Answered step by step

Verified Expert Solution

Question

1 Approved Answer

< Notes You work as the management accountant for Grabby's Medical Solutions Company (GMSco). They currently sell digital medical systems (systems) to the health care

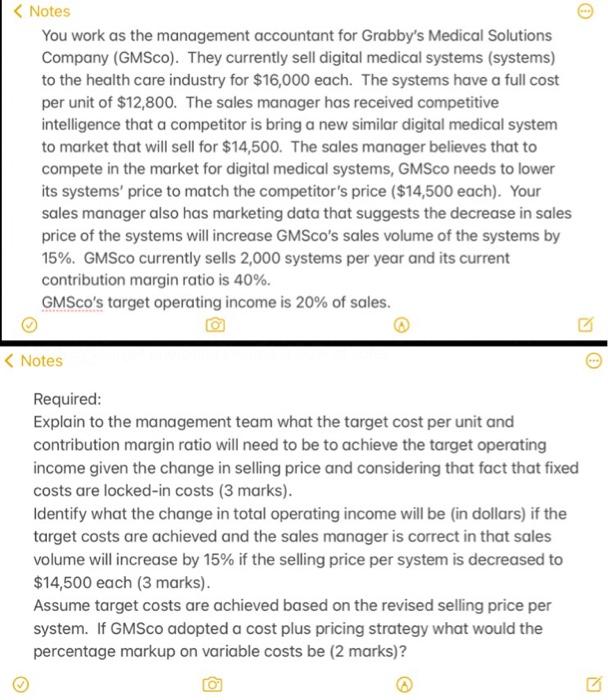

< Notes You work as the management accountant for Grabby's Medical Solutions Company (GMSco). They currently sell digital medical systems (systems) to the health care industry for $16,000 each. The systems have a full cost per unit of $12,800. The sales manager has received competitive intelligence that a competitor is bring a new similar digital medical system to market that will sell for $14,500. The sales manager believes that to compete in the market for digital medical systems, GMSco needs to lower its systems' price to match the competitor's price ($14,500 each). Your sales manager also has marketing data that suggests the decrease in sales price of the systems will increase GMSco's sales volume of the systems by 15%. GMSCO currently sells 2,000 systems per year and its current contribution margin ratio is 40%. GMSco's target operating income is 20% of sales. < Notes Required: Explain to the management team what the target cost per unit and contribution margin ratio will need to be to achieve the target operating income given the change in selling price and considering that fact that fixed costs are locked-in costs (3 marks). Identify what the change in total operating income will be (in dollars) if the target costs are achieved and the sales manager is correct in that sales volume will increase by 15% if the selling price per system is decreased to $14,500 each (3 marks). Assume target costs are achieved based on the revised selling price per system. If GMSco adopted a cost plus pricing strategy what would the percentage markup on variable costs be (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started