 6.35866 23 18.29220 17.33211 16,44361 14.85694 13.48857 12.30338 10.37106 9.59021 8.89322 8.26643 7.71843 6.39884 24 18.91393 17.88499 16.93554 15 24696 13.79864 12.55035 10.52876 9.70661 8.98474 8.34814 7.78432 6.43377 25 19.52346 18.42438 17.41315 15.62208 14/09394 12.78336 10.67478 9.82258 9.07704 8.42174 7.84314 6.46415 26 20.12104 18.95061 17.87684 15.98277 14.37519 13.00317 10.80998 9.92897 9.16095 8.48805 7.89566 6.49056 27 20.70690 19.46401 18.32703 03 16.32959 14.64303 13.21053 10.93516 10.02658 9.23722 8.45780 7.94255 6.51353 28 29 21.28127 19.96489 18.76411 16.66306 6 14 89813 13.40616 11.05108 10.11613 9.30657 8.60162 7.98442 6.53351 21.84438 20.45355 19.18845 16 98371 15.14107 13.59072 11.15841 10.19828 9.36961 8.65011 802181 6.55085 30 22.39646 20.93029 19.60044 17 29203 15.37245 13.76483 11.25778 10.27365 9.42691 8.69379 805918 6.56598 31 22.93770 21.39541 20.00043 17 58849 15.59281 13.92909 11.34980 10.34280 9.47901 8.73315 8.08499 6.57911 32 23.46833 21.84918 20.38877 17 87355 15 80268 14,08404 11.43500 10,40624 9.52638 8.76860 1 8 11159 6.59053 33 23.98856 22.29189 20.76579 18 14765 16.00255 14.23023 11.51389 10,46444 9.56943 8.80054 8.13535 6.60046 34 24.49859 22.72379 21.13184 18.41120 16.19290 14.36814 11.58693 10.51784 9.60858 8.82932 8.15656 6.60910 35 24.99862 23.14516 21.48722 18 66461 16.37419 14.49825 11.65457 10.56682 9.64416 8.85524 8.17550 6.61661 36 25.48984 23.55625 21.83225 18 90828 16.54685 14,62099 11.71719 10.61176 9.67651 8.87859 8.19241 6.62314 37 25.96945 23.95732 22.16724 19.14258 16.71129 14.73678 11.77518 10.65299 9.70592 8.89963 8.20751 6.62882 38 26.44064 24.34860 22.49246 19.36786 16.86789 14.84602 11.82887 10.69082 12 9.73265 8.91859 8.22099 6.63375 39 40 26.90259 2 24.73034 22.80822 19.58448 8 17:01704 14,94907 11.87858 10.72552 9.75697 8.93567 8.23303 6.63805 27.35548 25.10278 23.11477 19.79277 17.15909 15.04630 11.92461 10,75736 9.77905 8.95105 8.24378 6.64178