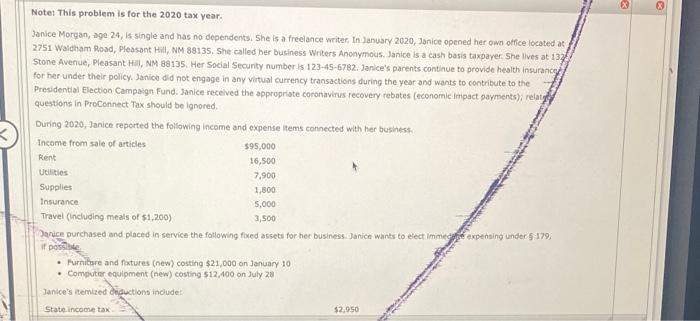

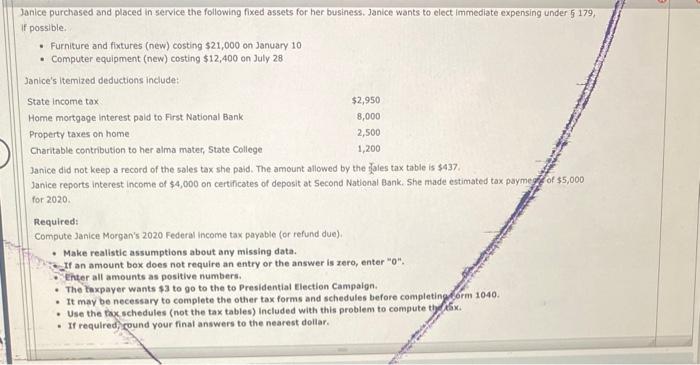

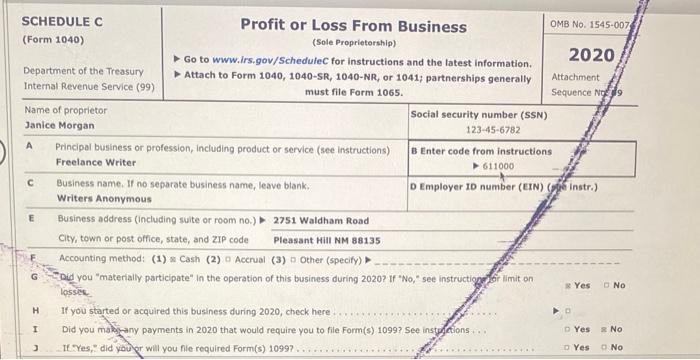

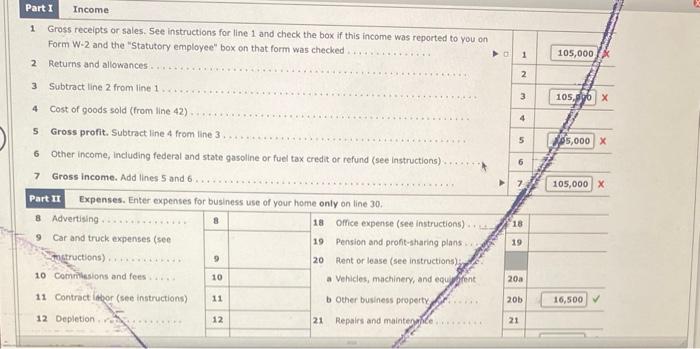

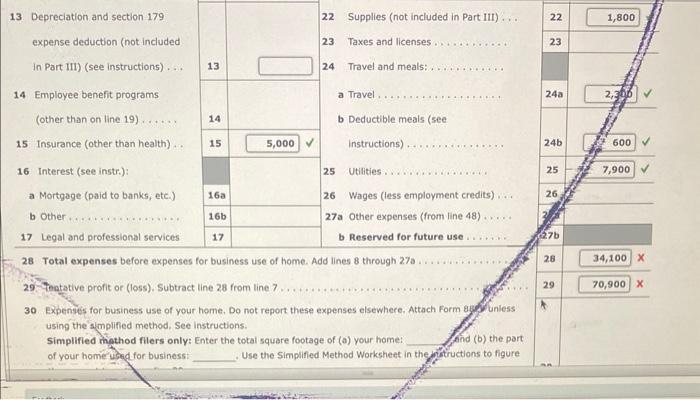

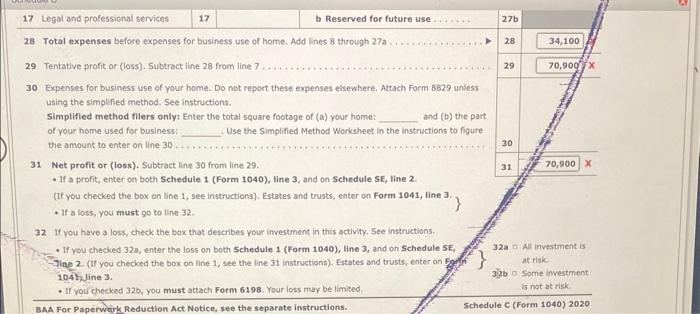

Notet This problem is for the 2020 tax year. Janice Morqan, age 24, is single and has no dependents. She is a freelance writer, In January 2020, Janice opened her own office located at 2751 Waldham Road, Pleasant Hill, NM 88135, She called her business Writers Anonymous, Janice is a cash basis taxpayer 5 he lives at 137 Stone Avenue, Pleasant Hal, NM 88135. Her Social Security number is 123-45-6782. Janice's parents continue to provide health insurances for her under their policy. Janice did not engage in any virtual currency transactions during the year and wants to contribute to the Presidentlal Election Campaign Fund. Janice received the appropriste coronavirus recovery rebates (economic inpact payments); relaty questions in ProConnect Tax should be ignored. During 2020, Janice reported the following income and expense thems connected with her business: Panice purchased and placed in service the following fixed assets for her business. Janice wants to elect immeg fof expensing under 5:179, if porstide. - Furnitsre and fatures (new) costing $21,000 on January 10 - Computer equipment (new) costing $12,400 on July 28 Janice's themized eeguctions induder. Janice purchased and placed in service the following fixed assets for her business. Janice wants to elect immediate expensing under 5 179, If possible. - Furniture and fixtures (new) costing $21,000 on January 10 - Computer equipment (new) costing $12,400 on July 28 3anice did not keep a record of the soles tax she paid. The amount allowed by the Jales tax table is $437. Janice reports interest income of $4,000 on certificates of deposit at Second National Bank. She made estimated tax paymegf of $5,000. for 2020 . Required: Compute Janice Morgan's 2020 Federal income tax payable (or refund due). - Make realistic assumptions about any missing data. - If an amount box does not require an entry or the answer is zero, enter " 0 .. - Enter all amounts as positive numbers. - The taxpayer wants $3 to go to the to Presidential Election Campaign. - It may be necessary to complete the other tax forms and schedules before completing 26 orm 1040. - Use the taxschedules (not the tax tables) Included with this problem to compute th x5. - If required, round your final answers to the nearest dollar. SCHEDULE C Profit or Loss From Business (Form 1040) (Sole Proprietership) Go to www.irs.gov/Scheduiec for instructions and the latest information. 2020 Department of the Treasury Internal Revenue Service (99) Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships generally Name of proprietor Janice Morgan must file Form 1065. A Principal business or profession, including product or service (see instructions). Freelance Writer C Business name. If no separate business name, leave blank. Writers Anonymous E Business address (including suite or room no.) 2751 Waldham Road City, town or post office, state, and ZIP code Pleasant Hill NM 88135 E. Accounting method: (1) \& Cash (2) a Accrual (3) p Other (specify) > 6. - "pid you "materially participate" In the operation of this business during 2020 ? If "No," see instructiogrier inmit on lesset. H If you started or acquired this business during 2020, check here I Did you majhany payments in 2020 that would require you to file Form(s) 1099? See instpuctions... Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked 2. Returns and allowances 3. Subtract line 2 from line 1 4 Cost of goods sold (from line 42) 5 Gross profit. Subtract line 4 from line 3 6 Other income, including federal and st Part II Expenses. Enter expenses for business use of your home only on line 30. Hinoctructions) ............ 10 Comrilissions and fees ..... 11 Contract iabor (see instructions) 12 Depletion. 13. Depreciation and section 179