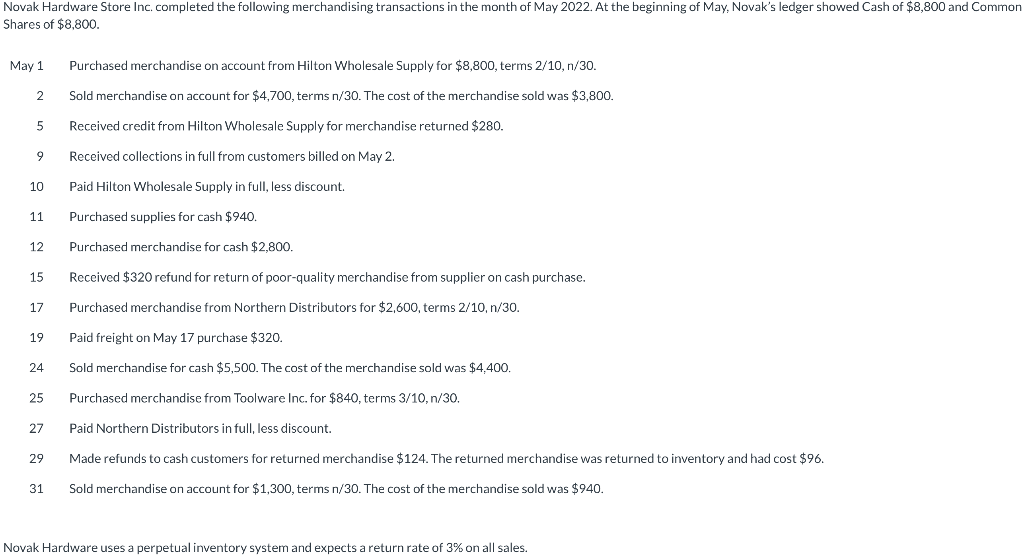

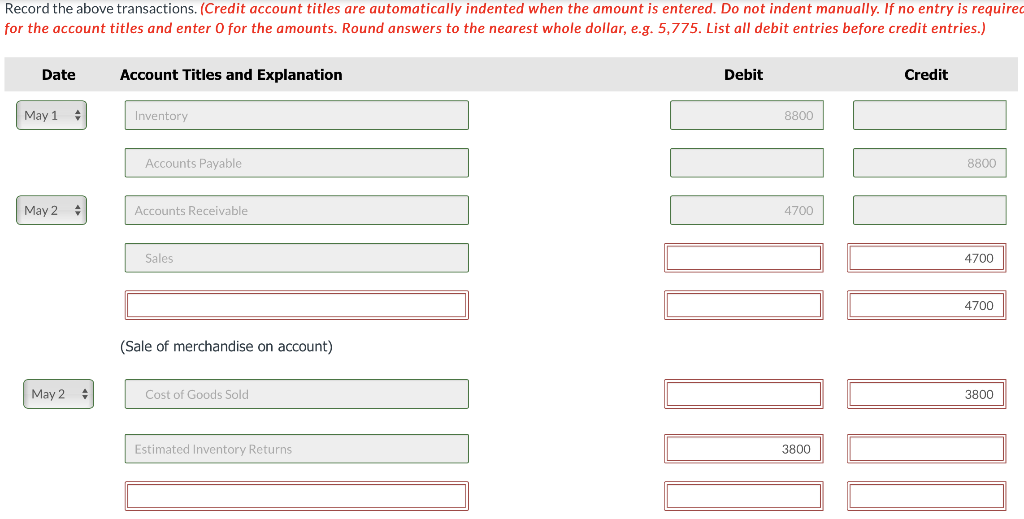

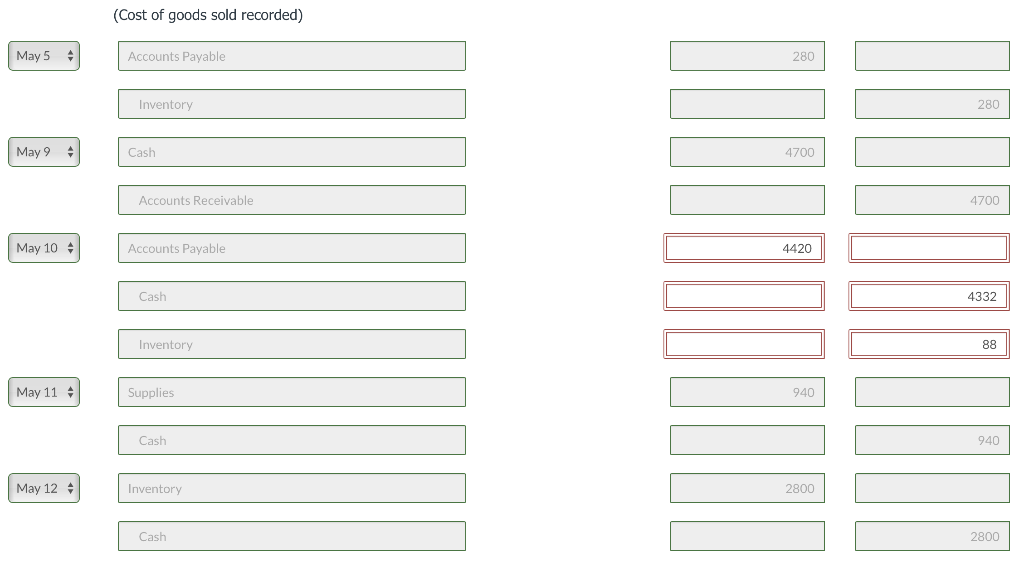

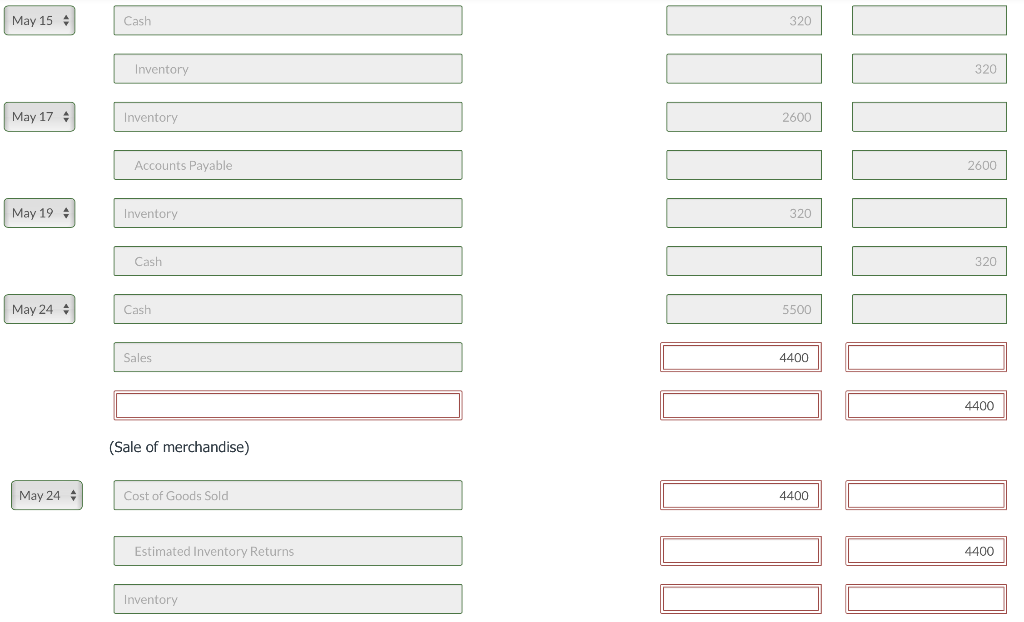

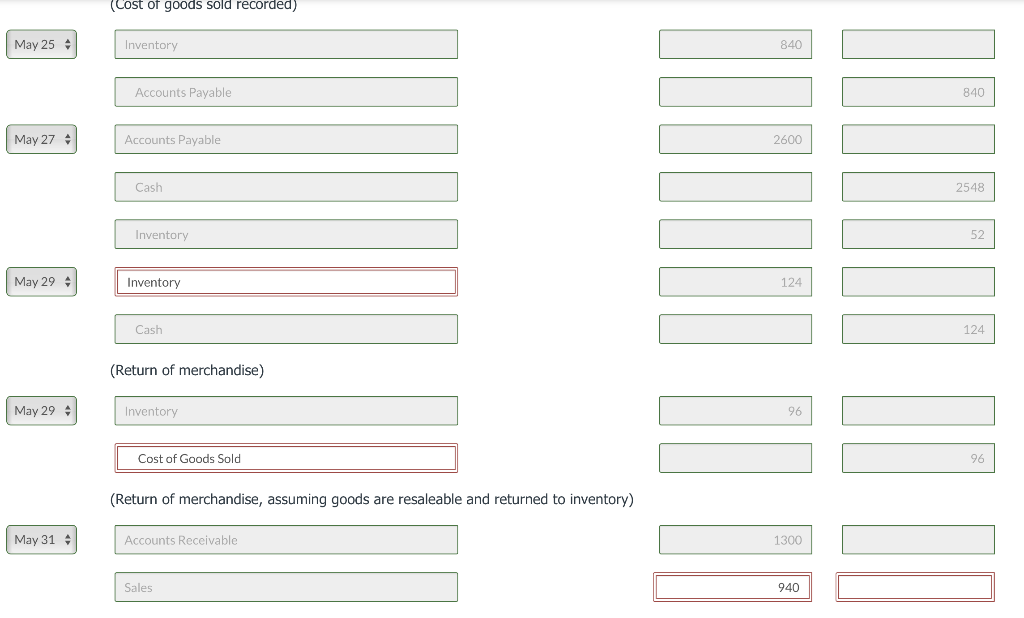

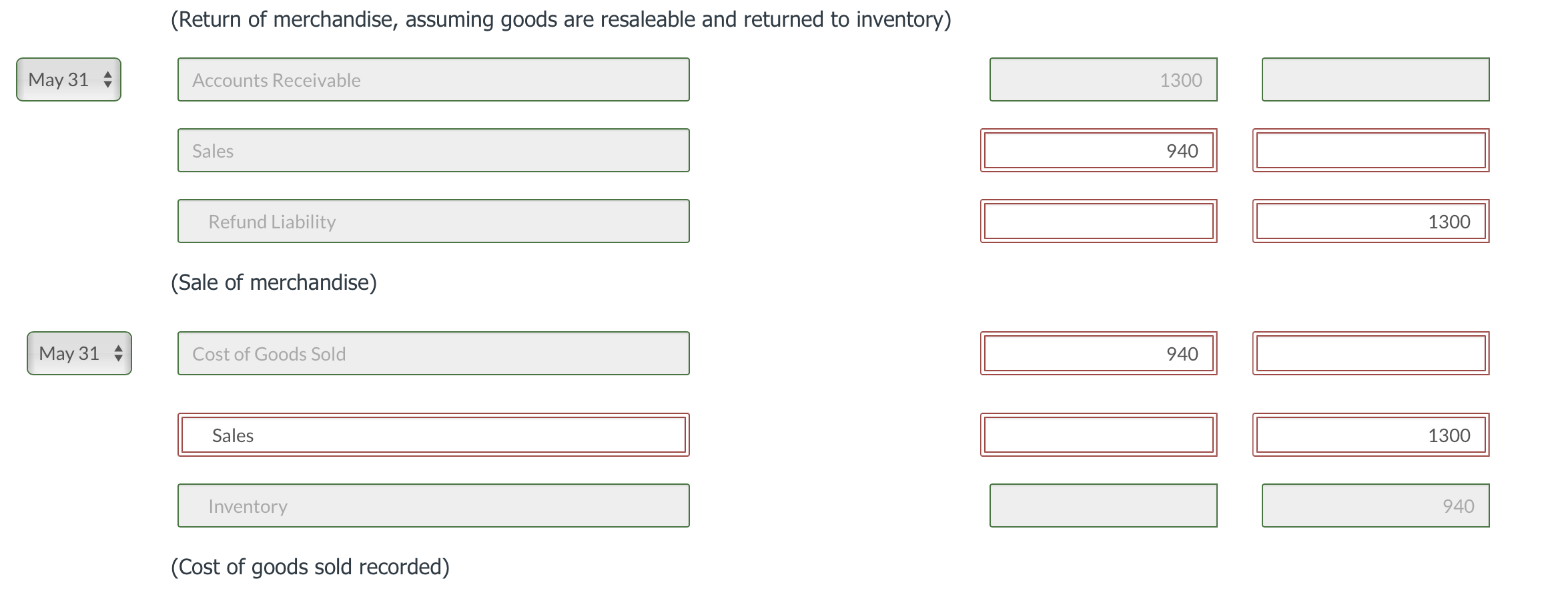

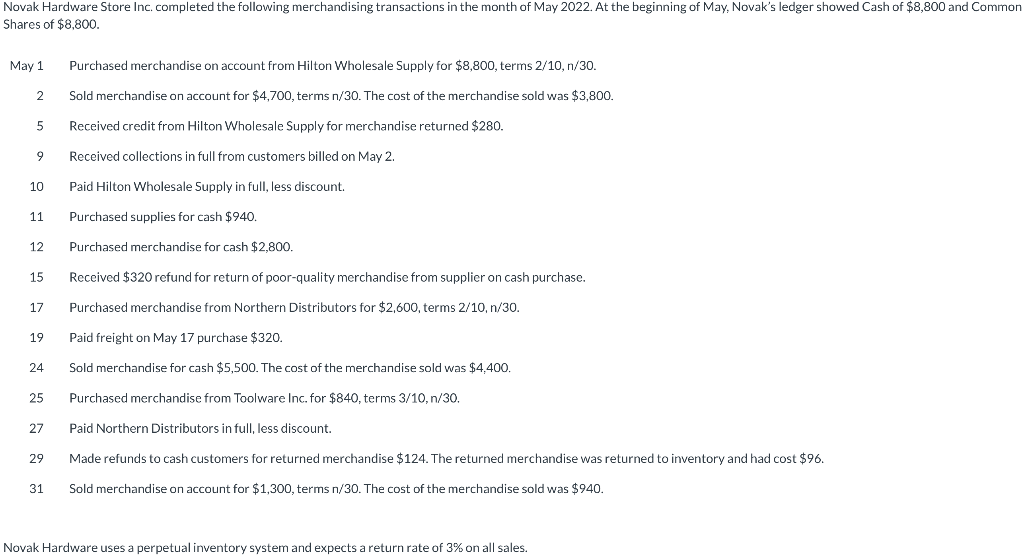

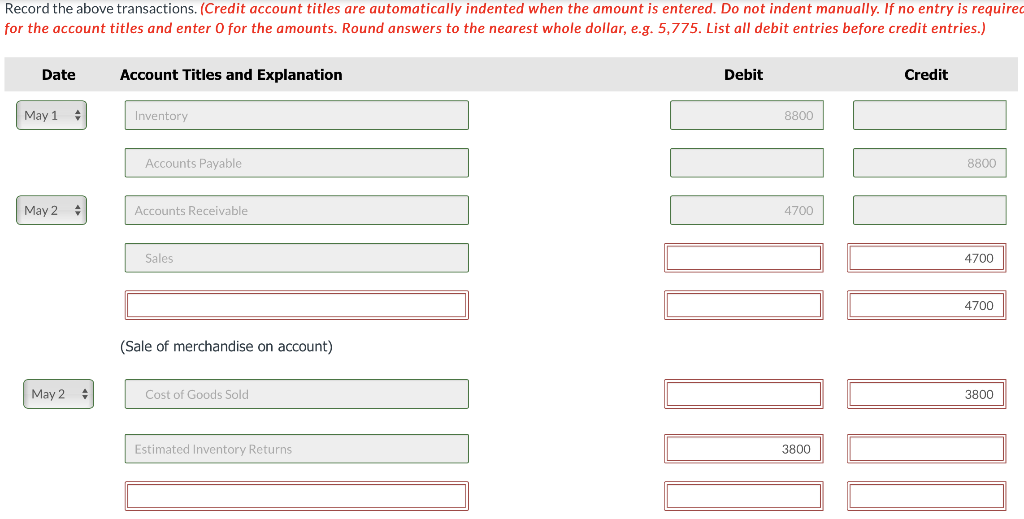

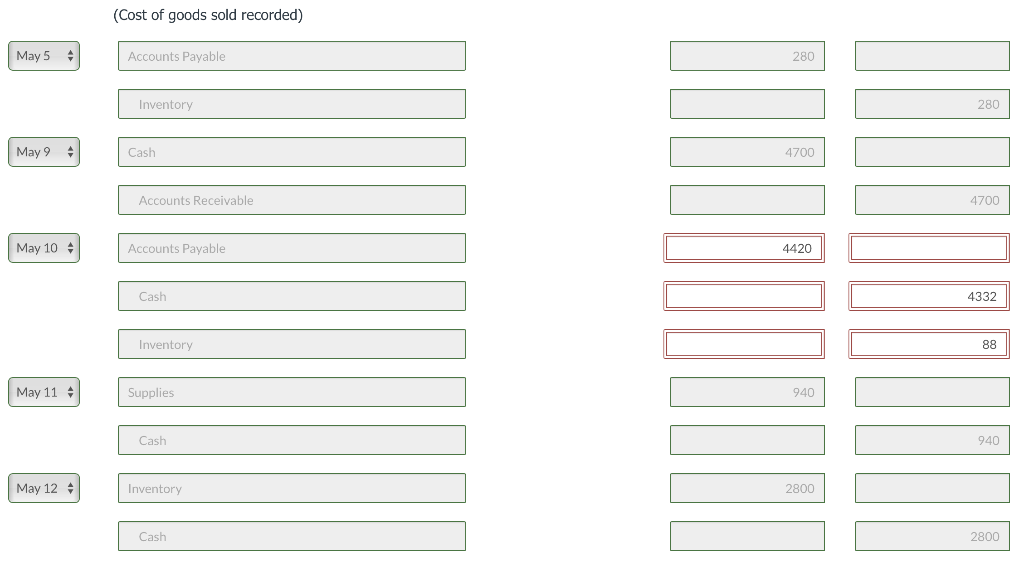

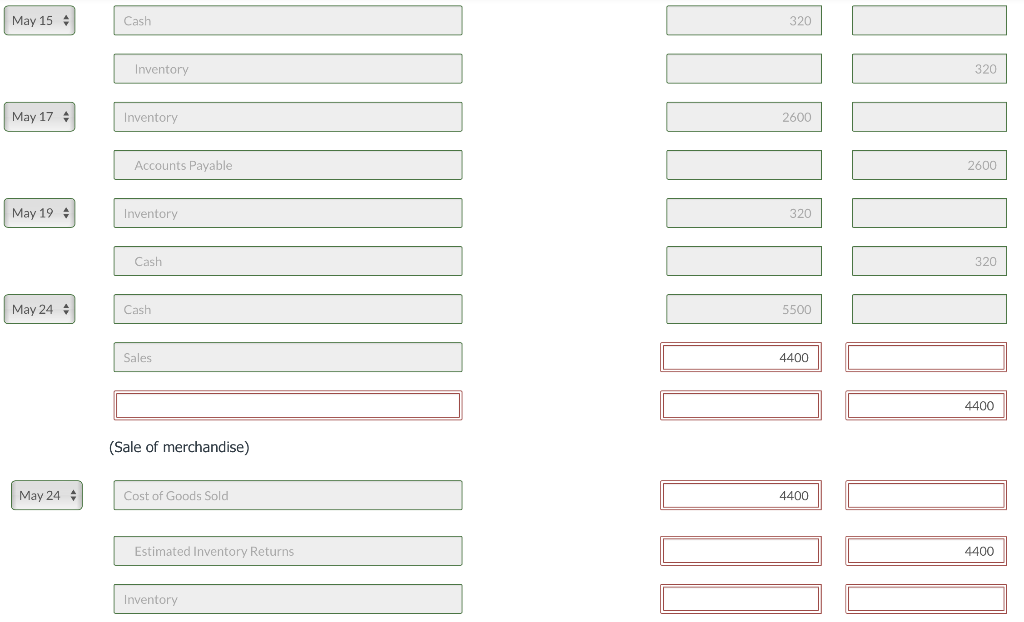

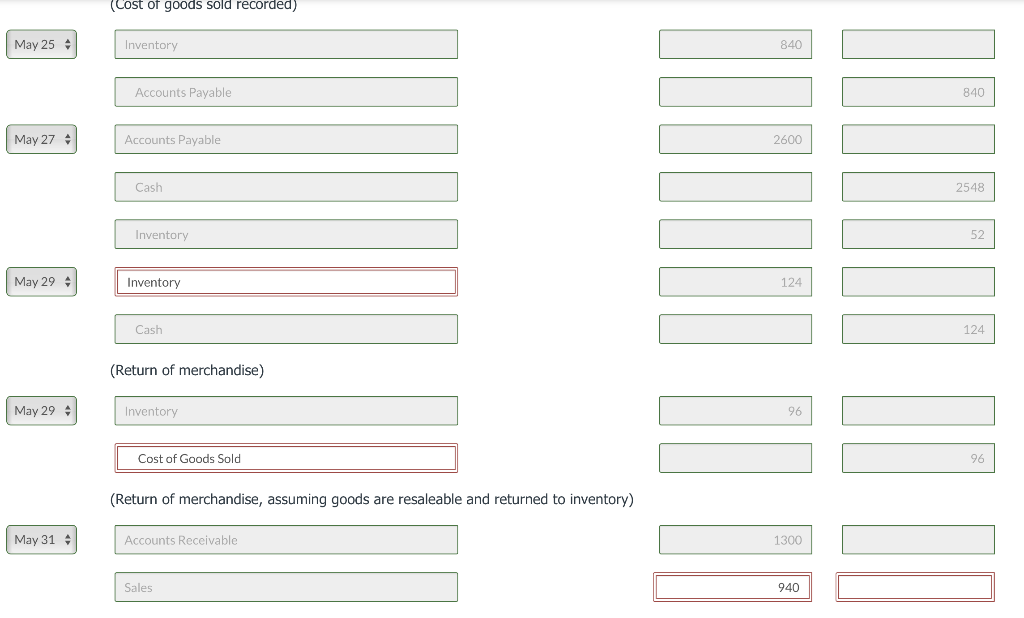

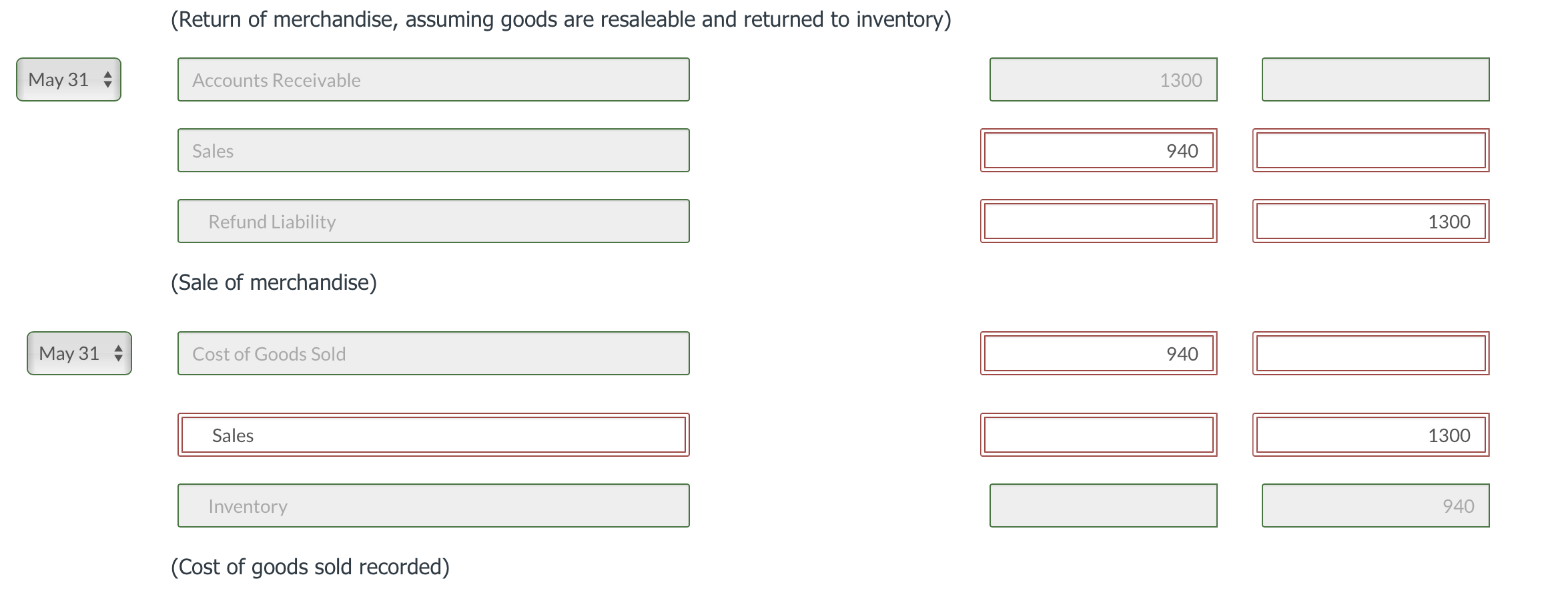

Novak Hardware Store Inc. completed the following merchandising transactions in the month of May 2022 . At the beginning of May, Novak's ledger showed Cash of $8,800 and Commor Shares of $8,800. May 1 Purchased merchandise on account from Hilton Wholesale Supply for $8,800, terms 2/10,n/30. 2 Sold merchandise on account for $4,700, terms n/30. The cost of the merchandise sold was $3,800. 5 Received credit from Hilton Wholesale Supply for merchandise returned $280. 9 Received collections in full from customers billed on May 2. 10 Paid Hilton Wholesale Supply in full, less discount. 11 Purchased supplies for cash $940. 12 Purchased merchandise for cash $2,800. 15 Received $320 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2,600, terms 2/10,n/30. 19 Paid freight on May 17 purchase $320. 24 Sold merchandise for cash $5,500. The cost of the merchandise sold was $4,400. 25 Purchased merchandise from Toolware Inc. for $840, terms 3/10,n/30. 27 Paid Northern Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $124. The returned merchandise was returned to inventory and had cost $96. 31 Sold merchandise on account for $1,300, terms n/30. The cost of the merchandise sold was $940. ecord the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is require or the account titles and enter 0 for the amounts. Round answers to the nearest whole dollar, e.g. 5,775. List all debit entries before credit entries.) (Cost of goods sold recorded) May 5 Accounts Payable 280 Inventory May 9 Cash Accounts Receivable May 10 Accounts Payable \begin{tabular}{|} 4420 \\ \hline \end{tabular} Cash Inventory May 11 Supplies Cash May 12 Inventory Cash May 15 Cash Inventory May 17 Inventory Accounts Payable May 19 Inventory Cash \begin{tabular}{|r|} \hline 320 \\ \hline \end{tabular} May 24 Cash Sales \begin{tabular}{|l|} \hline 5500 \\ \hline 4400 \\ \hline \end{tabular} (Sale of merchandise) May 24 Cost of Goods Sold Estimated Inventory Returns Inventory May 25 Inventory Accounts Payable May 27 Accounts Payable Cash Inventory May 29 Inventory Cash (Return of merchandise) May 29 Inventory Cost of Goods Sold (Return of merchandise, assuming goods are resaleable and returned to inventory) May 31 Accounts Receivable Sales (Return of merchandise, assuming goods are resaleable and returned to inventory) May 31^ Accounts Receivable Sales 940 Refund Liability 1300 (Sale of merchandise) May 31^ Cost of Goods Sold \begin{tabular}{|} 940 \\ \hline \end{tabular} Sales Inventory (Cost of goods sold recorded)